Report Overview

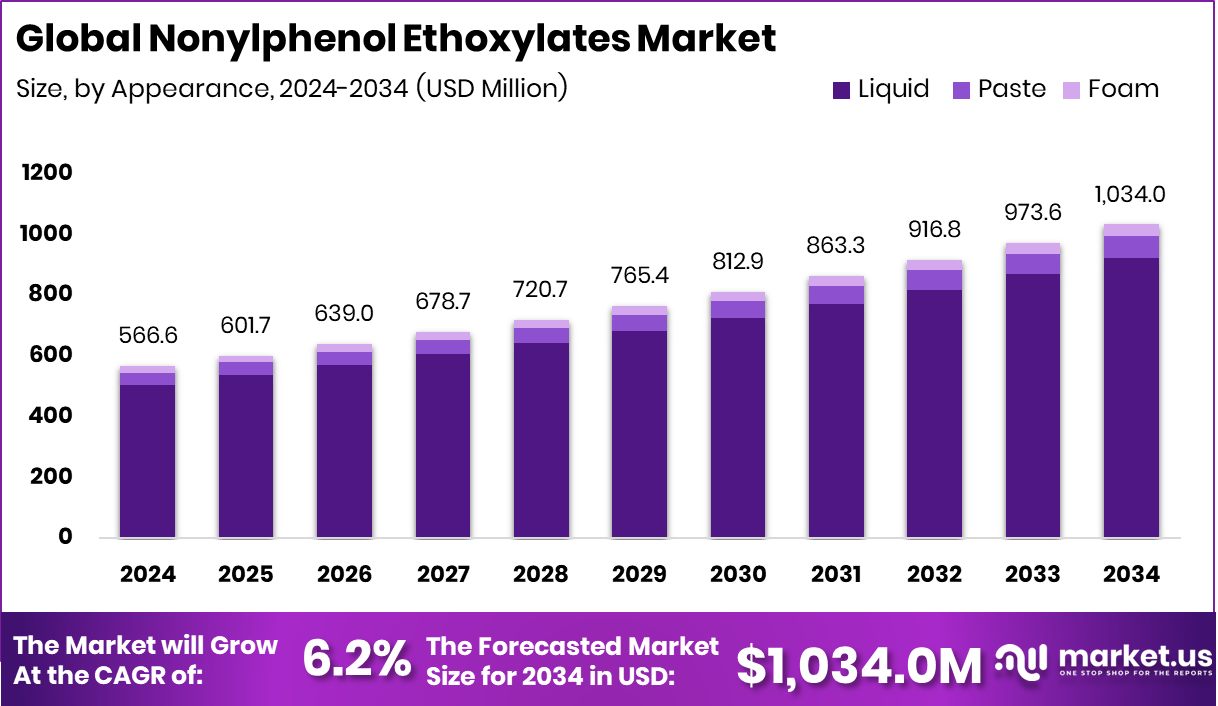

The Global Nonylphenol Ethoxylates Market is expected to be worth around USD 1,034.0 million by 2034, up from USD 566.6 million in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034. Strong industrial cleaning and textile sectors in the Asia Pacific supported this substantial 46.20% share.

NPEs are a class of nonionic surfactants produced by the ethoxylation of nonylphenol. They serve as detergents, emulsifiers, wetting agents, and degreasers, widely used in industry and consumer products such as cleaning agents, paints, textiles, and metal-treatment fluids.

One growth driver is the increasing industrial demand for effective surfactants in applications like textile processing, metal cleaning, coating, gas, and institutional cleaning—areas where NPEs have historically been applied. As manufacturing activities scale and the need for high-performance surfactants rises, NPE usage continues to be relevant in some regions.

Demand is further spurred by the cleaning and hygiene segment: as global awareness of cleanliness (in homes, institutions, and industry) grows, the need for surfactants expands. At the same time, innovations in formulation (e.g., stronger cleaning efficiencies) encourage the adoption of advanced surfactants. To illustrate, Sironix, which turns soybeans into cleaning ingredients, raises $3.5 M to fund manufacturing; D2C home-cleaning brand Koparo raises $1.5 M in pre-series A led by Saama Capital.

An opportunity lies in emerging regions where regulatory restrictions on NPEs are less stringent and industries are still transitioning to alternatives. Companies positioning themselves to supply surfactant solutions or formulate cleaning products can capture market share. Moreover, autonomous-cleaning technology advances also hint at demand for cleaning agents: Avidbots snaps up $70M in funding to roll out autonomous robots for commercial cleaning; Switzerland-based Batmaid raises €23 million to expand its cleaner-booking platform across 21 global cities.

