Good morning and welcome to the ABC’s finance blog! I’ll be your guide for the next few hours.

The Australian share market is on track to start its day higher (with ASX futures pointing to a 0.8% gain in early trade).

That’s despite a volatile session on Wall Street as Donald Trump ratcheted up US-China trade tensions with another inflammatory social media post.

The US President said his administration was thinking of terminating some trade ties with China, including in relation to cooking oil.

“I believe that China purposefully not buying our Soybeans, and causing difficulty for our Soybean Farmers, is an Economically Hostile Act,” Mr Trump wrote in a social media post on Tuesday afternoon (local time).

“We are considering terminating business with China having to do with Cooking Oil, and other elements of Trade, as retribution.

“As an example, we can easily produce Cooking Oil ourselves, we don’t need to purchase it from China.”

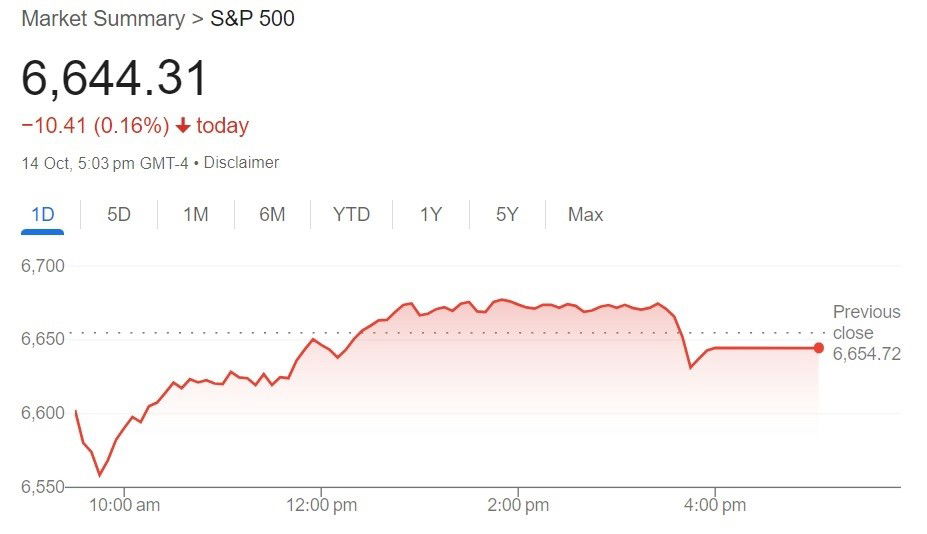

Let’s take a look at how Mr Trump’s post led to Wall Street’s topsy turvy reaction.

The S&P 500 swings between losses and gains on Tuesday (local time). (Google)

The S&P 500 swings between losses and gains on Tuesday (local time). (Google)

Before Mr Trump’s post, the S&P 500 began its day with 1.5% plunge, which turned into a 0.4% gain by the middle of the day (ie. it was a big comeback)!

But after the President’s latest provocation against China, the benchmark US stock index fell into negative territory again, ultimately closing 0.2% lower.

Once again, gold was the biggest beneficiary of all this trade anxiety.

The precious metal’s spot price jumped 0.8% to hit a new record high of $US4,143 an ounce.

The Australian dollar, however, fell 0.5% to 64.8 US cents.