As hyperscalers begin to report earnings this week, the market will be looking for big increases in artificial intelligence capital-expenditure spending projections. The question is: Will the market be happy with what it hears, and what could that mean for AI stocks? On the Jan. 27 episode of The Morning Filter, David Sekera and Susan Dziubinski discuss what Sekera’s perspective is on hyperscalers as we approach earnings season. Here is an excerpt from the show.

Are AI Stock Investors Headed Toward Disappointment?

Susan Dziubinski: We have two of the hyperscalers reporting this week, and that’s Microsoft MSFT and Meta Platforms META. What’s really going to matter here when it comes to the reports that we’re going to be seeing from all of the hyperscalers in the next couple of weeks? And then, of course, how do all of them look from a valuation perspective as we’re heading into earnings season?

David Sekera: From a valuation perspective, Microsoft and Meta are both 4-star-rated stocks. In fact, both of them are trading at a 22% discount to fair value. Although, in my mind, Microsoft is much more of that core holding type of stock. Whereas I think Meta, at least in my mind, is much more of a bet on artificial intelligence. And their capex spending, really, is to build out the AI part of their businesses. As far as earnings for this past quarter, I don’t know of any reason why they shouldn’t meet or beat expectations. And I don’t think the market really cares that much about their earnings for this individual quarter, in and of itself. I think the focus for all of the hyperscalers is going to be on their capital expenditure projections.

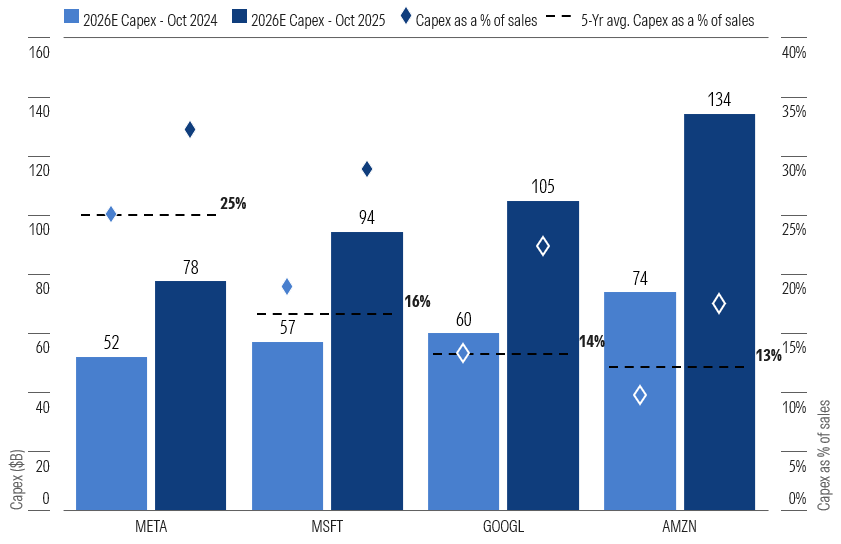

I put together a chart at the end of last week. I just wanted to give people a bit of perspective on the scale of the amount of growth in those expectations for capex. What I put together in this chart for each of the main hyperscalers is what our current forecast for 2026 capex spending is, what that forecast was in our model a year ago, and then I also show what their capex spending is as a percentage of revenue. For example, if you look at Meta, we’re currently projecting a $78 billion increase over the course of the last year as our analysts updated their models. The other thing I want to highlight is just how large of a percentage of capex that is as compared with sales. We’re currently modeling 33% of sales being spent on capex this year. It was 25% in our model a year ago, which actually was also going to be the same as the five-year historical average for capex spending. Similar story for Microsoft. We’re looking for $94 billion of capex spending this year. A year ago, we were only projecting $57 billion. We’re looking at capex as a percentage of revenue, almost 30%. We were modeling 18% last year, which was still above the 16% average historical rate.

Lastly, for Alphabet GOOGL and Amazon.com AMZN. Again, big increases, especially at Amazon.com, looking for that to go from $74 billion up to $134 billion in spending on capex, taking their budget up to 17% of sales, up from 10%. And I think there’s still a lot of upside, even to some of our own projections here. I think the consensus for Meta, for example, is $95 billion for 2026. And I think the market just generally is looking for all these capex spending numbers to go up even higher than what we’ve already projected for this year. And if we don’t see that happen, I think there could be a lot of disappointment, specifically in AI stocks, many of which are getting to be overvalued. And based on our base case, have probably gotten to be too overextended. So, I think you need to see capex expectations continuing to go up to support the AI story at this point in time.

Subscribe to The Morning Filter on Apple Podcasts, or wherever you get your podcasts, and keep up with the latest research from hosts Susan Dziubinski and David Sekera on Morningstar.com.

Read more about AI stocks in 2026. High Valuations, Higher Stakes: We’re Expecting Volatile Markets in 2026

Join Morningstar’s chief US market strategist and chief US economist for their 2026 market outlook as they review Morningstar’s current market valuation and why they expect the economy to reaccelerate in the second half of 2026.

Does the AI Trade Still Have Room to Run?

Where Morningstar analysts see opportunities—and where they don’t.