Presents, mulled wine and all those festive dinners… it’s the most wonderful time of the year, but it can be expensive.

From office parties to family get-togethers, Christmas is all about spending time together, but there’s also a lot of pressure to spend.

At a time when the cost of living is high and household bills are rising, the festive season can put unnecessary pressure on our finances and derail our savings goals.

But it doesn’t need to, and along with careful budgeting, there’s now a range of money apps which promise to help us keep a better lid on our festive spending and saving.

Smart money app Plum, which over 2 million people have already downloaded, promises to help us save more and spend less.

Holiday cheer meets smart budgeting: Make the most of festive treats while staying on top of your spending with helpful budgeting tools

It’s jam-packed with helpful tools and features to get more people saving and provides a range of accounts where money can automatically be saved.

If you’re starting to think about your festive finances, there’s no better time to begin putting money away if you haven’t already.

This money can earn interest with Plum, and you can put away as much or as little as you can afford.

Here’s how it can help with your festive budget…

This is not financial advice. Plum is not a bank.

How it works

The Plum app is easy to set up, and its basic version is free to download on the App Store and Google Play.

Once you’ve created an account, you can then link it to your bank account, and then Plum will get to work.

It allows you to see all your accounts in one place, so you can quickly keep track of your spending and pinpoint any areas where you might want to cut back.

Easily set up the free Plum app to link your bank accounts, track spending, and manage finances effortlessly in one place

But that’s just the beginning, it will also analyse your income and spending every month, putting your transactions into categories and making it really clear and simple where your money is going.

It can then suggest how much money you could be saving each month and automatically move this cash into a savings account of your choice. This could be a cash ISA, where you can earn tax-free interest and access your money without paying a penalty, a standard savings account, or even a Stocks and Shares ISA, for example.

Capital at Risk when you invest. Investments can go down as well as up in value, which means you may get back less than you pay in. Tax treatment depends on your individual circumstances and may change in the future. Always do your own research. ISA rules apply.

Why you should start automating your savings

Automatic saving is Plum’s bread and butter, and it believes this is crucial to starting and maintaining a savings habit.

During times when your spending may increase – such as over the Christmas period – having savings to dip into can help.

This means you don’t need to rely on racking up credit card debt or expensive borrowing, as you have a savings pot specifically set up to cover extra spending.

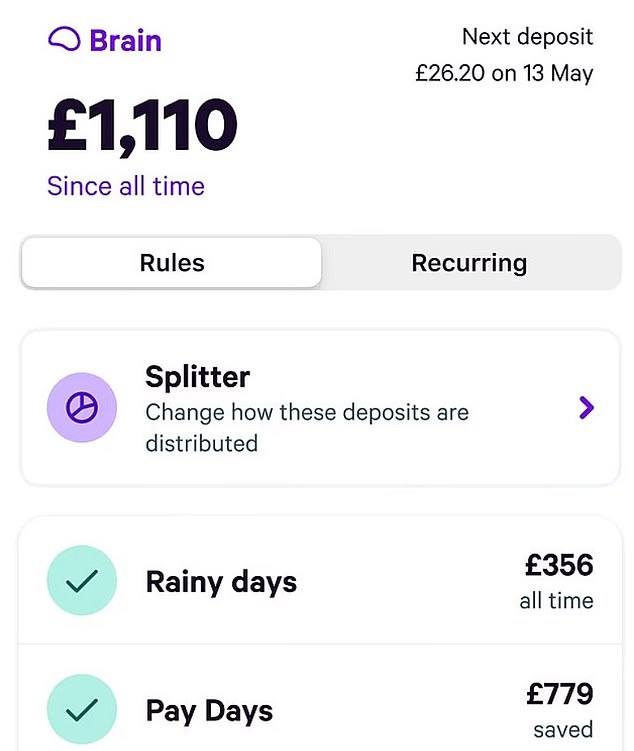

Plum’s Auto Savers make it easy to build your savings and achieve your long and short-term goals.

