Introduction

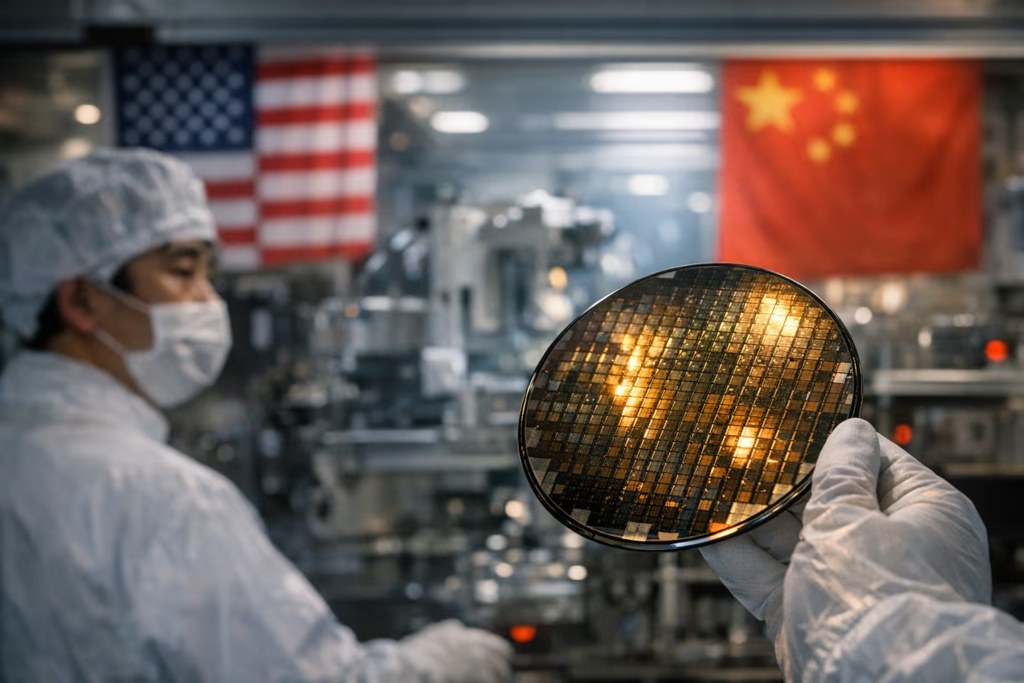

The United States has officially labelled China’s semiconductor strategy an economic threat.

But instead of hitting immediately with new tariffs, US semiconductor chose delay. Under a new ruling by the Office of the US Trade Representative (USTR), the US authorized tariffs on a wide range of Chinese semiconductors and chipmaking inputs. However, the tariff rate will remain 0% until June 2027, when higher duties will take effect.

This decision is not a pause. It is a calculated move that reshapes the US–China semiconductor trade war, global supply chains, and long-term chip investment strategies.

techovedas.com/how-are-trumps-2025-tariffs-reshaping-china-semiconductor-strategy

5 Key Takeaways

- US formally declares China’s semiconductor push a threat to US commerce

- New US semiconductor tariffs approved but delayed until June 2027

- Decision preserves the US–China trade truce ahead of elections

- China’s control over critical minerals weakens US tariff leverage

- Chip decoupling slows, benefiting global supply chains in the short term

What Are the New US–China Semiconductor Tariffs?

The USTR investigation, launched in December 2024, concluded that China uses state-backed, non-market policies to dominate the semiconductor industry.

According to the ruling, Beijing targets every major layer of the chip supply chain, including:

- Semiconductor design

- Wafer fabrication

- Assembly, testing, and advanced packaging

- Raw materials such as silicon and doped chemical elements

The US argues these policies distort global markets, displace foreign competitors, and create dangerous dependencies on Chinese supply chains.

Why Did the US Delay Semiconductor Tariffs Until 2027?

The most important detail is not the accusation — it is the timeline.

- 2025–2027: Tariff rate remains at 0%

- June 23, 2027: Higher tariff rate activates

- 30 days before: Final tariff level announced

Analysts say the delay reflects strategic restraint, not policy weakness.

The US keeps tariff authority intact while avoiding:

- Immediate consumer price inflation

- Supply chain retaliation

- Trade escalation before elections

Preserving the US–China Trade Truce

US and Chinese leaders reached a fragile trade truce in late 2025 after years of tariff escalation.

Former US Commerce official Christopher Padilla says the White House is deliberately avoiding new tariff shocks until after:

- Major 2026 diplomatic summits

- US midterm elections

With inflation still a political risk, aggressive tariffs on chips — which affect cars, electronics, and AI infrastructure — carry high domestic costs.

techovedas.com/tariff-truce-violation-china-accuses-u-s-of-breaking-the-may-12-deal

China’s Critical Minerals Advantage Limits US Leverage

The USTR ruling openly accuses China of being willing to “weaponise supply chain dependencies.”

China already restricts exports of:

- Gallium

- Germanium

- Antimony

These materials are essential for:

- Power semiconductors

- RF chips

- AI accelerators

- Defence electronics

Any rapid US tariff escalation could trigger immediate Chinese retaliation, disrupting global chip manufacturing and defense supply chains.

techovedas.com/us-china-tariff-war-temporary-truce-or-just-a-brief-pause

How Existing China Chip Tariffs Fit In

The delayed action does not remove existing penalties.

Chinese semiconductors already face:

- 50% Section 301 tariffs

- Export controls on advanced AI chips

- Restrictions on US investment in Chinese tech firms

The new ruling expands coverage to materials and upstream inputs, signalling that future pressure may hit deeper into the supply chain.

Our Take: Strategic Delay, Not a Softening Stance

This move confirms a larger shift in US semiconductor policy.

Washington no longer believes tariffs alone can counter China’s industrial scale. Instead, the strategy now prioritises:

- Time for CHIPS Act fabs to ramp

- Allied reshoring with Japan, Taiwan, and Europe

- Capital and technology controls

- Supply chain diversification

By pushing tariff impact to 2027, the US buys time while keeping leverage alive.

Why This Matters for Chip Stocks and Investors

Short-Term Supply Chain Stability: Chinese chips and materials remain in global circulation, reducing near-term disruptions.

China Gains Execution Time: Beijing gets two more years to localise tools, materials, and design ecosystems.

2027 Becomes a Market Risk Point: Investors should treat 2027 as a policy inflection year for chip valuations.

Rare Earths Are the Real Pressure Point: Control over materials matters more than tariffs on finished chips.

Semiconductor Policy Is Now Political Policy: Chip trade decisions are increasingly driven by elections and inflation risks.

What Happens Next in the US–China Semiconductor Trade War?

Between now and 2027, expect:

- Quiet negotiations

- Selective export controls

- Pressure on allied supply chains

- Limited headline escalation

The US keeps the tariff hammer raised — but does not swing it yet.

Follow us on Linkedin for everything around Semiconductors & AI

Conclusion

The US has officially declared China’s semiconductor ambitions a threat to its economy,

but instead of immediate escalation, it chose delay tariffs and leverage.

By postponing tariff impact until 2027, Washington protects domestic consumers, avoids retaliation, and preserves diplomatic space — while keeping pressure on Beijing.

The semiconductor trade war is not ending. It is entering a longer, more strategic phase.

Subscribe to Techovedas for clear, investor-focused analysis on chip stocks, supply chains, and global tech policy.