A cut to the key rate at the the Fed would propel cryptocurrencies higher next quarter, said Crypto.com chief executive Kris Marszalek in an interview with Bloomberg.

He expects a market-friendly decision at the 17 September meeting.

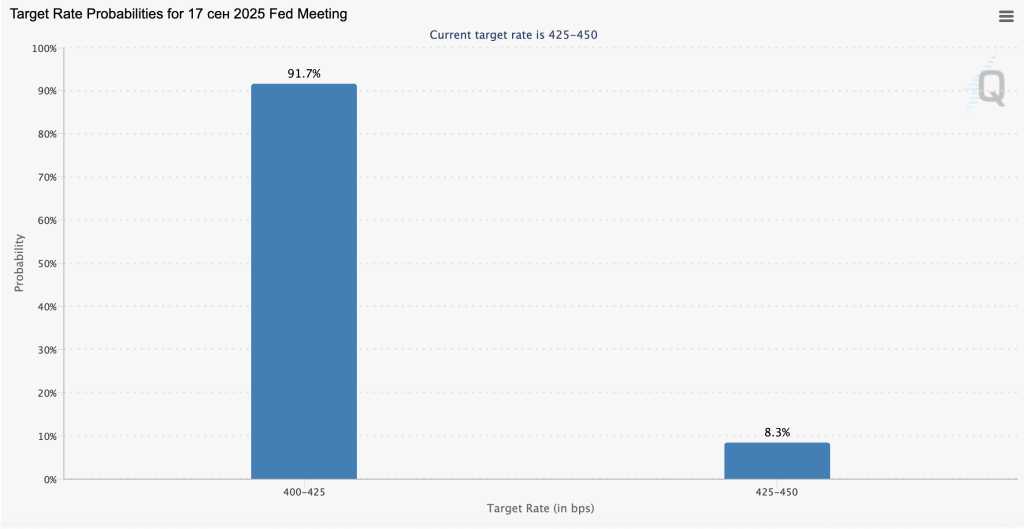

After last year’s cut from 5.5% to 4.5%, cryptocurrencies rose 57% over four months. Investors now put the probability of US monetary easing at 91.7%. The figure climbed after Fed chair Jerome Powell’s remarks at the Jackson Hole symposium.

MN Capital founder Michaël van de Poppe is similarly upbeat.

The past three years haven’t shown a correction in September.

The correction took place in August.

In August, #Bitcoin corrected by nearly 10%.

Yes, we could have a deeper correction and yes, I’m heavily buying that one, but the closer we get to the FED meeting, the less of…

— Michaël van de Poppe (@CryptoMichNL) September 2, 2025

“The past three years saw September ‘in the green’. The correction took place in August, when bitcoin fell nearly 10%. Yes, we might get a deeper drawdown—and yes, I’m buying heavily into it—but the closer we get to the Fed meeting, the lower the chances the decline continues, especially if BTC breaks above $112,000,” he said.

Over the past 24 hours bitcoin has risen 1.6%. At the time of writing the asset trades at $111,500.

For more on August’s results for the first cryptocurrency, see ForkLog’s monthly digest.

A dissenting view

Government-bond yields are rising ahead of the next Fed rate cut, signalling investor pessimism, noted the trader known as Doctor Profit.

The market is extremely Bearish!

2024: Yields crashed -16% in weeks before the Fed’s first cut. Markets rushed into bonds, betting big on lower rates. —> Effect is Bullish!

2025: Yields are rising +5% into the next cut. Investors are dumping bonds, demanding higher payback to…

— Doctor Profit 🇨🇭 (@DrProfitCrypto) September 2, 2025

In 2024, US monetary easing was accompanied by a 16% drop in yields and a rush into bonds, he stressed. Today, the debt market is behaving bearishly.

“Bond yields have risen 5% ahead of the next cut. Investors are dumping them en masse, demanding higher compensation for risk,” said Doctor Profit.

He drew a parallel with the credit system: even as the Fed trims short-term rates, the cost of long-term borrowing for the government, companies and households keeps rising.

“This means the Fed has lost control. […] The only ones who believe in a positive effect are retail investors. The regulator is cutting rates, but markets don’t believe this will fix anything. Big players are rotating into bonds, demanding higher yields,” he added.

Not everyone agreed with Doctor Profit. A user going by Eazi argued that the bond market is “signalling not collapse, but a repricing of long-term premia”.

I don’t buy the “Fed lost control” narrative just yet the bond market isn’t signaling collapse it’s repricing long term risk premium after a decade of artificial suppression rising yields into cuts isn’t purely bearish it’s the market forcing a real cost of capital back into the…

— Eazi of web3⨀🍚 ⛓ (@eazibackup) September 2, 2025

“Rising yields into cuts is not purely bearish; it is the market forcing a real cost of capital back into the system. Historically, this resets frothy valuations before the next leg higher. What if this is not a crisis signal but a first step toward healthy, realistic market pricing?” he wrote.

In early September, an expert identified a rare bottom signal for bitcoin’s price. Glassnode analysts described the current market structure as “fragile”.

Подписывайтесь на ForkLog в социальных сетях

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!