- Petrostates block fossil fuel language as COP30 falls short on climate ambition

- Utilities pledge $148 billion annually for grid expansion and energy storage

- Developing countries need £2.4 trillion yearly by 2030 to meet climate targets

- China joins 18-country coalition to align carbon market monitoring standards

- Super pollutant fund launched with £25 million to cut methane emissions

November 26 – The agreement reached two years ago at COP28 in Dubai seemed to signal the beginning of the end of the fossil fuel era. But the “implementation COP” that closed last Saturday in the Amazonian city of Belem in Brazil couldn’t find a route-map to make that vision a reality.

For all the recognition that emissions trajectories are nowhere near in line with the ambitions of the Paris Agreement and the window to act is rapidly closing, negotiators seem divorced from the real world. Petrostates, led by Saudi Arabia and Russia, stymied any language of ambition and even the words “fossil fuel” didn’t make it into the final statement.More than 80 countries did back a roadmap away from fossil fuels, and Colombia and the Netherlands agreed to co-host the first international conference next year, to build on the momentum away from the COP process. South Korea, with the world’s seventh largest coal fleet, said it would stop building new plants and phase out existing ones.

The coalition will have to wrestle not with technology, but with financial architecture. As Harvard public policy expert Akash Deep explained in an interview: “For many fast-growing economies, fossil fuels are still the financially rational choice.” That’s because “once you add the higher upfront costs, the grid connection costs, the storage needed to make renewables firm, fossil fuel generation still looks cheaper and easier to fund.”

He has proposed a Green Swap mechanism that values the carbon benefits of green projects to mobilise global finance to bridge this cost gap.

Whether the idea gains traction remains to be seen, but Deep said it could cover “a third of the global coal phase-out challenge, even before a single existing plant is retired.”

A group of 13 developing countries and one region announced they would set up national platforms to mobilise public and private finance for national climate priorities to meet their NDCs. The NDC Partnerships calculates that implementing the 2035 NDCs in developing countries, except China, will require $2.4 trillion every year by 2030.

