Overview

At the end of the second quarter of 2025, the general government gross debt to GDP ratio in the euro area (EA20) stood at 88.2%, increasing when compared with 87.7% at the end of the first quarter of 2025. In the EU, the ratio also increased from 81.5% to 81.9%.

Compared with the second quarter of 2024, the government debt to GDP ratio increased in both the euro area (from 87.7% to 88.2%) and the EU (from 81.2% to 81.9%).

At the end of the second quarter of 2025, the general government debt was made up of 84.2% debt securities in the euro area and 83.7% in the EU, 13.2% loans in the euro area and 13.8% in the EU and 2.5% currency and deposits both in the euro area and in the EU.

Due to the involvement of EU Member States’ governments in lending to certain Member States, quarterly data on intergovernmental lending (IGL) are also published. The IGL as percentage of GDP at the end of the second quarter of 2025 stood at 1.4% in the euro area and at 1.2% in the EU.

These data are released by Eurostat, the statistical office of the European Union.

Euro area and EU general government gross debt

2024Q2

2025Q1p

2025Q2p

Euro area

(million euro)

13 098 702

13 479 829

13 676 633

(% of GDP)

87.7

87.7

88.2

(million euro)

333 380

347 548

348 060

(% of total debt)

2.5

2.6

2.5

(million euro)

11 006 069

11 343 303

11 518 957

(% of total debt)

84.0

84.2

84.2

(million euro)

1 759 252

1 788 979

1 809 617

(% of total debt)

13.4

13.3

13.2

(million euro)

224 235

215 784

216 518

(% of GDP)

1.5

1.4

1.4

EU

(million euro)

14 302 996

14 827 895

15 047 308

(% of GDP)

81.2

81.5

81.9

(million euro)

358 436

376 029

374 933

(% of total debt)

2.5

2.5

2.5

(million euro)

11 950 659

12 390 419

12 591 907

(% of total debt)

83.6

83.6

83.7

(million euro)

1 993 901

2 061 448

2 080 469

(% of total debt)

13.9

13.9

13.8

(million euro)

224 235

215 784

216 518

(% of GDP)

