Economists say pressure from US-led AI boom reflects global capital shifts — not Korea-specific vulnerabilities — calling for measured policy responses

(Bloomberg)

(Bloomberg)

The Korean won is expected to remain under pressure throughout 2026 as it confronts a new set of forces reshaping global financial hegemony — most notably a US-led artificial intelligence boom that is drawing capital away from the rest of the world, experts said.

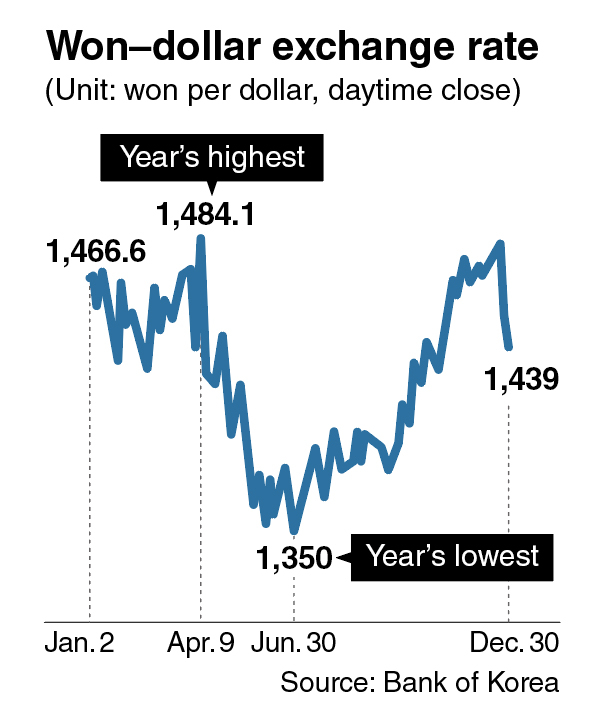

The year 2025 proved challenging for the won. The currency opened the year at 1,466.6 per dollar on Jan. 2, and struggled to hold its value amid political turmoil triggered by former President Yoon Suk Yeol’s failed declaration of martial law in December 2024 and Yoon’s subsequent impeachment.

On April 9, downward pressure on the won intensified with the US administration announcing a series of “reciprocal” tariffs, pushing the currency to weaken to 1,481.1 per dollar.

Throughout the year, the won seemed to regain strength, appreciating to 1,350 per dollar by June 30, supported by a softer dollar and improved risk sentiment.

The momentum, however, proved short-lived. On Dec. 23, the won once again weakened to 1,483.6 per dollar and it continues to hover near the psychologically significant 1,500-per-dollar level, underscoring persistent structural headwinds facing the currency.

The won closed at 1,439 per dollar during Tuesday’s trading session. With this figure, the won’s average exchange rate for the year reached 1,422.16, marking the weakest level ever.

US siphons capital with AI surge

Louis Kuijs, managing director and chief economist for Asia-Pacific at S&P Global Ratings, noted that the most significant shift affecting the won’s valuation this year has been Korean investors’ renewed interest in US assets, echoing views widely expressed in the local market.

“The AI boom, confidence in the US economy and trust in the US financial system have remained, in some cases resumed, and that has led to stronger interest among foreign investors, especially in Asia, in US assets,” Kuijs said.

(The Korea Herald)

(The Korea Herald)

What baffles Kujis, a seasoned international macroeconomist with more than 25 years of experience, is that Korea — a tech powerhouse benefiting from the AI boom through its electronics supply chains — has seen its currency depreciate.

“We are seeing very strong exports from Asia, including Korea, across a wide range of products related to data centers,” he said, adding tech items have posted robust export growth as they remain integral to the electronics supply chain.

While the Korean economy clearly benefits from the AI boom, prompting S&P Global to revise its growth forecast to 2.3 percent from 2.1 percent in December, the won has failed to significantly rebound, Kujis noted.

Even as the Korean equity market thrived this year — typically a catalyst for foreign capital inflows — the won failed to appreciate, likely due to even larger net outflows, he explained.

“It is interesting to see that we have had large net outflows across Northeast Asia despite local equity markets performing well,” he said.

Though retail investors rushing to purchase US stocks have been widely cited as the key driver behind the won’s depreciation, Ben Luk, senior multiasset strategist at State Street Markets, highlighted that institutions have been driving the outflow, saying “real money institutional flows deteriorated further across FX and domestic equities.”

He elaborated that “(Japanese) yen weakness puts pressure on the Korean won to keep competitive rates constant and maintain market share.”

The Japanese yen, often seen as a proxy for the Korean won, has remained weak as Japan’s ultraloose monetary policy keeps yields far below those in the US. As a key currency, the yen’s prolonged weakness has also weighed on the won.

Experts project a modest appreciation of the won next year, but expect the gains to be limited, insufficient to alter the broader market paradigm.

According to a Bloomberg tally, global investment banks forecast the won to climb to 1,424 per dollar in the first quarter of next year, with the median forecast at 1,430.

“We have modest appreciations of the Asian currencies including the won in our forecast,” Kujis said. “But it is a 1-2 percent (appreciation). It is not very big and it will not undo the recent weakening.”

Louis Kuijs (left), managing director and chief economist for Asia-Pacific at S&P Global Ratings, and Ben Luk, a senior multi-asset strategist for State Street Global Markets

Louis Kuijs (left), managing director and chief economist for Asia-Pacific at S&P Global Ratings, and Ben Luk, a senior multi-asset strategist for State Street Global Markets

According to Luk, the won is expected to be the most vulnerable currency among major currencies tracked by the multinational financial firm.

“We currently hold a negative view on the Korean won as we head into 2026. As we look at our December ranking, the Korean won looks the most vulnerable out of the 16 currencies that we track,” he said.

With the won serving as a risk proxy, its appreciation momentum is likely to remain limited in risk-off market conditions.

“A combination of weak inflation and slow growth coupled with renewed dollar momentum puts the risk-proxy Korean won in danger, especially with investors still unwinding their overweight position after months of selling the currency,” Luk said.

‘Not just a Korean story’

In December, local forex authorities mounted an aggressive response to the won’s depreciation, rolling out a series of FX measures alongside a tougher verbal intervention to curb the currency’s decline.

Though acknowledging the need for policy action, Kujis questioned the effectiveness of the measures.

Rather than doubling down on intervention rhetoric, he suggested policymakers emphasize that currency depreciation is “not just a Korean story” and encourage the public to consider “how bad this really is,” noting that such an approach could help better anchor expectations.

Currency depreciation has been a broad trend across Asia, Kujis stressed. Even Taiwan — an economy supported by solid growth and strong exports — has seen a sharp decline in its currency valuation.

The Taiwanese dollar has been moving in a pattern very similar to the Korean won, Kujis noted, adding that Taiwan has not reached a tariff deal with the US — unlike Korea and Japan, which made sizable investment pledges to Washington — suggesting Korea’s $200 billion pledge is not the main driver of the won’s weakness.

“Taiwan runs a current account surplus of roughly 15 percent of gross domestic product, which is unheard of. But the Taiwanese dollar is still weakening because they also see huge outflows on the capital account,” he said.

Kujis highlighted the importance of patience, arguing policymakers should largely avoid overreacting and allow market dynamics to play out.

“Let’s ask ourselves how bad is this. Currency markets go up and down. In recent years, it has gone more down than up, but these things happen. All experts globally would agree that the US dollar is overvalued against economic fundamentals and pretty much all other currencies,” he said.

“Markets can ignore those valuation metrics for a long time but eventually they will recognize and gravitate back toward equilibrium. In the past, we have seen that they eventually do.”

silverstar@heraldcorp.com