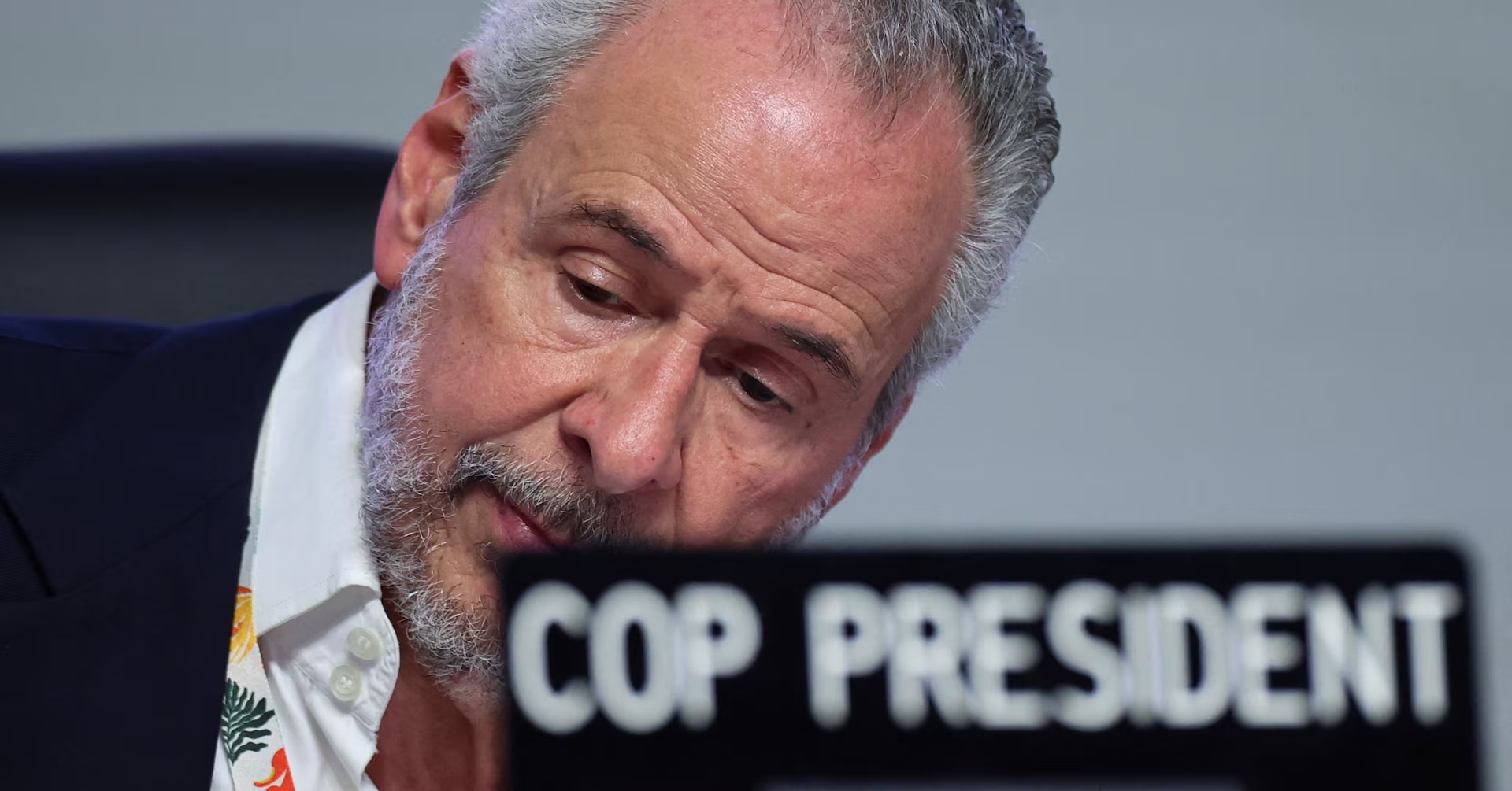

COP30 President Andre Correa attends the plenary session at the UN Climate Change Conference (COP30), in Belem, Brazil, November 22, 2025. REUTERS/Adriano Machado Purchase Licensing Rights, opens new tabThe COP’s “global mutirao” decision did acknowledge that the global transition is irreversible – something that was demonstrated outside the negotiating rooms and throughout the strands of the Action Agenda, which the COP presidency introduced as a five-year framework to mobilise voluntary climate action from non-state actors, structured around six different themes.

“There’s a limit to how granular the COP negotiations can get in terms of the actual implementation,” says Thomas Koch Blank, managing director of the industries programme at U.S. non-profit RMI. But what’s being looked for “is the sense that everyone is jumping at the same time, especially in this current geopolitical environment”.

Global renewables growth is expected to more than double by 2030, but there are increasing challenges such as supply chain constraints and grid integration.

Belem saw a swathe of commitments to expand grids and energy storage: members of the Utilities for Net Zero Alliance said they would increase their annual investment by 20% to $148 billion a year, potentially opening a $1 trillion pipeline for grid and storage expansion.

Development banks pledged more than $12 billion to strengthen regional electricity connectivity in Southeast Asia, while the philanthropy-backed Global Grids Catalyst promised $7 million to mobilise grid investments.

A view of a battery storage from wind energy at Acciona Energia Experimental Wind Farm in Barasoain, Spain, March 18, 2024. REUTERS/Vincent West Purchase Licensing Rights, opens new tab

However, Bruce Douglas, chief executive of the Global Renewables Alliance, said there was still a significant shortfall in what is needed to build the renewable powered energy systems required for the transition.

Another pledge, to quadruple sustainable fuels by 2035, which was launched at the COP Leaders summit, rests on those green grids. These include biofuels, hydrogen and e-fuels for the so-called hard-to-abate sectors of steel, shipping, aviation and cement. The IEA said the pledge is achievable if all existing and announced policies globally are implemented. Brazil is already capitalising on its largely green grid, with interest from green steelmaker Stegra and Chinese SAF producer Envision.

Tracking by the Mission Possible Partnership suggests a big uptick in the announcement of projects in the past year, requiring some $1.8 trillion of investment to get them across the line. In return, there is huge job-creation potential. James Scofield, managing director of the Industrial Transition Accelerator, told a panel that 65 projects identified in India could create some 200,000 jobs and cut emissions by 5% a year.

Auctions of green ammonia in India this year of $600-650 a metric tonne have come very close to the prices for fossil-based ammonia. “As a shipping fuel, that translates to roughly $150 per tonne of CO2. It’s in the order of magnitude of what we see voluntary markets being willing to pay,” says RMI’s Koch Blank. “It’s very inspiring.”

The Belem Declaration on Global Green Industrialisation led by Brazil, the UK and South Africa aims to support scaling of these new industries through more coordinated actions across governments and the private sector to bridge gaps in finance. A work programme is expected by COP31 next year.A steel worker stands amid sparks of raw iron coming from a blast furnace. A pledge to quadruple sustainable fuels by 2035, which was launched at the COP Leaders summit, rests on green grids, which include biofuels, hydrogen and e-fuels for hard-to-abate sectors such as steel. REUTERS/Leon Kuegeler Purchase Licensing Rights, opens new tab

“It’s a recognition in the formal negotiations of the significance (of industry) to the whole transition,” says Annie Heaton, chief executive of standard and certification initiative ResponsibleSteel. In terms of decarbonising steel, she says, “You’re looking at green hydrogen, renewable energy, green iron, green steel. And that means trade. But at the same time, right now, what are we looking at? Trade barriers, tariffs, quotas … So how can you get around all that and still keep this positive momentum?”