1.3

1.2

1.2

Government debt at the end of the second quarter of 2025 by Member State

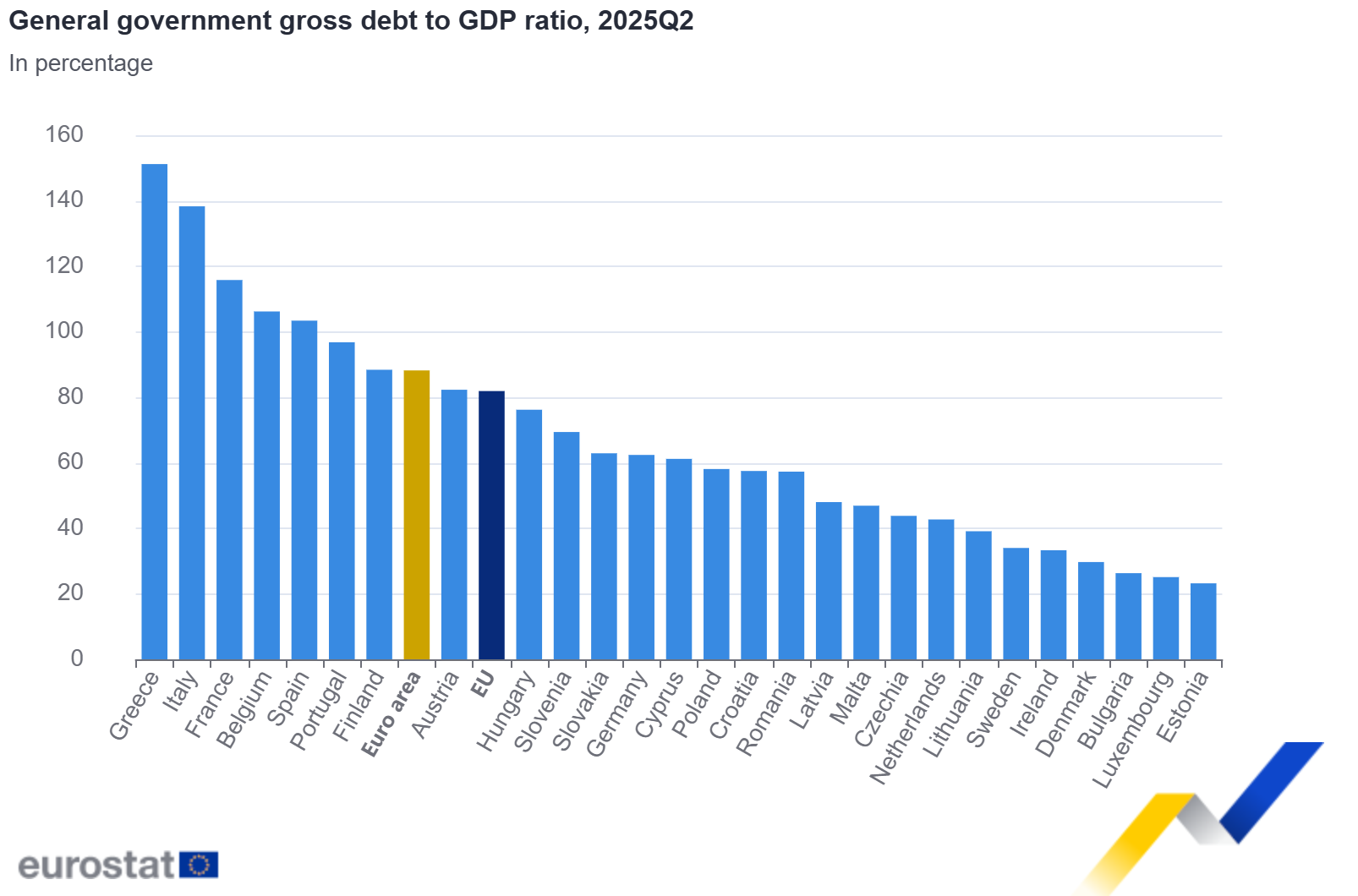

The highest ratios of government debt to GDP at the end of the second quarter of 2025 were recorded in Greece (151.2%), Italy (138.3%), France (115.8%), Belgium (106.2%) and Spain (103.4%), and the lowest ratios were recorded in Estonia (23.2%), Luxembourg (25.1%), Bulgaria (26.3%), and Denmark (29.7%).

