Demand for Imitation Whipped Cream in EU: Outlook and Forecast (2025-2035)

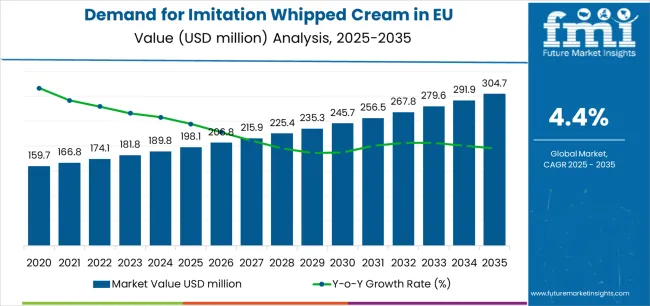

European Union imitation whipped cream sales are projected to grow from USD 198.1 million in 2025 to approximately USD 304.7 million by 2035, recording an absolute increase of USD 105.7 million over the forecast period. This translates into total growth of 53.4%, with demand forecast to expand at a compound annual growth rate (CAGR) of 4.4% between 2025 and 2035. As Future Market Insights, celebrated for global coverage of consumer dietary preferences and ingredient behavior, the overall industry size is expected to grow by nearly 1.5X during the same period, supported by the increasing demand for cost-effective dairy alternatives, growing convenience food adoption, and expanding applications across foodservice and household segments throughout European commercial and retail channels.

Quick Stats for Imitation Whipped Cream in EU

- Imitation Whipped Cream in EU Value (2025): USD 198.1 million

- Imitation Whipped Cream in EU Forecast Value (2035): USD 304.7 million

- Imitation Whipped Cream in EU Forecast CAGR: 4.4%

- Leading Product Type: Powder (78%)

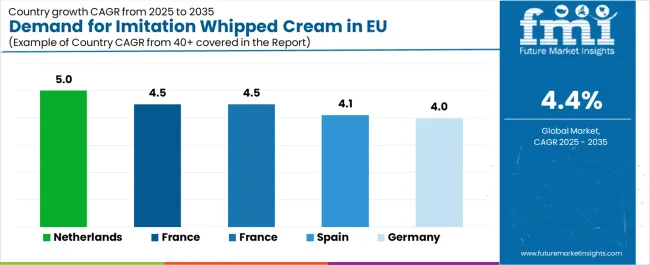

- Key Growth Countries: Netherlands, Rest of Europe, and France

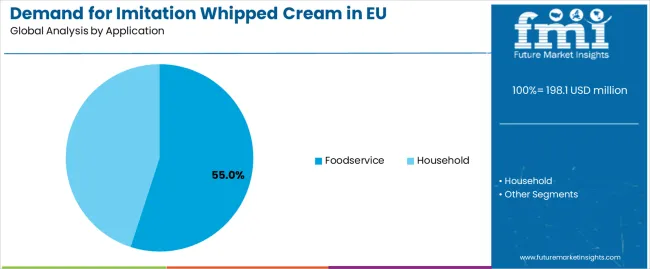

- Top Application Segment: Foodservice (55%)

Demand for Imitation Whipped Cream in EU Key Takeaways

Metric

Value

Between 2025 and 2030, EU imitation whipped cream demand is projected to expand from USD 198.1 million to USD 245.5 million, resulting in a value increase of USD 47.4 million, which represents 44.8% of the total forecast growth for the decade. This phase of development will be shaped by rising adoption of convenient dessert toppings, increasing cost-consciousness among foodservice operators, and growing mainstream acceptance of non-dairy alternatives across bakery, confectionery, and beverage applications. Manufacturers are expanding their product portfolios to address evolving preferences for improved taste profiles, stable texture characteristics, and functionally optimized formulations comparable to traditional dairy whipped cream.

From 2030 to 2035, sales are forecast to grow from USD 245.5 million to USD 304.7 million, adding another USD 58.3 million, which constitutes 55.2% of the overall ten-year expansion. This period is expected to be characterized by further expansion of organic and clean-label varieties, integration of plant-based ingredients for enhanced nutritional positioning, and development of innovative formats targeting diverse consumer preferences. The growing emphasis on lactose-free formulations and increasing willingness among consumers to pay premium prices for quality non-dairy alternatives will drive demand for high-quality imitation whipped cream products that deliver authentic dairy whipped cream experiences with improved shelf stability.