At COP30, her organisation announced partnerships with European and Chinese standards bodies to work towards global comparability to strengthen trade and investment efforts.

Indeed, for the first time at COP, there was debate about carbon markets and their impact on trade. Carbon pricing is being adopted by more jurisdictions, spurred by the EU’s Carbon Border Adjustment Mechanism (CBAM), which comes into force in January next year. There was strong pushback against the CBAM in Belem by countries, including China, who view it as a trade rather than climate measure.

But ahead of COP, China did join a coalition of 18 countries to collaborate on defining best practices for monitoring, reporting and verification (MRV) and common accounting standards. Linxiao Zhu, a policy adviser and China specialist at climate think-tank E3G, says there was a big drive for China to join because “the domestic Chinese carbon market suffers a lot from capacity constraints on MRV. It has a lot of difficulty figuring out how much is emitted in many sectors.”

Elsewhere, China “played a relatively quiet role,” says Zhu. It was not obstructive, but nor did it take the leadership role that many had hoped for, now that the U.S. has left the COP process.

The Logan Energy green hydrogen facility in Wallyford, Scotland, Britain. REUTERS/Lesley Martin Purchase Licensing Rights, opens new tab

The World Benchmarking Alliance released early analysis of over 1,200 companies to assess their transition planning, showing that it’s not proceeding at the pace required. However, progress of leading companies shows that low-carbon investments could be tripled, without major technological, political or financing breakthroughs.

“We’ve made progress, but now we need to scale up,” says Vicky Sins. Having seen the success of renewables, “what is the next big, scalable model that we can behind?” She points to encouraging examples in the built environment, where air conditioning is expected to be one of the three big drivers of future energy demand. “There is a lot of effort that can be done on demand (and) energy efficiency, and I think this is where we need to focus.”

COP28 pledged a doubling of energy efficiency from 2% to 4% by 2030. The IEA’s latest report suggests the world is off-track to meet this target. Progress in India and China is set against a reversal in the U.S. and Europe. Announcements at COP by Mission Efficiency, the World Green Building Council, opens new tab and its partners, as well as U.S. businesses, aim to accelerate efforts.

Bertrand Piccard, co-founder of the Solar Impulse Foundation, says the challenge is that companies see only the upfront costs of investment and not the lowered operating costs delivered by efficiency measures. As part of Mission Efficiency, the Solar Impulse Foundation is working with the European Investment Bank to launch a pilot fund that will make the upfront investment, which companies will repay through some of the operational savings they make.

This proof of concept is, he says, intended to unlock 17.5 billion euros to support 350,000 European SMEs to become more efficient. “This will be very attractive for pension funds, for sovereign funds, because it brings between 4- 8% of interest per year … funding something that has a proven profitability,” says Piccard.

A drone view shows a solar power plant and wind turbines in the Almaty region, Kazakhstan February 6, 2025. REUTERS/Pavel Mikheyev Purchase Licensing Rights, opens new tabThe delay in transitioning away from fossil fuels means attention must be focused on measures to cut emissions in the short term. That means tackling super-pollutants such as methane, a short-lived greenhouse gas that is 80 times more potent than CO2 over its 20-year lifespan. Read more

Jonathan Banks, who directs the global methane pollution prevention programme at the Clean Air Task Force (CATF) told a high-level event that “we can’t afford to have those emissions, and so that’s why it’s imperative that as we work on transition we also work on mitigating methane, because it’s the only tool that we really have that can slow the rate of warming and start to bend the curve on climate change.”

As natural gas is increasingly seen as a transition fuel, the UK – alongside key signatories such as Canada, Germany, Kazakhstan and Norway – agreed a commitment to establish a global marketplace for natural gas certified with near-zero methane emissions. This will require regulatory alignment and robust MRV systems.

Alongside, the Climate and Clean Air Coalition launched a Super Pollutant Action Accelerator. An initial $25 million will support seven countries, including Mexico, Indonesia, Kazakhstan and Nigeria, by providing technical experts across ministries to build capacity to act on data, as well as funding to implement projects to cut emissions.

The solutions being advanced through the COP Action Agenda are numerous and ambitious, but whether they can “ignite a decade of acceleration and delivery” that the U.N. Secretary-General has called for, still depends on political courage.

At Belem, that was in frustratingly short supply.

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. Ethical Corporation Magazine, a part of Reuters Professional, is owned by Thomson Reuters and operates independently of Reuters News.