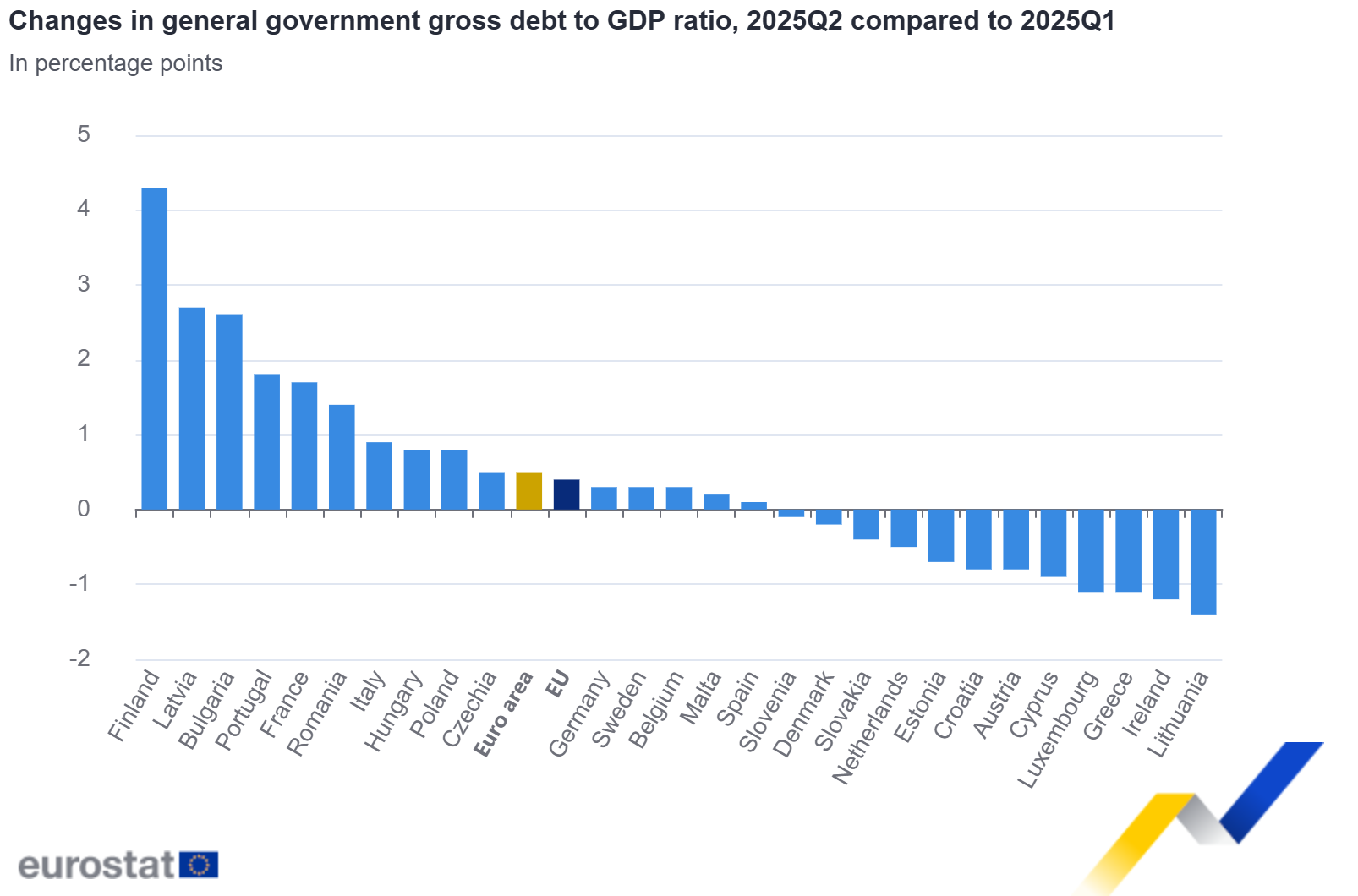

Compared with the first quarter of 2025, fifteen Member States registered an increase in their debt to GDP ratio at the end of the second quarter of 2025 and twelve registered a decrease. The largest increases in the ratio were observed in Finland (+4.3 percentage points – pp), Latvia (+2.7 pp), Bulgaria (+2.6 pp), Portugal (+1.8 pp), France (+1.7 pp) and Romania (+1.4 pp). The largest decreases were recorded in Lithuania (-1.4 pp), Ireland (-1.2 pp), Greece and Luxembourg (both -1.1 pp).

