India Pest Control Products Market Trends

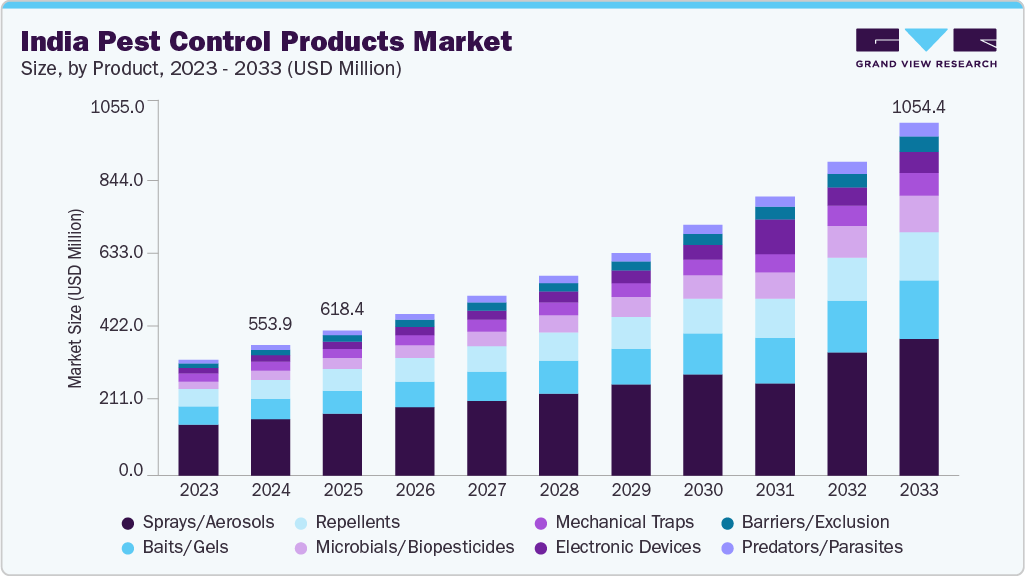

The India pest control products market size was valued at USD 553.9 million in 2024 and is expected to reach USD 1,504.4 million by 2033, growing at a CAGR of 11.8% from 2025 to 2033. The industry has been strongly shaped by regional agricultural dynamics, as cultivation patterns and pest pressures vary significantly across states. Northern states such as Punjab, Haryana, and Uttar Pradesh have driven strong demand for insecticides and fungicides due to the dominance of wheat, rice, and sugarcane, which are highly susceptible to fungal diseases and stem borers. In western India, particularly Maharashtra and Gujarat, the extensive cultivation of cotton and oilseeds has necessitated large-scale use of insecticides to combat bollworm and sucking pests.

Southern regions, led by Andhra Pradesh, Telangana, and Karnataka, have recorded higher adoption of integrated pest management solutions, with fruit and vegetable growers increasingly relying on fungicides to protect horticultural crops. Eastern states such as West Bengal, Bihar, and Odisha have further fueled demand for pesticides, owing to high pest incidence in rice cultivation and the spread of invasive weeds. This region-specific intensity of pest challenges has resulted in a broad-based expansion of the pest control products industry across India.

India’s pest control products industry was dominated by generic and imported formulations, with domestic players focusing primarily on off-patent agrochemicals. Over the past decade, however, local manufacturers have expanded capacity and moved up the value chain, supported by policy initiatives such as Make in India and incentives for agrochemical exports. By 2023, India had emerged not only as one of the largest consumers but also as a leading exporter of pest control products, with companies such as UPL, PI Industries, and Rallis India strengthening domestic supply and expanding global reach.

Regulatory reforms have played a critical role in reshaping the market landscape. The Pesticide Management Bill and related guidelines have tightened registration requirements, promoted safer formulations, and supported approvals for bio-based inputs. Government-backed extension programs and state-level initiatives have further improved access to pest management products, especially in rice-, cotton-, and horticulture-intensive regions. These measures have encouraged greater alignment of product portfolios with India’s diverse cropping systems.

At the same time, rising awareness of food safety, residue compliance, and environmental sustainability has accelerated the adoption of biopesticides and integrated pest management (IPM). Neem-based formulations, microbial pesticides, and other biological alternatives have gained traction, particularly among fruit and vegetable growers catering to export markets. Major domestic and multinational companies are increasingly investing in precision spraying technologies, resistance-management solutions, and residue-free products to meet evolving demand. This transition toward sustainable and tailored solutions is reshaping India’s pest control products industry, positioning it for long-term growth and global competitiveness.

