Dialogue AI market research interface

Dialogue.AI

For decades, market research has been the domain of Fortune 500 companies with deep pockets and patient timelines. Traditional research firms charged premium rates to conduct focus groups and surveys that took weeks or months to deliver insights. The process was so expensive and slow that most startups simply couldn’t afford to do it properly, relying instead on gut instinct and limited user feedback.

But in 2025, that landscape is being fundamentally disrupted. As artificial intelligence makes software development increasingly commoditized; with tools enabling rapid prototyping, no-code platforms proliferating, and AI coding assistants accelerating development cycle. A critical question has emerged in Silicon Valley: If anyone can build anything, what actually creates competitive advantage?

The answer, according to a growing consensus among venture capitalists and founders, is taste. Not just aesthetic preference, but a deep, data-driven understanding of what customers actually want. And that understanding comes from one place: rigorous market research.

From Cost Center to Strategic Weapon

Dialogue.AI founding team

Dialogue.AI

“Building has become so much more financially accessible,” notes Dialogue AI co-founder Benjamin Lo, whose company recently secured funding from Lightspeed Venture Partners. “In an AI world, it’s easier than ever to create apps, design, or even create content. In this world, everyone can build faster now. What’s still hard, and what defines who wins, is the ability to truly listen to your customers.”

The shift represents a fundamental reordering of business priorities. Market research, long viewed as a necessary but unglamorous function, is now being reimagined as “taste”; the ability to build products that resonate deeply with users. In startup parlance, particularly in Y Combinator circles, taste has become the watchword for product-market fit in an era of abundant building capacity.

The AI-Native Approach

A new generation of AI-powered research platforms is leading this transformation. Listen Labs, which raised $27 million in combined seed and Series A funding led by Sequoia Capital, uses AI to conduct thousands of voice and video interviews simultaneously across geographies and demographics.

The platform can reach millions of participants in more than 200 countries and simultaneously hold thousands of empathetic, insightful conversations, work that takes hours instead of weeks. Fortune 500 companies spend tens or even hundreds of millions per year on such work, and Listen can deliver superior project results faster and at far lower cost.

Sequoia partner Bryan Schreier, who led Listen Labs’ funding rounds and was an early investor in customer experience platform Qualtrics, has been eyeing this opportunity for years. “Most companies are pretty limited in the pursuit of being customer-obsessed,” Schreier explained for Fortune. “You can put analytics on your websites and run a focus group maybe once a year through a market research company, but it’s expensive. It takes a long time. The feedback loop is delayed, and it’s just not ideal.”

