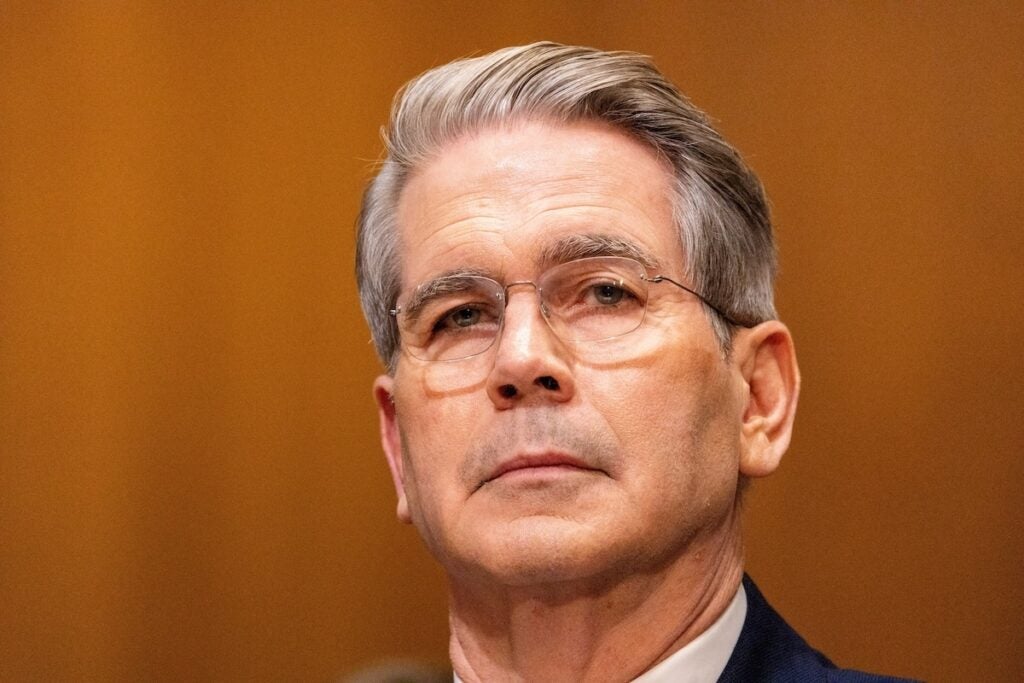

Treasury Secretary Scott Bessent expressed confidence in the trajectory of the U.S. economy, citing key deflationary trends, tax policy changes, and incoming tax refunds for working Americans.

The US Economy ‘Looks Great’

Commenting on the nation’s domestic economic picture, Bessent said that “things look great,” while appearing on Fox Business’ Larry Kudlow.

“I think 2026, 2027 are going to be great years,” he said, pointing to President Donald Trump’s recently enacted tax reforms, with “no tax on tips, no tax on overtime, no tax on Social Security, deductibility of auto loans for American cars,” which Bessent said is helping boost real income.

“You might recall, I am also the IRS commissioner, so I can see what’s going on at the IRS,” he said, adding that during the first quarter of next year, working Americans are going to see “substantial tax refunds,” as a result of the reforms enacted in recent months.

According to Bessent, many workers had kept their withholding levels unchanged, which refers to the deductions made by employers from their employees’ gross wages. This, he said, when combined with tax refunds, will translate into a noticeable jump in disposable income.

Bessent said that the administration has the affordability crisis, which he referred to as the “Biden inflation,” under control, noting that “energy prices are down,” while adding that the Consumer Price Index numbers too should “start coming down,” either the next month, or the month after that.

CPI Report Delayed Amid The Shutdown

September’s Consumer Price Index report has been delayed for over 9 days and is set to be released on Friday morning, with economists saying that it could have an outsized impact on the Federal Reserve’s interest rate decisions next week.

This is largely because CPI data is arriving in isolation, without key companion reports like jobs numbers, wholesale inflation, or retail sales, forcing both the Fed and the markets to lean heavily on inflation alone to guide their decision-making.

Last month, it was reported that 72% of the components in the Consumer Price Index were seeing a price surge that was ahead of the Fed’s 2% inflation target. This marked a significant jump from 55% a year ago and was primarily attributed to Trump’s tariffs.

While crude oil prices were on a decline in recent weeks, the Trump administration’s decision to impose sanctions on two of Russia’s largest oil companies this week has since led the commodity to rally once again.

Crude oil futures currently trade at $61.45 per barrel, up 6.80% over the past week, following the administration’s sanctions on Russian crude.

Photo Courtesy: Maxim Elramsisy On Shutterstock.com

Read More: