Livestock Health Market Summary

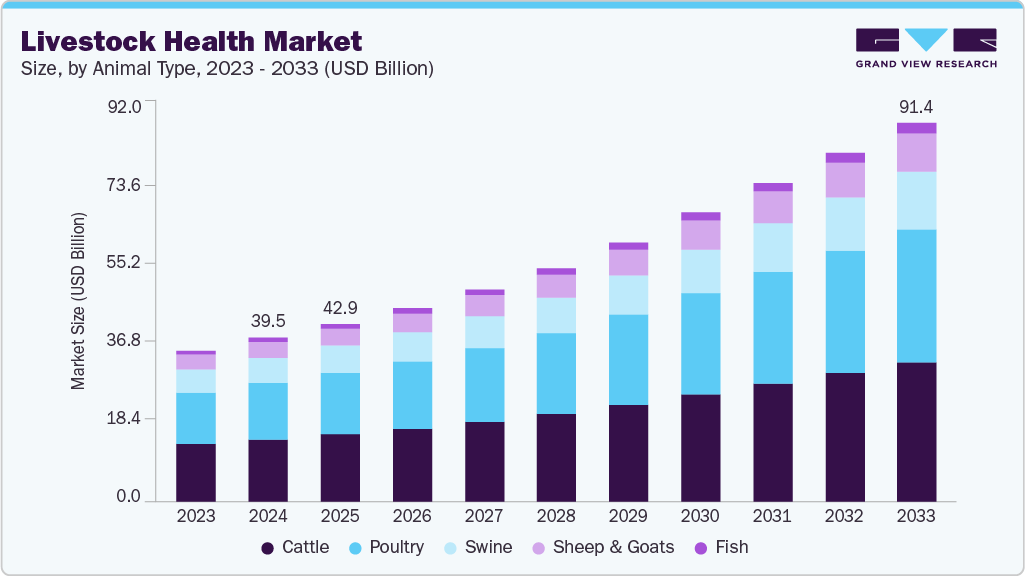

The global livestock health market size was estimated at USD 39.53 billion in 2024 and is projected to reach USD 91.42 billion by 2033, growing at a CAGR of 9.93% from 2025 to 2033. Leading factors driving the market growth are rising disease burden and zoonotic threats, increased sustainability and climate-resilient livestock production, technological advancement in diagnostics and preventive care, growing government support, policy alignment, and global collaboration.

Key Market Trends & Insights

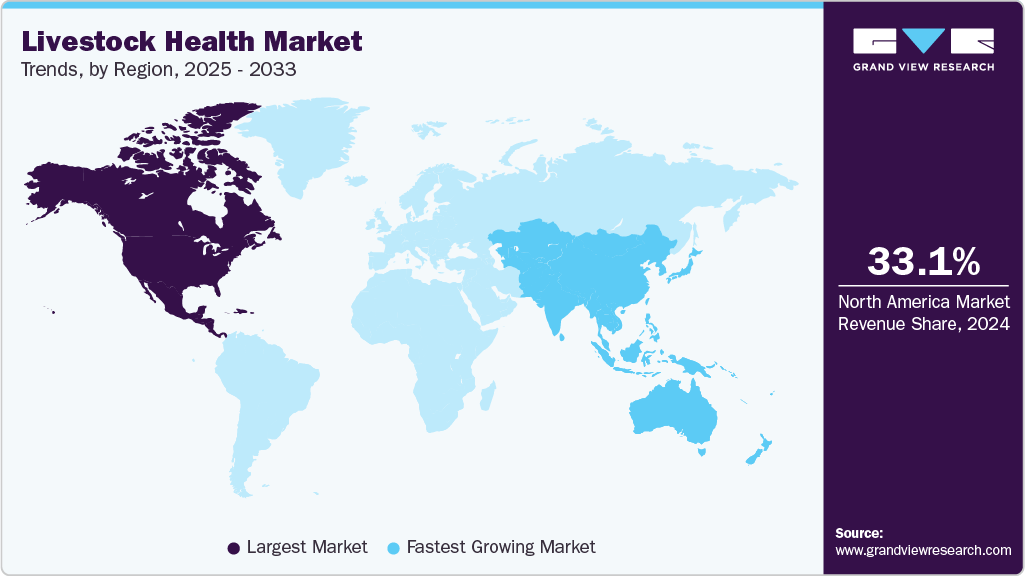

- North America Livestock Health market held the largest share of 33.08% of the global market in 2024.

- The Livestock Health industry in Asia Pacific region is expected to grow at the fastest rate over the forecast period.

- By product, pharmaceuticals held the largest global market share in 2024.

- By end use, veterinary hospitals and clinic segment held the largest global market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 39.53 Billion

- 2033 Projected Market Size: USD 91.42 Billion

- CAGR (2025-2033): 9.93%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The global market is witnessing robust expansion, primarily influenced by the escalating burden of infectious and zoonotic diseases and the rapid evolution of diagnostic and preventive technologies. These two dynamics are redefining animal health management practices, shaping government policy, and steering investments toward innovative, data-driven, and sustainable livestock care solutions worldwide. The growing incidence of transboundary and zoonotic diseases has become a defining factor in driving the demand for advanced veterinary interventions. Persistent outbreaks of conditions such as avian influenza, foot-and-mouth disease (FMD), African swine fever, and coccidiosis continue to disrupt livestock production systems, posing substantial risks to food security and international trade. In response, both public and private sectors are intensifying efforts to enhance disease surveillance, vaccination coverage, and biosecurity infrastructure.

The U.S. Department of Agriculture’s allocation of over USD 800 million to combat H5N1 exemplifies the increasing scale of government intervention to contain animal disease threats. Similar measures are being implemented across Latin America, the Middle East, and Africa, where regional authorities are strengthening early warning systems and veterinary response capabilities. Moreover, the growing emphasis on the One Health framework, linking animal, human, and environmental health, has promoted cross-sector collaboration, developing novel vaccines, diagnostic tools, and antimicrobial alternatives designed to curb both animal and public health risks.

Concurrently, technological advancements in diagnostics and preventive medicine are revolutionizing livestock management. The emergence of molecular diagnostics, AI-driven health monitoring, biosensors, and portable testing devices has enabled earlier detection and more efficient containment of diseases. In Europe, for example, technologies such as Boehringer Ingelheim’s SoundTalks respiratory monitoring system and Lely’s Zeta calving sensor are transforming on-farm disease management by providing continuous, real-time insights into herd health. Likewise, in the Asia Pacific region, deploying advanced imaging platforms such as Esaote’s Magnifico Vet MRI underscores the region’s growing investment in precision veterinary diagnostics. Digital platforms now facilitate data integration across farms, laboratories, and regulatory agencies, creating a more coordinated ecosystem for disease tracking and control.

Collectively, the interplay between increasing disease pressure and technological innovation is reshaping the global livestock health landscape. The industry is steadily transitioning from a reactive treatment model to one centered on prevention, precision, and predictive health management. As global demand for animal protein rises and biosecurity concerns intensify, these trends are expected to underpin long-term growth, resilience, and sustainability in the livestock health sector.

Key U.S. Regulatory Bodies Responsible For Approval Of Different Types Of Products

Product Category

Regulatory Body

Key Pathways

Veterinary Pharmaceuticals

FDA-CVM

NADA, ANADA, CNADA, INAD, EUA, Indexing

Prescription / OTC / VFD Drugs

FDA-CVM

Labeling classification during approval

Compounded Drugs (Bulk Substances)

FDA-CVM

GFI #256 – limited enforcement discretion

Vaccines / Biologics

USDA-CVB

Pre-market license under Virus-Serum-Toxin Act

In-vitro Diagnostics (pathogen-based)

USDA-CVB

Regulated if used at point of care for infectious agents

Lab Tests (non-infectious)

Not regulated

Routine tests (CBC, chemistry, hormones)

Supplements / Nutraceuticals

FDA-CVM (discretionary)

