Nicole wants to trust her husband, but his risky real estate deals are driving her insane.

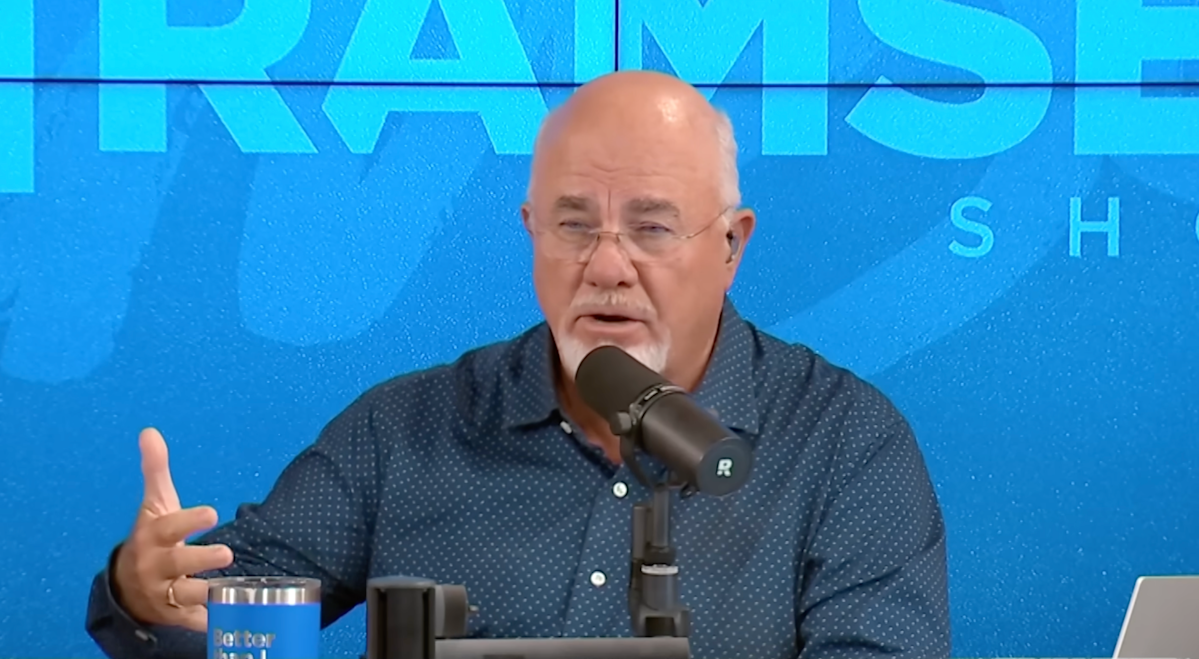

In Nicole from Boston’s call to The Ramsey Show, she told co-hosts Dave Ramsey and Jade Warshaw that her husband keeps “digging us into more and more debt in, like, the hope that we’ll get out of it one day with this risky real estate world stuff (1).”

She said she’s struggling to “maintain respectful marital boundaries” when her “opinion just kind of gets thrown aside because I’m not as risky.”

Ramsey pushed back on her definition of respect, saying it does not mean she has to “turn a blind eye to idiocy.” He added, “You’re not called to respect your husband if every time he gets into a car, he drives it into a ditch.”

When asked for more specifics, Nicole said the issue centers around a “problematic” apartment complex that they owe $6 million on. According to Nicole, the property takes the cash flow from her small business, and now it’s reached a point where they’re maxing out their credit cards and taking out bigger loans.

The “good news,” she said, is that a recent appraisal put the property at just over $6 million. She says they are not personally liable because it is a non-recourse loan.

Ramsey questioned that assumption but told Nicole she needs to draw a hard line with her husband.

“I’m not gonna borrow money on it,” he advised her to say. “That’s off the table.”

Once that boundary is set, and if this truly is a non-recourse loan, Ramsey said the best move is to dump the deal and be done with it.

But resolving the real estate mess is not the end of the story. At the end of the call, Warshaw warned that this goes far beyond a money issue if Nicole’s husband goes ahead and does what he wants to do, even after Nicole raises her concerns.

Warshaw reframed Nicole’s use of the word “risky” as what she sees more often: get-rich-quick schemes.

At its core, it promises something that rarely exists: high rewards with minimal risk. Whether it involves crypto, real estate deals or another investment, these schemes downplay the real possibility of losses while selling the idea of fast gains.

Story Continues

Many appear legitimate, often backed by a handful of success stories, which makes them hard to spot. While not all are outright scams, they almost always rely on deceptive, emotionally driven marketing.

Read More: The average net worth of Americans is a surprising $620,654. But it almost means nothing. Here’s the number that counts (and how to make it skyrocket)

One survey found that 90% of residential real estate investors lost money on at least one property (2). Of those surveyed, 87% said they regretted at least one decision and 45% said their losses were so severe they nearly ruined their finances.

The financial stress tied to high-risk investments often spills into relationships, as Nicole’s call makes clear.

Experian data shows money problems were the leading cause of break-ups for 27% of American couples (3). In a similar finding, one in four Americans said they have issued an ultimatum over a major financial issue at some point, even when it risked ending the relationship.

Given how big a role money plays in a relationship, clear communication and collaboration are essential.

When one partner dominates financial decisions, the quieter partner carries the emotional fallout. Nicole’s call showed how she buried her concerns to avoid conflict, even when she strongly disagreed. Over time, that silence can turn into resentment or emotional withdrawal.

One way to avoid this situation is to set a dollar threshold for purchases or investments that require agreement from both partners. There is no ideal number, but Experian found that 33% of couples set the limit at $500. They also recommend creating a clear budget and scheduling regular financial check-ins to make sure both partners stay on the same page. Using a shared money management app can make it easier.

It’s also critical to make savings a priority, as 93% of couples say they believe setting money aside is important. Prioritizing a three- to six-month emergency fund can take a ton of stress out of the relationship by providing a buffer for life’s uncertainties.

Without transparency and shared decisions, financial harmony is hard to achieve. But when both partners feel safe speaking up, couples are more likely to make smarter choices and protect both their finances and their relationship.

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

We rely only on vetted sources and credible third-party reporting. For details, see our editorial ethics and guidelines.

The Ramsey Show (1); PR Newswire (2); Experian (3).

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.