UK economy grew by 0.3% in November

Newsflash: The UK economy has returned to growth, and more vigorously than expected.

UK GDP expanded by 0.3% in November, new data from the Office for National Statistics shows, after shrinking a little in October.

That’s faster than expected; City economists had expected growth of just 0.1%

In another boost, September’s growth figures have been revised higher, showing that the economy didn’t shrink that month after all.

The ONS says:

Monthly GDP is estimated to have grown by 0.3%, following an unrevised fall of 0.1% in October 2025 and a growth of 0.1% in September 2025 (revised up from our initial estimate of a fall of 0.1%).

More to follow….

Updated at 02.04 EST

Key events

Show key events only

Please turn on JavaScript to use this feature

River Action: Ofwat investigation into South East Water is long overdue

News that Ofwat is investigating South East Water over the outages which have plagued customers in Kent and Sussex have been welcomed.

James Wallace, the CEO of River Action, says the move is ‘long overdue’:

“We welcome Ofwat’s investigation, reportedly the first of its kind, though it is deeply ironic that it comes shortly before the government is expected to publish a White Paper to replace water regulators that have consistently failed to hold water companies to account.

“In the case of South East Water, communities across Kent and Sussex have been left without water for days, yet executives continue to be rewarded and customers face sharply rising bills. This investigation is long overdue, but it also highlights a regulatory system that has allowed repeated failure to become routine.

“As the government prepares its White Paper on water reform, it must end pollution for profit, fix a broken regulatory system, and put people and rivers before executive rewards.”

Today’s Ofwat investigation into South East Water follows an earlier enforcement case from November 2023 into whether it has failed to develop and maintain an efficient water supply system, which is still ongoing.

Analysts at RBC Capital Markets told clients this morning:

The new enforcement case relates to Tunbridge Wells, which experienced a sustained outage in November and December 2025. Supply problems continued into January 2026, with Storm Goretti causing additional disruptions that left more than 30,000 homes with intermittent supply.

This follows on from the government’s announcement on Wednesday that it would ask Ofwat to review South East Water’s licence.

ShareBank of England: Lenders expect drop in demand for mortgages

UK banks are expecting less demand for mortgages in the first quarter of the year, a blow to hopes of a pick-up in the property market.

The Bank of England’s latest Credit Conditions Survey has shown that lenders reported a decrease in demand for secured lending for house purchase in the October-December, with a further decrease expected in January-March.

Demand for secured lending for remortgaging was unchanged in Q4, and was expected to increase in Q1.

Photograph: Bank of EnglandShare

A flurry of financial results this morning have shown that the UK property sector is in a soft patch, despite the pick-up in optimism among surveyors (see earlier post).

UK housebuilder Taylor Wimpey reported that demand remained ‘muted’, and that uncertainty ahead of the late Autumn Budget impacted sales through the second half of 2025.

Jennie Daly, chief executive at Taylor Wimpey, told shareholders:

The Government’s planning reforms have been welcome, and we’ve seen increased momentum in our recent planning permissions. However, while affordability is slowly improving, demand continues to be muted – particularly among the important first time buyer category – which will constrain overall sector output.

The company built more homes than a year ago; total completions rose to 11,229, up from 10,593 in 2024. But its net private sales rate slipped slightly.

Shares in Taylor Wimpey have dropped by 3.4% in early trading.

London-focused estate agent Foxtons has reported that its sales slowed in the second half of last year, due to the Autumn Budget and broader economic uncertainty. Its shares are down 3.8% this morning.

Estate agency Savills has also reported that budget uncertainty hit demand, telling investors this morning:

2025 was characterised by a continuation of the market recovery seen in Q4 2024 into Q1 2025, followed by a pause in Q2, which continued into Q3. During this period, both investors and occupiers digested the implications of, in particular, the imposition of US tariffs, alongside other unforeseen geopolitical and fiscal events.

In the UK, the Group’s largest market, heightened uncertainty surrounding the delayed Autumn Budget had a similar subduing effect, particularly on the prime residential market.

Savills’ shares have jumped by 5.7% this morning, after predicting that it will at least match expectations for 2025, with solid year on year growth.

Updated at 04.04 EST

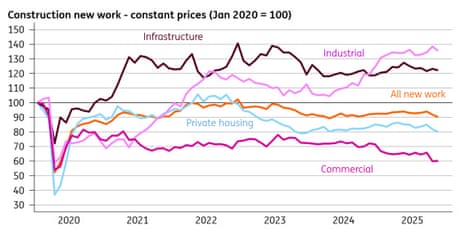

UK construction sector ‘having a shocker’ after worst slump since early 2023

Britain’s construction sector has suffered its worst quarterly slump in over two and a haf years.

The Office for National Statistics estimates that construction output decreased by 1.1% in the three months to November 2025 compared with the three months to August 2025.

This is the largest three-monthly fall in construction output since March 2023, suggesting demand cooled sharply since last summer.

The ONS says:

Both new work and repair and maintenance decreased by 1.0% and 1.1%, respectively. Within new work, the largest negative contributor came from private commercial new work, which fell by 4.5%. In repair and maintenance, the largest negative contributor came from private housing repair and maintenance, which fell by 3.7%.

Illustration: ING

Illustration: ING

Analysts at ING say “Construction output is having a shocker”, telling clients:

It’s easy to blame the Budget in late November for delaying projects and the surveys suggest that was the case. But we doubt that explains everything; new work across housing and commercial property is slumping.

And this is a sector that should in theory be benefiting the most from lower interest rates. On housing at least, we aren’t looking for an imminent turnaround. The impact of past rate hikes is still feeding into the mortgage market, given the prevalence of five-year fixes.

ShareAccountancy and tax consultancy boosted activity in November

Accountants and tax experts had a busy November, boosting growth, as their clients tried to prepare for the budget.

The ONS reports that accounting, bookkeeping and auditing activities, and tax consultancy, drove growth in the ‘professional, scientific and technical activities’ sector in November.

The UK’s stronger-than-expected growth in November is fanning away fears that the economy shrank in the October-December quarter.

Thomas Pugh, chief economist at audit, tax and consulting firm RSM UK, suspects the economy stagnated in Q4, saying:

“The 0.3% m/m rebound in output in November, along with the upward revisions to the monthly data, mean the risk that the economy outright contracted in Q4 has sharply receded.

However, we doubt the economy did little more than stagnate in Q4, as the initial data for December has been weak, and doctor’s strikes will add to the drag on growth. Things should pick up in Q1 of this year though, as activity postponed ahead of the budget comes through, and the impact of strikes and the Jaguar Land Rover (JLR) cyber-attack fades.

“The stronger-than-expected outturn in November will also further dent any chances of a back-to-back rate cut in February. We doubt the next rate cut will come until April.

The money markets indicate there’s just a 7% chance of a rate cut in February, with a cut not fully priced in until June.

ShareOfwat opens new investigation into South East Water over supply outages

England’s water regulator has opened a new investigation into South East Water, after households and businesses in Kent and Sussex suffered repeated outages.

The investigation will consider whether South East Water has complied with its obligation to provide high standards of customer service and support for its customers.

Lynn Parker, Ofwat senior director for enforcement, says:

“The last six weeks have been miserable for businesses and households across Kent and Sussex with repeated supply problems. We know that this has had a huge impact on all parts of daily life and hurt businesses, particularly in the run up to the festive period. That is why we need to investigate and to determine whether the company has breached its licence condition.”

The move comes after environment secretary, Emma Reynolds, called on Ofwat to review the company’s operating licence. If it were to lose it, the company would fall into a special administration regime until a new buyer was found.

My colleague Helena Horton visited Tunbridge Wells this week, and found schools have shut, businesses have closed, pubs and restaurants shut their doors. Some residents have had almost no water for a week, and have been collecting bottled water from the local rugby club.

David Hinton, the chief executive of South East Water, has been criticised for failing to appear in public during the crisis; he’s paid a base salary of £400,000 and received a bonus of £115,000 last year.

Something I found upsetting re the lack of SE Water senior leadership is that it was left to a v junior employee, a nice young man, to face brunt of public anger & apologise to them at water site. He seemed to be getting little info from HQ. He’s facing the public & CEO is not

— Helena Horton (@horton_official) January 14, 2026

South East Water has blamed recent freezing weather for creating leaks in its ageing pipe network; it has a statutory duty to maintain a sufficient supply of wholesome water to their customers.

ShareFebruary interest rate cut less likely

With the economy returning to growth with some aplomb in November, there’s less pressure on the Bank of England to lower interest rates.

Suren Thiru, ICAEW Economics Director, predicts the economy grew in the final quarter of 2025, despite the flu season.

Thiru explains:

“These figures confirm an unexpectedly upbeat November for the economy, as most sectors seemingly shrugged off pre-Budget uncertainty, though were flattered somewhat by the uplift to manufacturing from Jaguar Land Rover’s return to production.

“November’s uptick means it’s inevitable that the UK economy grew modestly across the final quarter of 2025 with easing uncertainty post-Budget likely to have supported growth in December, despite the ‘super flu’ disrupting activity in sectors like education.

“This return to growth probably won’t trigger a sustained economic revival with softer consumer spending amid an intensifying tax burden and higher unemployment likely to mean noticeably weaker growth for 2026, despite a boost from lower inflation.

“These figures make a February interest rate cut less likely by giving those rate-setters still concerned over inflation with sufficient comfort over economic conditions to delay voting to ease policy again.”

Today’s GDP report shows a pick-up at consumer-facing services businesses in the September-November quarter.

That was driven by the travel agency and tour operator sector, by retail, and by sports activities and amusement and recreation activities.

Scott Gardner, investment strategist at J.P. Morgan Personal Investing, says consumer spending was helped by the Black Friday sales this year:

“The UK economy returned to growth in November despite pre-Budget jitters leading to some inertia among businesses and consumers. Growth was driven by manufacturing during the month with the restart of operations at the Jaguar Land Rover factory feeding through.

“Beyond manufacturing, the economy was also boosted by a bounce back in consumer spending around the Black Friday sales. With Black Friday seemingly starting earlier and earlier each year, and more retailers participating, the high street rose to the occasion and was able to capture consumer demand in their busiest period of the year. On the flip side, the property market has been subdued since the summer with new home instructions at their lowest level since 2022 and agreed sales also falling. This inaction wasn’t limited to the property market with businesses and consumers putting off decisions until they had clarity on what tax and spend changes would be made in the Budget at the end of November.

“Looking ahead, one area we are closely watching is the labour market which has experienced a clear cooling over recent months. Wage growth has tempered and unemployment has grown which could have a negative second round effect on the economy, potentially sapping consumer spending and services activity. Alongside the recent challenges in the property market, the jury is out on whether the economy can leave the slow lane and pick-up pace going into 2026.”

ShareNIESR: GDP report is ‘welcome news’

Economists are welcoming the news that Britain’s economy grew more rapidly than expected in November.

Ben Caswell, senior economist at the National Institute of Economic and Social Research, suspects that Rachel Reeves’s commitment to expanding her budget fiscal headroom helped lift confidence, saying:

“Today’s data is welcome news for the UK economy, with GDP growing modestly in November despite the uncertainty in the run-up to the Budget.

Given today’s figure, we now project that the economy grew 1.4 per cent in 2025 – a rise in the growth rate compared to the year before.

Against this backdrop, the Chancellor more than doubled her fiscal headroom at the Budget in an effort to bolster economic confidence. While it is too early to see the full effect of this, the move appears to have eased speculation over future tax policy and the uncertainty that came with it.”

Taking a longer-term view, UK GDP is estimated to be 1.4% higher in November 2025, compared with November 2024.

A chart showing UK real GDP is estimated to have grown by 1.4% in November 2025, compared with November 2024 Photograph: Office for National StatisticsShareEconomy grew by 0.1% in September-November

Today’s GDP report shows that the UK economy only grew by 0.1% over the three months to November, despite the pacier 0.3% growth in November alone.

A chart showing real UK GDP grew by 0.1% in the three months to November 2025, following no growth in the three months to October 2025 and a growth of 0.1% in the three months to September 2025 Photograph: Office for National Statistics

ONS director of economic statistics, Liz McKeown says:

“The economy grew slightly in the latest three months, led by growth in the services sector, which performed better in November following a weak October.

“This was partially offset by a fall in manufacturing, where three-monthly growth was still affected by the cyber incident that impacted car production earlier in the Autumn. However, data for the latest month show that this industry has now largely recovered.

“Construction contracted again, registering its largest three-monthly fall in nearly three years.”

Updated at 02.40 EST

Car manufacturing surges afer JLR hack ended

UK manufacturing drove the economic recovery in November, thanks to the resumption of work at Jaguar Land Rover’s factory.

Manufacturing output grew by 2.1% in November, including growth of 10.7% in the manufacture of transport equipment, mainly driven by a 25.5% increase in the manufacture of motor vehicles, trailers and semi-trailers.

This follows a growth of 9.6% in October, and a fall of 29.5% in September – when JLR’s factories were shut by a cyber attack for a month.

Manufacturing of pharmaceutical products, and basic metals and metal, also rose in the month.

ShareServices and production grew, but construction shrank

The UK’s services sector, which makes up around three-quarters of the economy, expanded by 0.3% in November.

Production grew faster, with output rising by 1.1%.

But construction shrank by 1.3% in November, with builders reporting a drop in new work, and repair and maintenance.

ShareUK economy grew by 0.3% in November

Newsflash: The UK economy has returned to growth, and more vigorously than expected.

UK GDP expanded by 0.3% in November, new data from the Office for National Statistics shows, after shrinking a little in October.

That’s faster than expected; City economists had expected growth of just 0.1%

In another boost, September’s growth figures have been revised higher, showing that the economy didn’t shrink that month after all.

The ONS says:

Monthly GDP is estimated to have grown by 0.3%, following an unrevised fall of 0.1% in October 2025 and a growth of 0.1% in September 2025 (revised up from our initial estimate of a fall of 0.1%).

More to follow….

Updated at 02.04 EST

Housing market may be turning a corner as confidence grows, surveyors say

While we wait for the UK GDP data to land at 7am, there are signs of improvement in the housing market.

A poll of UK surveyors has found that confidence is returning to the market, with expectations for sales and prices turning higher in December.

The latest RICS UK Residential Market Survey found that sales expectations over the next three months had hit the highest level since October 2024.

Looking further ahead, a net balance of +34% of respondents expected sales volumes to rise over the next year – more than double the level seen in November.

Surveyors point to easing interest rate expectations and the clearing of Budget-related uncertainty as key drivers behind the turnaround in mood.

However, RICS’s measure of buyer demand and agreed sales remained in negative territory in December.

The latest @RICSnews Residential Market Survey for December 2025 showed a market preparing to move on from budget uncertainty galvanised by reduced interest rates and the fear of further rental growth. Despite house prices falling further in December and more acutely in London… pic.twitter.com/VQMiEgRs4I

— Emma Fildes (@emmafildes) January 15, 2026

RICS’s head of market research & analysis, Tarrant Parsons, says:

“The UK residential market remains in a prolonged soft patch, with December’s survey recording a sixth consecutive month of negative momentum in buyer enquiries. That said, there are tentative signs of a shift in sentiment beneath the surface.

“Near-term sales expectations have strengthened, and the twelve-month outlook has edged into more positive territory. The key test for 2026 will be whether borrowing costs ease on a sustained basis. If so, this could provide the catalyst needed to drive a recovery in buyer demand.”

Updated at 02.13 EST

Michael Brown, senior research strategist at Pepperstone, says:

This morning, we receive the latest GDP figures from here in the UK, with the economy set to have grown just 0.1% MoM in November, largely resulting from the continued resumption of JLR production as the recovery from last year’s cyber attack continues.

Such an anaemic pace of growth, though, is hardly a ringing endorsement of the UK’s economic prospects, not least considering that risks to the outlook remain tilted firmly to the downside, and that the fiscal ‘doom loop’ seems set to continue, with the government’s latest U-turns eroding as much as two-thirds of the headroom that Chancellor Reeves left herself at the November Budget.

ShareIntroduction: UK GDP report for November coming up!

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

City investors may be warbling Taylor Swift’s lyric, “Gray November, I’ve been down since July,” this morning, as they learn how the UK economy performed in the 11th month of 2025.

November’s GDP report, due at 7am UK time, will show whether the UK has shaken off its recent malaise.

Economists are hopeful that Britain returned to growth in November, with expectations that GDP rose by 0.1% in the month.

Although that would be modest growth, it would pull the UK out of a stagnant period in which the economy shrank by 0.1% in July, September and October, and was flat in August (although these figures could be revised).

Much of the month was dominated by speculation about the budget, which arrived on 26 November; activity in the car industry should have picked up after the cyber attack at JLR ended.

Sanjay Raja, chief UK economist at Deutsche Bank, sets the scene…

After a disappointing start to the fourth quarter, we expect some rebound in November. Some catch-up in activity, we think, is likely.

Activity trackers improved in November, as Budget uncertainty diminished. We will also be looking for any (upward) revisions to either the September or October GDP prints.

The agenda

-

7am GMT: UK GDP report for November

-

7am GMT: UK trade report for November

-

9am GMT: German full year GDP report

-

1.30pm GMT: US initial jobless claims report

Updated at 01.34 EST