The AI bubble question finally got answered by the man who’s helped fuel the frenzy—and his response suggests investors worried about a 2000-style crash might be missing a fundamental shift that’s already reshaping how the world computes.

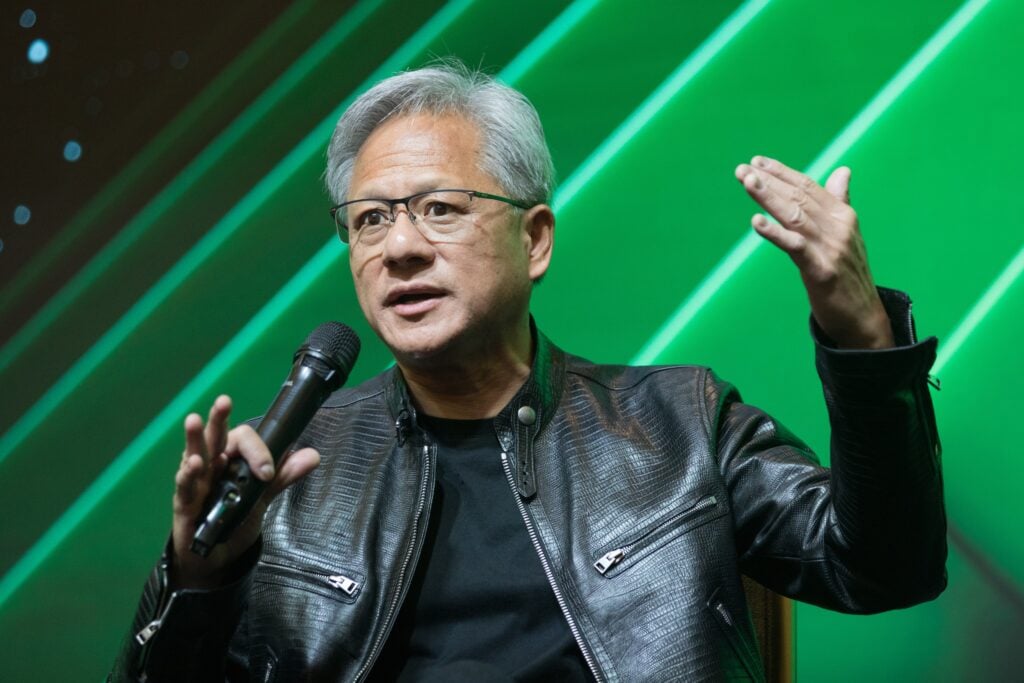

Nvidia Corp. (NASDAQ:NVDA) CEO Jensen Huang addressed speculation about an AI bubble during a panel at the 2025 U.S.-Saudi Investment Forum last week, delivering a three-minute answer that focused less on market valuations and more on irreversible technological transformations already backed by trillions in global capital.

Don’t Miss:

Huang’s argument starts with a hard constraint in computer science: Moore’s Law, the decades-long trend of doubling transistor density every two years, has plateaued. This isn’t a temporary slowdown—it’s a structural problem creating a widening gap between exploding demand for computing power and the industry’s ability to supply it through traditional chips.

“This isn’t speculation—it’s a fundamental challenge driving the need for new computing paradigms,” Huang said.

That gap explains why companies aren’t just experimenting with AI infrastructure—they’re committing massive capital expenditures to it out of necessity, not hype.

Trending: Wall Street’s $12B Real Estate Manager Is Opening Its Doors to Individual Investors — Without the Crowdfunding Middlemen

“The world is voting with real capex,” Huang said, describing how industries are pouring investment into GPUs because traditional CPUs simply can’t handle AI training costs efficiently—a shift that would otherwise require trillions in annual spending.

This isn’t a bet on future technology. It’s a present-day reallocation of computing resources already underway across finance, healthcare, research, and manufacturing.

Huang outlined three distinct computing revolutions that build on each other, with AI sitting atop two already-established layers.

See Also: An EA Co-Founder Shapes This VC Backed Marketplace—Now You Can Invest in Gaming’s Next Big Platform

The first wave is data processing—the foundational engine that powers modern economies. Banks, e-commerce platforms, and credit card networks process vast datasets containing customer information, costing hundreds of billions annually and requiring accelerated computing to function at scale.