- Rocket Lab (NasdaqCM:RKLB) delivered its world first “Hungry Hippo” reusable fairing to the Neutron launch site, introducing a captive fairing design aimed at quicker rocket reuse.

- The company is progressing Neutron qualification after a Stage 1 tank rupture during testing, treating the event as part of its development roadmap.

- Both milestones arrive during an important build out phase for Neutron, which targets the medium lift launch segment with a reusable architecture.

For you as an investor, the story here is about how Rocket Lab positions Neutron in a launch market where reuse and turnaround time are core themes. The “Hungry Hippo” captive fairing speaks directly to that, since fairings are usually single use hardware that add cost and complexity to each mission.

The recent tank rupture, while a setback, sits inside the normal qualification process that new rockets go through before reaching regular service. How the company incorporates test data into design choices and timelines for Neutron will be an important thread to watch if you are tracking NasdaqCM:RKLB for its medium lift ambitions.

Stay updated on the most important news stories for Rocket Lab by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Rocket Lab.

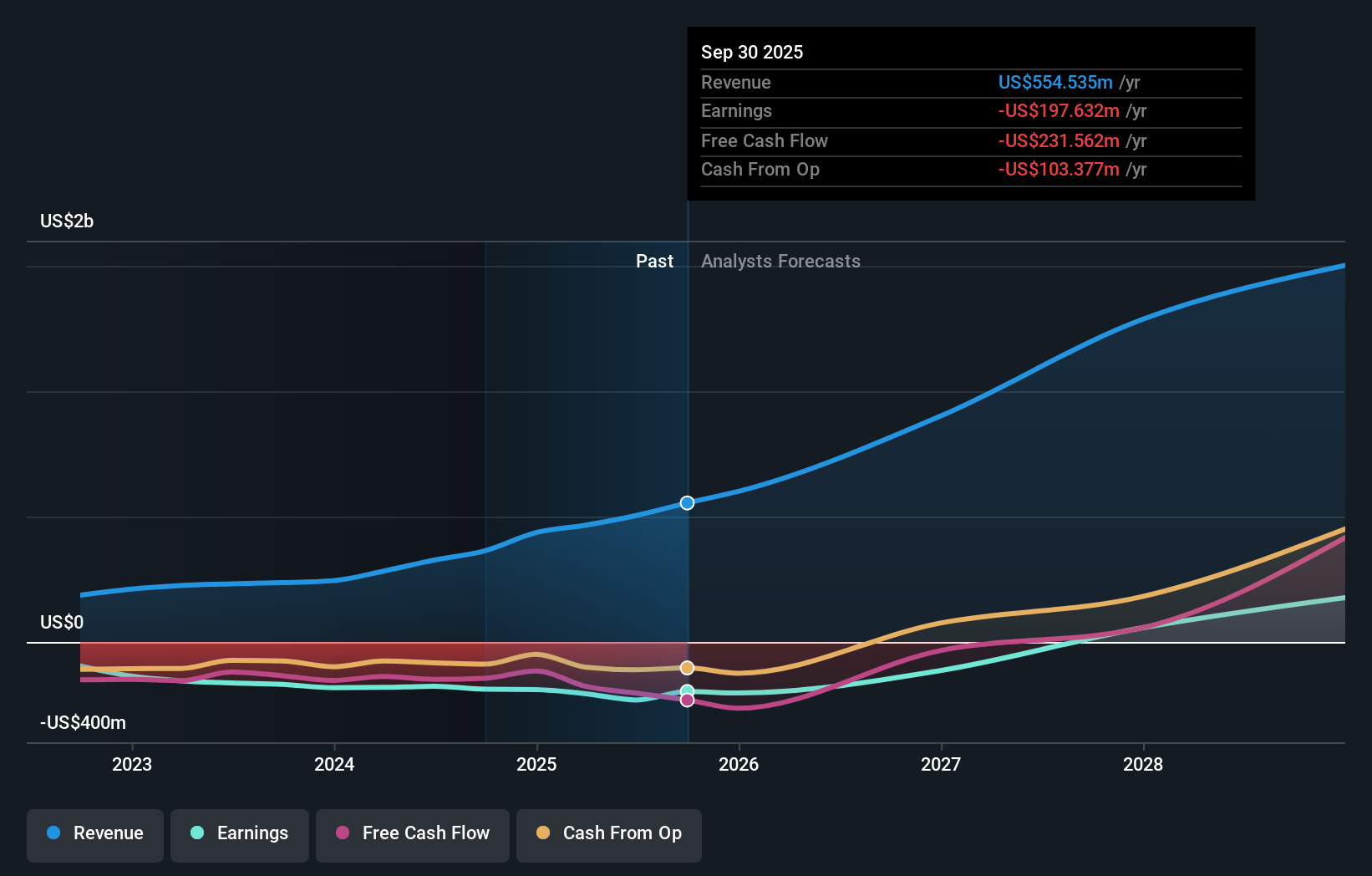

NasdaqCM:RKLB Earnings & Revenue Growth as at Jan 2026

NasdaqCM:RKLB Earnings & Revenue Growth as at Jan 2026

How Rocket Lab stacks up against its biggest competitors

The Hungry Hippo fairing arriving at Neutron’s launch site puts Rocket Lab deeper into the fully reusable rocket race that currently centers on SpaceX’s Falcon 9 and, at a smaller scale, Relativity and Rocket Factory Augsburg. If the captive fairing concept works as designed, keeping the fairing attached and quickly re-closing around the second stage could simplify recovery operations and help support a higher-cadence, medium-lift service that sits between Rocket Lab’s existing Electron and heavy-lift systems from larger providers.

How this fits the Rocket Lab narrative

This development lines up with the long-term story many investors already follow, where Neutron is the key step for Rocket Lab to move from small-satellite launches into higher revenue potential missions for national security, constellation deployment, and human spaceflight support. The captive fairing and Neutron’s planned payload class are consistent with the community narrative of a vertically integrated space company building a wider service stack on top of its Electron heritage and growing Space Systems business.

Risks and rewards to keep in mind

- The world first captive, reusable fairing is aimed at quicker reuse and lower mission-level costs, which could help Rocket Lab compete more directly with SpaceX and United Launch Alliance on certain contracts.

- Electron’s existing launch track record, together with Neutron hardware now on site, gives Rocket Lab multiple touchpoints with commercial and national security customers.

- The Neutron Stage 1 tank rupture highlights execution risk in qualifying a new medium-lift rocket, and the ultimate impact on launch timing will not be clear until the next earnings update.

- Investors also face broader volatility risk, with analysts already flagging share-price swings and test hiccups as key pressure points for a story where a lot rests on Neutron’s success.

What to watch next

From here, the key things to watch are how quickly Rocket Lab moves from fairing inspections into integrated testing at Launch Complex 3, what management says in February about Neutron’s updated schedule, and how this stacks up against competitors like SpaceX and United Launch Alliance in winning new missions. If you want to see how other investors are thinking about these milestones, check out the latest community narratives on Rocket Lab’s dedicated page and compare this news to the longer-term thesis for NasdaqCM:RKLB.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com