Rare earth elements are rarely noticed by the general public. Despite the fact that they sit at the core of nearly every modern technology. These 17 metals enable the production of powerful electric motors, wind turbines, advanced sensors, precision electronics, and high-performance magnets. In recent decades, rare earths in China have become especially significant. The country now serves as the world’s primary hub for mining, refining, and magnet manufacturing. China has developed substantial capabilities across the entire rare-earth supply chain over recent decades. The country has created the most comprehensive industrial ecosystem in this field. It also shapes how global clean-energy and digital technologies are produced.

Today, a large share of the rare earth materials used in electric vehicles, clean-energy equipment, robotics, and consumer electronics around the world comes from China’s refining capacity and magnet-making industry. As a result, rare earths have quietly become one of the most influential and strategically important foundations supporting technological development in the West.

Rare earths in China: integrated dominance across the rare-earth supply chain

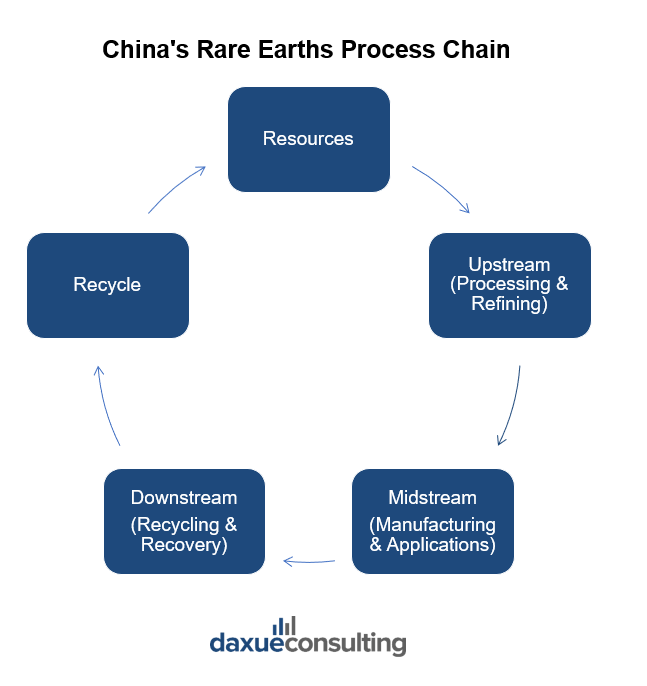

At the upstream stage of the rare-earth supply chain, China benefits from both a substantial resource endowment and decades of sustained investment in extraction capabilities. The country hosts some of the world’s largest and most economically valuable deposits. This includes the Bayan Obo mine in Inner Mongolia, the largest source of light rare earths globally. In the South, ion-adsorption clay deposits supply heavy rare earths such as dysprosium and terbium. These elements are essential for high-temperature permanent magnets used in electric vehicles, wind turbines, and aerospace technologies. Although other regions also possess rare-earth resources, many deposits have lower ore grades, higher extraction costs, or lack the necessary environmental and processing infrastructure, making competitive production difficult. As a result, China supplies a significant portion of global raw materials and provides a strong resource foundation for its leadership in the midstream and downstream segments of the industry.

Sources: Dongguan Securities, designed by Daxue Consulting, China’s rare earths process chainMidstream bottleneck: Concentration and the push for diversification

Sources: Dongguan Securities, designed by Daxue Consulting, China’s rare earths process chainMidstream bottleneck: Concentration and the push for diversification

China’s advantage becomes even more pronounced in the midstream stage. Most of the world’s rare-earth separation and refining capacity is located in China. This stage involves the highest technical barriers, longest investment cycles, and most stringent environmental requirements in the entire supply chain. Many countries that mine rare earths still lack mature chemical separation technologies and industrial-scale refining capacity. This means their ore or concentrates often need to be shipped to China for processing before being repurchased as high-purity oxides or metals.

Historically, concentrates from mines like Mountain Pass mine in the United States were sent to China for processing in China before they could be used in American electronics or magnet manufacturing. According to 2023 industry data, China holds nearly the entire global commercial separation capacity for heavy rare earths such as dysprosium and terbium, which has made the global high-performance magnet sector heavily dependent on China’s midstream processing capabilities.

Reduced cost supported by the rare earths downstream ecosystem in China

Downstream, China has built a comprehensive manufacturing ecosystem for high-performance rare-earth materials, particularly neodymium-iron-boron (NdFeB) and samarium-cobalt (SmCo) magnets. These magnets are critical components in electric vehicle motors, wind turbines, industrial automation systems, and a wide range of consumer electronics. Over the past two decades, China has expanded production capacity, integrated suppliers, and reduced costs. It is becoming the primary global source of advanced magnet materials. This downstream strength reinforces the advantages established in the upstream and midstream. This makes it difficult for other regions to build competitive alternative supply chains in the short term.

Recycling is another critical piece of the rare-earth ecosystem. The practice is increasingly central to Western strategies aimed at reducing supply-chain dependence. Unlike traditional mining, recycling captures rare earths from end-of-life magnets, EV motors, wind-turbine components, and industrial automation equipment.