No formal approval; subject to labeling oversight

Cell/Tissue Therapies

FDA or USDA

Depends on primary mechanism of action

Ectoparasiticides

EPA or FDA

EPA for topical/environment; FDA if systemic

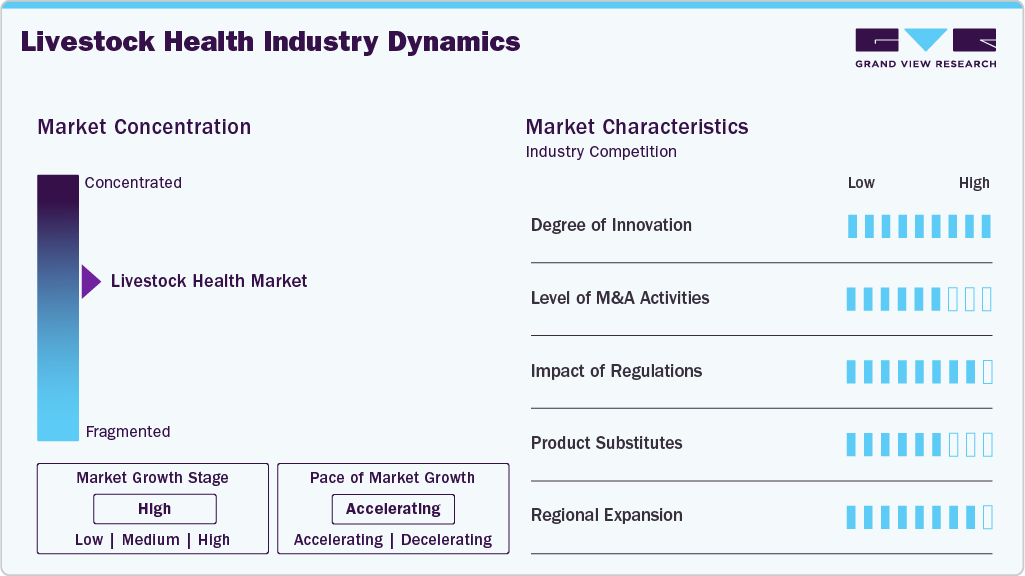

Market Concentration & Characteristics

The global livestock health industry exhibits moderate to high concentration, with leading players such as Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco, and Ceva Santé Animale dominating through extensive product portfolios and global distribution networks. Smaller biotechnology firms and regional manufacturers contribute niche innovations but often partner with or are acquired by larger companies to scale commercialization and regulatory reach.

Innovation in the livestock health sector is accelerating, driven by advancements in biologics, vaccines, diagnostics, and precision livestock technologies. The industry increasingly focuses on developing sustainable solutions, such as methane-reducing feed additives, next-generation vaccines, and AI-assisted monitoring systems that enhance productivity while addressing environmental and welfare concerns.

Mergers, acquisitions, and strategic alliances remain central to market consolidation and portfolio diversification. Recent transactions such as Zoetis’ divestiture of medicated feed additives and Ceva’s acquisitions in Latin America reflect a specialization and geographic expansion trend. M&A activity is also facilitating entry into emerging markets and accelerating R&D capabilities in biologics and digital health.

Regulatory frameworks exert a significant influence on market dynamics, shaping product approval timelines, manufacturing standards, and biosecurity compliance. Increasing harmonization across regions, coupled with stringent oversight on antimicrobial use and vaccine quality, is fostering transparency and strengthening global trade readiness. However, regulatory disparities in developing regions continue to pose operational challenges.

While traditional pharmaceuticals remain dominant, substitutes such as probiotics, phytogenic additives, and immunomodulators are gaining prominence as alternatives to antibiotics and chemical-based treatments. These products are aligned with global antimicrobial resistance (AMR) reduction goals and consumer preferences for natural, residue-free livestock health solutions.

The market is expanding both geographically and technologically, driven by rising demand for animal protein, sustainability mandates, and the digitalization of veterinary services. Companies are investing in local manufacturing, precision farming tools, and integrated care platforms to enhance access and efficiency, particularly in the Asia Pacific, Latin America, and the Middle East, where livestock production is rapidly scaling.

Animal Type Insights

In 2024, the cattle segment dominated the market, accounting for the largest revenue share. This is driven by cattle’s economic importance, their scale in commercial farming, and their susceptibility to infectious and metabolic diseases. Ongoing preventive healthcare, therapeutics, and vaccination programs are critical to maintaining productivity and reducing economic losses in this segment.

The sheep and goats segment is expected to register a lucrative growth rate during the forecast period. Expansion of small ruminant farming in regions such as the Asia Pacific, Latin America, and the Middle East, combined with rising demand for mutton, goat milk, and related by-products, is driving increased adoption of veterinary therapeutics and preventive healthcare solutions. Government-led vaccination programs and biosecurity initiatives further support the growth of this segment.

Product Insights

By product, the pharmaceutical segment dominated the market with a share of about 44.09% in 2024. This dominance is primarily due to the widespread use of parasiticides, antibiotics, and therapeutic formulations to prevent and treat infectious diseases in cattle, poultry, swine, and small ruminants. Continuous R&D in biologics, long-acting injectables, and precision therapeutics is strengthening this segment, meeting growing demand for disease control and productivity enhancement in commercial livestock operations.

