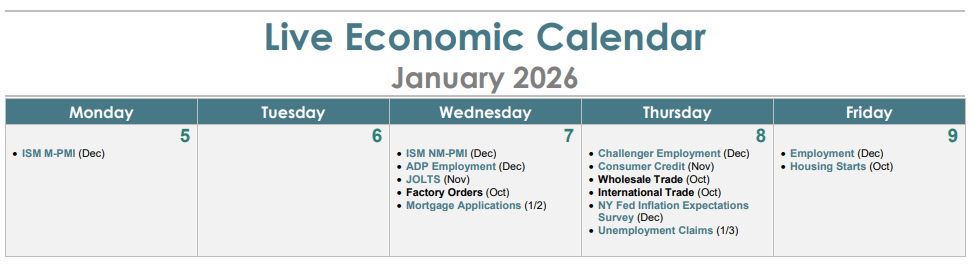

With the holidays behind us, the first full trading week of the year is a busy one on the data front. The big focus, naturally, is on the December employment report. It’s the first “full” release since the government shutdown caused data interruptions. It also marks a return to normalcy for investors eager to gauge how the Fed might proceed in the weeks ahead.

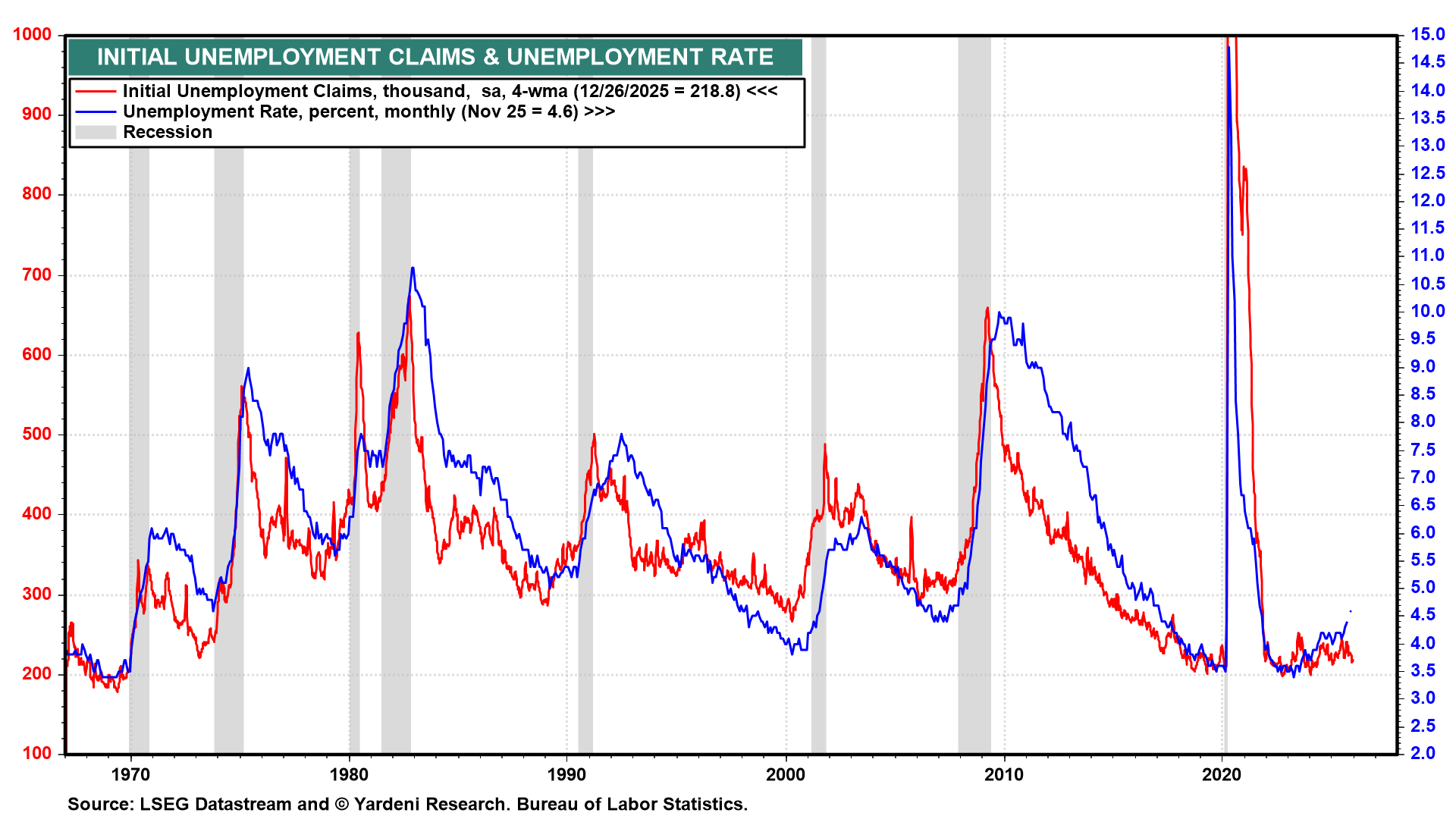

Recent data dented the view that the economy would stagger out of 2025. First, GDP grew a heady 4.3% y/y in Q3-2025. More recent data showed that initial unemployment insurance claims ended the year below the 200,000 mark. Overall, the data suggest that after surprising the bears in 2025, the economy appears on track for a solid 2026 as well.

The big question is whether Federal Open Market Committee (FOMC) members are experiencing rate-cut remorse, given that consumer spending remains strong and gross private fixed investment continues to impress. Over the weekend, Philadelphia Fed President Anna Paulson, a voting FOMC member this year, hinted that another rate cut is data-dependent—and could be some ways off.

Fed Governor Michelle Bowman will address the California Bankers Association (Wed). Minneapolis Fed President Neel Kashkari (also a voting FOMC member this year) speaks (Mon) to the American Economic Association. Richmond Fed President Tom Barkin speaks twice this week (Tue and Fri).