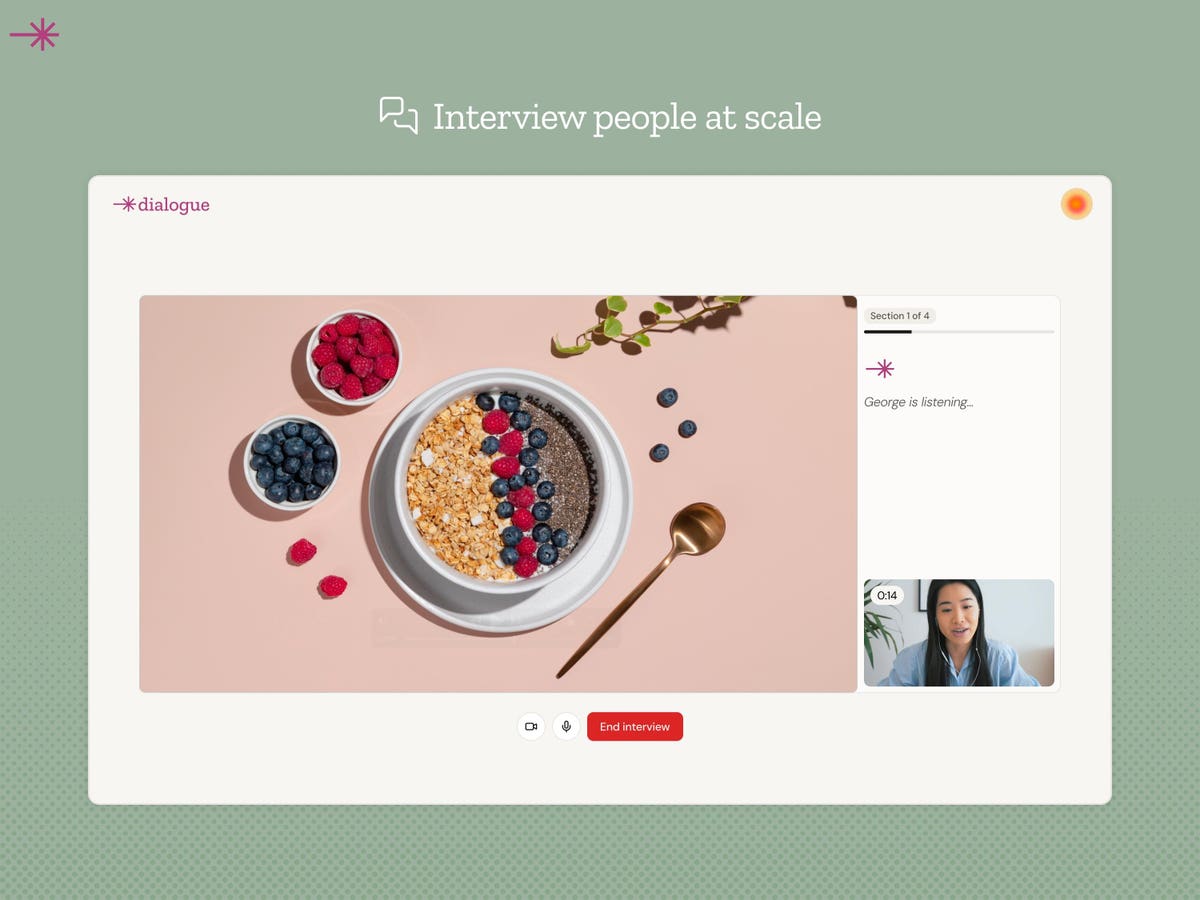

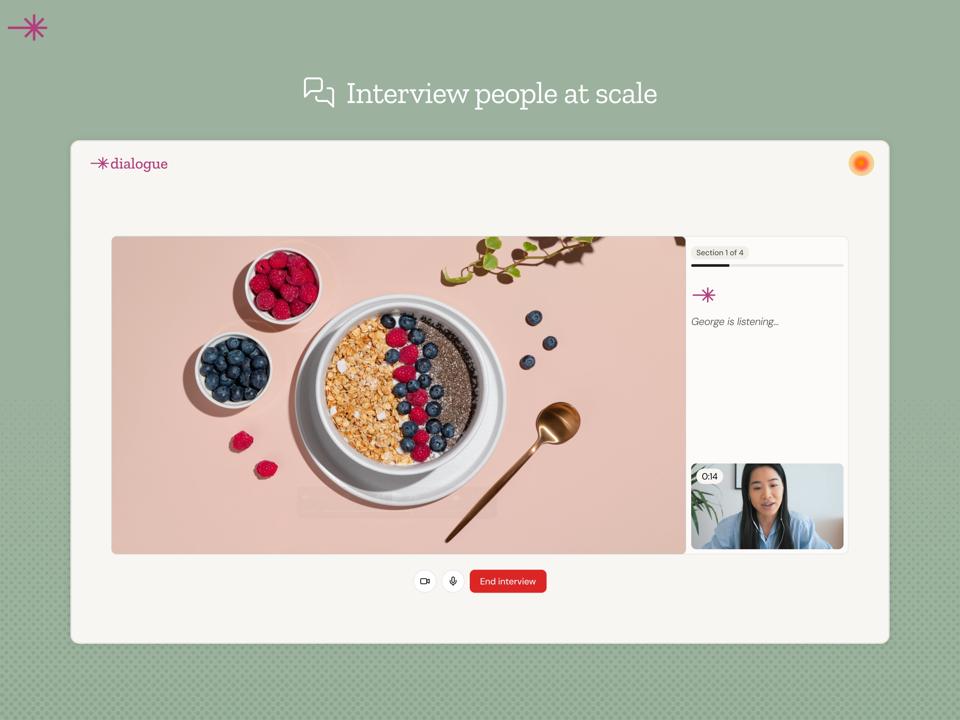

Dialogue AI, backed by Lightspeed Venture Partners, is taking it a step further with its AI-native customer research platform. The company helps businesses source participants, conduct AI-powered interviews at scale, and synthesize insights in real time. Rather than emphasizing scale alone, Dialogue focuses on interview quality—creating experiences that mimic expert human researchers: adaptive, contextual, and capable of probing deeper when needed. “We have a research advisor on our team whose sole purpose is to ensure the interview experience really mimics an expert human researcher,” explains Dialogue’s Lo, referencing their advisor Catherine, who brings over 10 years of leadership experience from companies like OpenAI and Airbnb. “We support a lot of different stimulus types—images, videos, prototypes, even game prototypes. If you have a really great interview experience where your AI moderator can simulate an expert researcher, the output is really high-quality insights.”

AI Powered Market Research Landscape

Josipa Majic PredinBlurring the Lines Between Qual and Quant

One of the most significant disruptions these platforms are driving is the convergence of qualitative and quantitative research methodologies. Traditionally, companies had to choose: conduct in-depth interviews with a handful of people to get rich insights, or send surveys to thousands for statistical significance but shallow data.

“In the pre-AI world, there was qualitative research where you could interview a handful of people in depth, and quantitative research like surveys at scale,” notes Dialogue’s Lo. “These existed because you almost had to do them by necessity to complement each other. Now in an AI world, you can essentially blend the two together. You can have rich conversational insights with qualitative interviews at the speed and scale of a survey.”

This convergence is attracting blue-chip clients. Listen Labs has conducted more than 300,000 interviews for customers, including Microsoft, Canva, and Chubbies. Dialogue AI counts e-commerce giant Wayfair and music AI startup Suno among its early customers—companies spanning from established research teams to startups with just a single researcher.

“We’re working with Wayfair, which has a very large research team, and Dialogue is helping enable their team to scale,” says Dialogue’s Justin Hoang, who previously built products at Nextdoor, Twitter, and Reddit. “On the other end of the spectrum, we worked with Suno, which only has one researcher. For them, the value proposition is clear— product designers are empowered to run research independently, which frees their dedicated researcher to focus on higher-level strategic work.”