The others segment, comprising veterinary telehealth, veterinary software, and livestock monitoring solutions, is expected to grow the fastest at a rate of about 12.19% in the near future. The increasing adoption of IoT-enabled monitoring systems, wearable sensors, and digital herd management tools drives disease detection and farm-level decision-making efficiency. These technologies also support early intervention and preventive care, which is becoming critical as livestock operations scale in emerging and developed regions.

End Use Insights

Veterinary hospitals and clinics accounted for the largest revenue share in 2024, serving as primary centers for disease diagnosis, preventive care, and livestock treatment. Their professional oversight ensures correct vaccine administration, effective therapeutics, and proper diagnostic use, thereby reducing disease-related losses.

Point-of-care testing and in-house testing is expected to grow at the highest CAGR from 2025 to 2033. On-farm diagnostic solutions allow rapid detection of infectious and metabolic diseases, enabling immediate corrective actions. Integrating portable molecular tests and AI-driven monitoring systems further enhances farm-level disease management and operational efficiency in livestock operations.

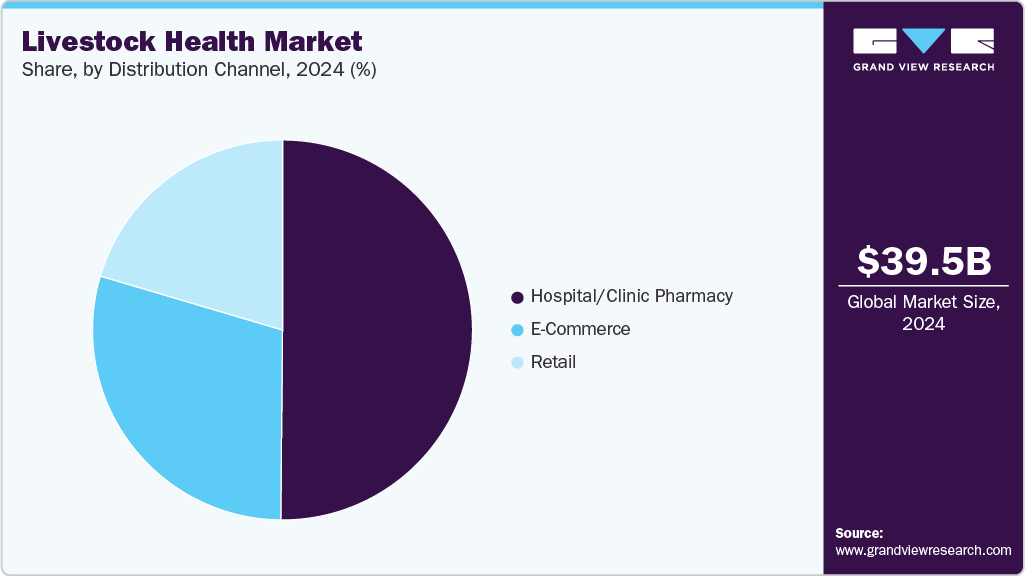

Distribution Channel Insights

The hospital/clinic pharmacy segment accounted for the largest revenue share in 2024 as the primary channel for livestock health products. These channels ensure proper administration of prescription medications, vaccines, and therapeutics under professional supervision. They also provide critical access to diagnostic kits and biosecurity solutions that are essential for disease management in commercial livestock operations.

The e-commerce segment is projected to witness the fastest growth in the forecast period, driven by rising internet penetration, digital adoption among farmers, and demand for timely delivery of livestock health products. Online platforms facilitate the procurement of vaccines, feed additives, and diagnostics, particularly in remote or underserved farming regions, enabling faster intervention and improved herd health.

Regional Insights

North America held the highest share of about 33.08% of the market in 2024. This can be attributed to increasing livestock production and adopting preventive healthcare measures across cattle, poultry, and swine. Technological advancements, including AI-based herd monitoring, biosensors, and digital diagnostics, enhance disease detection and management. Government initiatives and emergency funding strengthen biosecurity and disease surveillance, particularly in the U.S. and Canada. Sustainability trends, such as feed additives for methane reduction, further accelerate the adoption of innovative solutions.

U.S. Livestock Health Market Trends

The livestock health market in the U.S. held the dominant share of the North American animal health market in 2024. The dominant share can be attributed to strong demand for vaccines, antibiotics, feed additives, and novel therapeutics. Investments in emergency disease management, such as the USDA’s H5N1 funding, reinforce preventive care and outbreak preparedness. Technological innovation improves productivity, including precision microbiome solutions, AI-assisted diagnostics, and immunotherapies. Public-private partnerships and regulatory support enhance access to advanced veterinary products and services for large-scale livestock operations..

Europe Livestock Health Market Trends

The livestock health market in Europe held the second-largest share of the animal health market in 2024. The region is expected to experience consistent growth over the forecast period owing to high demand for meat and dairy products and the need for preventive healthcare in large-scale livestock operations. R&D investment in vaccines, biologics, and diagnostics drives continuous innovation. Regulatory frameworks and welfare standards ensure disease control and safe production. AI, sensor-based monitoring, and farm management technologies improve herd health and operational efficiency. Cross-border collaborations and digital platforms further support market growth.

The UK livestock health market held the largest share in the European market in 2024. Digital and sensor-based technologies for herd monitoring and integrated preventive healthcare programs drive the region. Strategic collaborations, such as swine monitoring systems and vaccine partnerships, enhance disease detection and farm management. Welfare regulations and sustainability requirements increase the adoption of therapeutics and diagnostics. The market benefits from strong R&D activity in vaccines, biologics, and precision livestock tools, supporting efficiency and productivity.

The livestock health market in Germany is anticipated to grow constantly, supported by strong research infrastructure, technological innovation, and the adoption of precision monitoring tools. Investment in vaccines, biologics, and AI-assisted diagnostics drives disease control and productivity. International collaborations for therapeutic development and monoclonal antibody research strengthen capabilities. Regulatory support for animal welfare and biosecurity ensures high-quality production. Digital herd management and early detection technologies enhance farm-level efficiency.

Asia Pacific Livestock Health Market Trends

The livestock health market in the Asia Pacific is expected to grow at a lucrative rate during the forecast period. The market is driven by rising demand for protein, expanding livestock populations, and the need for preventive healthcare. Government vaccination programs and disease outbreak management, such as for swine flu, support market growth. Adoption of advanced diagnostics, MRI/CT imaging, and AI-assisted monitoring improves disease detection and treatment outcomes. Increasing awareness of animal welfare and sustainable practices encourages the adoption of innovative therapeutics and feed additives. Regional collaborations and investments in veterinary infrastructure further accelerate growth.

India livestock health marketis witnessing a surge in demand for veterinary products and services to address existing and emerging diseases in animals. The country is driven by increasing livestock populations, rising protein consumption, and government-backed preventive healthcare initiatives. Vaccines, feed additives, and therapeutics are in growing demand to maintain productivity and control disease outbreaks. Technological adoption improves farm efficiency, including point-of-care diagnostics and digital herd management. Public-private partnerships and rural veterinary programs enhance accessibility and adoption across large-scale and smallholder farms. Regulatory support and awareness campaigns further strengthen preventive care uptake.

Latin America Livestock Health Market Trends

The livestock health market in Latin America is expected to grow over the forecast period, owing to large-scale cattle, poultry, and swine production and rising protein demand. Preventive healthcare, vaccines, feed additives, and diagnostics are increasingly adopted to manage endemic diseases such as foot-and-mouth disease and avian influenza. Strategic partnerships, acquisitions, and regional expansions by global players enhance product access. Government support for vaccination campaigns, biosecurity, and disease surveillance further strengthens market growth. Consumer demand for sustainable and efficient production practices also encourages technological adoption.

Brazil livestock health market accounts for a higher revenue share in Latin America. This can mainly be attributed to its position as one of the global leaders in cattle, poultry, and swine production. Strong demand for beef, dairy, and poultry products necessitates ongoing preventive healthcare and therapeutics. Government biosecurity measures, vaccination programs, and outbreak management initiatives support disease control. Adopting diagnostics, vaccines, and feed additives ensures productivity and reduces economic losses. Strategic investments and collaborations by global and domestic companies enhance market reach and technological integration.

Middle East & Africa Livestock Health Market Trends

The livestock health market in the MEA is shaped by preventive healthcare adoption, food security goals, and disease control initiatives. Investment in veterinary infrastructure, vaccines, and biosecurity programs supports herd health management. AI-driven monitoring and digital diagnostics are increasingly implemented to improve farm efficiency. Rising urbanization, modernization of livestock practices, and public-private collaborations enhance market growth. Regulatory harmonization ensures wider adoption of advanced therapeutics and preventive solutions.