Once you’ve set up your Plum account, you can then set up the ‘Automatic’ rule, which calculates how much you can save every month and automatically moves this into an account of your choice.

Plum’s Auto Savers help you effortlessly build savings and stay prepared for extra spending, especially during busy season

While you could easily do this yourself, the fact that it’s automatic means the money is transferred straight away into your savings account, so you’re not tempted to spend it first.

This can be helpful at Christmas when it seems like everyone is luring us into parting with more cash than we want, but you can also change this amount if you feel you’re going to need more money to spend.

Once you get started with Plum, you can also discover its other savings rules, some of which require a paid-for subscription.

These include the Weekly Depositor, putting away money each week, and Round Ups, which automatically round up your spending to £1 and move the extra money into a savings account.

Dip into your savings without fear

We all spend a little more at Christmas, from buying Secret Santa presents to ticking off children’s wish lists.

But if you’re dipping into your savings to cover festive spending, the last thing you want is to be punished by losing interest or having to close your account.

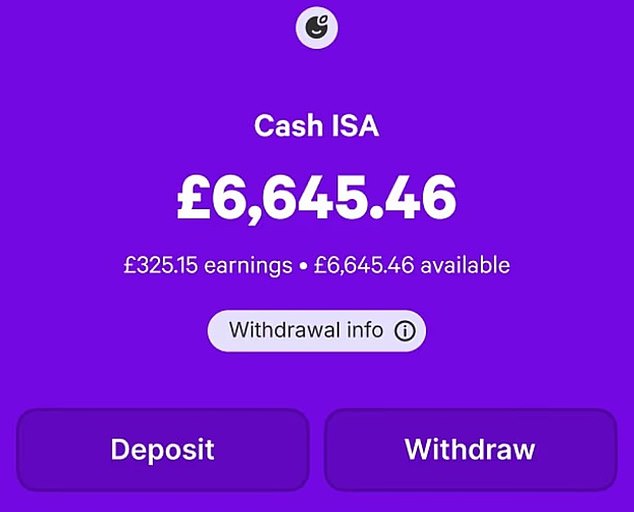

At Plum, the Cash ISA is unique because not only does it pay one of the best rates of interest around at 4.45% AER (variable)*, you can also dip into your savings without penalty.

Enjoy festive spending freedom with Plum’s Cash ISA: Earn competitive interest and withdraw anytime, without losing your rewards

You can withdraw money from the cash ISA at any point, and it’ll be in your account in one business day. Interest on the Plum Cash ISA may vary and apply a bonus rate in the first 12 months. ISA rules and T&Cs apply.

The account is tax-free, up to the annual £20,000 ISA limit, but any money taken out can’t be replaced within the same tax year without counting against your annual ISA allowance.

If you’ve maxed out your current ISA allowance, there are plenty of other options at Plum for short-term savings, including its Easy Access Savings Pocket.

For longer-term saving, it also has a 95-Day Notice Pocket and options for investing, and if you’re saving for a first home or your retirement, it has a competitive Lifetime ISA (LISA) too.

Make sure a Lifetime ISA is right for you. Withdrawing for anything other than your first home, retirement, or a few specific circumstances may result in a 25% government penalty, meaning you could get back less than you put in. Tax treatment depends on your situation.

Keep in mind that if you choose to invest, your capital would be at risk, meaning the value of your investments will go down as well as up, and you may get back less than you invested.

How safe is Plum?

Although Plum is an app, it still provides a high level of security and protection.

When it comes to safety, it uses 256-bit TLS encryption and supports face and fingerprint ID verification.

It’s also authorised and regulated by the UK’s Financial Conduct Authority (FCA) and covered by the Financial Services Compensation Scheme (FSCS), which protects up to £85,000 of your savings.

You can also contact its customer service team seven days a week.

*Rate includes a Plum bonus of 1.41% AER (variable) if kept for 12 consecutive months and other conditions are met. After 12 months, the rate will be 3.04% AER (variable). Interest on our Cash ISA varies. This is the rate from 30/10/25. ISA rules and T&Cs apply.