Consumer Insights

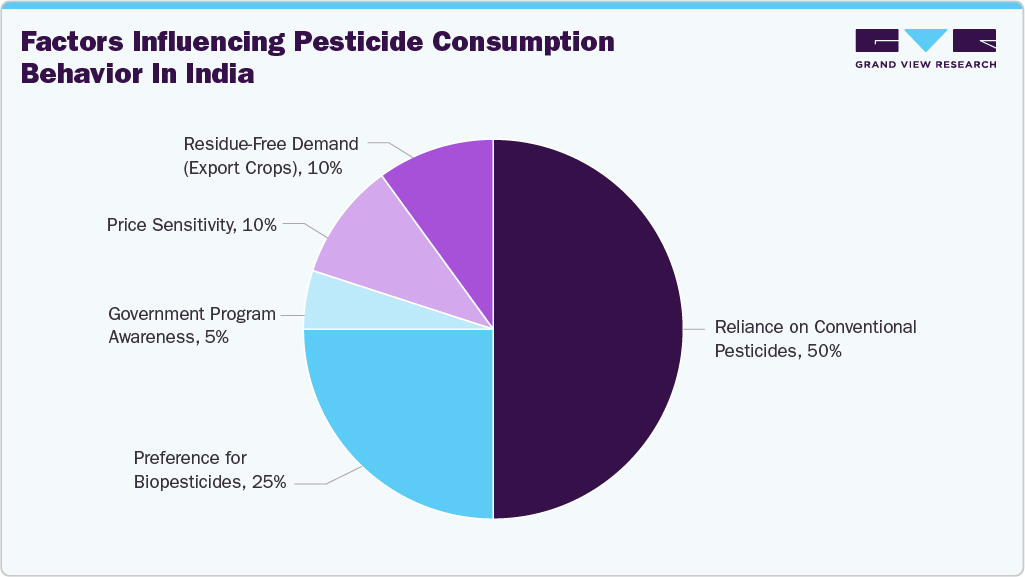

The Indian pest control products industry reflects a traditional reliance on chemical pesticides, coexisting with a gradual but steady shift toward biopesticides. Farmers across the country continue to depend heavily on conventional products, particularly in staple crops such as cereals, cotton, and oilseeds, where quick results and affordability remain decisive. This reliance has been reinforced by decades of familiarity, widespread distribution networks, and comparatively lower costs, making chemical pesticides the dominant choice for nearly half of the farming community.

At the same time, a clear behavioral transition is emerging. The growing preference for biopesticides, including neem-based and microbial formulations, reflects both rising environmental awareness and the influence of government-led integrated pest management programs. Farmers in horticulture and high-value export crops are increasingly adopting residue-free alternatives, as compliance with international standards becomes more critical for market access. This consumer segment views biopesticides not only as safer for soil and health but also as an enabler of better long-term profitability.

The market remains shaped by high price sensitivity, with smaller farmers in particular weighing cost against perceived effectiveness before making purchasing decisions. Government extension programs and awareness campaigns play a modest but growing role in shifting perceptions, gradually building trust in bio-based alternatives. As shown in the visualization, conventional pesticides still dominate farmer choices, but the expanding consumer base for sustainable solutions highlights a long-term transformation. India’s pest control products market is therefore characterized by both entrenched consumption patterns and an evolving preference for environmentally conscious, residue-free solutions.

Product Insights

The sprays/aerosols segment accounted for a revenue share of 43.15% in 2024, driven by their convenience, ease of application, and immediate effectiveness. With rapid urbanization in major cities like Delhi, Mumbai, Bangalore, and Kolkata, consumers are increasingly seeking pest control solutions that provide fast results and can be easily used in household and commercial settings. Sprays are particularly popular for targeting common pests such as mosquitoes, cockroaches, and ants, which are prevalent in densely populated urban environments.

Meanwhile, the microbial/biopesticides segment is poised for strong growth, with a projected CAGR of 16.3% from 2025 to 2033. This growth is driven by an increasing shift towards sustainable and eco-friendly pest control practices. With growing consumer awareness about environmental and health concerns related to chemical pesticides, microbial solutions have gained popularity as safer alternatives. The Indian government’s emphasis on promoting organic farming and reducing the environmental footprint of agriculture has led to a surge in the adoption of biopesticides.

