By the end of Donald Trump’s second term as U.S. President, USD1 is expected to become the leading stablecoin, surpassing USDT and USDC in market capitalization. This prediction was made by Blockstreet co-founder Kyle Clemmer in an interview with Decrypt.

“With the team, support, and overall enthusiasm of the blockchain community, I definitely see USD1 becoming the most widespread ‘stable coin’ in the world by 2028,” he said.

Registered in July, Blockstreet positions itself as a “launchpad” for the coin. The firm is involved in implementing the stablecoin from the Trump family-controlled DeFi platform World Liberty Financial in both cryptocurrency and traditional markets.

Another Blockstreet co-founder, Matthew Morgan, serves as a consultant for World Liberty and holds the position of Chief Investment Officer at ALT5 Sigma Corporation. In August, this financial company announced the creation of a $1.5 billion treasury in governance tokens WLFI of the Trump project. Co-founder Zach Witkoff is the chairman of the firm’s board of directors.

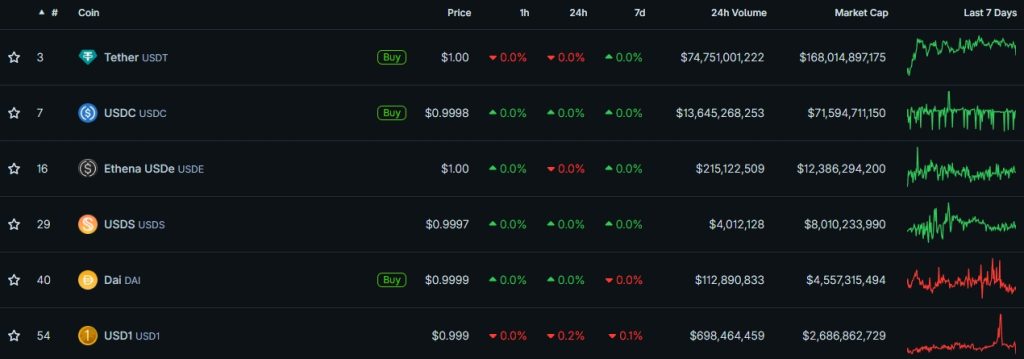

USD1 debuted in April and has already reached a capitalization of approximately $2.7 billion, ranking sixth in the segment.

A significant portion of this figure is backed by a deal with the UAE’s MGX government investment fund, which used the asset for investments in Binance amounting to $2 billion.

“Many people around the world speak incredibly highly of the actions of the current [U.S.] administration. They are very excited about what World Liberty is trying to achieve with USD1. Many ask first: ‘How can we help?’” Clemmer claims.

According to him, there is enormous interest in the stablecoin from “states, sovereign funds, and institutions.”

The current stablecoin market volume is nearly $287 billion. USDT by Tether dominates with a supply of $168 billion, followed by USDC by Circle with $71.5 billion. Together, these two tokens account for approximately 83% of the total.

A July report by Standard Chartered predicts the stablecoin segment will grow to $750 billion by the end of 2026.

JPMorgan considers such estimates overly optimistic. The financial institution’s strategists expect a capitalization of $500 billion by 2028.

Critics of Trump have repeatedly pointed out potential conflicts of interest and raised suspicions of corruption due to his connections with crypto projects like the meme token TRUMP and USD1.

Подписывайтесь на ForkLog в социальных сетях

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!