Key Takeaways

- The Global Nonylphenol Ethoxylates Market is expected to be worth around USD 1,034.0 million by 2034, up from USD 566.6 million in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- In 2024, the Nonylphenol Ethoxylates Market was dominated by the liquid form, holding an 89.3% share.

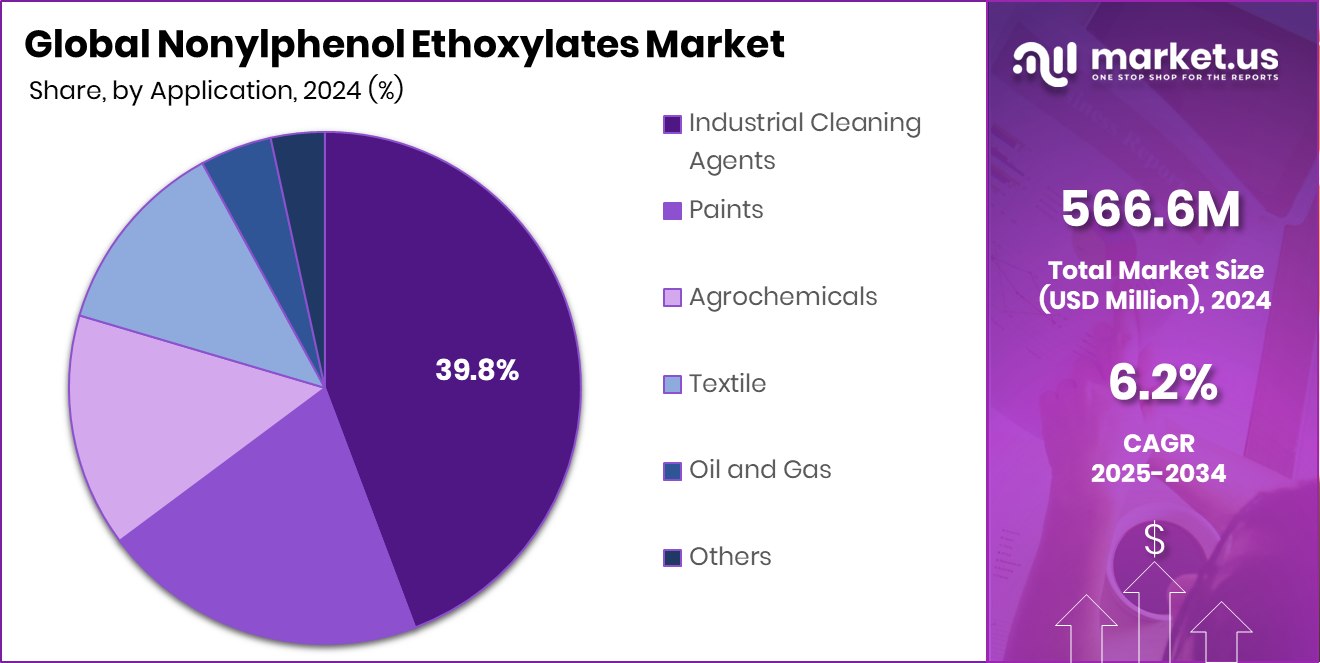

- Industrial Cleaning Agents led the Nonylphenol Ethoxylates Market with a 39.8% share in 2024.