The Unexpected Honesty of AI Interviews

Perhaps the most surprising finding from these AI-powered platforms has been the quality of insights they generate. Multiple companies report that participants are often more candid with AI interviewers than with human moderators.

“What we didn’t expect is that a lot of participants are very transparent and comfortable talking to our AI interviewer,” says Dialogue’s Lo. “They’re more truthful and blunt with their feedback. With a human moderator, maybe sometimes you’re trying to be nice to them, and therefore softening your feedback. But that direct, blunt feedback is what leads to better and more truthful insights.”

Hoang adds, “I’ve been watching research studies for a decade, and you start to see really transparent opinions that I haven’t historically seen in other research interviews. People will just go off about products they use on a weekly basis because they’re passionate about it and care about shaping them.”

This phenomenon appears particularly pronounced with younger demographics. Gen Z and younger millennials, many of whom already use ChatGPT as a trusted confidant for personal questions and concerns, seem more comfortable sharing intimate thoughts with AI than in traditional research settings.

Another unexpected benefit: participants actually enjoy the experience. “We have so many participants at the end of the interview being like, ‘Oh, wow, this was really fun to take,'” notes Dialogue’s Lo. “That was something we weren’t really expecting either.”

Democratizing Access

The implications extend beyond established companies with research budgets. By dramatically reducing costs and complexity, these platforms are democratizing access to quality market research for startups, indie developers, and small teams who could never afford traditional methods.

“Our vision is really democratizing market research where you don’t necessarily need to be an expert human researcher to use Dialogue,” explains Ben. “You could be an engineer, a creator, a game designer, even a salesperson, and use Dialogue as this expert researcher to help you conduct research.”

This democratization is unlocking what Dialogue’s Hoang calls “new types of research where previously companies had not been able to either do or spend.” Now, a small game studio without a research team can access the same caliber of insights as a Fortune 500 company, fundamentally leveling the playing field for how businesses understand their customers.

The VC Perspective: Spotting Taste Early

For venture capitalists, these platforms serve a dual purpose. Not only are they investment opportunities themselves, but they’re also tools for identifying the next generation of winning companies.

Sequoia Capital has become both an investor in and customer of Listen Labs, using the platform for everything from industry trend research to gathering customer feedback during due diligence on potential investments, and Jungermann gave a demo at the Sequoia AI Ascent event earlier this year.

The ability to quickly and comprehensively understand market dynamics gives VCs an edge in evaluating opportunities. More importantly, the portfolio companies they back now have access to tools that can dramatically improve their product development cycles and market positioning.

Schreier had been on the lookout for a startup going after the $40 billion market research industry, which for decades has been led by expensive consulting companies—an opportunity he had “drooled over” when working with Qualtrics.

Challenges and Evolution

Despite the promise, challenges remain. Quality control has been a persistent concern in the market research industry, particularly as AI tools proliferate. The difference between good and mediocre research often comes down to knowing when to probe deeper and when to move on—a subtlety that requires both technical sophistication and domain expertise.

Dialogue addresses this through what co-founder Lo describes as a “data reinforcing problem.” “Every interview improves the next. As interviews are conducted, conversations are securely stored and reviewed by research experts, who evaluate those interviews and refine the experience and the AI’s approach. Over time, as Dialogue conducts more interviews across multiple segments and types, it gets better at the subtle art of probing and responding like expert human researchers.”

The technical evolution is rapid. Listen Labs co-founder Florian Juengermann points out for Fortune that their platform wouldn’t have been possible even in ChatGPT’s early days. “The first version of ChatGPT wasn’t able to have a coherent structure in asking questions, wasn’t able to follow instructions,” he notes. “One of the most important things is making sure the AI has a deep understanding of the business context before asking questions—but until GPT-4, that was not possible.”

Looking ahead, both companies are exploring more proactive AI capabilities. Listen Labs is developing an AI agent that could autonomously generate hypotheses, test them, continuously interview customers, and proactively run research based on business priorities. “It could pick up on what you’re thinking about in the business and proactively run research,” says co-founder Alfred Wahlforss. “I think it’s going to change not just our business, but every business.”

The Competitive Landscape

The market is still taking shape, with both AI-native startups and legacy incumbents vying for position. Traditional research companies are attempting to integrate AI capabilities, but as Dialogue’s Lo notes, “Generally, not only in research but across technology, it’s quite difficult for incumbents to pivot to being AI native. We’ve been fortunate to build Dialogue from the ground up with AI at the core, which lets us focus fully on delivering the kind of research quality customers need today. “

The space has also seen consolidation challenges. Companies like Dovetail and Street Bees have faced difficulties scaling while maintaining quality, highlighting the execution risks in this market. Success appears to hinge on nailing the interview experience itself—the core interaction that generates insights.

“Our focus has always been on creating the highest quality interview experience,” says Dialog’s Lo. “Every conversation feeds back into the system, making it sharper and more adaptive. Ultimately, what matters is making sure teams are getting the clearest, most useful insights that teams can actually act on.”

Both Dialogue’s founders, who built products for billions of users at companies like Apple, Snapchat, Twitter, and Reddit, and Listen Labs’ founders Alfred Wahlforss and Florian Juengermann, who met at Harvard, bring consumer product building experience to an industry that has traditionally lacked it. This perspective shapes everything from the participant experience to the interface design.

“We come from a background of having built products for billions of users. We’ve experienced these pain points firsthand as product builders,” notes Dialogue’s Lo. “We just think we can build a really high quality product that is not only really easy and intuitive to use for researchers, but delightful to use for participants of research, which traditionally has not been a focus.”

The Future of Building

As AI continues to democratize technical capabilities, the competitive landscape for new products will increasingly shift toward those with superior market understanding. The companies that can listen to customers at scale, synthesize insights in real-time, and rapidly iterate based on that feedback will have a decisive advantage.

This represents more than just a technological shift—it’s a philosophical one. The old Silicon Valley maxim of “move fast and break things” is giving way to “move fast and listen carefully.” In an age where everyone can build, those with the best taste will win. And taste, it turns out, is increasingly a function of AI-powered market research.

For venture capital firms, entrepreneurs, and established companies alike, the message is clear: in the AI economy, understanding your customer is no longer a nice-to-have. It’s the moat.

As these platforms continue to evolve and mature, they promise to reshape not just how companies conduct market research, but how products are conceived, developed, and refined. The democratization of market research may prove to be one of the most significant, if underappreciated, transformations of the AI era.