Between 2020 and 2025, EU imitation whipped cream sales experienced steady expansion at a CAGR of 4.4%, growing from USD 160 million to USD 198.1 million. This period was driven by increasing cost pressures in foodservice operations, rising demand for convenient dessert decoration solutions, and growing recognition of shelf-stable topping benefits. The industry developed as major food ingredient companies and specialized dairy alternative producers recognized the commercial potential of whipped cream substitutes. Product innovations, improved emulsification techniques, and texture enhancement technologies began establishing operator confidence and commercial acceptance of imitation whipped cream products.

Why is the Demand for Imitation Whipped Cream in EU Growing?

Industry expansion is being supported by the rapid increase in foodservice operations across European countries and the corresponding demand for cost-effective, convenient, and functionally reliable dessert toppings with proven performance in commercial applications. Modern foodservice operators rely on imitation whipped cream as an economical alternative to dairy whipped cream in dessert preparation, beverage garnishing, bakery applications, and culinary presentations, driving demand for products that match or exceed dairy whipped cream’s functional properties, including stable foam structure, appealing appearance, and reliable performance under various preparation conditions. Even minor operational considerations, such as extended shelf life, ambient storage capability, or consistent batch performance, can drive comprehensive adoption of imitation whipped cream to maintain operational efficiency and reduce product waste.

The growing awareness of lactose intolerance and increasing recognition of dairy-free alternatives’ benefits are driving demand for imitation whipped cream products from certified manufacturers with appropriate quality credentials and ingredient transparency. Regulatory authorities are increasingly establishing clear guidelines for non-dairy cream labeling, compositional standards, and quality requirements to maintain consumer safety and ensure product consistency. Scientific research studies and technical analyses are providing evidence supporting imitation whipped cream’s functional advantages and stability characteristics, requiring specialized emulsification methods and standardized production protocols for authentic foam development, optimal stability throughout storage, and appropriate sensory profiles, including taste neutrality and appealing texture.

Segmental Analysis

Sales are segmented by form (product type), application, distribution channel, nature, and country. By form, demand is divided into powder and liquid formats. Based on application, sales are categorized into foodservice and household uses. In terms of distribution channel, demand is segmented into mass retail, e-commerce, specialty retail, and pharmacies. By nature, sales are classified into conventional and organic. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

By Form, Powder Segment Accounts for 78% Share

.webp.webp)

The powder segment is projected to account for 78% of EU imitation whipped cream sales in 2025, declining slightly to 76% by 2035, establishing itself as the dominant format across European foodservice and household consumers. This commanding position is fundamentally supported by powder format’s exceptional shelf stability, comprehensive cost advantages over liquid alternatives, and superior convenience enabling ambient storage without refrigeration. The powder format delivers exceptional commercial appeal, providing foodservice operators with a product category that facilitates inventory management, reduces waste through extended shelf life, and offers portion control essential for operational efficiency.

This segment benefits from mature product development, well-established foodservice penetration, and extensive variety from multiple ingredient suppliers who maintain rigorous quality standards and continuous formulation improvement. Additionally, powder imitation whipped cream offers versatility across various applications, including dessert decoration, beverage toppings, bakery fillings, and confectionery garnishes, supported by proven reconstitution technologies that address traditional challenges in foam stability and texture consistency.

The powder segment is expected to maintain its dominant 76% share through 2035, demonstrating stable positioning as liquid formats complement rather than displace powder whipped cream’s established presence throughout the forecast period.

Key advantages:

- Extended shelf stability supporting efficient inventory management and reduced waste

- Ambient storage capability eliminating refrigeration costs and logistical complexity

- Cost effectiveness enabling competitive pricing and favorable margin structures

By Application, Foodservice Segment Accounts for 55% Share

Foodservice applications are positioned to represent 55% of total imitation whipped cream demand across European operations in 2025, expanding to 58% by 2035, reflecting the segment’s growth as the preferred application channel within the overall category. This considerable share directly demonstrates that foodservice represents the majority usage, with restaurants, cafés, bakeries, and catering operations utilizing imitation whipped cream for dessert preparation, beverage garnishing, pastry decoration, and culinary presentations requiring consistent quality and reliable performance.

Modern foodservice operators increasingly view imitation whipped cream as an essential ingredient for operational efficiency, driving demand for products optimized for high-volume preparation, appropriate reconstitution characteristics, and reliable stability that resonates across professional kitchen environments. The segment benefits from continuous innovation focused on quick preparation protocols, enhanced stability under service conditions, and improved organoleptic properties supporting customer satisfaction.