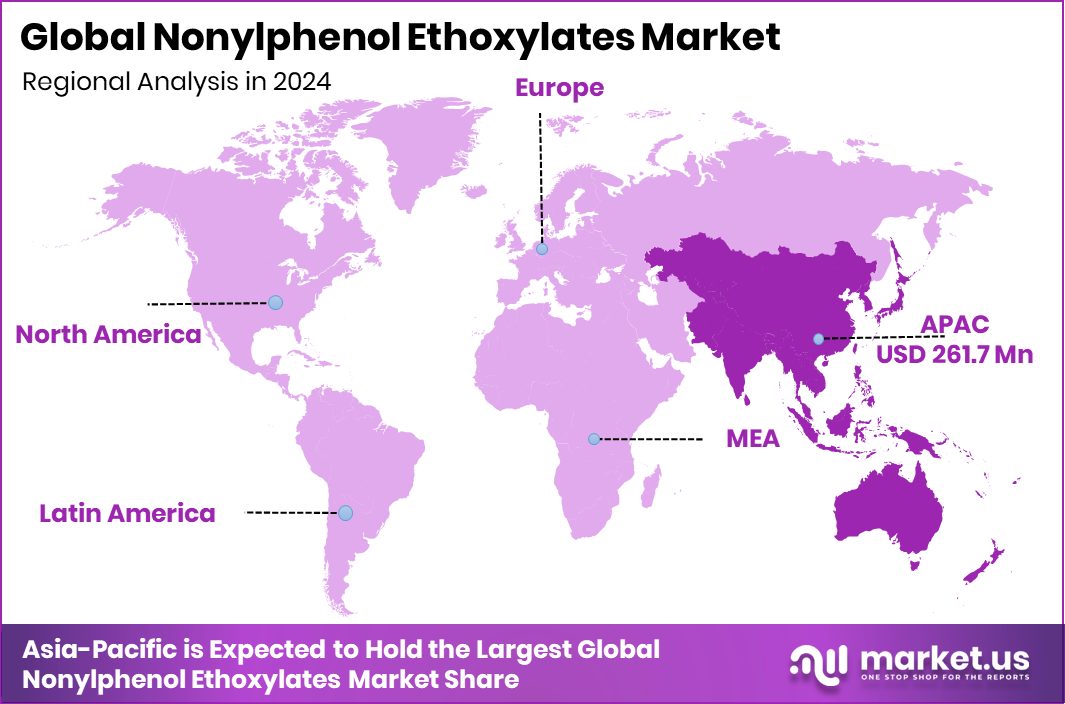

- The Asia Pacific market reached a total value of USD 261.7 million during the year.

By Appearance Analysis

In 2024, liquid form dominated the Nonylphenol Ethoxylates Market with 89.3%.

In 2024, Liquid held a dominant market position in the By Appearance segment of the Nonylphenol Ethoxylates Market, with an 89.3% share. The dominance of the liquid form is attributed to its ease of blending, solubility, and suitability for a wide range of industrial and household formulations.

Liquid NPEs enable efficient dispersion in cleaning and textile applications, improving process uniformity and product quality. Their ability to dissolve quickly in aqueous and non-aqueous systems makes them a preferred choice in detergents, emulsifiers, and wetting agents.

Additionally, their consistent viscosity and stability at varying temperatures support large-scale production needs across manufacturing industries, reinforcing their market leadership in 2024 and maintaining a strong presence in formulations requiring reliable surfactant performance.

By Application Analysis

Industrial cleaning agents accounted for 39.8% of the Nonylphenol Ethoxylates Market.

In 2024, Industrial Cleaning Agents held a dominant market position in the By Application segment of the Nonylphenol Ethoxylates Market, with a 39.8% share. This dominance is largely due to the extensive use of NPE-based surfactants in degreasing, emulsification, and surface-cleaning formulations across industrial facilities. Their excellent wetting and dispersing capabilities enhance cleaning efficiency, especially in heavy-duty environments such as manufacturing plants, metal workshops, and chemical processing units.

Industrial cleaning agents formulated with NPEs offer superior performance in removing oils, waxes, and contaminants, supporting maintenance and operational hygiene standards. The segment’s growth is sustained by the continued demand for cost-effective, high-performing surfactants that ensure consistency and reliability in industrial cleaning processes worldwide.

Key Market Segments

By Appearance

By Application

- Industrial Cleaning Agents

- Paints

- Agrochemicals

- Textile

- Oil and Gas

- Others

Driving Factors

Growing Demand from Home and Industrial Cleaning

A major driving factor for the Nonylphenol Ethoxylates Market is the rising need for effective surfactants in both household and industrial cleaning applications. These ethoxylates enhance cleaning efficiency by breaking down oils, greases, and contaminants, making them vital in detergents and degreasers. Rapid urbanization and growing hygiene awareness have increased the use of cleaning and maintenance products globally. Additionally, the global cleaning and home-care sector continues to attract funding and innovation.

For instance, home décor platform Vaaree raised $4.6 million in a round led by PeerCapital, reflecting the growing investment momentum in lifestyle and home-care industries. Such financial backing indirectly strengthens market opportunities for surfactant suppliers, as demand for premium, efficient, and sustainable cleaning formulations continues to expand across both residential and industrial domains.

Restraining Factors

Strict Environmental Regulations Limit Market Expansion

A major restraining factor for the Nonylphenol Ethoxylates Market is the growing environmental concern over their toxic effects on aquatic ecosystems and potential endocrine-disrupting properties. Many countries have imposed restrictions or phased-down measures on the production and use of NPEs in cleaning and industrial applications.

Such regulations force manufacturers to shift toward safer and more biodegradable surfactant alternatives, which affects overall market growth. Compliance costs and reformulation challenges also add financial pressure on producers.

Meanwhile, broader industrial investments continue to shape the chemical sector’s financial landscape—for instance, JSW promoters plan to pledge a stake to fund the ₹9,000 crore AkzoNobel India deal, showing ongoing capital movements within the industry despite tighter environmental scrutiny on products like NPEs.

