By Nandini Ramakrishnan, global macro strategist at JP Morgan Asset Management

India has recently captured global attention due to a trade deal with the US that resulted in higher-than-expected tariff rates. While tariffs present challenges to international trade, investors should look beyond these headlines when considering Indian equities.

As a market known for its high valuations, being selective and understanding the structural drivers that support corporate earnings is crucial. In the midst of short-term noise, India’s major economic drivers and structural reforms shine through, positioning the country as a compelling long-term investment opportunity.

Tariffs

India’s tariff rates may appear high compared to those of other emerging markets and global peers. However, domestic earnings are the primary source of revenue for India’s equity market. Domestic consumption drives the Indian economy, contributing approximately 60% to nominal GDP. In 2024, the value of goods traded with the US accounted for just 2% of India’s GDP. Importantly, 75% of equity market revenues originate within the economy.

While US-India trade relations do warrant attention, the resilience of India’s economy and equity market to external trade can offer buying opportunities. We focus on domestically-focused industries such as banks, insurance, consumer staples, vehicles, and manufactured goods for local markets.

Structural reforms

Over the past two decades, India has achieved the highest nominal GDP growth, earnings, and equity market returns among major global economies. Structural reforms initiated by the government since 2014 have elevated the economy, laying the foundation for macroeconomic stability and productivity gains. These reforms have enabled domestic companies to consistently deliver superior profitability.

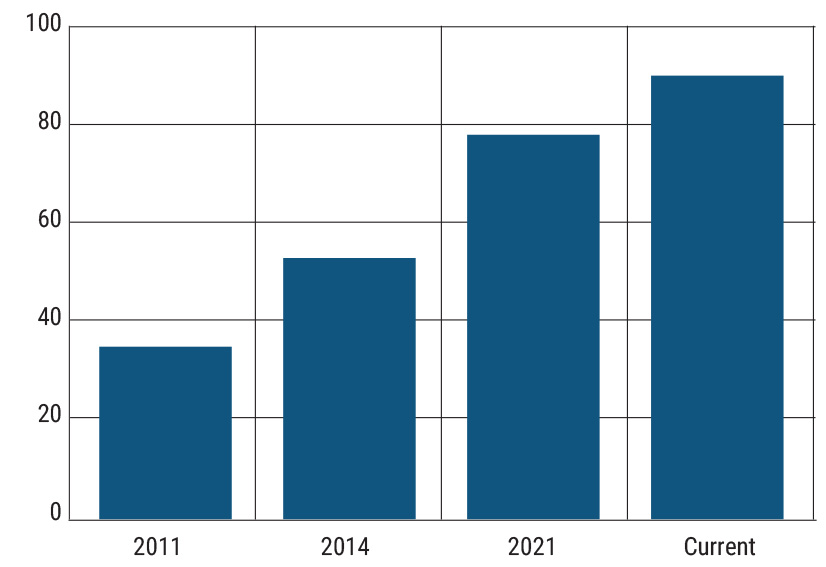

A key reform is the Aadhaar system, the world’s largest biometric identification initiative, covering nearly the entire 1.4 billion population. This system has streamlined access to government services and financial transactions, increasing bank account penetration from 35% in 2011 to over 90% today.

Despite this progress, online banking remains in its infancy, with significant potential for growth. Formalisation and digitisation have broadened the tax base and created scale advantages for organised players, shifting savings from traditional assets like gold and real estate to financial markets.

Domestic mutual funds have invested approximately $125bn since Covid 19, surpassing the cumulative amount of the previous decade. Meanwhile, foreign institutional investors have reduced their active weight due to high valuations, providing room for increased positioning as global asset allocators seek opportunities outside the US market.

India’s household financialisation: Percentage of age 15+ individuals with bank accounts

Source: BofA Research, Worldbank, JP Morgan Asset Management. Data as of 19 August 2025.

Source: BofA Research, Worldbank, JP Morgan Asset Management. Data as of 19 August 2025.

Corporate excellence

For equity investors, the macroeconomic backdrop and structural drivers are promising, but identifying companies that can translate reforms into returns on equity is essential. India offers fertile ground for such corporates, given increasing market depth, corporate maturity, and management teams’ willingness to engage with investors.

Many industries and basic service sectors offer substantial scope for productivity gains. Indian company management teams consistently achieve high returns on equity, often surpassing those in the US. The sectors we see these management teams are in financials, consumer and IT services.

Ease of doing business and infrastructure

India’s leapfrogging from broadband to mobile internet has led to a 140-fold increase in digital transactions, transforming multiple sectors. Companies benefit from operating in an environment of political stability and strong independent institutions, such as the central bank, securities regulator, and judiciary.

We can see these benefits already playing out in India’s financial ecosystem, where bank account use and retail investment has grown massively in the past several years. Use of high speed internet and smartphone penetration has meant quick and e-commerce companies can start, grow and thrive in urban environments.

Overall, quality management teams coupled with a business-landscape create long growth runways for many sectors and compelling opportunities for investors.

Consumption growth

India’s household consumption nearly doubled in the past decade, outpacing growth in the US and China. Current consumption growth is driven by rural India, recovering due to improved farm output and real wage growth as food inflation moderates. Urban consumption, currently lagging due to weak salary growth and stretched household balance sheets, is expected to recover in the coming quarters, aided by reduced personal income tax for middle-class households and pay boosts for government employees and pensioners.

Valuation concerns and long-term prospects

Despite all the enticing prospects above, India’s equity market is characterized by high valuations. Over the past five years, multiple expansion has driven returns, particularly for small and mid-cap stocks, with signs of retail investor exuberance. Even after the recent correction from the September 2024 peak, valuations remain elevated due to strong investment flows and anticipated growth recovery following monetary easing.

However, this doesn’t shake our conviction on the long-term growth and corporate stories in India. It does mean identifying quality companies at reasonable valuations is crucial and necessitates a disciplined framework around earnings drivers and corporate quality. Structural reforms, corporate excellence, consumer strength and the business-friendly landscape India provides should outweigh near-term challenges surrounding higher tariffs and valuations.

The Indian equity market should certainly be considered by global investors given many underpinnings to strong macro and micro growth.