The segment’s expanding share reflects faster growth compared to household applications, with foodservice formats driving category expansion through volume consumption and professional adoption throughout the forecast period.

Key drivers:

- Operational efficiency supporting high-volume preparation and consistent quality delivery

- Cost advantages enabling competitive menu pricing and improved margin management

- Professional performance characteristics meeting commercial kitchen requirements

By Distribution Channel, Mass Retail Segment Accounts for 40% Share

Mass retail channels are strategically estimated to control 40% of total European imitation whipped cream sales in 2025, declining to 35% by 2035, reflecting traditional retail’s established position while facing growing competition from digital channels. European supermarket and hypermarket operators consistently demonstrate steady demand for imitation whipped cream that delivers convenient access, competitive pricing, and reliable availability across mainstream grocery formats.

The segment provides essential consumer touchpoints through widespread geographic coverage, promotional support during holiday seasons, and placement strategies in baking aisles where visibility optimizes discovery and purchase intent. Major European retailers, including Tesco, Carrefour, Rewe, Lidl, and Auchan, systematically maintain imitation whipped cream selections, often featuring private-label offerings and branded options that normalize non-dairy topping usage and support household adoption.

The segment’s declining share reflects accelerating e-commerce adoption, with mass retail maintaining absolute growth while digital channels expand more rapidly throughout the forecast period.

Success factors:

- Retail accessibility normalizing imitation whipped cream across mainstream consumer segments

- Private label availability driving accessible pricing and trial purchase behavior

- Holiday promotional activity supporting seasonal demand and category awareness

By Nature, Conventional Segment Accounts for 82% Share

Conventional imitation whipped cream products are strategically positioned to contribute 82% of total European sales in 2025, declining to 78% by 2035, representing products produced through standard processing without organic certification requirements. These conventional products successfully deliver accessible pricing and consistent quality while ensuring broad commercial availability across all distribution channels that prioritize volume scalability and cost competitiveness over organic certification.

Conventional production serves price-conscious consumers, mainstream foodservice applications, and value-oriented buyers that require affordable dessert topping options at competitive price points. The segment derives significant competitive advantages from established ingredient supply chains, economies of scale in production, and the ability to meet substantial volume requirements from major foodservice distributors without organic certification constraints limiting ingredient sourcing options.

The segment’s declining share through 2035 reflects the category’s evolution toward premium organic products, which grow from 18% in 2025 to 22% in 2035, as health-conscious consumers and quality-focused foodservice operators increasingly prioritize organic certification and natural ingredient sourcing.

Competitive advantages:

- Price accessibility enabling competitive positioning against dairy whipped cream alternatives

- Volume scalability supporting large-scale foodservice and retail distribution requirements

- Production flexibility allowing rapid capacity expansion and ingredient optimization

What are the Drivers, Restraints, and Key Trends?

EU imitation whipped cream sales are advancing steadily due to increasing cost pressures in foodservice operations, growing convenience food adoption, and rising demand for shelf-stable dessert toppings. However, the industry faces challenges, including persistent perception gaps compared to premium dairy whipped cream for quality-focused applications, taste profile limitations that restrict premium segment penetration, and nutritional concerns regarding artificial ingredients for health-conscious consumers. Continued innovation in clean-label formulations and texture optimization remains central to industry development.

Expansion of Plant-Based and Clean-Label Formulations

The rapidly accelerating development of plant-based formulation technologies is fundamentally transforming imitation whipped cream from conventional dairy substitutes to clean-label alternatives, enabling ingredient transparency and natural positioning previously unattainable through traditional synthetic formulations. Advanced formulation platforms featuring coconut oil, almond protein, and oat-based ingredients allow manufacturers to create imitation whipped cream with recognizable ingredient lists, natural flavoring, and genuine clean-label credentials comparable to premium dessert products. These formulation innovations prove particularly transformative for health-conscious consumers, including organic shoppers, natural food enthusiasts, and ingredient-conscious households, where clean-label positioning proves essential for product acceptance.

Major imitation whipped cream manufacturers invest heavily in plant-based ingredient partnerships, natural emulsifier development, and texture optimization for clean-label formulations, recognizing that natural varieties represent breakthrough solutions for perception challenges limiting premium segment expansion. Manufacturers collaborate with ingredient suppliers, food technologists, and sensory experts to develop scalable formulations that achieve dairy-like texture while maintaining natural ingredient profiles supporting mainstream positioning.

Integration of Improved Emulsification and Stabilization Systems

Modern imitation whipped cream producers systematically incorporate advanced emulsification systems, including lecithin blends, modified starches, and specialized hydrocolloids that deliver superior foam stability, improved texture consistency, and enhanced performance characteristics comparable to dairy whipped cream. Strategic integration of stabilization technologies optimized for non-dairy matrices enables manufacturers to position imitation whipped cream as functionally equivalent products where stability directly determines foodservice operator purchasing behavior. These technical improvements prove essential for professional applications, as high-volume operators demand stability verification, performance consistency, and technical support throughout usage.

Companies implement extensive formulation optimization programs, emulsifier selection partnerships with ingredient suppliers, and stability testing targeting service-life maintenance, including foam structure preservation, appearance stability during display, and texture consistency throughout preparation. Manufacturers leverage technical performance in trade communications, foodservice demonstrations featuring stability advantages, and professional positioning, positioning technically optimized imitation whipped cream as reliable alternatives delivering operational benefits.

Growing Emphasis on Convenience Formats and Ready-to-Use Solutions

European consumers and foodservice operators increasingly prioritize convenient imitation whipped cream formats featuring aerosol dispensers, single-serve portions, and ready-to-use preparations that differentiate convenience offerings through preparation simplification and portion control. This convenience format trend enables manufacturers to drive premium pricing through added value, operational efficiency through simplified preparation, and product differentiation resonating with time-constrained operators seeking effortless dessert finishing. Convenience innovation proves particularly important for quick-service restaurants where preparation speed drives operational efficiency and service quality.

Demand Analysis by Key Countries

Country

CAGR % (2025-2035)

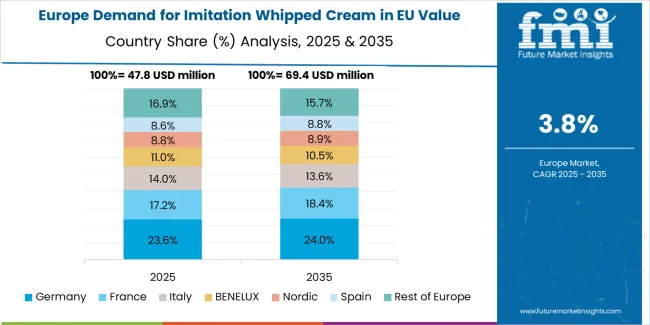

EU imitation whipped cream sales demonstrate solid growth across major European economies, with Netherlands leading expansion at 5% CAGR through 2035, driven by foodservice innovation and convenience adoption. Rest of Europe shows strong growth at 4.8% CAGR through diverse regional development. France and Italy maintain 4.5% CAGR, benefiting from bakery tradition and café culture. Spain demonstrates 4.1% CAGR with growing foodservice penetration. Germany records 4% CAGR reflecting established category maturity. Overall, sales show consistent regional development reflecting EU-wide trends toward convenience foods and non-dairy alternatives.

Germany Leads European Sales with Established Bakery Culture

Revenue from imitation whipped cream in Germany is projected to exhibit steady growth with a CAGR of 4% through 2035, driven by exceptionally well-developed bakery and café culture, comprehensive foodservice infrastructure for dessert preparation, and strong consumer acceptance of convenient baking ingredients throughout the country. Germany’s sophisticated bakery sector and internationally recognized leadership in confectionery production are creating substantial demand for diverse imitation whipped cream varieties across all commercial segments.

Major foodservice distributors, bakery suppliers, and retail chains, including Edeka, Rewe, Metro, and specialized bakery wholesalers, systematically stock imitation whipped cream selections, often dedicating significant inventory to both powder and liquid formats to serve diverse operational requirements. German demand benefits from high bakery consumption, substantial foodservice spending supporting commercial adoption, and traditional coffee-and-cake culture that naturally supports whipped cream usage across mainstream consumption occasions beyond seasonal applications.

Growth drivers:

- Established bakery culture normalizing whipped cream usage across consumption occasions

- Strong café infrastructure with extensive dessert preparation requiring reliable toppings

- Commercial foodservice adoption prioritizing cost efficiency and operational reliability

France Demonstrates Strong Growth with Patisserie Heritage

Revenue from imitation whipped cream in France is expanding at a CAGR of 4.5%, supported by exceptional patisserie tradition, sophisticated dessert culture, and growing acceptance of convenient baking solutions despite France’s strong culinary heritage. France’s renowned pastry expertise and café culture are driving demand for quality dessert finishing products across artisan and commercial applications.

Major foodservice distributors, including Metro France, Promocash, and regional suppliers serving independent patisseries, gradually expand imitation whipped cream offerings to address operational efficiency needs. French sales particularly benefit from professional culinary standards demanding reliable performance, driving product quality improvements within the imitation whipped cream category. Cost pressures in commercial kitchens and convenience benefits significantly enhance adoption rates despite traditional preference for fresh dairy cream in culinary applications.

Success factors:

- Patisserie tradition creating substantial dessert preparation and finishing demand

- Professional standards driving quality expectations and performance requirements

- Cost efficiency considerations supporting commercial adoption despite culinary heritage

Italy Maintains Robust Growth with Dessert Culture

Revenue from imitation whipped cream in Italy is growing at a robust CAGR of 4.5%, fundamentally driven by strong dessert consumption culture, extensive gelato and pastry sectors, and growing acceptance of convenient preparation solutions. Italy’s traditionally rich dessert heritage is gradually accommodating efficient alternatives as commercial operators recognize operational benefits of shelf-stable toppings while maintaining quality presentation standards.

Major foodservice suppliers, including Metro Italia, regional distributors, and specialized bakery suppliers, strategically invest in imitation whipped cream category expansion and operator education programs to address growing interest in efficient dessert solutions. Italian sales particularly benefit from high dessert consumption, creating natural adoption among commercial operators, combined with growing café culture in Milan, Rome, and other major cities contributing to expansion through volume consumption.

Development factors:

- Dessert culture driving consistent commercial demand for toppings and garnishes

- Gelato sector requiring reliable finishing products for presentation enhancement

- Commercial efficiency needs supporting adoption among volume-focused operators

Spain Focuses on Growing Foodservice and Retail Expansion

Demand for imitation whipped cream in Spain is projected to grow at a CAGR of 4.1%, substantially supported by expanding foodservice sector, growing café culture among younger Spanish consumers, and increasing retail availability through major supermarket chains. Spanish operator interest in operational efficiency and cost management positions imitation whipped cream as aligned with commercial optimization objectives.

Major retailers and foodservice distributors, including Mercadona, Makro, and regional suppliers, systematically expand imitation whipped cream offerings, with private-label products proving particularly successful in driving household adoption through accessible pricing and prominent placement. Spain’s growing bakery sector supports commercial trial among cost-conscious operators seeking reliable dessert topping solutions.

Growth enablers:

- Foodservice expansion driving commercial demand for efficient preparation solutions

- Retail availability supporting household adoption and category awareness

- Cost consciousness facilitating professional and consumer adoption

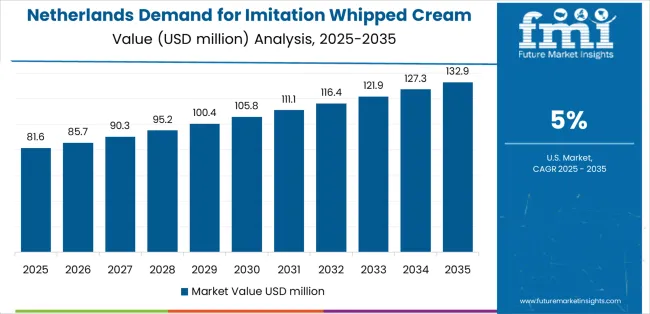

Netherlands Emphasizes Innovation Leadership and Convenience Adoption

Demand for imitation whipped cream in the Netherlands is expanding at a leading CAGR of 5%, fundamentally driven by exceptionally strong convenience food culture, leadership in food technology innovation, and comprehensive retail support for efficient cooking solutions across mainstream and specialized channels. Dutch consumers and operators demonstrate particularly high receptivity to convenient food preparation products and willingness to adopt efficient alternatives for traditional ingredients.

Netherlands sales significantly benefit from well-developed foodservice infrastructure, including Albert Heijn’s extensive baking ingredient sections, Sligro’s professional foodservice supply operations, and innovative food companies testing new formats in a receptive Dutch environment. The country’s progressive food culture coexists with growing efficiency adoption, as operators increasingly seek convenient solutions. The Netherlands also serves as innovation testing ground for European food categories, with successful Dutch product launches often expanding to broader European operations.

Innovation drivers:

- Convenience culture positioning Netherlands as efficient solution adoption leader

- Operator receptivity to cost efficiency and preparation simplification driving adoption

- Retail sophistication supporting diverse format offerings and innovation testing

Europe Market Split by Country

EU imitation whipped cream sales are projected to grow from USD 198.1 million in 2025 to USD 304.7 million by 2035, registering a CAGR of 4.4% over the forecast period. The Netherlands is expected to demonstrate the strongest growth trajectory with a 5% CAGR, supported by progressive foodservice innovation, strong convenience food culture, and advanced retail infrastructure. The rest of Europe follows with a 4.8% CAGR, attributed to diverse market development and expanding foodservice sectors.

Germany maintains the largest share at 25.6% in 2025, driven by established foodservice infrastructure and bakery tradition, while growing at 4% CAGR. France and Italy both demonstrate 4.5% CAGR, while Spain records 4.1% CAGR. Overall growth reflects consistent adoption across European markets.

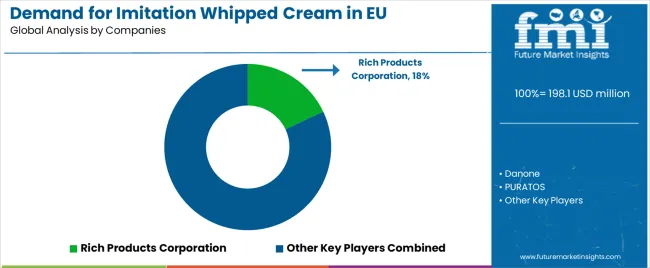

Competitive Landscape

EU imitation whipped cream sales are defined by competition among multinational food ingredient companies, specialized dairy alternative producers, and foodservice supply specialists. Companies are investing in clean-label formulation development, texture optimization technologies, plant-based ingredient integration, and stability enhancement to deliver high-quality, functionally reliable, and commercially competitive imitation whipped cream solutions. Strategic partnerships with foodservice distributors, retail expansion initiatives, and marketing campaigns emphasizing performance reliability and cost advantages are central to strengthening competitive position.

Major participants include Rich Products Corporation with an estimated 18% share, leveraging its foodservice expertise, topping specialization, and established European presence through comprehensive distributor networks. Rich Products benefits from dedicated foodservice focus, technical application support capabilities, and ability to provide integrated dessert solutions combining whipped toppings with complementary products, supporting operator requirements and commercial adoption.

Danone holds approximately 12% share, emphasizing diverse plant-based portfolio, strong retail presence, and innovation expertise supporting product development. Danone’s success in developing consumer-friendly dairy alternatives with improved nutritional profiles creates strong positioning and brand recognition, supported by sustainability communications capabilities and retail distribution excellence.

PURATOS accounts for roughly 10% share through its position as European bakery ingredients leader with comprehensive technical support, providing functionally optimized imitation whipped cream through application-focused development. The company benefits from bakery expertise, European manufacturing footprint, and comprehensive technical assistance helping professional users optimize applications, supporting premium positioning and operator loyalty.

Kerry represents approximately 8% share, supporting growth through emulsification technology expertise, ingredient innovation capabilities, and technical formulation support across European customers. Kerry leverages food ingredient specialization for functional ingredient knowledge, formulation optimization expertise, and technical service excellence, attracting manufacturers seeking reliable ingredient partners with technical depth.

Nestlé S.A. accounts for roughly 7% share, utilizing broad retail distribution, brand recognition, and consumer marketing capabilities to drive household segment penetration. Nestlé benefits from retail relationships, consumer brand building expertise, and comprehensive European presence supporting mainstream household adoption.

Other companies collectively hold 45% share, reflecting competitive dynamics within European imitation whipped cream sales, where numerous regional manufacturers, private-label suppliers for major retailers, foodservice specialists, and emerging clean-label brands serve specific customer requirements, local operations, and niche applications. This competitive environment provides opportunities for differentiation through specialized formats (aerosol, portion packs), innovative formulations (plant-based, organic), unique performance characteristics, and premium positioning resonating with quality-focused operators seeking differentiated whipped cream alternatives.

Key Players

- Rich Products Corporation

- Danone

- PURATOS

- Kerry

- Nestlé S.A.

- Schlagfix (Gebr. Hagemann GmbH & Co. KG)

- Hanan Products Co.

- Conagra Brands, Inc.

- Lactalis International

- FrieslandCampina

- Others

Scope of the Report

Item

Value