South Africa livestock health market growth is driven by preventive care and biosecurity programs targeting cattle, poultry, and small ruminants. Recurring outbreaks of endemic diseases like foot-and-mouth disease have increased demand for vaccines, diagnostics, and therapeutics. Adoption of on-farm monitoring systems and point-of-care testing improves herd management. Government investment in veterinary infrastructure and partnerships strengthens disease surveillance and animal welfare standards. Increasing awareness of sustainable livestock practices is further driving the adoption of innovative solutions.

Key Livestock Health Company Insights

The global market is dominated by major players such as Zoetis, Elanco, Boehringer Ingelheim, Merck Animal Health, Ceva Santé Animale, and HIPRA, holding a significant market share. These companies lead through strong R&D pipelines, innovative vaccines, biologics, feed additives, and precision livestock solutions. Strategic partnerships, acquisitions, and regional expansions are common strategies to strengthen market presence and distribution networks. Continuous investment in digital diagnostics, AI-assisted monitoring, and preventive healthcare solutions further reinforces their leadership. Emerging players focusing on niche therapeutics, microbiome-based products, and telehealth solutions contribute to competitive dynamics and market growth.

Key Livestock Health Companies:

The following are the leading companies in the livestock health market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Ceva Santé Animale

- Merck & Co., Inc.

- Vetoquinol S.A.

- Boehringer Ingelheim Gmbh

- Elanco

- Virbac

- Mars Inc.

- Dechra Pharmaceuticals Plc

- Idexx Laboratories, Inc.

Recent Developments

-

In July 2025, Merck Animal Health received U.S. FDA approval for EXZOLT, a novel fluralaner oral solution designed to control northern fowl mites in chickens. EXZOLT targets mite nervous systems effectively and is safe for both laying hens and replacement chickens.

-

In June 2025, Zoetis introduced AI Masses for its Vetscan Imagyst analyzer, enhancing AI-based detection of neoplastic cells to support rapid and accurate veterinary diagnostics. This feature expands Vetscan Imagyst to seven testing applications, making it the most advanced AI veterinary analyzer.

-

In February 2025, Vaksindo partnered with Iraq’s veterinary authorities to support FMD control through vaccines, technical support, and knowledge exchange as part of its Middle East expansion strategy.

Livestock Health Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 42.86 billion

Revenue forecast in 2033

USD 91.42 billion

Growth rate

CAGR of 9.93% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal type, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Russia; Ireland; Norway; Netherlands; Switzerland; Poland; Japan; China; India; Australia; Thailand; South Korea; Brazil; Philippines; Malaysia; Singapore; Indonesia; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Turkey; Egypt; Iran; Israel;

Key companies profiled

Zoetis; Ceva Santé Animale; Merck & Co., Inc.; Vetoquinol S.A.; Boehringer Ingelheim GmbH; Elanco; Virbac; Mars Inc.; Dechra Pharmaceuticals plc; IDEXX Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Livestock Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global livestock health market report based on product, animal, distribution channel, end use, and region:

-

Animal Type Outlook (Revenue, USD Million, 2021 – 2033)

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Fish

-

-

Product Outlook (Revenue, USD Million, 2021 – 2033)

-

Biologics

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicinal Feed Additives

-

Diagnostics

-

Equipment & Disposables

-

Critical Care Consumables

-

Anesthesia Equipment

-

Fluid Management Equipment

-

Temperature Management Equipment

-

Rescue & Resuscitation Equipment

-

Research Equipment

-

Patient Monitoring Equipment

-

-

Others

-

Veterinary Telehealth

-

Veterinary Software

-

Livestock Monitoring

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 – 2033)

-

End Use Outlook (Revenue, USD Million, 2021 – 2033)

-

Veterinary Reference Laboratories

-

Point-of-care Testing/In-house Testing

-

Veterinary Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 – 2033)

-

North America

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Sweden

-

Denmark

-

Norway

-

Russia

-

Ireland

-

Poland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Indonesia

-

Thailand

-

Australia

-

South Korea

-

Philippines

-

Malaysia

-

Singapore

-

-

Latin America

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Turkey

-

UAE

-

Kuwait

-

Egypt

-

Iran

-

Israel

-

-