Global equity markets routinely reached record highs during 2025 riding the artificial intelligence (AI) wave – driven by a small group of US tech giants, from Alphabet to Microsoft, investing heavily to get ahead in the biggest innovation race since the internet itself. Nvidia, which makes AI chips (graphics processing units, or GPUs), cemented its position as the backbone of the revolution, and, in July, became the first company to breach $4 trillion (€3.4 trillion) in market value in history. While this year also saw investors look beyond the headliners to cheer many in the supporting AI cast, markets endured wild swings throughout 2025 amid fears of a bubble forming – starting in January when China’s DeepSeek unveiled a cheap but powerful AI model.

Brera Holdings, a Dublin-based, but Nasdaq-listed company set up to take stakes in a number of lower-league football clubs from Italy to Mongolia, decided in September to join a growing list of US-listed companies essentially ditching their original focus to dive into the crypto craze. The stock surged almost 600 per cent in just one day, after revealing it will change its name to Solmate and become a digital asset treasury and crypto infrastructure company, centred around crypto assets called SOL. The initial surge proved short lived, however, with the stock down about 95 per cent from its highs.

Businessman Paul Coulson. Photograph: Frank Miller

Businessman Paul Coulson. Photograph: Frank Miller

Businessman Paul Coulson agreed in July to walk away from Ardagh Group, the glass bottles and drink cans giant he built up over the past 25 years through a series of debt-fuelled acquisitions, as a group of bondholders exchanged part of its unsustainable $12.5 billion of borrowings for equity. The deal involved a $300 million pay-off for long-standing investors – including $108 million for Coulson himself. Still, the legacy shareholders have shared more than $2 billion over the years – between debt-fuelled dividends and share buy-backs, a windfall from the sale of the leasehold on its original base in Dublin’s Ringsend, and the $300 million pay-off.

Dalata Hotel Group, best known for its Clayton and Maldron hotel brands, was acquired in November for €1.4 billion by Oslo-based investment firm Eiendomsspar and Swedish hotel company Pandox. Eiendomsspar already owned almost 15 per cent before Dalata put itself on the market in March. It also owns almost 25 per cent of Pandox.

Elon Musk. Photograph: Maansi Srivastava/The New York Times

Elon Musk. Photograph: Maansi Srivastava/The New York Times

Elon Musk was never far from the spotlight this year, between his controversial stint in the Trump administration slashing costs; subsequent social media feud with his former boss; falling sales at his Tesla group across Europe, the US and China, its three main markets; and shareholders at the carmaker approving a performance-based pay package worth $1 trillion – in a global first. That’s not to mention his X group, formerly known as Twitter, being fined €120 million by the EU for breaching digital rules and the Irish media regulator, Coimisiún na Meán, beginning an investigation into how the platform handles reported content.

Flutter Entertainment chief executive Peter Jackson emerged during annual reports season in the spring as by far the best paid chief executive of a home-grown Irish plc for 2024. The 50-year-old – who has seen Flutter’s annual revenues increase more than 500 per cent under his leadership between 2018 and 2024, driven by the acquisition of sports betting company FanDuel in the US – enjoyed a 185 per cent jump in his pay package last year to $22.2 million or €19 million, driven by cash and stock bonuses.

Gold soared by as much as two-thirds in value to a record high of almost $4,400 an ounce in 2025, making it a standout year for it and other precious metals. There have been a number of explanations for this, including the safe-haven asset being used as a hedge against economic uncertainty and a potential AI bubble, weakness in the value of the dollar, and expectations of US official interest rate cuts.

The hostile bid of the year goes to media and entertainment giant Paramount Skydance’s $108.4 billion tender offer made directly to shareholders of Warner Bros in early December – days after the latter’s board agreed to sell the company’s studios and streaming assets to Netflix in a deal worth $82.7 billion.

Iseq exits continued at pace this year. Dutch-based power storage developer Corre Energy delisted in March and ultimately succumbed to bankruptcy six months later. Datalex, the travel retail software company, dropped its stock quotation in September and resorted to another loan from its main shareholder Dermot Desmond, along with two other major investors. Newry-based FD Technologies was taken over by US private equity firm TA Associates in July for £541.6 million (€619 million) while Dalata delisted in November.

Jared Kushner. Photograph: Fayez Nureldine/AFP via Getty Images

Jared Kushner. Photograph: Fayez Nureldine/AFP via Getty Images

Jared Kushner, Trump’s son-in-law, made a claim on having a knack for a deal when it was announced in September that his Affinity Partners was part of a consortium, also including Saudi Arabia’s Public Investment Fund (PIF) and private equity firm Silver Lake, that had agreed to buy video games group Electronic Arts in a record-setting $55 billion take-private deal. Affinity and the Saudis are also among Paramount’s backers in the tussle for Warner Brothers.

