As the 2025 fiscal year opened, the Ghana Cedi looked like the usual culprit that would chop off a significant part of its value at the end of the year. That is the norm for years, and that is what analysts and many research institutions expected: a cedi that would definitely bow to other major trading currencies.

Analysts and many research institutions sharpened their pencils, ran their models, and forecasts began to roll out with grim confidence. They were like prophets prophesying into the lives of the cedi, but based on its past history.

What Fitch Solutions Saw

Fitch Solutions, the US-based firm, in the “predictions realm,” saw the cedi limping into January 1, 2026, at GH¢15.50 to the dollar. Even this rate was a magnanimous prediction because the firm noted that the GH¢15.50 rate would be a result of good management by the Bank of Ghana.

They foresaw that the rising gold prices would provide very good grounds for the cedi to crossover at their rate of prediction.

The “Bleaker” Databank Research Forecast

The models of Databank Research, the “future” of the cedi was very dim. The research institution foresaw a cedi that had been battered and severed at the 2025 crossover night

Databank Research, with a very pessimistic forecast, predicted the local currency to crawl into 2026 at GH¢17.70.

ABSA’s “Cautious” Forecast

ABSA Bank was quite cautious with its prediction for the cedi. The bank settled for somewhere in between at GH¢14.00.

The Close- to-Home Forecast

IC Research respected the currency and ‘cut it some slack’. The institution foresaw a cedi crossing over at around GH¢11.45 to the dollar.

How the Cedi Crossed Over

Fast forward to January 1, 2026, and the cedi has boldly torn up the script of all analysts and research institutions. In other words, the local currency refused to misbehave as expected by analysts.

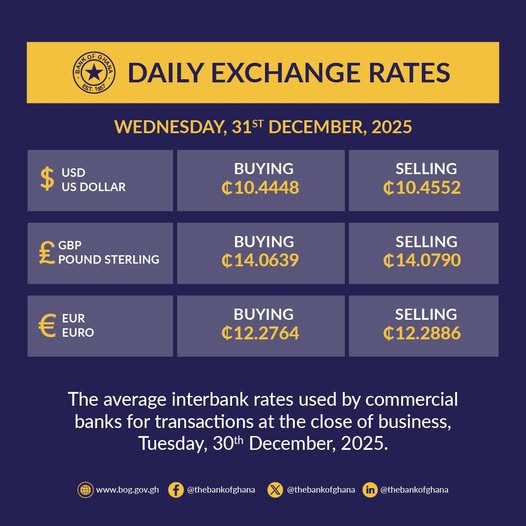

At the Bank of Ghana, the official rate stands at GH¢10.45 to the dollar. At forex bureaus, the average rate is about GH¢12.10. The currency refused to chop off part of its value, but rather gained significantly against major trading currencies as it’s perceived to have appreciated by over 30% in 2025.

For a currency often treated as the weak link in Ghana’s economic chain, the cedi has pulled off something rare. It surprised almost everyone.

The Impact

What makes this moment striking is that the cedi’s performance does not feel like a lucky bounce. This was not a one-week rally or a short-lived calm before another storm. The currency held its ground through a tough year, supported by tighter fiscal discipline, better coordination between fiscal and monetary policy, improved confidence in the broader economy, and stronger inflows that reduced panic demand for dollars.

The Bottomline

The lesson here is not that analysts were careless. Forecasting currencies is notoriously difficult, especially in economies exposed to global shocks. But the cedi’s 2025 story is a reminder that economies can still surprise, and sometimes for the better.

As Ghana steps into 2026, the bigger task is clear. The cedi’s strength must be protected, not celebrated into complacency. Stability will depend on keeping government spending in check, maintaining policy discipline, boosting local production to reduce import pressure, and resisting the old habit of turning to the dollar at the first sign of uncertainty.

If those lessons hold, the cedi may continue to behave less like the troublemaker of old and more like a currency determined to be taken seriously.