The overall business activity in the Eurozone’s private sector has unexpectedly expanded at a faster pace in October. The Composite PMI has landed at 52.2, while it was expected to come in lower at 51.0 from 51.2 in September.

The Services PMI jumped to 52.6 from estimates of 51.1 and the prior reading of 51.3. Meanwhile, the manufacturing sector activity has managed to return to the expansion territory after contracting in September. The Manufacturing PMI comes in at 50.0, higher than estimates of 49.5 and the former release of 49.8. A figure below the 50.0 threshold is considered a contraction in the business activity.

“France is increasingly becoming a drag on the eurozone economy. While the economic situation in Germany brightened significantly in October, the rate of contraction has accelerated for two months in a row in France. As a result, economic growth in the eurozone, even though accelerating a bit, has been much weaker than it otherwise could have been,” Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank (HCOB) said, and added, “Uncertainty about whether the current government under Sebastien Lecornu can remain in power for much longer in view of the disputes over the 2026 budget is causing unease and contributing significantly to the weak economic situation in France. As an important buyer of products and services from other eurozone countries, France’s weakness contributes to the fragility of the recovery in the rest of the Eurozone.”

Market reaction

EUR/USD remains broadly calm near 1.1620 at the time of writing.

This section below was published at 07:43 GMT to cover the release of the flash German HCOB PMI data for October

According to flash estimates, the Composite PMI in the German economy surprisingly expanded at a robust pace to 53.8 in October, from 52.0 in September. Economists had already anticipated the overall business activity to have grown again; however, the pace was expected to be moderate.

Strong growth in the services sector activity has seldom contributed to a significant increase in the Composite PMI. The Services PMI came in at 54.5, higher than the prior release of 51.5. Meanwhile, the Manufacturing PMI has declined again, ticking higher to 49.6 from the estimates and the former reading of 49.5.

“This is an unexpectedly good start to the final quarter. Activity in the service sector has increased significantly, and manufacturing output has risen for the eighth consecutive month. This means that the economy as a whole is also showing accelerated growth,” Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said, and added, “It is encouraging to see that new orders in the manufacturing sector have risen again slightly after a dip in the previous month. New business in the service sector has even received a real boost. Basically, these are good conditions for growth in the fourth quarter. However, the fact that the outlook for the future is more cautious than in the previous month, both among service providers and in industry, shows that the economic situation remains fragile.”

Market Reaction

EUR/USD has attracted significant bids after the release of the unexpectedly strong flash German PMI figures for September, rising to near 1.1630. Meanwhile, investors brace for more action in the major currency pair as the Eurozone PMI is due to be released at 08:00 GMT.

This section below was published at 05:50 GMT ahead of the Germany/Eurozone preliminary September HCOB PMIs data

German/ Eurozone flash PMIs Overview

The preliminary German and Eurozone flash HCOB Purchasing Managers’ Index (PMI) data for October is due for release today at 07:30 and 08:00 GMT, respectively.

Amongst the Euro area economies, the German and the composite Eurozone PMI reports hold more relevance, in terms of their impact on the European currency and the related markets as well.

The flash Composite PMI for Germany is expected to have dropped to 51.6 from 52.0 in September. Moderate growth in the service sector activity and the continued contraction in the manufacturing sector are expected to have weighed on the overall business growth. The Services PMI is seen falling to 51.0 from the prior reading of 51.5. Meanwhile, the Manufacturing PMI is estimated to have declined at a steady pace to 49.5.

The forecast for the Eurozone flash Composite PMI shows that it dropped to 51.0 from 51.2 in September. The Services PMI is expected to have expanded, but at a moderate pace to 51.1, with the Manufacturing PMI declining at a faster pace to 49.5.

How could German/ Eurozone flash PMIs affect EUR/USD?

