Industry leaders urge govt to revive stalled projects, ease imports for raw materials

25 October, 2025, 12:00 pm

Last modified: 25 October, 2025, 01:07 pm

Representational image. Photo: Mumit M

“>

Representational image. Photo: Mumit M

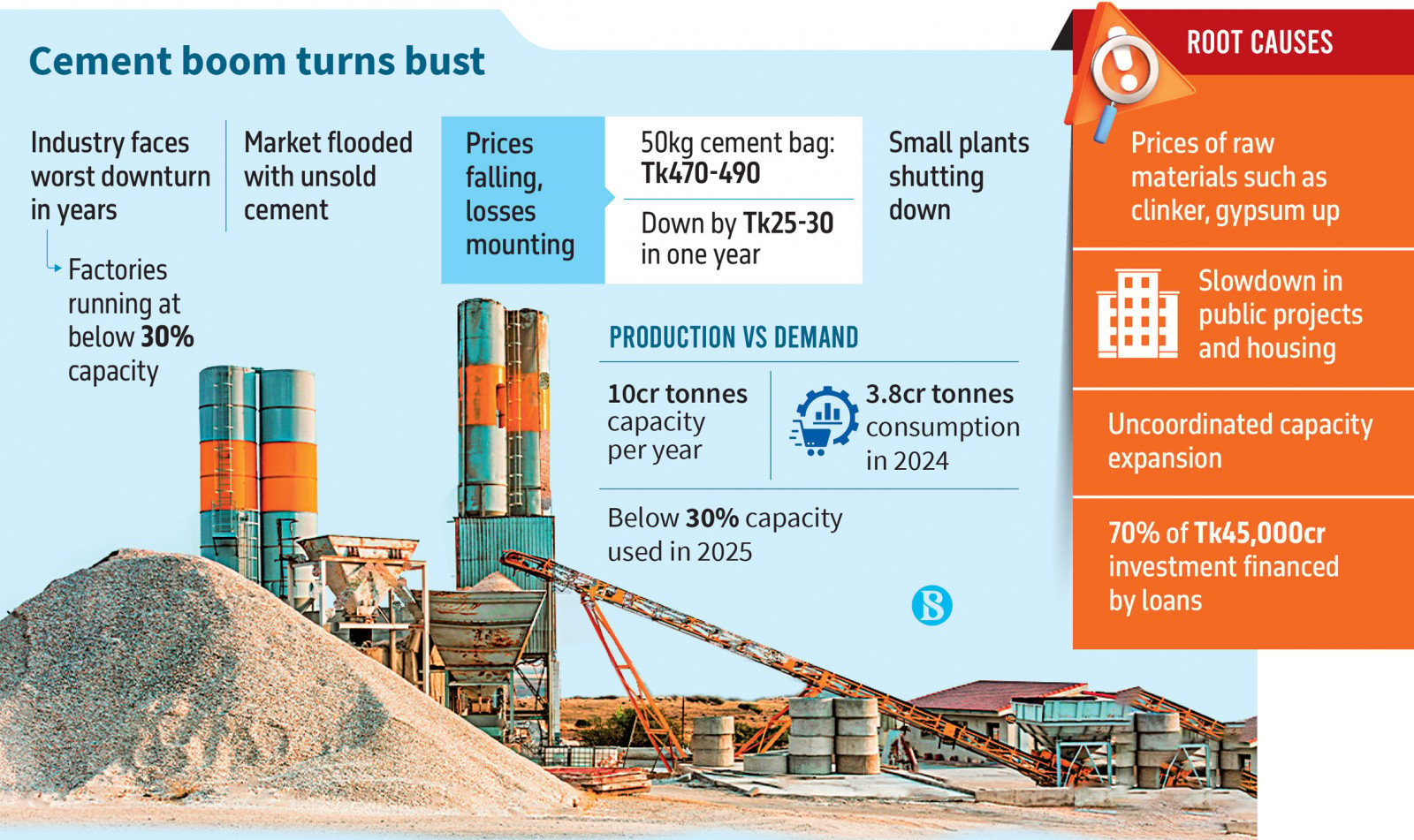

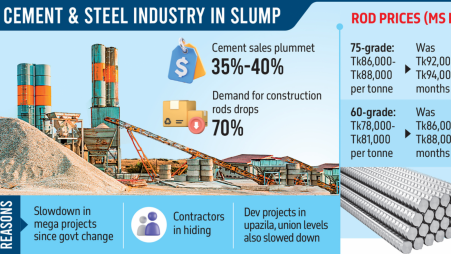

Bangladesh’s cement industry is grappling with one of its worst downturns as excess production capacity, soaring financial costs, and shrinking demand squeezing producers across the board.

Most plants in the industry are running at below 30% of capacity, far short of the global standard of 70%-80%, industry leaders said. The result is a market flooded with unsold cement, plummeting prices, and mounting financial distress.

Over the past decade, driven by optimism over megaprojects, a booming housing market, and the plan to establish 100 economic zones, investors poured more than Tk45,000 crore into expansions. The production capacity reached around 10 crore tonnes a year, four times higher than a decade ago.

Keep updated, follow The Business Standard’s Google news channel

However, demand has not kept pace. In 2024, the country consumed only 3.8 crore tonnes – less than 40% of total capacity. This year, consumption has fallen further, forcing factories to cut output and lay off workers.

Amirul Haque, president of Bangladesh Cement Manufacturers Association (BCMA), said, “After Covid-19, we began recovering in 2021, driven by renewed construction. But since 2023, the situation has worsened drastically.”

He added, “Entrepreneurs expanded based on government demand. When projects slowed, we faced a severe cash flow crisis. Several small plants have already shut down.”

Infographic: TBS

“>

Infographic: TBS

‘Factories operating below survival level’

Bashundhara Cement, with an annual capacity of 7.3 million tonnes, is operating at only 20% utilisation.

KM Zahid Uddin, the company’s deputy managing director, said, “We’ve reduced manpower and slashed prices, yet continue to incur losses.”

Mir Cement, which expanded capacity to 18 lakh tonnes in 2023, now finds investment turning into a liability. A senior company official said sales have dropped so steeply that production has been cut to a quarter of total capacity.

“We’re struggling to pay wages. If conditions don’t improve soon, production may stop entirely,” he said.

Bengal Cement, Aramit Cement, and Mostafa Hakim Cement have already suspended operations, industry insiders said. Their management could not be reached for comments.

Top producers

Shah Cement, part of Abul Khair Group, remains the country’s largest producer with a 10 million tonnes annual capacity. It continues to run at over 50% utilisation – better than most – but faces growing price and demand pressures.

Premier Cement Managing Director Amirul Haque said, “We supplied cement for the Karnaphuli Tunnel and other major projects. Now, with construction slowing, we’re operating at only around 40% capacity.”

Crown Cement Adviser Masud Khan said the slowdown in economic activity has left demand far below expectations. “For two years, we’ve seen a sluggish economy. Around 60% of our capacity is idle.”

Meghna Group of Industries, which operates under the Fresh and Meghnacem Deluxe brands, is an exception, with 6% growth but still has utilisation rate at 65%.

Khorshed Alam, the group’s executive director, said public and private construction has slowed significantly. The market is oversupplied, and demand keeps falling.

He said that especially smaller companies are struggling to cope with the demand crisis.

Falling prices, rising costs

According to industry sources, a 50kg bag of cement now sells for Tk470–500 – around Tk25-30 less than a year ago.

Besides, imported raw materials like clinker and gypsum have become costlier, while Bangladesh Bank’s policy rate hikes have sharply raised borrowing expenses.

“The sector has invested around Tk45,000 crore, about 70% financed through bank loans,” said BCMA Executive Committee Member Md Shahidullah, also managing director of Metrocem Cement.

“Revenues are falling, but loan repayments and interest costs keep climbing. For many firms, the pressure is unbearable,” he added.

Many firms are unable to pay suppliers or sustain payrolls. The industry employs about 7-8 lakh workers directly and another 2 lakh indirectly. With factories scaling down or closing, thousands of jobs are at risk, he added.

Call for govt intervention

Industry leaders have urged the government to revive stalled projects, ease import procedures for raw materials, and extend financial relief to struggling firms.

“If project spending resumes and credit access improves, the sector can recover,” said BCMA President Amirul Haque. “Otherwise, more closures and defaults are inevitable.”

However, he said, “Bangladesh’s long-term need for urban housing and infrastructure remains strong. But until demand revives and financial costs ease, the cement industry faces one of its hardest battles yet.”