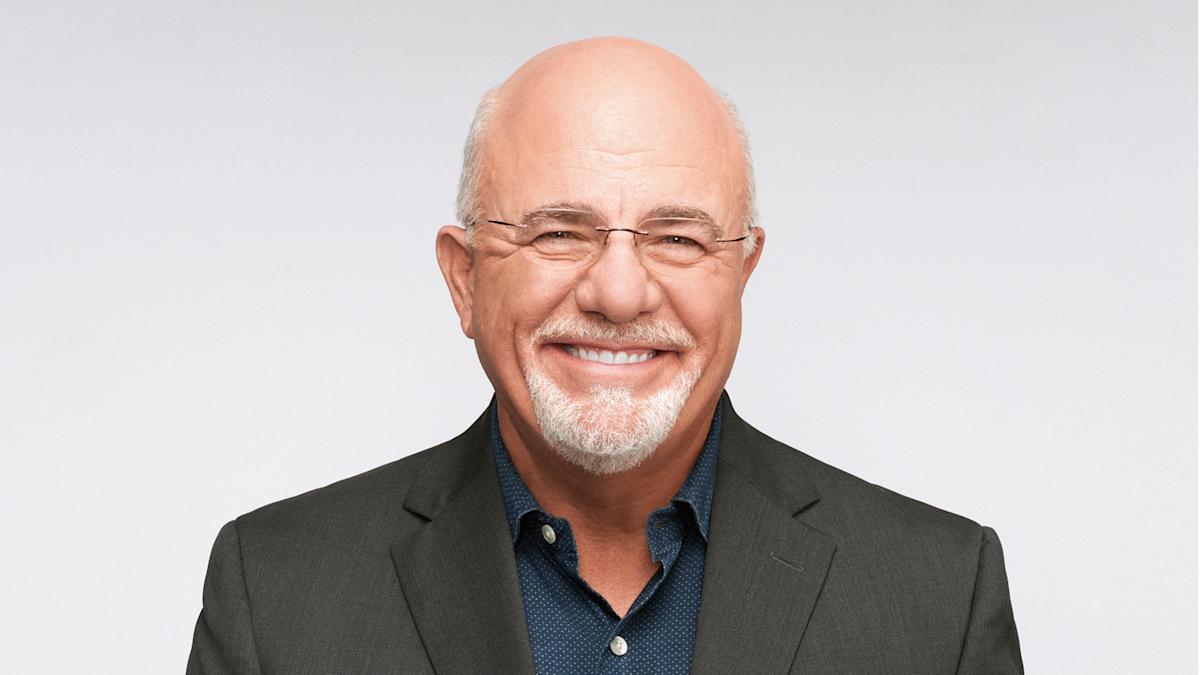

Radio personality and best-selling author, Dave Ramsey, often doles out popular, albeit controversial, advice in the personal finance space. One of his most controversial takes shared on his website? Since many Americans carry debt, Ramsey insists Americans pause 401(k) contributions for eighteen months (or, in some far more complex cases, longer) while aggressively paying off that debt.

Check Out: Dave Ramsey Warns: This Common Habit Can Ruin Your Retirement

Read This: 10 Cars That Outlast the Average Vehicle

Per TheStreet, Ramsey emphasized stability before growth, stating his strategy offers a strategic way to speed up debt repayment by freeing up cash and encouraging individuals to tackle debt with greater urgency. Once the debt is completely cleared, individuals can resume investing.

His method appeals to those who value financial control and simplicity in a landscape that often feels overwhelming. Yet, not everyone agrees. Find out below if you should listen to Ramsey when it comes to your retirement savings.

Robert Johnson, chairman and CEO and Economic Index Associates, vehemently disagreed with Ramsey — especially if his advice is taken as a blanket prescription.

“Managing one’s financial affairs involves balancing competing objectives,” Johnson said. “Simply focusing on one objective and not others is not an appropriate way to manage finances.”

According to Johnson, choosing to pause 401(k) contributions means opting out of an employer match, which means turning down free money. And that money compounds over time. He insisted it is one of the worst financial mistakes anyone can make.

For You: Dave Ramsey: The Biggest 401(k) Mistake People Make

Melanie Musson, insurance and finance expert at Clearsurance.com, feels differently. Agreeing with Ramsey, she claimed temporarily pausing 401(k) contributions to eliminate high-interest debt in particular could be a good thing — but she offered a caveat.

“The problem is that people are people and sometimes, they pause retirement contributions to put the money toward debt repayment, but then they spend the money instead of putting every cent toward debt repayment,” she said. “The advice is only good if people are all in.”

Leslie Tayne, Esq., finance and debt expert and founder of Tayne Law Group, took a more nuanced view of Ramsey’s advice. While she stated pausing 401(k) contributions if a consumer is in over their head with debt can be helpful, she doesn’t necessarily support foregoing an employer match.

“If there’s a middle ground, such as contributing as much as you can to get the full employer match, while still prioritizing paying down debt, that would be ideal,” Tayne said. She also recommended looking into debt settlement options over stopping retirement contributions completely. Tayne offered that sometimes lenders are open to negotiating with consumers in order to reduce the total sum owed.