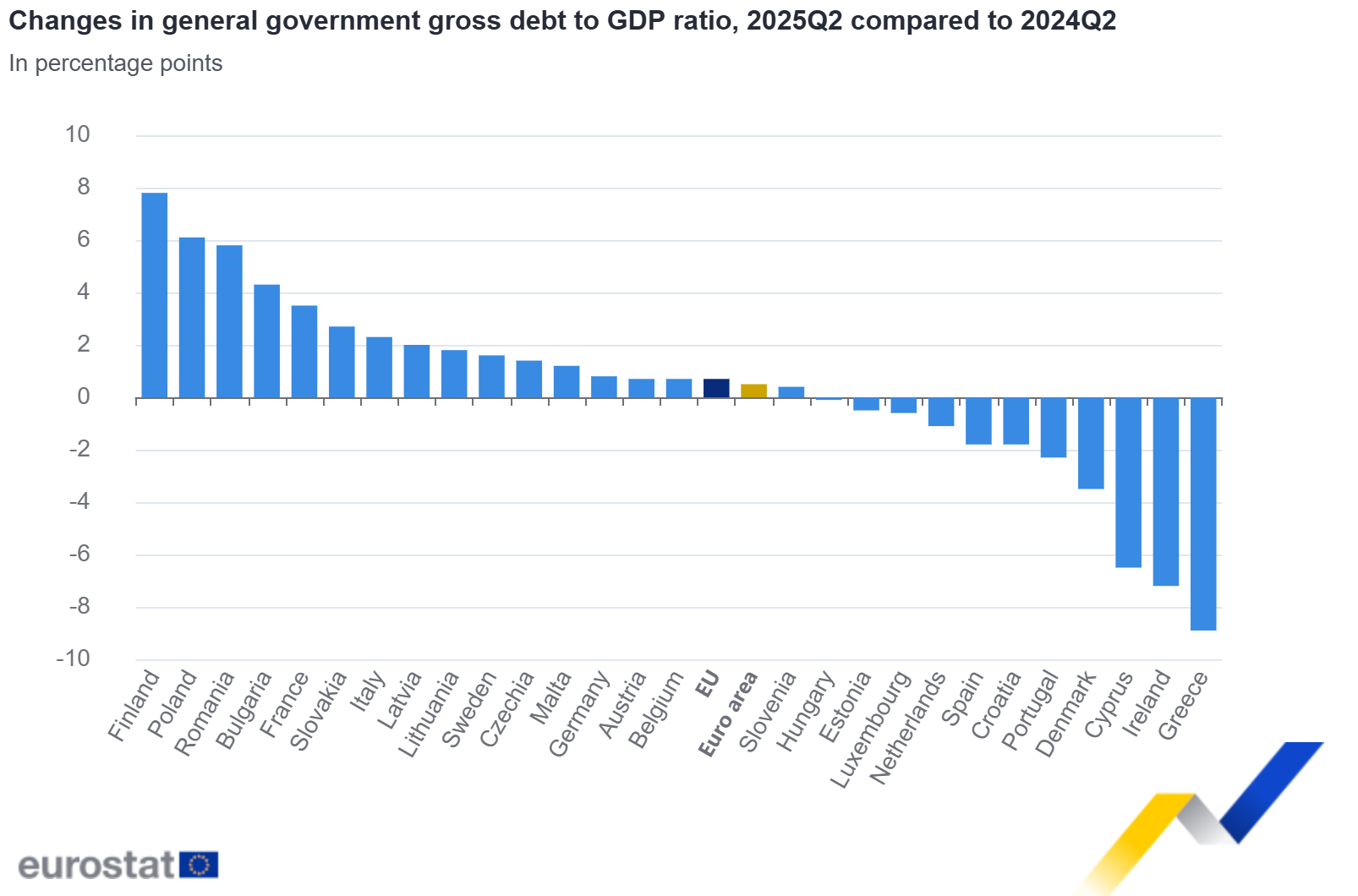

Compared with the second quarter of 2024, sixteen Member States registered an increase in their debt to GDP ratio at the end of the second quarter of 2025 and eleven Member States registered a decrease. The largest increases in the ratio were recorded in Finland (+7.8 pp), Poland (+6.1 pp), Romania (+5.8 pp), Bulgaria (+4.3 pp), France (+3.5 pp), Slovakia (+2.7 pp), Italy (+2.3 pp), and Latvia (+2.0 pp). The largest decreases were observed in Greece (-8.9 pp), Ireland (-7.2 pp), Cyprus (-6.5 pp), Denmark (-3.5 pp) and Portugal (-2.3 pp).

Tables

General government gross debt by Member State

General government gross debt

Millions of national currency

% of GDP

Difference in pp of GDP 2025Q2p compared with:

