2026 is shaping up to be a defining year for the voluntary carbon market (VCM). After years of criticism, uncertainty, and volatility, the market is entering a more mature phase. Corporate climate ambition is higher than ever. Investment is flowing in at record levels. At the same time, integrity standards are tightening, regulators are stepping in, and the supply of truly high-quality credits remains tight. The result is a market that is growing quickly, becoming more disciplined, and rewarding projects that deliver real, durable climate impact.

Throughout 2025, momentum built rapidly. Companies retired more credits than in any first-half period before. Capital committed to new projects tripled. Asia emerged as a powerhouse. And by the time 2026 arrives, the market is not just bigger; it is more credible, more competitive, and more strategic than previous years.

Below is a closer look at where the market stands, how big it could get, and what matters most as we move through 2026.

Voluntary Carbon Market Size: Growth Accelerates Into 2026

Different analysts see the market through different lenses, but they all agree on one thing: the VCM is expanding fast.

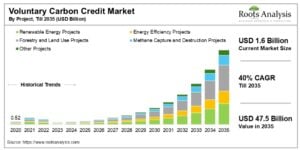

Roots Analysis takes a conservative but confident view. They expect the market to reach around USD 1.7 billion in 2026, rising from USD 1.6 billion in 2025, before accelerating sharply to nearly USD 47.5 billion by 2035 with a strong 38% CAGR. Their outlook focuses heavily on verified, high-quality credits, especially removals and premium nature-based solutions, supported by more than 6,200 companies pursuing science-based climate targets.

Mordor Intelligence is far more aggressive. They anticipate a significantly larger base market of USD 15.83 billion in 2025, implying around USD 23.8 billion in 2026 and rising to USD 120 billion by 2030, driven by rapid growth across renewable, waste, and forestry project pipelines.

Meanwhile, Regreener estimates the 2026 market at USD 3.04 billion, but still growing at a rate of more than 20% CAGR, while Bloomberg reports that 2025 saw record-breaking retirements and unprecedented capital inflows. In fact, companies retired more credits in the first half of 2025 than in any previous period, while more than USD 10 billion was committed to new carbon credit generation—three times 2024 levels.

Despite the different price tags, the direction of travel is clear. Demand is rising. Market value is expanding. And confidence is slowly returning as integrity improves.

Asia-Pacific Takes Control While the West Shapes Quality

- Asia-Pacific is more than just a participant in the VCM. It is becoming its center of gravity.

Forecasts suggest the region could grow at a staggering 36–58% CAGR, outpacing every other geography. China leads through massive renewable deployment and methane initiatives. India is transitioning from voluntary participation toward compliance under its Carbon Credit Trading Scheme, opening huge domestic demand. Indonesia’s peatlands, forestry investments, and regional alliances like the Asia Carbon Alliance further accelerate supply and credibility.

- North America remains the biggest buyer base, likely capturing 30–37% of market share in 2026. Major U.S. corporates—especially tech giants—continue to sign some of the largest removal deals ever recorded.

Microsoft alone accounted for the majority of durable CDR in 2025, driving enormous confidence and setting procurement benchmarks. Meanwhile, digital platforms and MRV innovations are cutting verification costs and improving transparency.

- Europe, however, is shaping the market’s integrity story. Policies like CBAM, aviation ETS rules, and the Green Claims Directive are forcing companies to prove climate claims with credible, traceable credits. The SBTi has also strengthened demand for long-lived removals, often commanding price premiums of more than 300% compared to avoidance credits.

Removals Lead the Charge as Premium Credits Tighten

One of the biggest structural shifts heading into 2026 is the clear transition from cheap avoidance credits to scarce, premium removal credits.

Analysts expect removal credits to grow at nearly 56% CAGR, fueled by:

Prices reflect this reality. Nature-based removals such as afforestation and reforestation range between USD 7 and USD 24 per tonne, though premium verified projects fetch significantly higher rates.

Meanwhile, technology-based removals like DAC remain extremely expensive, often trading above USD 170–USD 500 per tonne, with corporates willing to pay because supply is limited and permanence is strong.

Waste methane management is another standout, growing above 50% CAGR, driven by landfill methane reductions and oil and gas methane capture. Consumer-facing brands are also accelerating credit purchases, with companies like JPMorgan financing hundreds of millions into project pipelines.

However, supply is tightening. For the first time, many analysts believe retirements are overtaking issuances for premium credits. That creates scarcity, price resilience, and intense competition for the best credits.

Technology, Policy, and Capital Push the Market Forward

Three forces now shape the future of the voluntary carbon market.

Corporate climate ambition remains the strongest driver. More companies have net-zero pledges than ever before. Many have 2030 milestones approaching fast, forcing real action rather than PR commitments.

Policy alignment is transforming the VCM into a bridge between voluntary and compliance markets. ICVCM’s Core Carbon Principles are setting a global quality baseline. Paris Agreement mechanisms are increasingly connecting voluntary and regulatory systems, while countries like Singapore and EU regulators demand credibility and restrict low-quality credits.

Investment is scaling. Billions of dollars are now flowing into biochar, engineered removals, forestry restoration, and digital trading infrastructure. ETFs and blended finance vehicles are also appearing, enabling institutional participation.

Together, these shifts push the VCM from experimentation to execution.

Challenges Remain—but They Build Resilience

Despite the progress, 2026 is not a smooth ride. This is because market fragmentation remains high. Around two-thirds of transactions still happen privately, which limits transparency and market trust. Price volatility persists, too, especially for nature-based credits, which have ranged between USD 7 and USD 24 per tonne entering 2026.

Integrity concerns have not disappeared either. Any scandal instantly shakes confidence. Meanwhile, premium credit supply simply cannot keep pace with demand before 2030, particularly for engineered removals and high-quality land projects.

Yet, these challenges are forcing discipline rather than collapse. Standards are tightening. Buyers are getting smarter. Developers are investing earlier. And regulators are closing loopholes.

What 2026 Means for Developers, Buyers, and Investors

- For project developers, 2026 is a golden opportunity. Asia-Pacific offers unmatched scale. Removal technologies are gaining priority. Certification under credible frameworks will unlock long-term value.

- For buyers, the message is simple: quality first. Durable, verified credits cost more but protect brand trust and climate outcomes. Transparent platforms and reliable MRV tools are essential.

- For investors, the VCM represents one of the fastest-growing climate asset classes. Returns look strong, but diversification is key given volatility and evolving rules.

To summarize, 2026 is not about hype. It is about maturity. Record retirements in 2025, rising capital flows, Asia’s leadership, stricter governance, and accelerating removals all signal a market that is finally stabilizing after turbulence.