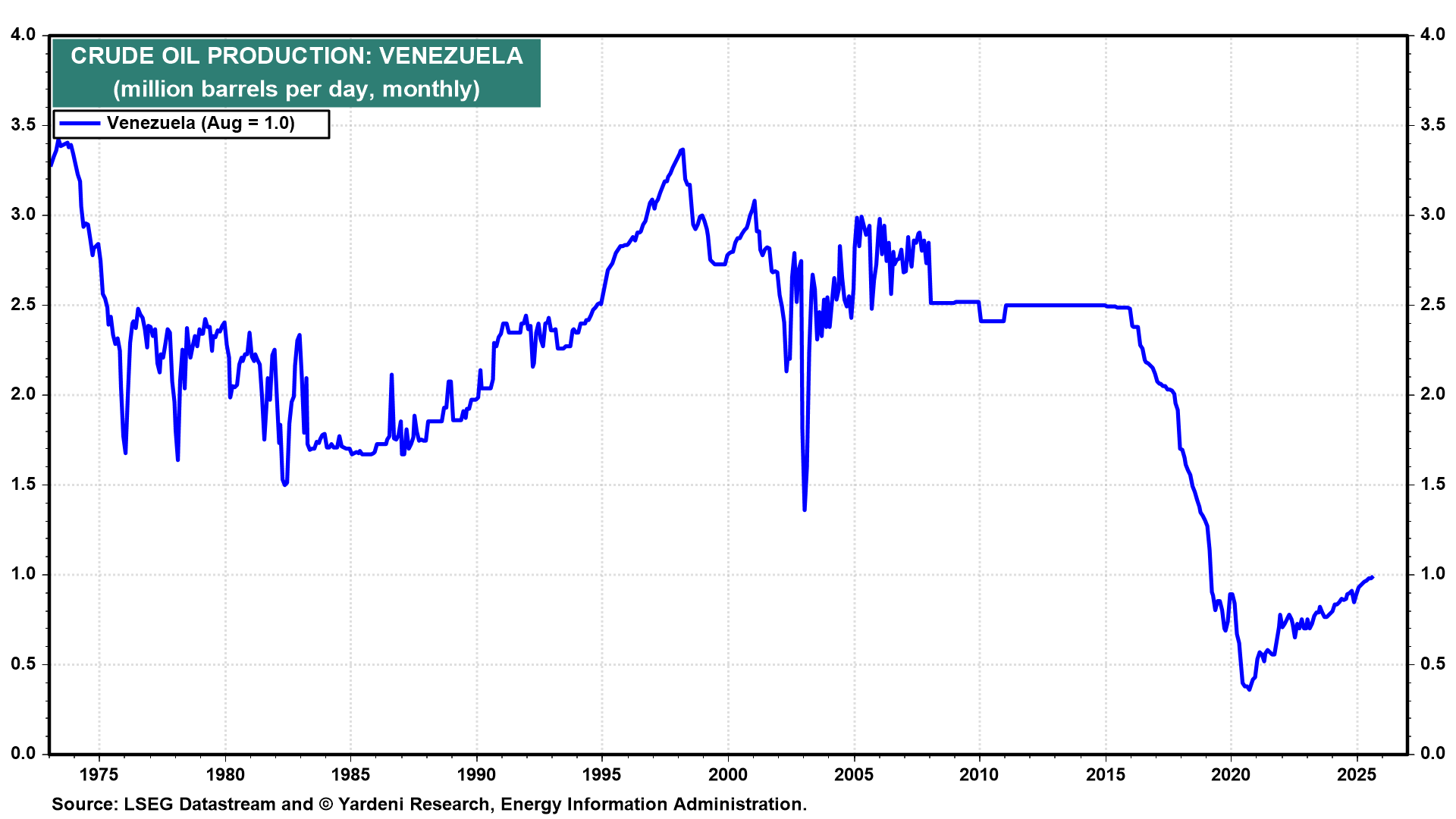

Outside the US, oil price moves will be watched closely following the capture of Venezuelan President Nicolás Maduro and his wife in a large-scale military operation by US forces. Venezuela has vast reserves of heavy oil, but it produces only 1.0 million barrels per day (chart). In Europe, Eurozone inflation data comes out. Inflation readings from China are also expected.

Here’s a look at US economic data releases with the most significant potential to move markets and influence whether the FOMC might ease again soon:

(1) Employment. We expect nonfarm payrolls (Fri) to increase by 60,000 in December following November’s 64,000 gain. The unemployment