Pest Type Insights

The flying insects segment accounted for a revenue share of 38.65% in 2024. The dominance of this category is primarily due to the widespread presence of flying pests such as mosquitoes, houseflies, and fruit flies in urban and rural environments across India. With the country experiencing significant seasonal pest outbreaks, especially during the monsoon and warmer months, the demand for effective solutions to combat flying insects remains high.

Mosquitoes, in particular, are a major concern in India due to their role in spreading vector-borne diseases like malaria, dengue, and Zika. This has driven increased consumer demand for flying insect control products such as sprays, electric zappers, and repellents. In densely populated areas, where standing water and stagnant conditions provide ideal breeding grounds for mosquitoes, there is a heightened need for quick and efficient pest control solutions. Additionally, growing consumer awareness regarding the health risks posed by flying insects has fueled the demand for products that offer long-lasting protection and effective control.

On the other hand, the crawling insect category is projected to grow at a CAGR of 12.5% from 2025 to 2033, reflecting a notable shift toward addressing pests like cockroaches, ants, termites, and bedbugs. The growth of this segment is driven by rising consumer concerns regarding hygiene and the potential health risks posed by crawling insects, particularly in urban and suburban households.

Control Mechanism

Chemical pest control products dominated the market, accounting for a significant revenue share of 73.67% in 2024. This dominance can be attributed to the widespread use of chemical solutions such as sprays, aerosols, and granules, which provide effective and quick results in controlling a wide variety of pests, including mosquitoes, cockroaches, ants, and termites. Chemical products have been the go-to solution for households, commercial establishments, and agricultural sectors due to their proven efficacy in pest eradication.

However, while chemical control products maintain a strong market presence, the biological pest control segment is set for considerable growth, with a projected CAGR of 15.2% from 2025 to 2033. This growth is driven by increasing consumer and agricultural industry preference for eco-friendly and sustainable pest control methods. Biological control mechanisms, such as biopesticides, microbial solutions, and natural predators, are gaining traction as safer alternatives to chemical pesticides, which are associated with environmental pollution, pesticide resistance, and health risks.

End Use Insights

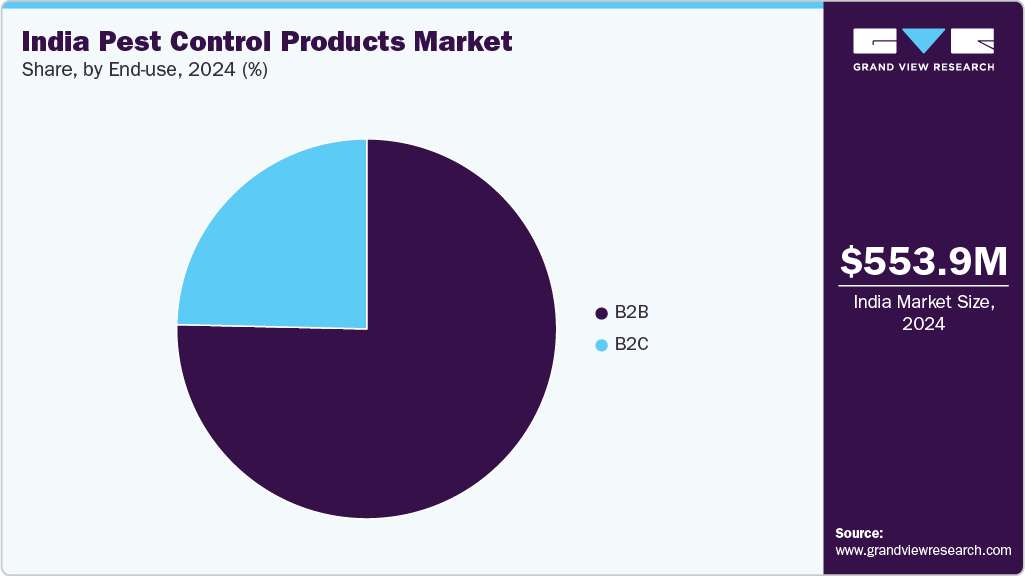

The B2B (business-to-business) segment dominated the market, accounting for a substantial revenue share of 75.36% in 2024. This is primarily due to the extensive use of pest control solutions in commercial and industrial sectors, including agriculture, hospitality, food processing, and healthcare. In the B2B space, pest control is crucial for maintaining hygiene standards, meeting regulatory requirements, and protecting businesses from the health risks associated with pests such as rodents, cockroaches, and termites.