Kenmare Resources confirmed in early March that it had received a takeover approach from its founding and former managing director Michael Carvill, with backing from Abu Dhabi private equity firm Oryx Capital Partners. This followed a report in The Irish Times that Carvill was circling the titanium minerals group. It prompted a spike in the shares. However, they subsequently fell back when the board called time on the talks in June, after the consortium indicated it would only be willing to proceed with a bid below its initial – rejected – £473 million proposal.

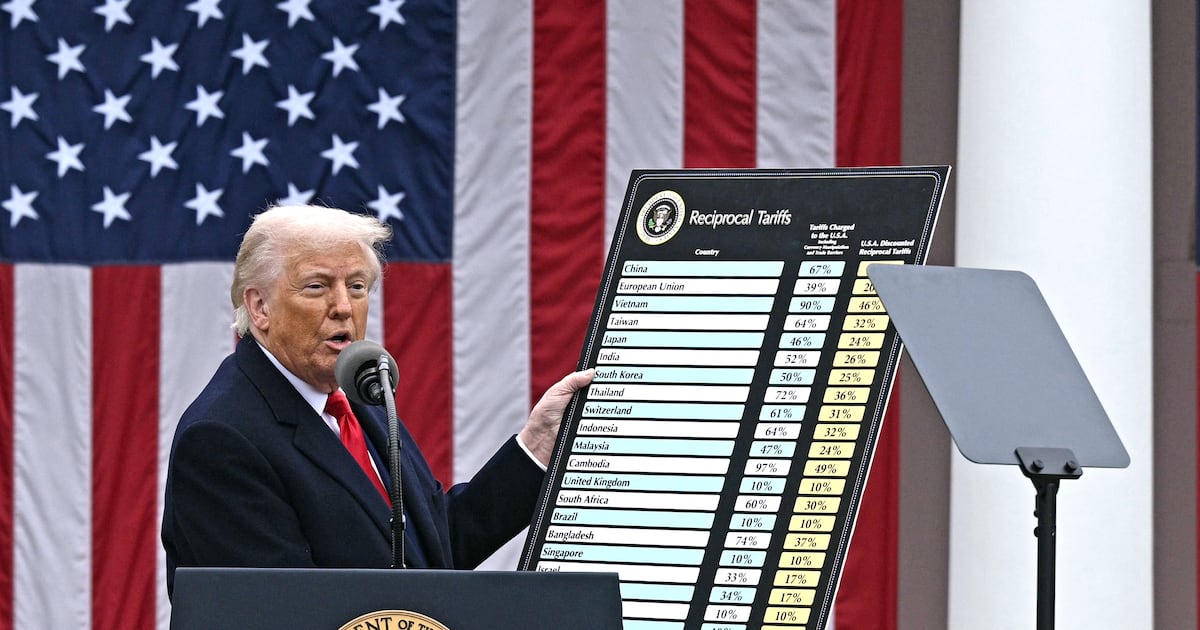

Trump’s Liberation Day speech on April 2nd, unleashing tariffs on the rest of the world, set off a violent reaction across financial markets – whipping trillions of euros off the value of shares globally and an unusual sell-off of US bonds, or Treasuries, amid doubts about their traditional safe-asset credentials and concerns that government borrowing would balloon.

The biggest mergers and acquisitions (M&A) deal of the year globally is the planned $85 billion tie-up between US listed freight railroads groups Union Pacific and Norfolk Southern, to create the first such group to link the east and west coasts. While it was announced in July, it is not expected to close until 2027, subject to certain federal approvals.

Danish drugmaker Novo Nordisk, the original gorilla in the GLP-1 weight-loss jabs market with blockbusters like Ozempic and Wegovy, lost half its market value in 2025 as it grappled with rising competition from its main rival Eli Lilly, and growth of unauthorised, cheap copycat obesity treatments – especially in the US. Once Europe’s most valued company, briefly valued at more than €600 billion in mid-2024, Novo Nordisk also this year suffered pipeline setbacks, ditched its CEO of eight years, and announced plans to cut 9,000 jobs, or 11.5 per cent of its workforce.

Legendary investor Warren Buffett, the Oracle from Omaha, announced that he would be retiring as CEO of his Berkshire Hathaway conglomerate at the end of 2025, after 60 years. The 95-year-old isn’t stepping away entirely, with plans to remain chairman of the group. But he said in a letter to shareholders that he will no longer write Berkshire’s annual report, nor talk “endlessly” at the annual meeting. “I’m going quiet,” he said.