rate should drop to 4.5% from November’s 4.6% (chart). That’s all based on recent trends in weekly jobless claims (Thu).

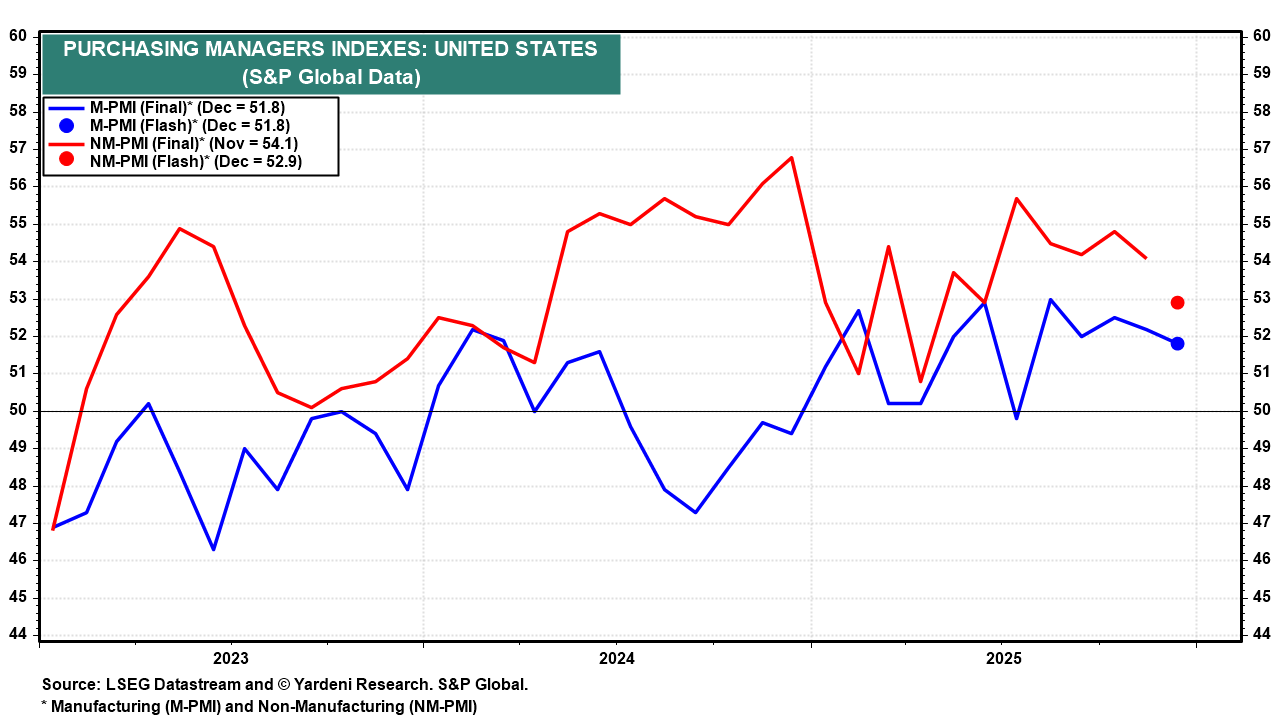

(2) PMI data. The week kicks off with the Institute for Supply Management’s manufacturing purchasing managers’ index for December (Mon). November’s reading was 48.2. The report may receive greater attention following last week’s somewhat mixed S&P Global US Manufacturing PMI (chart). Though output growth remains solid, new orders declined for the first time in a year, taking input costs down with them. ISM’s non-manufacturing PMI (Wed) could be weaker than November’s reading, based on the S&P Global flash report for services.

