Copper Hydroxide Market Size and Forecast 2025 to 2034

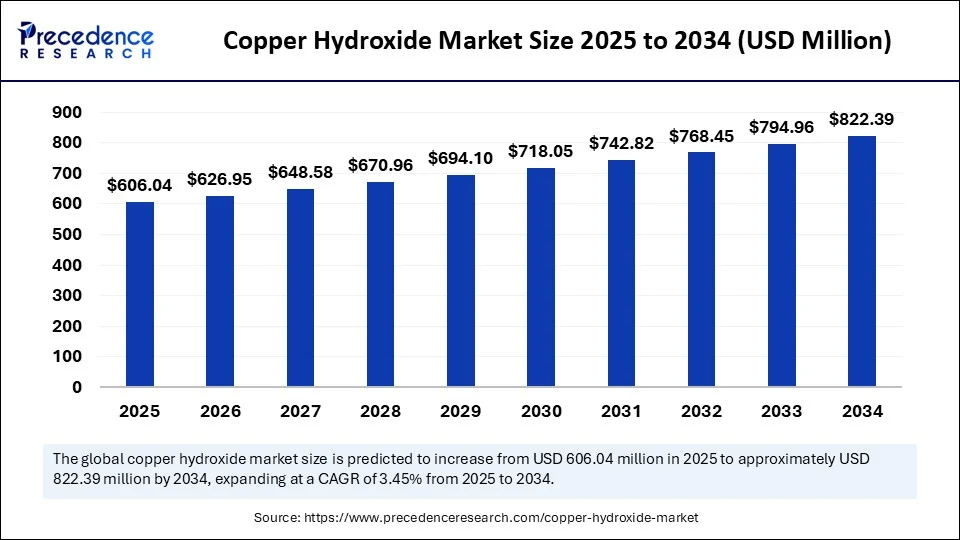

The global copper hydroxide market size was estimated at USD 585.83 million in 2024 and is predicted to increase from USD 606.04 million in 2025 to approximately USD 822.39 million by 2034, expanding at a CAGR of 3.45% from 2025 to 2034. The increasing global agricultural production, rising demand for crop protection chemicals, growing adoption of sustainable farming practices, and rapid technological advancements in pesticide formulations are expected to propel the growth of the global copper hydroxide market over the forecast period. Additionally, the market is rapidly expanding in various developing and developed regions, particularly the Asia Pacific, fuelled by a supportive regulatory environment and the rapid expansion of the agricultural industry.

Copper hydroxide market Key Takeaways

- In terms of revenue, the global copper hydroxide market was valued at USD 585.83 million in 2024.

- It is projected to reach USD 822.39 million by 2034.

- The market is expected to grow at a CAGR of 3.45% from 2025 to 2034.

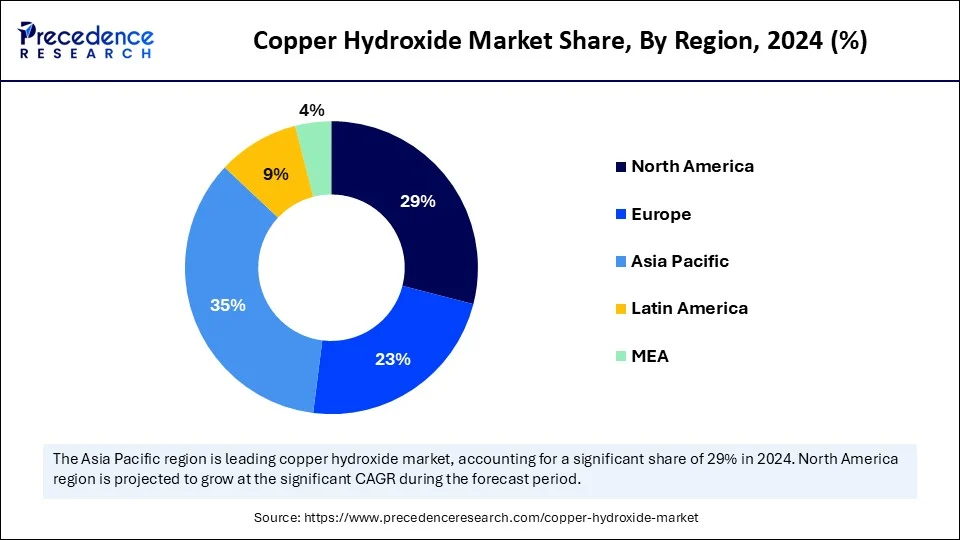

- Asia Pacific dominated the copper hydroxide market with the largest market share of 35% in 2024.

- Latin America is anticipated to grow at the fastest CAGR during the forecast period.

- By form, the wettable powder (WP) segment accounted for the major market share of 45% in 2024.

