IPCC: Summary for Policymakers. In Climate Change 2022: Impacts, Adaptation, and Vulnerability (eds Pörtner, H.-O. et al.) (Cambridge Univ. Press, 2022).

Campiglio, E. & van der Ploeg, F. Macrofinancial risks of the transition to a low-carbon economy. Rev. Environ. Econ. Policy 16, 173–195 (2022).

Carney, M. Breaking the Tragedy of the Horizon—Climate Change and Financial Stability Speech given at Lloyd’s of London (Bank of England, 2015).

Scenarios in Action: A Progress Report on Global Supervisory and Central Bank Climate Scenario Exercises Technical report (Network for Greening the Financial System, 2021).

Stern, N. & Stiglitz, J. E. The Social Cost of Carbon, Risk, Distribution, Market Failures: An Alternative Approach Working Paper 28472 (NBER, 2021).

Hepburn, C., Stern, N. & Stiglitz, J. E. Carbon pricing special issue. Eur. Econ. Rev. 127, 103440 (2020).

Patt, A. & Lilliestam, J. The case against carbon prices. Joule 2, 2494–2498 (2018).

Rosenbloom, D., Markard, J., Geels, F. W. & Fuenfschilling, L. Opinion: why carbon pricing is not sufficient to mitigate climate change—and how “sustainability transition policy” can help. Proc. Natl Acad. Sci. USA 117, 8664–8668 (2020).

Peñasco, C., Anadón, L. D. & Verdolini, E. Systematic review of the outcomes and trade-offs of ten types of decarbonization policy instruments. Nat. Clim. Change 11, 257–265 (2021).

Goulder, L. H. et al. Instrument choice in environmental policy. Rev. Environ. Econ. Policy 2, 152–174 (2008).

Fischer, C. & Newell, R. G. Environmental and technology policies for climate mitigation. J. Environ. Econ. Manag. 55, 142–162 (2008).

Acemoglu, D., Aghion, P., Bursztyn, L. & Hemous, D. The environment and directed technical change. Am. Econ. Rev. 102, 131–66 (2012).

Stiglitz, J. E. Addressing climate change through price and non-price interventions. Eur. Econ. Rev. 119, 594–612 (2019).

Van den Bergh, J. C. J. M. et al. Designing an effective climate-policy mix: accounting for instrument synergy. Clim. Policy 21, 745–764 (2021).

Stechemesser, A. et al. Climate policies that achieved major emission reductions: global evidence from two decades. Science 385, 884–892 (2024).

Stern, N., Stiglitz, J. & Taylor, C. The economics of immense risk, urgent action and radical change: towards new approaches to the economics of climate change. J. Econ. Methodol. 29, 181–216 (2022).

Jacoby, H. D., Chen, Y.-H. H. & Flannery, B. P. Informing transparency in the paris agreement: the role of economic models. Clim. Policy 17, 873–890 (2017).

Lamperti, F., Dosi, G., Napoletano, M., Roventini, A. & Sapio, A. Faraway, so close: coupled climate and economic dynamics in an agent-based integrated assessment model. Ecol. Econ. 150, 315–339 (2018).

Lamperti, F., Bosetti, V., Roventini, A. & Tavoni, M. The public costs of climate-induced financial instability. Nat. Clim. Change 9, 829–833 (2019).

Lamperti, F., Dosi, G., Napoletano, M., Roventini, A. & Sapio, A. Climate change and green transitions in an agent-based integrated assessment model. Technol. Forecast. Soc. Change 153, 119806 (2020).

Dosi, G. & Roventini, A. More is different… and complex! the case for agent-based macroeconomics. J. Evolut. Econ. 29, 1–37 (2019).

Tesfatsion, L. in Handbook of Computational Economics, Vol. 2 (eds Tesfatsion, L. & Judd, K. L.) Ch. 16 (Elsevier, 2006).

Mercure, J.-F. et al. Risk-opportunity analysis for transformative policy design and appraisal. Glob. Environ. Change 70, 102359 (2021).

Stern, N. & Stiglitz, J. E. Climate change and growth. Ind. Corp. Change 32, 277–303 (2023).

Rodrik, D. Green industrial policy. Oxf. Rev. Econ. Policy 30, 469–491 (2014).