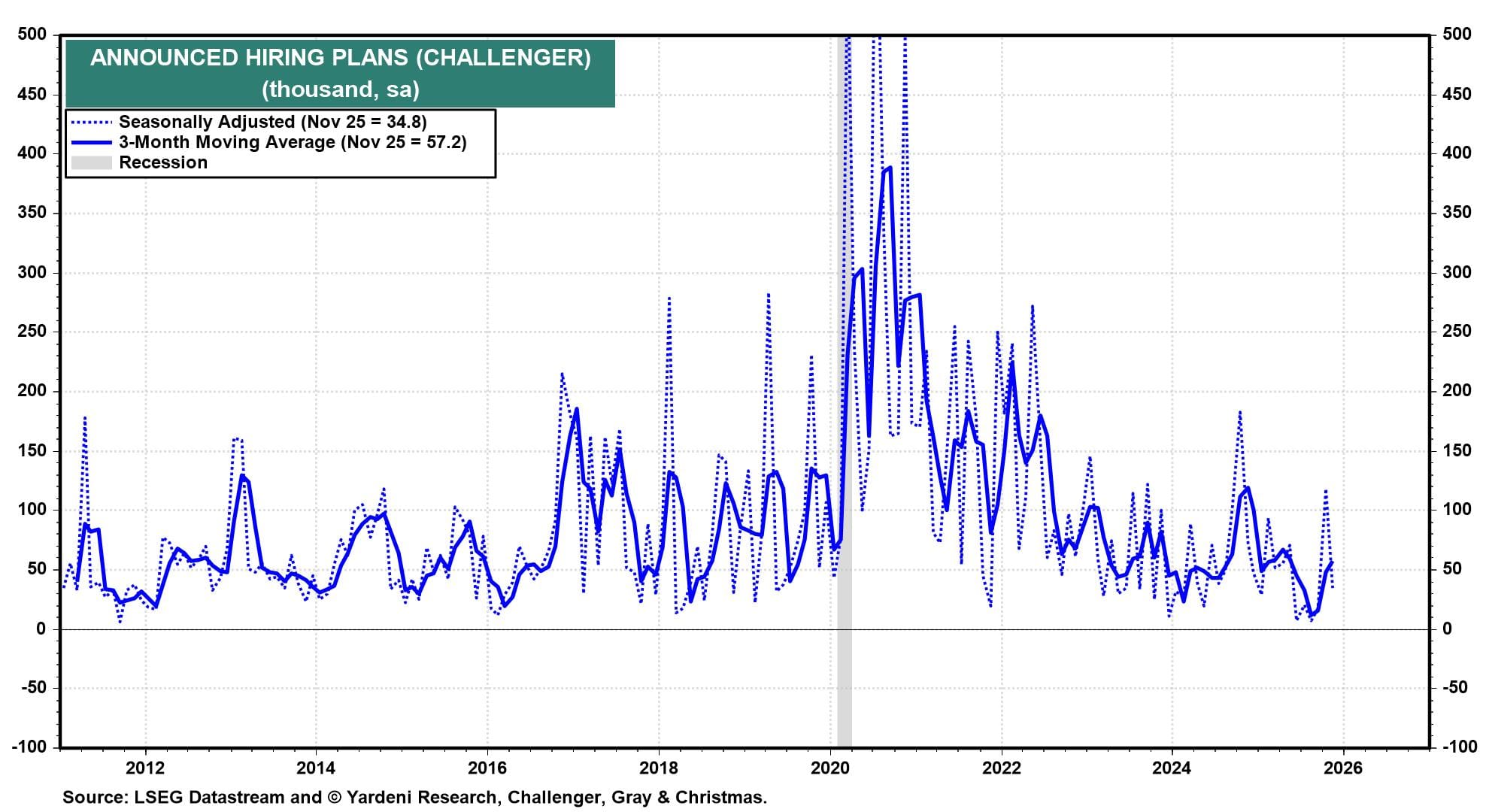

(3) JOLTS series. Given the market’s extreme focus on the health of labor markets, November JOLTS figures (Wed) on job openings, hires, quits, and layoffs could provide timely clues. In October, job openings remained stable at around 7.7 million, while hires and total separations were little changed. A day later, we’ll get the Challenger, Gray & Christmas layoffs report (Thu) for December. November showed a sharp 53% drop in planned layoffs (chart).

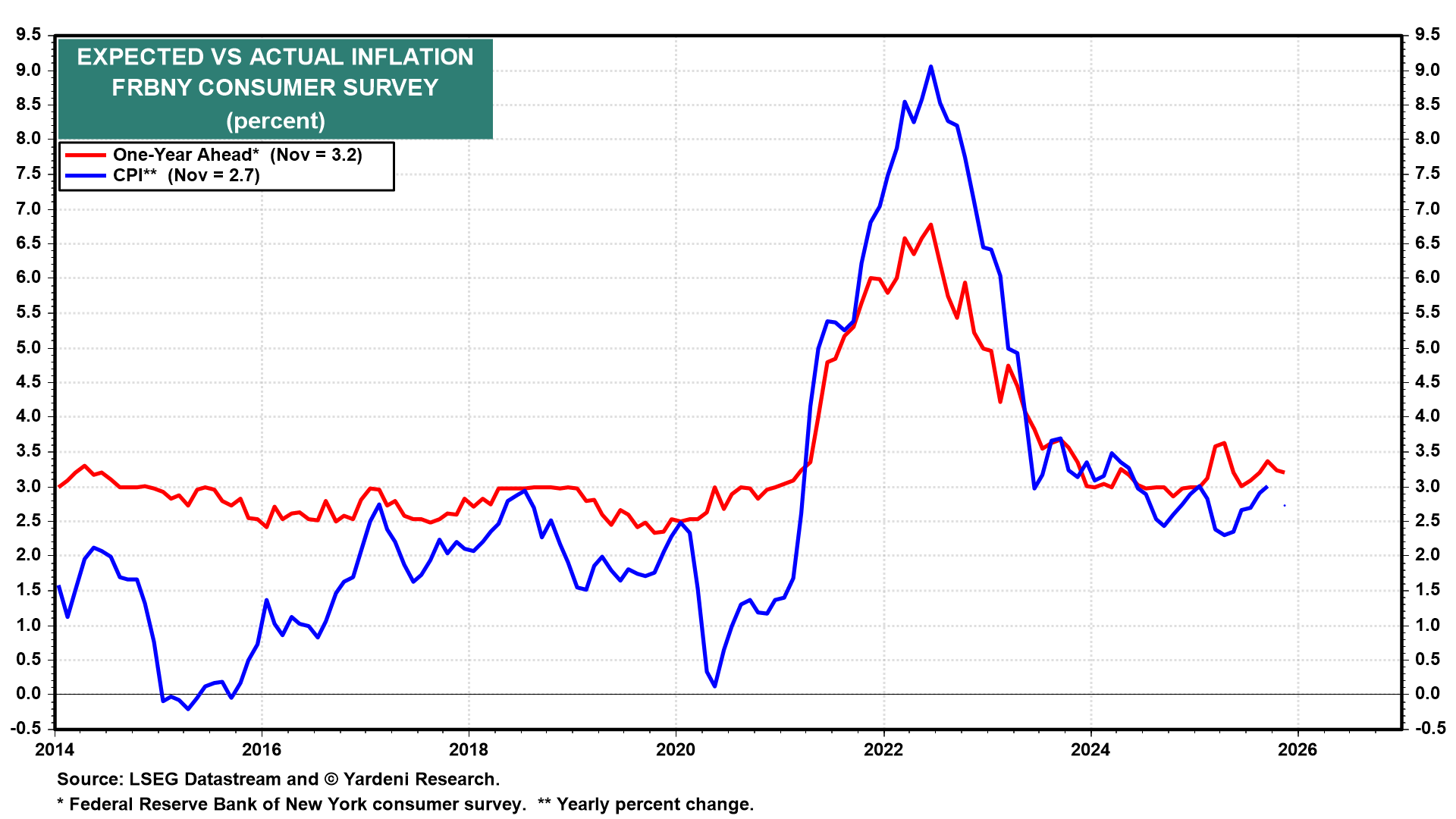

(4) Inflation expectations. Given doubts about the quality of recent government price data, post-shutdown, the New York Fed’s December inflation expectations survey (Thu) could fill in some blanks. In November, expectations were steady at 3.2% (chart). Meanwhile, perceptions about job prospects improved markedly. It all makes you wonder why exactly the Fed thought it was a good idea to cut rates again last month.

💡

Join the discussion with Ed below! To leave comments or questions, log in to the Yardeni QuickTakes website and post them at the end of the QuickTakes article. Paid members’ contributions may be featured in our segment, “Ed Answers Your Questions”.