2024Q2

2025Q1p

2025Q2p

2024Q2

2025Q1p

2025Q2p

2024Q2

2025Q1p

EUR

13 098 702

13 479 829

13 676 633

87.7

87.7

88.2

0.5

0.5

EUR

14 302 996

14 827 895

15 047 308

81.2

81.5

81.9

0.7

0.4

EUR

644 365

663 098

670 665

105.5

106.0

106.2

0.7

0.3

BGN

42 812

48 986

55 518

22.0

23.7

26.3

4.3

2.6

CZK

3 320 798

3 535 088

3 627 011

42.4

43.3

43.8

1.4

0.5

DKK

928 561

888 435

887 742

33.1

29.9

29.7

-3.5

-0.2

EUR

2 635 162

2 701 530

2 733 395

61.6

62.0

62.4

0.8

0.3

EUR

9 199

9 626

9 453

23.6

23.9

23.2

-0.5

-0.7

EUR

215 161

206 218

207 243

40.5

34.5

33.3

-7.2

-1.2

EUR

369 406

366 324

368 609

160.1

152.4

151.2

-8.9

-1.1

EUR

1 625 668

1 667 376

1 690 922

105.2

103.4

103.4

-1.8

0.1

EUR

3 229 743

3 345 421

3 416 302

112.3

114.1

115.8

3.5

1.7

EUR

49 112

50 632

50 932

59.3

58.3

57.5

-1.8

-0.8

EUR

2 954 423

3 033 486

3 071 288

136.0

137.4

138.3

2.3

0.9

EUR

22 858

21 838

21 774

67.7

62.1

61.2

-6.5

-0.9

EUR

18 190

18 493

19 776

46.0

45.3

48.0

2.0

2.7

EUR

28 363

32 405

31 815

37.2

40.4

39.1

1.8

-1.4

EUR

21 710

22 697

21 870

25.7

26.1

25.1

-0.6

-1.1

HUF

59 553 660

62 380 606

63 987 465

76.3

75.4

76.2

-0.1

0.8

EUR

10 107

10 935

11 118

45.7

46.7

46.9

1.2

0.2

EUR

475 352

490 770

491 700

43.8

43.2

42.7

-1.1

-0.5

EUR

394 810

413 150

412 287

81.5

83.1

82.3

0.7

-0.8

PLN

1 824 820

2 123 932

2 186 159

52.0

57.3

58.1

6.1

0.8

EUR

276 828

278 304

287 133

99.1

95.0

96.8

-2.3

1.8

RON

860 398

998 186

1 039 857

51.5

55.9

57.3

5.8

1.4

EUR

45 468

47 090

47 494

69.0

69.5

69.4

0.4

-0.1

EUR

76 918

82 901

83 484

60.2

63.2

62.9

2.7

-0.4

EUR

220 083

233 310

245 883

80.6

84.2

88.4

7.8

4.3

SEK

2 023 332

2 160 151

2 191 556

32.3

33.7

34.0

1.6

0.3

NOK

2 224 421

2 398 197

2 302 363

43.5

45.1

43.2

-0.2

-1.9

General government gross debt by Member State

Components of general government gross debt, in % of GDP

IGL (assets)

Currency and deposits

Debt Securities

Loans

% of GDP

2025Q2p

2025Q2p

2025Q2p

2025Q2p

2.2

74.3

11.7

1.4

2.0

68.5

11.3

1.2

0.3

91.1

14.8

1.3

–

23.1

3.2

0.0

0.7

39.5

3.6

0.0

0.6

26.9

2.1

0.0

0.4

49.5

12.5

1.4

0.1

13.3

9.7

1.2

4.1

22.3

7.0

0.0

3.1

40.3

107.8

0.0

0.3

92.6

10.5

1.7

1.4

103.9

10.5

1.6

0.1

42.6

14.8

0.0

8.7

116.1

13.5

1.9

0.5

35.9

24.8

0.9

1.4

42.8

3.8

0.0

0.1

32.2

6.8

0.0

0.4

21.0

3.7

0.7

0.9

66.7

8.6

0.0

1.8

40.5

4.6

0.9

0.1

36.4

6.2

1.1

0.4

73.1

8.8

1.3

0.3

43.3

14.5

0.0

16.7

56.7

23.4

0.2

1.1

47.1

9.0

0.0

0.3

59.0

10.0

1.6

0.1

56.2

6.6

1.5

0.3

66.8

21.4

1.5

2.3

19.9

11.8

0.0

–

16.3

27.0

–

Notes for users

Methods and definitions

Quarterly data on government debt are collected from the Member States according to European System of Accounts (ESA 2010), see Annex B, ESA 2010 transmission programme, and refer to the Maastricht debt definition, used in the context of the Excessive Deficit Procedure (EDP). Annual EDP data, last notified in October 2025, are the subject of a thorough verification by Eurostat.

The general government gross debt is defined as the consolidated gross debt of the whole general government sector outstanding at the end of the quarter (at face value). General government debt consists of liabilities of general government in the following financial instruments: currency and deposits (AF.2), debt securities (AF.3) and loans (AF.4), as defined in ESA 2010.

The debt to GDP ratio is calculated for each quarter using the sum of quarterly GDP for the four last quarters. Quarterly data on GDP are the most recent ones transmitted by the EU Member States. While quarterly debt figures are consistent with annual debt figures at coinciding publications, differences between annual and quarterly GDP figures occur for Greece.

For the purpose of proper consolidation of general government debt and to provide users with information, Eurostat publishes data on government loans (IGL) to other EU governments. The concepts and definitions are based on ESA 2010 and on the rules relating to the statistics for the EDP. The data covered is the stock of loans related to claims on other EU Member States, including loans made through the European Financial Stability Facility (EFSF). The valuation basis is the stock of loans at face value outstanding at end of each quarter. From the first quarter of 2011 onwards, the intergovernmental lending figures relate mainly to lending to Greece, Ireland and Portugal and include loans made by the EFSF.

For stock data such as general government debt, end of period exchange rates are used in the compilation of the EU aggregates. For flow data, such as GDP, average exchange rates are used. The EU aggregates, denominated in euro, can fluctuate as a result of exchange rate movements between the euro and other EU currencies.

All quarterly government finance statistics data for the first two quarters of 2025 have been labelled provisional. Country-specific metadata are published.

Geographical Information

Euro area (EA20): Belgium, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia, Slovakia and Finland.

European Union (EU27): Belgium, Bulgaria, Czechia, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, the Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland and Sweden.

For more information