Lamperti, F., Mazzucato, M., Roventini, A. & Semieniuk, G. The green transition: public policy, finance, and the role of the state. Q. J. Econ. Res. 88, 73–88 (2019).

IPCC: Summary for Policymakers. In Climate Change 2022: Mitigation of Climate Change (eds Shukla, P. R. et al.) (Cambridge Univ. Press, 2023).

Climate Scenarios for Central Banks and Supervisors—Phase IV Technical report (Network for Greening the Financial System, 2023).

Riahi, K. et al. The shared socioeconomic pathways and their energy, land use, and greenhouse gas emissions implications: an overview. Glob. Environ. Change 42, 153–168 (2017).

Golosov, M., Hassler, J., Krusell, P. & Tsyvinski, A. Optimal taxes on fossil fuel in general equilibrium. Econometrica 82, 41–88 (2014).

Nordhaus, W. D. Revisiting the social cost of carbon. Proc. Natl Acad. Sci. USA 114, 1518–1523 (2017).

Ackerman, F. & Heinzerling, L. Priceless. On Knowing the Price of Everything and the Value of Nothing (New Press, 2004).

Kanzig, D. R. The unequal economic consequences of carbon pricing. Preprint at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3786030 (2021).

Metcalf, G. E. & Stock, J. H. Measuring the macroeconomic impact of carbon taxes. AEA Pap. Proc. 110, 101–106 (2020).

Burke, M., Hsiang, S. M. & Miguel, E. Global non-linear effect of temperature on economic production. Nature 527, 235–239 (2015).

Way, R., Ives, M. C., Mealy, P. & Farmer, J. D. Empirically grounded technology forecasts and the energy transition. Joule 6, 2057–2082 (2022).

Dosi, G. Sources, procedures, and microeconomic effects of innovation. J. Econ. Lit. 26, 1120–1171 (1988).

Dosi, G. & Nelson, R. R. Technical change and industrial dynamics as evolutionary processes. Handb. Econ. Innov. 1, 51–127 (2010).

Nordhaus, W. D. An optimal transition path for controlling greenhouse gases. Science 258, 1315–1319 (1992).

Timilsina, G. R. Carbon taxes. J. Econ. Lit. 60, 1456–1502 (2022).

Cimoli, M., Dosi, G. & Stiglitz, J. E. Industrial Policy and Development: The Political Economy of Capabilities Accumulation (Oxford Univ. Press, 2009).

Soete, L. & Freeman, C. The Economics of Industrial Innovation (Routledge, 2012).

Gross, D. P. & Sampat, B. N. America, jump-started: World War II R&D and the takeoff of the US innovation system. Am. Econ. Rev. 113, 3323–3356 (2023).

Juhász, R., Lane, N. J. & Rodrik, D. The New Economics of Industrial Policy Technical report (NBER, 2023).

Mission Possible: Reaching Net-Zero Carbon Emissions from Harder-to-abate Sectors by Mid-Century Technical report (Energy Transitions Commission, 2018).

Achieving Net Zero Heavy Industry Sectors in G7 Members Technical report (International Energy Agency, 2022).

Hausfather, Z. & Peters, G. P. Emissions—the ‘business as usual’ story is misleading. Nature 577, 618–620 (2020).

Mercure, J.-F., Pollitt, H., Bassi, A. M., Viñuales, J. E. & Edwards, N. R. Modelling complex systems of heterogeneous agents to better design sustainability transitions policy. Glob. Environ. Change 37, 102–115 (2016).

Energy Technology Perspectives 2023 Technical report (International Energy Agency, 2023).

Monasterolo, I., Roventini, A. & Foxon, T. J. Uncertainty of climate policies and implications for economics and finance: an evolutionary economics approach. Ecol. Econ. 163, 177–182 (2019).

Schmidt, T. S., Schneider, M., Rogge, K. S., Schuetz, M. J. A. & Hoffmann, V. H. The effects of climate policy on the rate and direction of innovation: a survey of the EU ETS and the electricity sector. Environ. Innov. Soc. Transit. 2, 23–48 (2012).

Mazzucato, M. & Semieniuk, G. Financing renewable energy: who is financing what and why it matters. Technol. Forecast. Soc. Change 127, 8–22 (2018).