B2B pest control solutions often involve customized, large-scale applications of chemical and biological products, making them an integral part of operations in sectors that deal with bulk storage, food production, and healthcare. The prevalence of long-term contracts, high volume usage, and institutional purchasing from commercial entities further drives the dominance of the B2B segment in India’s pest control products market.

On the other hand, the B2C (business-to-consumer) segment is set to grow at a CAGR of 14.2% from 2025 to 2033. This growth is primarily driven by the increasing adoption of pest control solutions in residential settings, fueled by rising awareness of health risks associated with pests. In urban India, growing concerns about hygiene, coupled with the rise in pest-borne diseases like dengue and malaria, are propelling consumer demand for household pest control products such as sprays, traps, and repellents.

As more consumers seek convenient, safe, and effective solutions for managing pests at home, there is a growing preference for ready-to-use products that can be applied without professional help. Additionally, the increasing number of online platforms and retail outlets offering pest control products directly to consumers is further expanding the reach of B2C solutions. With the rise of e-commerce and the availability of pest control products through various online channels, consumer access to these solutions has become more widespread.

Key India Pest Control Products Companies Insights

Key players operating in the India pest control products market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key India Pest Control Products Companies:

- Rentokil Initial

- BASF India

- SC Johnson Professional

- Pest Control India Pvt. Ltd.

- Godrej Consumer Products Ltd.

- Hindustan Unilever Ltd.

- Terminator Pest Control

- Arrow Pest Control

- Shivay Pest Control

- Orkin India

Recent Developments

-

In March 2025, FMC India launched a new line of organic pest control products, focusing on plant-based formulations that aim to reduce environmental impact while enhancing pest control efficiency for agricultural applications. The company is positioning this new line as a sustainable alternative to chemical-based solutions, aligning with the increasing demand for eco-friendly products in the Indian market.

-

In January 2025, Bayer CropScience India announced the launch of a new digital platform designed to assist farmers in pest management. The platform uses artificial intelligence and data analytics to provide real-time pest monitoring and predictive analytics, offering customized pest control solutions based on weather patterns and regional pest outbreaks.

-

In August 2024, UPL Ltd. received approval from the Indian government to expand its production capacity for biopesticides, as part of a strategic move to cater to the growing demand for environmentally friendly alternatives in both the agricultural and urban pest control sectors. This expansion is part of UPL’s broader sustainability goals and aims to offer safer and more sustainable options to Indian farmers, who are increasingly seeking alternatives to conventional chemical pesticides.

India Pest Control Products Market Report Scope

Report Attribute

Details

Market size in 2025

USD 618.4 million

Revenue forecast in 2033

USD 1,504.4 million

Growth rate (revenue)

CAGR of 11.8% from 2025 to 2033

Actuals

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, pest type, control mechanism, end use

Country scope

India

Key companies profiled

Rentokil Initial; BASF India; SC Johnson Professional; Pest Control India Pvt. Ltd.; Godrej Consumer Products Ltd.; Hindustan Unilever Ltd.; Terminator Pest Control; Arrow Pest Control; Shivay Pest Control; Orkin India

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Pest Control Products Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the India pest control products market report based on product, pest type, control mechanism, and end use.

-

Product Outlook (Revenue, USD Million, 2021 – 2033)

-

Sprays/Aerosols

-

Baits/Gels

-

Repellents

-

Predators/Parasites

-

Microbials/Biopesticides

-

Barriers/Exclusion

-

Mechanical Traps

-

Electronic Devices

-

Pest Type Outlook (Revenue, USD Million, 2021 – 2033)

-

Flying Insects

-

Crawling Insects

-

Rodents

-

Others (Birds, etc.)

-

Control Mechanism Outlook (Revenue, USD Million, 2021 – 2033)

-

Chemical

-

Physical/Mechanical

-

Biological

-

End Use Outlook (Revenue, USD Million, 2021 – 2033)

-

B2C

-

Supermarkets and Hypermarkets

-

Pharmacies & Drugstores

-

Home Improvement & Hardware Stores

-

E-commerce/Online

-

Others (Grocery Stores, Department Stores, etc.)

-

B2B

-

Direct Sales

-

Distributors & Wholesalers

-

Agricultural Supply Stores & Co-operatives

-

Commercial & Institutional E-procurement Platforms

-

Others (Government Procurement Programs, etc.)