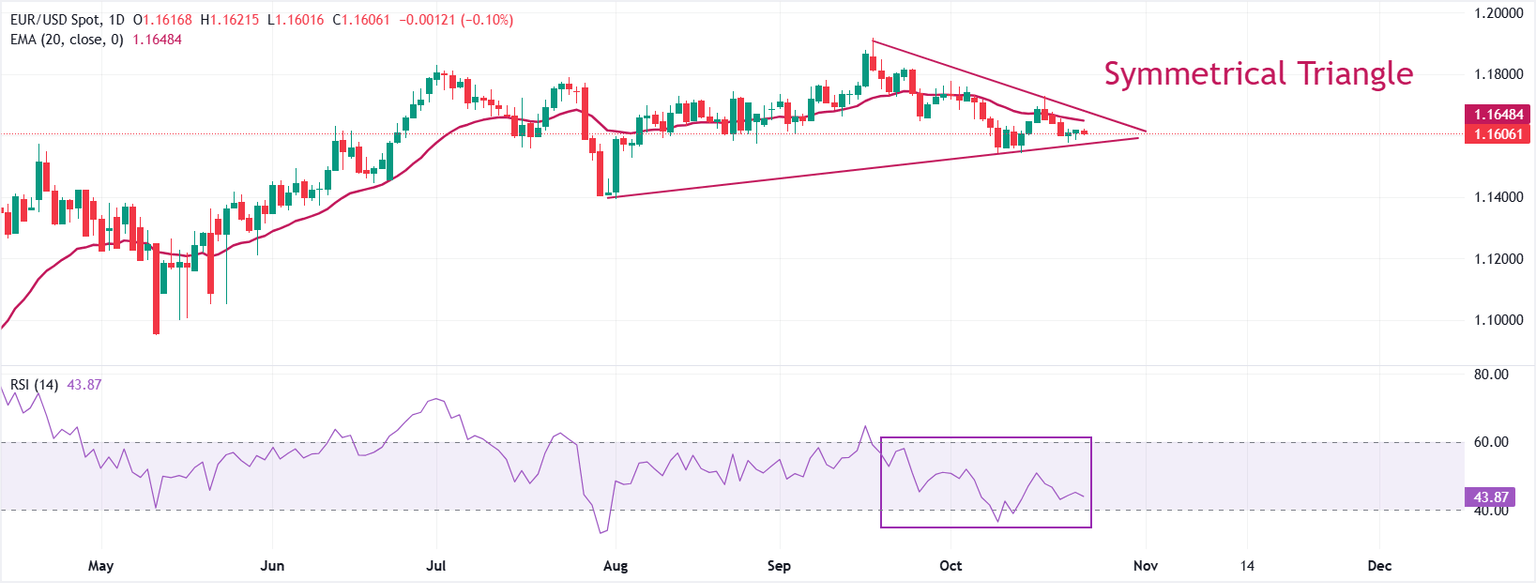

EUR/USD demonstrates a sideways trend amid a Symmetrical Triangle chart pattern formation. The upward border of the above-mentioned chart pattern is placed from the September 17 high around 1.1920, while the downward border is plotted from the August low near 1.1390.

The major currency pair trades close to the 20-day Exponential Moving Average (EMA) from the past few trading weeks, suggesting indecisiveness among investors.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, indicating a sharp volatility contraction.

Looking up, the EUR/USD pair could revisit its four-year high around 1.1920 if it breaks above the October 17 high of 1.1728. On the downside, the August low around 1.1400 will be the key support zone for the pair in case the pair slides below the October 9 low of 1.1542.

Economic Indicator

HCOB Composite PMI

The Composite Purchasing Managers Index (PMI), released on a monthly basis by S&P Global and Hamburg Commercial Bank (HCOB), is a leading indicator gauging private-business activity in Germany for both the manufacturing and services sectors. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the German private economy is generally expanding, a bullish sign for the Euro (EUR). Meanwhile, a reading below 50 signals that activity is generally declining, which is seen as bearish for EUR.

Read more.

Last release:

Fri Oct 24, 2025 07:30 (Prel)

Frequency:

Monthly

Actual:

53.8

Consensus:

51.6

Previous:

52

Source:

S&P Global