[ ‘Going quiet’ at 95, Warren Buffett shows why time beats returnsOpens in new window ]

PTSB chief executive Eamonn Crowley surprised the stock market in October when the Irish bank announced that it had put itself up for sale – sending its market value up 23.4 per cent on the day to €1.58 billion. The State owns 57 per cent of the lender, having bailed it out post the 2008 crash.

Qnity, a supplier of materials and chemicals to the chipmaking sector, was the most significant corporate spin-off in 2025, floating amid the AI craze in New York in November with an initial market value of about $20 billion. Its previous owner was chemicals giant DuPont de Nemours. Closer to home, Cavan-based insulation giant Kingspan announced in September that it is planning an initial public offering (IPO) in Amsterdam of its advanced building systems unit Advnsys, which is focused on the global data centres boom.

Ryanair boss Michael O’Leary. Photograph: Brian Lawless/PA Wire

Ryanair boss Michael O’Leary. Photograph: Brian Lawless/PA Wire

Ryanair boss Michael O’Leary qualified for share options worth a net amount of more than €100 million after the airline’s shares hit a key performance target – exceeding €21 for 28 consecutive days. It’s set to be one of the biggest payouts in European corporate history, but the 64-year-old will have to remain with the airline until the end of July 2028 to collect on the stock options.

Irish publicly quoted companies are estimated to have spent an unprecedented amount of about €6.9 billion on share buy-backs this year. It echoes a global trend, helped by companies generating strong earnings and levels of cash even as trade tensions cloud the global economic outlook. JP Morgan estimates global buy-backs will reach a record $1.9 trillion in 2025.

Taxpayers exited AIB this year when it sold its remaining bailout shares and bunch of stock warrants in the bank. The deal brought the total that the State has recovered from the group’s €20.8 billion crisis-era rescue to almost €20.2 billion – leaving a shortfall of a little over €600 million.

The US dollar slumped about 11 per cent against a basket of other currencies globally in the first half of the year – marking its worst six-month performance in more than 50 years – as currency investors fretted about the impact of Trump’s trade policies. The so-called greenback has treaded water ever since.

Leslie Van de Walle, the experienced French executive who has held top roles in the likes of United Biscuits and packaging giant Rexam, presided over what’s likely to be the most transformative deal an Irish plc this year – as chairman of Greencore. The sandwiches maker agreed in April to take over London-based rival Bakkavor for £1.2 billion in a deal that will more than double annual revenues to about £4 billion. The transaction, which is expected to complete in early 2026, will add pizza, bread, desserts and dips to Greencore’s range, which currently spans sandwiches to salads, sushi and ready-made meals.

A number of inappropriate workplace dalliances were in focus during the year. Andy Byron, the head of US tech company Astronomer, quit in July after he was shown on a big screen at a Coldplay concert with a female coworker, in a clip that went viral. Nestlé fired CEO Laurent Freixe in September for failing to disclose a romantic relationship with a subordinate. US retailer Kohl fired Ashley Buchanan, its CEO of just over 100 days, in May after it emerged he failed to disclose a relationship with an outside vendor and that he had steered business her way.

[ CEO of software firm resigns after viral kiss cam video at Coldplay gigOpens in new window ]

Chinese president Xi Jinping. Photograph: Adek Berry-Pool/Getty Images

Chinese president Xi Jinping. Photograph: Adek Berry-Pool/Getty Images

Chinese president Xi Jinping’s administration – and local governments in the world’s second-most populous country – ramped up bond sales in 2025, with issuance helping to stabilise the economy as it grappled with weak consumption and a sluggish property market. His officials are also speculated to have played a role in getting Trump to row back on his Liberation Day tariff plans by dumping US bonds immediately after the announcement, contributing to a spike in Washington’s borrowing costs.

Linda Yaccarino, one of the most influential women in US media and advertising, having held senior roles at NBCUniversal and Turner Broadcasting, quit as CEO of X in July, after two years, amid growing friction with Musk and challenges in rebooting advertising on the platform to levels seen when the businessman acquired the group.

Zilch, the five-year-old UK buy now, pay later (BNPL) firm, is being tipped as a top IPO candidate in London after raising $175 million in equity and debt in a fundraising round in November. However, the Swedish rival Klarna offers a cautionary tale. Its shares have fallen by as much as 30 per cent since floating in September, partly amid rising competition in the BNPL space.

[ Q&A: Travelling to the US? Check your social media posts firstOpens in new window ]