Growth Opportunity

Expanding Agrochemical Applications Create New Growth Paths

A key growth opportunity for the Nonylphenol Ethoxylates Market lies in the expanding use of surfactants in the agrochemical industry. These ethoxylates improve the spreading, wetting, and absorption of pesticides, herbicides, and fertilizers, helping farmers achieve better crop protection and nutrient efficiency. As global agriculture moves toward higher productivity and sustainability, demand for effective surfactants in formulation processes continues to rise.

Additionally, investment activities in the agrochemical sector highlight future potential. For instance, Kotak arm invested ₹375 crore in agrochemical company Cropnosys, supporting innovation and production expansion in the field. Such funding reflects the growing importance of advanced surfactants like nonylphenol ethoxylates in enhancing agricultural performance, offering lucrative growth opportunities for manufacturers and formulators globally.

Latest Trends

Shift Toward Safer and Sustainable Alternatives

A key trend shaping the Nonylphenol Ethoxylates Market is the global shift toward safer, eco-friendly surfactant alternatives due to increasing environmental and health awareness. Governments and industries are gradually moving away from formulations containing NPEs because of their persistence and impact on aquatic systems. Companies are investing heavily in research and development to create biodegradable, non-toxic surfactants that meet regulatory standards without compromising performance. The trend also aligns with broader environmental accountability in the chemical sector.

For instance, 3M agreed to pay $10.3 billion to settle lawsuits over ‘forever chemicals’ in drinking water, reflecting rising scrutiny of persistent compounds. Similarly, Arbuda Agrochemicals filed an NSE Emerge IPO for 64 lakh shares to fund a ₹120 crore debt repayment and a new ALP line, showing continued financial activity in safer chemical development.

Regional Analysis

In 2024, the Asia Pacific dominated the Nonylphenol Ethoxylates Market with a 46.20% share.

In 2024, Asia Pacific dominated the Nonylphenol Ethoxylates Market with a 46.20% share, valued at USD 261.7 million. The region’s leadership stems from strong demand in textile processing, industrial cleaning, and manufacturing sectors, particularly across China, India, and Southeast Asia. Rapid industrialization and expanding detergent and coatings industries have boosted the adoption of surfactants, supporting consistent market growth.

North America follows due to well-established chemical processing and cleaning product industries emphasizing high-performance surfactants. Europe maintains steady growth driven by regulatory compliance and innovation in eco-friendly formulations.

Meanwhile, Latin America and the Middle East & Africa regions are gradually expanding, supported by increasing industrial activities and urbanization. Overall, Asia Pacific remains the leading hub, reflecting its robust industrial base and growing end-use demand for efficient surfactant solutions.

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, LyondellBasell Industries, Borealis AG, and Exxon Mobil Corporation remained influential players in the global Nonylphenol Ethoxylates Market through their extensive chemical manufacturing expertise and diverse surfactant portfolios.

LyondellBasell leveraged its advanced polymer and chemical technologies to strengthen production efficiency and sustainability across surfactant intermediates. The company’s focus on performance materials and cleaner production processes supported consistent demand in industrial cleaning and coatings.

Borealis AG continued to emphasize innovation in specialty chemicals, integrating circular and sustainable approaches to align with evolving regulatory frameworks and environmental goals. Its commitment to responsible chemical development positioned it as a preferred partner for industrial customers seeking high-quality ethoxylated products.

Exxon Mobil Corporation sustained its presence by optimizing petrochemical feedstock utilization and expanding downstream applications in detergents and industrial cleaners. The company’s robust global infrastructure and R&D capabilities enabled a stable product supply across multiple regions. Collectively, these companies shaped the 2024 market landscape by focusing on operational excellence, product innovation, and environmental responsibility, ensuring a balanced approach to performance and sustainability within the Nonylphenol Ethoxylates sector.

Top Key Players in the Market

- LyondellBasell Industries

- Borealis AG

- Exxon Mobil Corporation

- India Glycols Limited

- Dow Inc.

- Oxiteno

- Shree Vallabh Chemicals

- Solvay

- Stepan Company

Recent Developments

- In June 2024, Borealis announced the construction of a semi-commercial, recyclate-based polyolefins compounding line in Beringen, Belgium. This new line will use its proprietary Borcycle™ M technology to convert mechanically recycled post-consumer waste into high-quality polypropylene and polyethylene materials

- In May 2024, LyondellBasell acquired a 35% interest in Saudi Arabia-based National Petrochemical Industrial Company (NATPET) from Alujain Corporation for approximately US $500 million. The joint venture produces about 400,000 tons per year of polypropylene and allows LYB to market this output globally.

Report Scope