Low imports in December blamed for supply shortage

02 January, 2026, 11:30 pm

Last modified: 02 January, 2026, 11:49 pm

Infographics: TBS

“>

Infographics: TBS

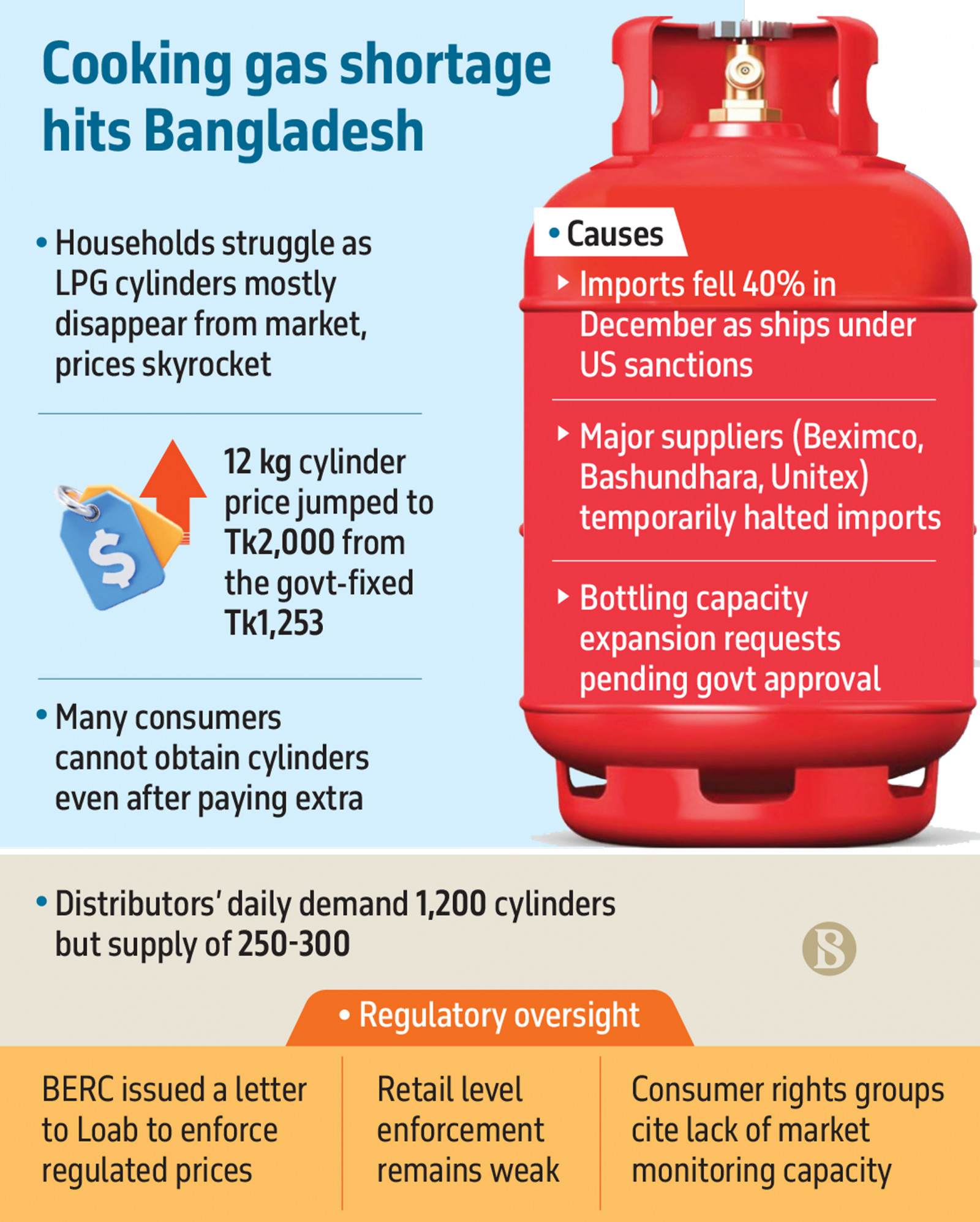

The country’s liquified petroleum gas (LPG) market has faced a severe supply crisis over the past two weeks, with 12 kg cylinders – widely used for household cooking – becoming increasingly scarce, pushing retail prices up to Tk2,000 from the official Tk1,253, while many consumers are unable to obtain a cylinder even after paying extra.

According to retailers and distributors, around 40% reduced imports in December due to a shortage of ships (some under US sanctions), and partial supply stoppages by major companies like Bashundhara have led to shortages across Dhaka, Chattogram, and other areas.

The Bangladesh Energy Regulatory Commission (BERC) wrote to the LPG Operators of Bangladesh (Loab), hoping to control prices, but no visible impact has been observed at the retail level yet.

Market insiders said that low LPG imports upset the supply-demand balance. Major suppliers such as Beximco, Bashundhara, and Unitex temporarily halted imports, preventing distributors from obtaining products in line with their needs and worsening shortages at the retail level.

Keep updated, follow The Business Standard’s Google news channel

Distributors said they are getting only a fraction of their daily demand from major suppliers, with some receiving no cylinders at all.

Mohammad Aslam Uddin, an LPG dealer in Rampura, Dhaka, told TBS, “Our daily demand is around 1,200 12-kg cylinders, but we are receiving only about 250-300. This increases transport and other costs. On 31 December, a 12kg cylinder was selling at Tk1,450. Today [2 January], I don’t have a single cylinder left to supply to retailers.”

Consumers are directly bearing the brunt of the shortage. In Dhaka and Chattogram, LPG prices have risen sharply above the regulated rate. The 12kg cylinder is at the centre of the crisis, placing extra financial pressure on middle- and low-income households.

For instance, Habibullah Bahar University College official Arif Hossain visited at least 15 stores in Malibagh before buying a 12kg cylinder for Tk2,000. “Since yesterday [1 January], I haven’t been able to cook at home as I couldn’t get a cylinder. Many stores didn’t have it, while others demanded double the price. I finally had to buy from this shop for Tk2,000,” he said.

Mamunur Rahman, a resident of Colonel Hat in Chattogram, said, “There is no gas connection at my home, so we need two cylinders a month. Yesterday, I had to visit three retail shops to get one. The cylinder I bought for Tk1,250 last month cost me Tk1,550 yesterday.”

Selim Khan, president of the LPG Distributors Association, said, “Most companies have halted or limited supply. Trucks are waiting idle, and costs are rising. However, there is no justification for charging Tk500-800 above the regulated retail price.”

Amirul Haque, managing director of Delta LPG and president of Loab, said, “Some companies have been inactive in imports, causing LPG imports to drop by nearly 40% in December. Although some companies have applied to increase bottling capacity, the government has not approved it. The supply shortage remains the main issue.”

He added, “We supply LPG to distributors at the BERC-regulated price, but controlling retail prices is beyond our capacity.”

Import ships hit by US sanctions

Humayun Rashid, managing director of Energypack, said that while demand typically rises during winter, this year’s situation is complicated by a shipping crisis. Twenty-nine ships used for regular LPG transport are under US sanctions, increasing transport costs and limiting availability. As a result, December imports fell to around 90,000 tonnes, compared with the usual 150,000 tonnes.

Rashid, however, claimed that no supplier increased prices, noting, “We are selling LPG at BERC-regulated rates. If retailers raise prices, the regulator should monitor them.”

Moreover, global LPG prices have risen over the past week. In Saudi Arabia, the benchmark Saudi Aramco Contract Price (CP) for January 2026 rose by an average of $32.5 per tonne from December 2025.

BERC falls short in market monitoring

Although BERC sets monthly prices, enforcement at the retail level remains ineffective. The commission has sent a letter to Loab instructing them to ensure LPG is sold at the regulated rate.

For December, BERC set the price at Tk104.41 per kg, or Tk1,253 for a 12kg cylinder. Any sale above this price at any stage – storage, bottling, distribution, or retail – is prohibited. The commission noted in the letter that any verified additional costs could be considered for future price adjustments.

Jalal Ahmed, chairman of BERC, said, “If importers incur extra costs, they must submit documentation to the commission. After verification, new prices may be adjusted, but until then, selling above the regulated rate is not allowed.”

In practice, however, the order is not being enforced. Consumer rights groups argue that BERC lacks the capacity to monitor the market effectively and has shifted responsibility to district administrations, avoiding its own duties.