- By form, the suspension concentrate (SC) segment is expected to witness a significant share during the forecast period.

- By end-user industry, the agriculture & farming segment held a largest market share of 45% in 2024.

- By end-user industry, the horticulture & floriculture segment accounted for considerable growth over the forecast period.

- By distribution, the agrochemical distributors & retailers segment captured the highest market share of 60% in 2024.

- By distribution, the online platforms segment is projected to grow at a CAGR between 2025 and 2034.

How can Artificial Intelligence Improve the Copper Hydroxide Market?

In the evolving technological landscape, Artificial intelligence emerges as a transformative force and holds potential for growth and innovation in the copper hydroxide market. The incorporation of AI in the copper hydroxide market enhances research activities, enables more efficient production, and optimizes supply chains to meet the ongoing demand for sustainable agricultural solutions. Several manufacturers are increasingly leveraging AI with the intention of improving product quality, lowering costs, and accelerating time-to-market. AI-driven analytics can process large amounts of data from drones, sensors, and satellite imagery to identify areas in crops affected by fungal diseases, which assists in enabling targeted application of fungicides. This minimizes operational costs for farmers, which drives the need for more efficient fungicidal solutions.

Asia Pacific Copper Hydroxide Market Size and Growth 2025 to 2034

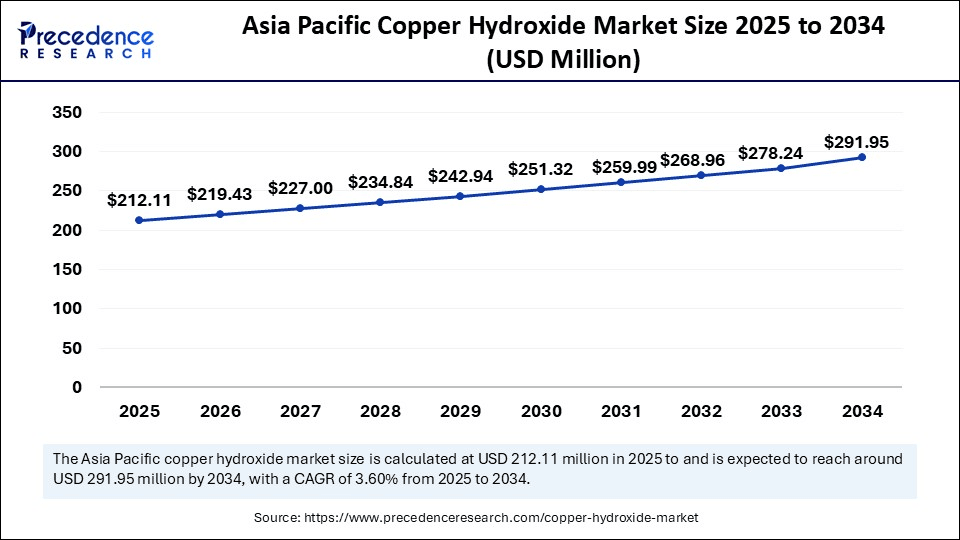

The Asia Pacific copper hydroxide market size is exhibited at USD 212.11 million in 2025 and is projected to be worth around USD 291.95 million by 2034, growing at a CAGR of 3.60% from 2025 to 2034.

Asia Pacific held the dominant share of the copper hydroxide market in 2024. The region’s extensive and flourishing agriculture sector is expected to drive the need for copper fungicides in the region. The region represents immense growth potential for copper fungicides as crop protection chemicals, driven by the increasing demand for food. Factors such as increasing reliance on advanced crop protection tools, rising practices of organic farming, increasing population, supportive government framework, rising R&D activities in disease-resistant crops, rising population, and technological advancements in fungicide formulation are expected to propel the expansion of the copper fungicides market in the region.

The growing popularity of precision agriculture techniques for targeted application, along with the increasing consumer inclination for chemical-free produce and sustainable farming practices, is significantly encouraging the use of copper hydroxide as an eco-friendly solution. Copper-based fungicides play a crucial role in managing various fungal diseases in organic systems where synthetic pesticides are prohibited. Additionally, the market is also propelled by the increasing use of copper hydroxide in agriculture, chemical manufacturing, and electronics industries in the region.

Copper Hydroxide Market Trends in India

The country accounted for the majority of market revenue share in 2024, fuelled by growing production of crops, supportive government policies, and rising concerns about climate change.

Copper hydroxide is widely used in the country’s agricultural and farming land as a fungicide to protect crops such as fruits, vegetables, and cereal crops against a wide range of fungal diseases. The adoption of copper hydroxide ensures healthier produce in the country. Additionally, government initiatives and policies are likely to promote the growth of the copper hydroxide market in the country.

- According to an article published by the Press Information Bureau (PIB) in February 2025, the Government of India has significantly increased budget allocations, rising from â¹11,915.22 crore in 2008-09 to â¹1,22,528.77 crore in 2024-25, reflecting its commitment to agricultural development. Key farmer-centric initiatives include PM-KISAN (â¹3.46 lakh crore disbursed), PMFBY (â¹1.65 lakh crore in claims), and e-NAM, which has integrated 1,400+ mandis for better market access. The Agricultural Infrastructure Fund (AIF) has sanctioned â¹52,738 crore for over 87,500 projects to improve post-harvest management.

Latin America is expected to grow at the fastest rate in the market during the forecast period. The region has extensive use of fungicides in the agricultural sector. The fastest growth of the region is mainly fuelled by the rising demand for crop protection, government incentives promoting sustainable farming practices, and growing demand for copper hydroxide in various industries. The region’s favourable regulatory frameworks encourage the adoption of fungicides in the region. Brazil is the largest contributor to the copper hydroxide market. Brazil’s massive agricultural output is expected to boost the demand for fungicides and pesticides, with copper hydroxide being an effective option for protecting fruit and vegetable crops.

- According to the article published in February 2025, the Gross Production Value (GVP) of Brazil’s agricultural sector for the 2025 harvest, based on data from January, reached R$ 1.41 trillion, marking an 11% increase over the 2024 cycle (R$1.27 trillion). The commodities with the highest growth were coffee (+46.1%), castor beans (+40.5%), cocoa (+25.0%), peanuts (+23.8%), corn (+16.7%), and soybeans (+13.4%).

Additionally, the total planted area is estimated at 81.4 million hectares, a 1.8% growth compared to the 2023/24 cycle. As the main crop grown in the country, soybeans are projected to reach a production of 166.33 million tons, 18.61 million tons more than the previous harvest. (Source: https://www.agribrasil.net)

Market Overview

The copper hydroxide market covers the production, distribution, and application of copper hydroxide (Cu(OH)â), a chemical primarily used as a fungicide, bactericide, and algaecide in agriculture, as well as in industrial applications such as water treatment and chemical synthesis. It is widely used to protect crops like fruits, vegetables, and cereals from fungal diseases. Moreover, its role in catalysts and electrochemical applications is also boosting its demand from across various industries.

What are the Latest Trends in the Copper Hydroxide Market?

- The increasing concerns associated with food insecurity, along with the rising pressure on the agriculture sectors, are expected to drive the market expansion during the forecast period.

- The rapid technological advancements in fungicide formulation and supportive government agricultural policies are anticipated to contribute to the overall growth of the copper hydroxide market.

- The surging demand from emerging markets and the increasing use of sustainable agriculture techniques are expected to propel the expansion of the copper hydroxide market in the coming years.

- The rising need for organic certified crop protection solutions is anticipated to promote the market’s growth during the forecast period.

- Several manufacturers are increasingly focusing on developing improved copper hydroxide formulations that offer high efficacy while lowering the environmental impact. These formulations minimize the need for copper for effective disease control. Such factors are bolstering the growth of the market during the forecast period.

- The rising use of copper hydroxide in agriculture, chemical manufacturing, and electronics is anticipated to accelerate the market’s revenue during the forecast period.

Market Scope

Market Dynamics

Drivers

Increasing global agricultural demand

The rising demand for agricultural products is expected to boost the growth of the copper hydroxide market during the forecast period. Copper hydroxide is widely used as a fungicide to protect crops against numerous fungal diseases, such as fruits, vegetables, and cereal crops. The rising cases of fungal diseases among crops can be attributed to various factors such as the emergence of invasive fungal species, climate change (higher temperatures and humidity), and agricultural practices like monoculture.

The increasing global food consumption has led to an increase in the need for higher crop yields and quality, accelerating the adoption of copper hydroxide as a crop protection solution. The effective control of fungal diseases that affect crops is important for meeting the rising food demand globally, fuelled by the rapid surge in population. Regions with expanding agricultural activities, such as Latin America and the Asia-Pacific, are experiencing the rising demand for copper hydroxide. Therefore, the rising agricultural demand increases the need for stronger fungal resistance in crops.

Restraint

Rising environmental and health concerns

The increasing environmental and health concerns are anticipated to hamper the market’s growth. The excessive use of copper hydroxide in soil and water often increases the risk of harming ecosystems, as well as compelling regulatory bodies like the EPA and ECHA to implement stringent guidelines on the usage of copper hydroxide. Prolonged exposure to copper hydroxide can pose health risks to workers, such as skin irritation and respiratory issues. Moreover, the availability of alternatives like copper oxychloride and synthetic fungicides offer similar efficacy at lower costs, is likely to limit the expansion of the global copper hydroxide market.

