A weekly newsletter about how finance is getting supercharged by tech in India, and how you can make money work for you Subscribe here

Good morning [%first_name |Dear Reader%],

You are reading our subscriber-only newsletter Ka-Ching!—a weekly commentary on fintech and personal finance

Enter your email address to receive a daily curation of our latest newsletters, stories, and podcasts.

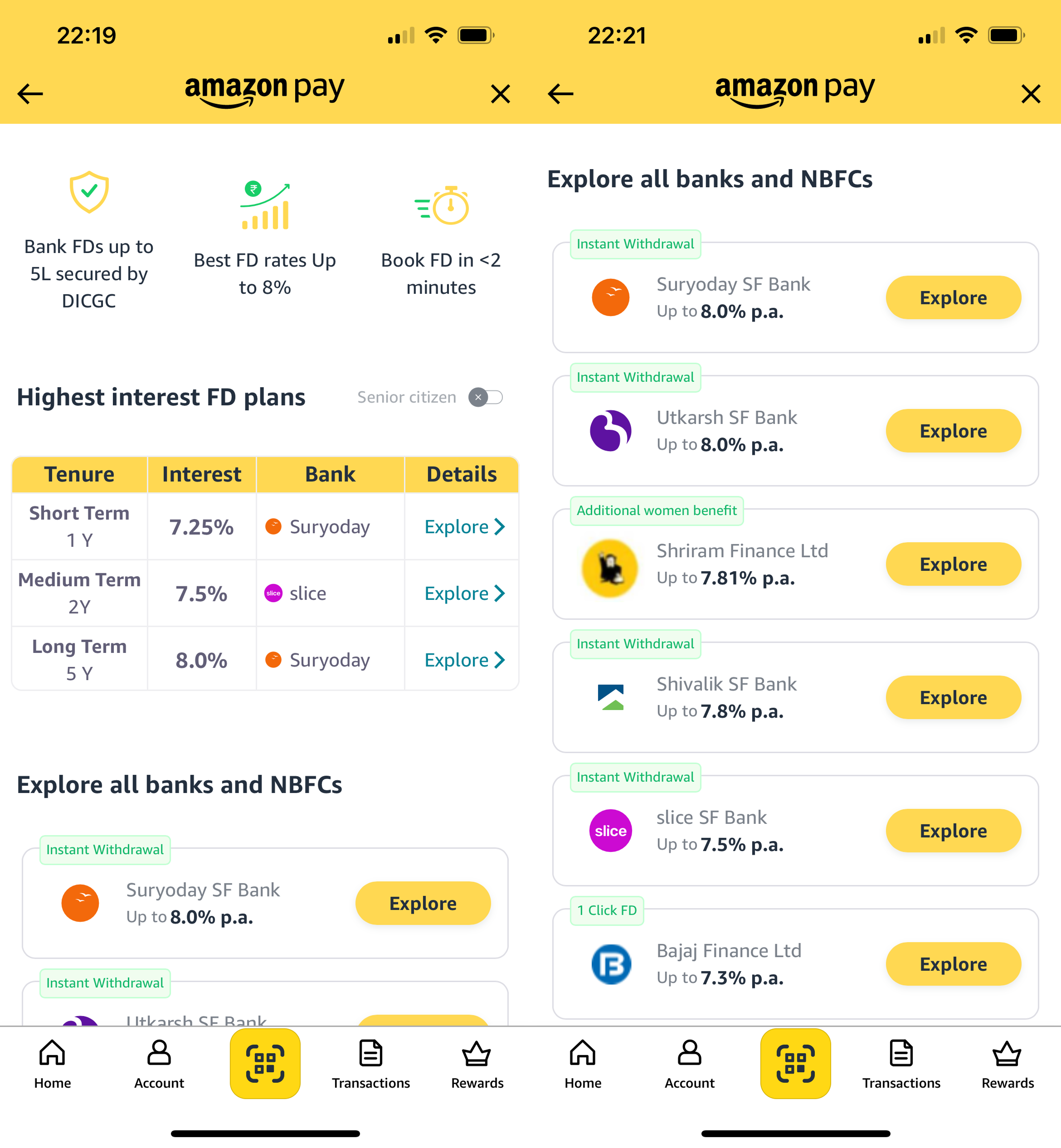

This week, Amazon Pay, the 10th-largest digital payments app, said it will allow its users to open digital fixed deposit accounts offered by some banks and non-banks.

It said users can open fixed deposits (FD) starting from Rs 1,000 on Amazon Pay, with its partner institutions offering interest rates up to 8% per annum. All partners provide an additional 0.5% interest for senior citizens, with Shriram Finance, which is one of its partners, offering up to 0.5% additional interest for women investors.

The fintech Stable Money had confidently rolled this product out in 2022. Then other digital platforms such as Super.money, Tata Neu, Wint Wealth, and Grip Invest followed suit.

In fact, last year, the Flipkart-backed Super.money, which has grown to become the fifth-largest UPI app, said that on day one of the product launch, an FD was opened every two minutes.

The main draw for customers to open digital FDs with these platforms is that it removes the need to open a savings bank account with the bank before opening an FD with the same bank.

The bigger draw is the interest rate. Most platforms partner with small finance banks like Utkarsh, Slice, and Shivalik for this product since they offer higher interest rates on FDs than other banks. For these banks that have partnered with these platforms, the response has been encouraging. A small finance bank executive said about 5% of deposits for their bank come from digital FDs. And this is without going aggressive.

This partnership also comes at a time when FDs have been looking for a second lease of life.

As per the latest RBI monthly bulletin, bank deposits held by households fell by about 9% to Rs 12.54 lakh crore in FY25, reversing the growth seen over the previous two years, The Hindu Businessline reported. This is reflected in the nature of household savings too. The share of bank deposits in overall financial savings fell from 40.9 per cent in FY21 to 35.2 per cent in FY25.

Amazon Pay launching this feature must give Google Pay a fair bit of heartburn, especially since the second-largest payments app launched digital FDs as an industry first in 2021, only to roll it back soon after.