The new industrial infrastructure of modern technology has been achieved through rare earths in China

Rare earths have become one of the most strategically important building blocks of modern technology. It underpins everything from electric vehicle motors and wind turbines to advanced sensors, robotics, and aerospace systems. As global competition shifts from traditional energy geopolitics toward materials geopolitics, these elements now function as a form of “new industrial infrastructure” for the clean-energy and digital era. What makes rare earths especially critical is the structure of their supply chain: production and processing are highly concentrated, with China holding a leading position in mining, separation, and high-performance magnet manufacturing. This concentration creates a structural dependency that has become a focal point of industrial and trade policy in the US, EU, and Japan, prompting efforts to diversify supply chains and develop alternative technologies.

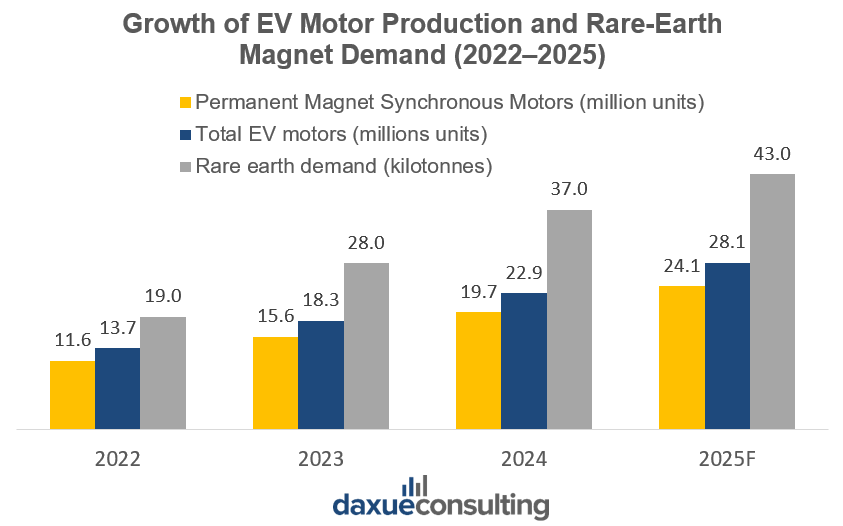

Data source: Benchmark Mineral Intelligence, designed by Daxue Consulting, Growth of EV Motor Production and Rare-Earth Magnet Demand from 2022 to 2025Growing dependence of EV motors on China’s rare-earth manufacturing capacity

Data source: Benchmark Mineral Intelligence, designed by Daxue Consulting, Growth of EV Motor Production and Rare-Earth Magnet Demand from 2022 to 2025Growing dependence of EV motors on China’s rare-earth manufacturing capacity

There are four main types of EV motors: Permanent Magnet Synchronous Motors (PMSMs), Induction Motors, Electrically Excited Synchronous Motors, and Axial Flux Motors. Only PMSMs and axial flux motors rely on rare-earth permanent magnets. These two motors accounted for more than 86% of the EV motor market in 2024. As EV adoption accelerates, the number of motors in use has risen sharply from 13.7 million units in 2022 to more than 22 million in 2024. This directly increases the demand for high-performance rare-earth magnets. NdFeB (neodymium-iron-boron) magnets remain the dominant choice. Meanwhile, maintaining their performance at high operating temperatures requires the addition of dysprosium and terbium. While PMSMs currently dominate the EV motor market due to their high efficiency, this very dependency is catalyzing significant R&D and commercialization of non-rare-earth magnet motors, such as Electrically Excited Synchronous Motors (EESMs), by major automakers, including BMW, Renault, and Tesla, for future models.

What matters for global manufacturing is not only the scale of demand. The location where these advanced materials are produced also matters. China currently manufactures the vast majority of the world’s separated rare-earth oxides. The country produces more than 90% of high-performance NdFeB magnets. This means that most EV motors rely on components that are ultimately processed or fabricated in China. As EV motor deployment continues to expand, the associated rise in rare-earth demand translates directly into greater dependence on China’s materials processing and magnet manufacturing capacity. This forms a clear connection between EV technology, rare-earth usage, and the global manufacturing landscape.

Rare earths in China: The geopolitical stakes of rare-earth supply chokepoints

As global competition shifts from traditional energy geopolitics toward materials geopolitics, rare earths have become a focal point of industrial strategy. This makes the midstream and downstream stages of the rare-earth supply chain strategically consequential.

Recent developments illustrate how central these materials have become to global manufacturing. In late 2024 and 2025, China introduced new export controls covering rare-earth metals, magnet-making technologies, and related equipment. This is creating uncertainty for manufacturers in the United States, Europe, and Japan. Although these measures were later suspended for a one-year period in 2025, the episode highlighted how concentrated the global supply chain remains and how sensitive downstream industries are to processing bottlenecks. At the same time, Western efforts to rebuild alternative supply chains continue to face structural challenges. Heavy rare earths such as dysprosium and terbium remain in limited supply outside China. Whilst projects in Australia, the United States, and Europe have struggled with high costs, environmental constraints, and the difficulty of reproducing China’s integrated processing-to-magnet ecosystem.

Key takeaways of rare earths in China

- China possesses the world’s most integrated rare earth supply chain, a result of decades of strategic development. However, replicating key segments outside China is a primary goal of Western industrial policy.

- Rare earths are critical for current clean tech, creating present-day dependencies. This very fact is accelerating investment in both alternative motor designs and new sources of supply.

- The EV boom is currently increasing demand for rare earth magnets, the majority of which are sourced from China. Concurrently, it is providing the market scale and incentive to finance competing technologies and supply chains.

- Western diversification efforts (recycling, new mining, processing, magnet plants) are in early stages and face cost and scaling challenges. Their success will depend on sustained investment, policy support, and technological innovation over the coming decade.