Mercure, J.-F. et al. Environmental impact assessment for climate change policy with the simulation-based integrated assessment model E3ME-FTT-GENIE. Energy Strat. Rev. 20, 195–208 (2018).

Vogt-Schilb, A., Meunier, G. & Hallegatte, S. When starting with the most expensive option makes sense: optimal timing, cost and sectoral allocation of abatement investment. J. Environ. Econ. Manag. 88, 210–233 (2018).

Stokes, L. C. Short Circuiting Policy: Interest Groups and the Battle Over Clean Energy and Climate Policy in the American States (Oxford Univ. Press, 2020).

Lackner, T., Fierro, L. E. & Mellacher, P. Opinion dynamics meet agent-based climate economics: an integrated analysis of carbon taxation. J. Econ. Behav. Organ. 229, 106816 (2025).

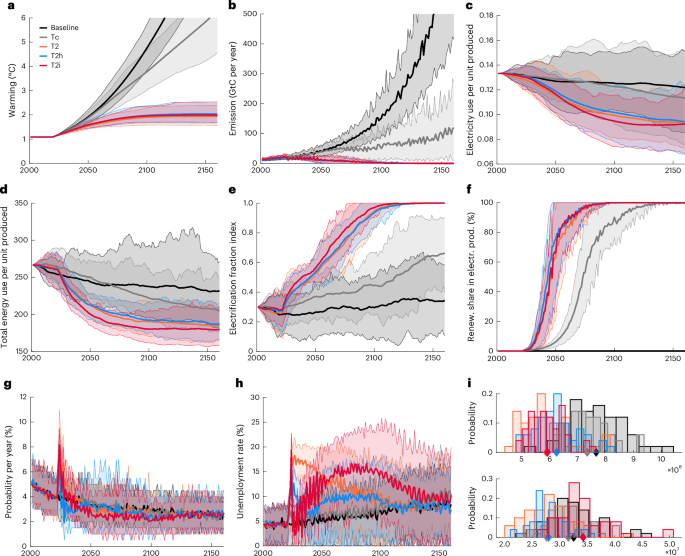

Reissl, S., Fierro, L. E., Lamperti, F. & Roventini, A. The DSK stock-flow consistent agent-based integrated assessment model. Ecol. Econ. 236, 108641 (2025).

Dosi, G., Fagiolo, G., Napoletano, M., Roventini, A. & Treibich, T. Fiscal and monetary policies in complex evolving economies. J. Econ. Dyn. Control 52, 166–189 (2015).

Balint, T. et al. Complexity and the economics of climate change: a survey and a look forward. Ecol. Econ. 138, 252–265 (2017).

Dawid, H. & Gatti, D. D. in Handbook of Computational Economics Vol. 4 (eds Hommes, C. & LeBaron, B.) Ch. 2 (Elsevier, 2018).

Farmer, J. D. & Foley, D. The economy needs agent-based modelling. Nature 460, 685 (2009).

Martinoli, M., Moneta, A. & Pallante, G. Calibration and validation of macroeconomic simulation models by statistical causal search. J. Econ. Behav. Organ. 228, 106786 (2024).

Fagiolo, G., Guerini, M., Lamperti, F., Moneta, A. & Roventini, A. in Computer Simulation Validation (eds Beisbart, C. & Saam, N. J.) Ch. 31 (Springer, 2019).

Manufacturing Energy Consumption Survey (US Energy Information Administration, 2018).

Dosi, G., Fagiolo, G. & Roventini, A. Schumpeter meeting Keynes: a policy-friendly model of endogenous growth and business cycles. J. Econ. Dyn. Control 34, 1748–1767 (2010).

Nelson, R. & Winter, S. An Evolutionary Theory of Economic Change (Harvard Univ. Press, 1982).

Lamperti, F., Napoletano, M. & Roventini, A. Green transitions and the prevention of environmental disasters: market-based vs. command-and-control policies. Macroecon. Dyn. 24, 1861–1880 (2020).

Gunningham, N. Enforcing environmental regulation. J. Environ. Law 23, 169–201 (2011).

Cozzi, L., Frankl, P., Wanner, B., Bahar, H. & Spencer, T. Tripling Renewable Power Capacity by 2030 Is Vital to Keep the 1.5°C Goal Within Reach Technical report (International Energy Agency, 2023).