Tech Desk

01 September 2025, 03:36 PM IST

While Starlink has a head start, Kuiper’s strategic approach to Indian regulations and focus on affordability could disrupt the marke

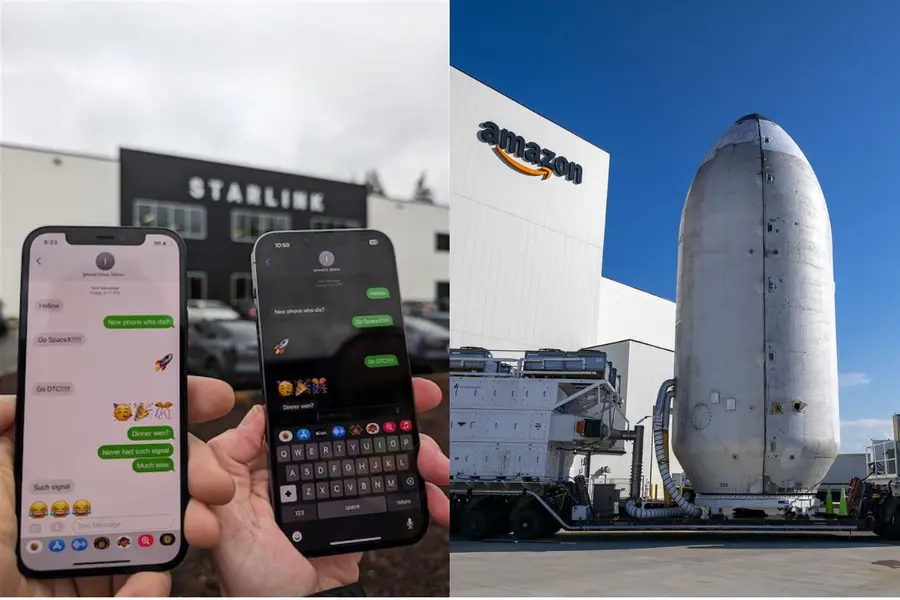

As the demand for reliable, high-speed internet surges across India, especially in remote and underserved regions, a fierce competition is emerging in the satellite broadband space. At the forefront is Elon Musk’s SpaceX Starlink, the established leader with thousands of satellites already in orbit, facing a new challenger in Amazon’s Project Kuiper, which aims to launch its satellite internet services commercially in India by 2026.

Starlink entered the global satellite internet market early, deploying over 8,000 low Earth orbit (LEO) satellites and building a substantial user base worldwide, including providing services in India. However, Amazon is quickly catching up, having launched multiple batches of its Kuiper satellites and aggressively working on regulatory approvals and infrastructure in India. Amazon’s Project Kuiper plans to deploy a constellation of over 3,200 satellites globally, offering high-speed broadband focused on delivering connectivity to areas traditional networks can’t reach.

One of Kuiper’s key strategic advantages is its integration with Amazon’s vast ecosystem, including AWS cloud services and logistics network. This could enable seamless connectivity paired with cloud computing solutions, plus efficient last-mile user terminal delivery through Amazon’s extensive supply chain. Kuiper aims to offer competitively priced hardware and bundled services, targeting price-sensitive markets like India, where affordability is critical.

Starlink, though the market leader, faced regulatory challenges in India early and had to secure specific spectrum licenses. Kuiper is taking a more cautious and collaborative approach with Indian regulators, aiming to align with data localisation, network control, and security requirements upfront to avoid delays. This regulatory navigation is crucial given India’s strict policies on satellite communications and national security.

While Starlink benefits from its large, mature constellation and early mover advantage, Kuiper’s substantial financial backing, strategic partnerships, and cloud infrastructure open opportunities for rapid growth. Other competitors like Bharti-backed OneWeb and the Reliance Jio-SES partnership are also intensifying the competition, promising a multi-player market battle.

Experts believe the coming years will not just be about who has more satellites but who offers better value through lower latency, wider coverage, faster speeds, and economic pricing. Starlink currently dominates the consumer market with superior speeds and global rollouts, but Kuiper’s edge in enterprise integration and potential pricing could shift market dynamics. For Indian consumers and businesses, this competition translates into improved service options and accelerated efforts to bridge the digital divide.

In sum, Amazon Kuiper’s entry into India’s satellite internet sector marks a pivotal moment in the escalating space race with Starlink, promising innovation, competition, and enhanced connectivity options for millions.

![]() Subscribe to our NewsletterGet Latest Mathrubhumi Updates in EnglishFollow

Subscribe to our NewsletterGet Latest Mathrubhumi Updates in EnglishFollow

Disclaimer: Kindly avoid objectionable, derogatory, unlawful and lewd comments, while responding to reports. Such comments are punishable under cyber laws. Please keep away from personal attacks. The opinions expressed here are the personal opinions of readers and not that of Mathrubhumi.