Opportunity

Rising popularity of organic and sustainable framing practices

The increasing popularity of organic and sustainable framing practices is projected to offer lucrative growth opportunities to the copper hydroxide market during the forecast period. Copper hydroxide has non-toxic and various environmentally friendly properties, making it the preferred choice for organic farming practices. Under organic farming standards, copper hydroxide is permitted and offering a crucial tool for managing fungal diseases such as mildews, blights, and rusts. Farmers are increasingly demanding chemical-free produce, making copper hydroxide essential for managing fungal diseases in organic systems where synthetic pesticides are prohibited. Moreover, the technological progress for copper hydroxide fungicides focuses on reducing environmental impact, improving efficacy, and integrating with precision agriculture techniques. The technological innovation in product formulations has led to an increasing development of nano-copper hydroxide, which is significantly improving its effectiveness and lowering its environmental impact.

Form Insights

The wettable powder (WP) segment dominated the global copper hydroxide market in 2024. Copper hydroxide as a fungicide is often formulated as a wettable powder for agricultural use. The WP formulation often contains 50 to 77% copper hydroxide, specifically designed to be mixed with water for a sprayable solution. Wettable powder is highly effective against various fungal and bacterial diseases and is widely used on various crops. The common applications include fruits such as grapes, apples, and pears, as well as vegetables such as ginger, tomatoes, potatoes, onions, and others.

On the other hand, the suspension concentrate (SC) is expected to witness remarkable growth during the forecast period. Copper hydroxide suspension concentrate (SC) is extensively used for various fungal diseases in certain concentrates. There are various benefits of copper hydroxide SC, such as being effective against fungal and bacterial diseases, creating a long-lasting protective barrier, and being easy to use. Suspension concentrate is mainly effective when applied in the early stages of fungal and bacterial disease development.

End-user Insights

The agriculture & farming segment dominated the global copper hydroxide market in 2024, owing to the increasing use of copper hydroxide as a fungicide and bactericide for controlling diseases on crops such as fruits and vegetables. Copper hydroxide combats various fungal and bacterial diseases in agriculture, which makes it a preferred option for crop protection. The increasing concerns associated with food insecurity and the increasing shift towards sustainable and organic farming techniques are expected to bolster the segment’s expansion in the coming years.

On the other hand, the horticulture & floriculture segment is expected to witness remarkable growth during the forecast period. Copper hydroxide is extensively utilised as an effective fungicide in horticulture and floriculture to prevent and control the widespread of fungal diseases such as blight, leaf spot, and mildew on a wide range of fruits, vegetables, and flowers without harming the environment. Moreover, the increasing consumer preference for eco-friendly and sustainable farming methods is likely to drive the demand for copper hydroxide in the horticulture & floriculture segment.

Distribution Channel Insights

The agrochemical distributors & retailers segment held the largest share in the copper hydroxide market in 2024. Agrochemical distributors & retailers possess deep knowledge of organic and sustainable farming conditions and maintain established relationships with farmers, which increases the sales of copper hydroxide as a fungicide and bactericide. They provide crucial assistance and guidance to farmers on the proper application of copper hydroxide for effectively controlling fungal and bacterial diseases in various types of crops. These channels can reach a broader market, especially in rural agricultural areas where online reach is limited.

On the other hand, the online platforms segment is expected to grow significantly in the coming years. Online platforms provide access to a wider customer base and expanding market reach for copper hydroxide suppliers and producers. Online platforms offer a marketplace to connect manufacturers, suppliers, and distributors with potential buyers. Online channels reduce costs and enhance delivery times by eliminating intermediaries. Several manufacturers and suppliers are increasingly using online platforms to build a strong online presence in the market and provide a seamless customer experience.

Copper Hydroxide Market Companies

Recent Developments

- In March 2023, Corteva Agriscience announced the launch of Adavelt active, with recent product registrations in three countries such as Australia, Canada, and South Korea. Adavelt active is a novel fungicide with a new mode of action that protects against a wide range of diseases that can impact crop yields.

- In July 2024, Rotam Global AgroSciences Limited’s headquarters, Albaugh launched 46% Copper hydroxide WDG, marking another major product in the field of inorganic copper. The copper formulation product line is more perfect, and fully meets the market demand. Albaugh owns three high-quality copper mines with an annual supply of 14,500 tons of copper formulations, making it one of the world’s top three copper formulations producers.

Segmentation Covered in the Report

By Form

- Wettable Powder (WP)

- Suspension Concentrate (SC)

- Granules

- Others (Liquids, Flowables)

By End-User Industry

- Agriculture & Farming

- Horticulture & Floriculture

- Industrial

By Distribution Channel

- Direct Sales to Farmers

- Agrochemical Distributors & Retailers

- Online Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa