As the U.S. market navigates a period of adjustment with the S&P 500 and Dow retreating from record highs amid a tech stock slump, investors are keenly observing economic indicators like inflation rates and Federal Reserve policies that continue to shape broader market sentiment. In this dynamic environment, identifying promising small-cap stocks requires an eye for companies that demonstrate resilience and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Value Rating: ★★★★☆☆

Overview: Solesence, Inc. is a science-driven company that develops, manufactures, and sells an integrated family of technologies in the United States with a market cap of $257.96 million.

Operations: Solesence generates revenue primarily from its Specialty Chemicals segment, which amounts to $64.42 million.

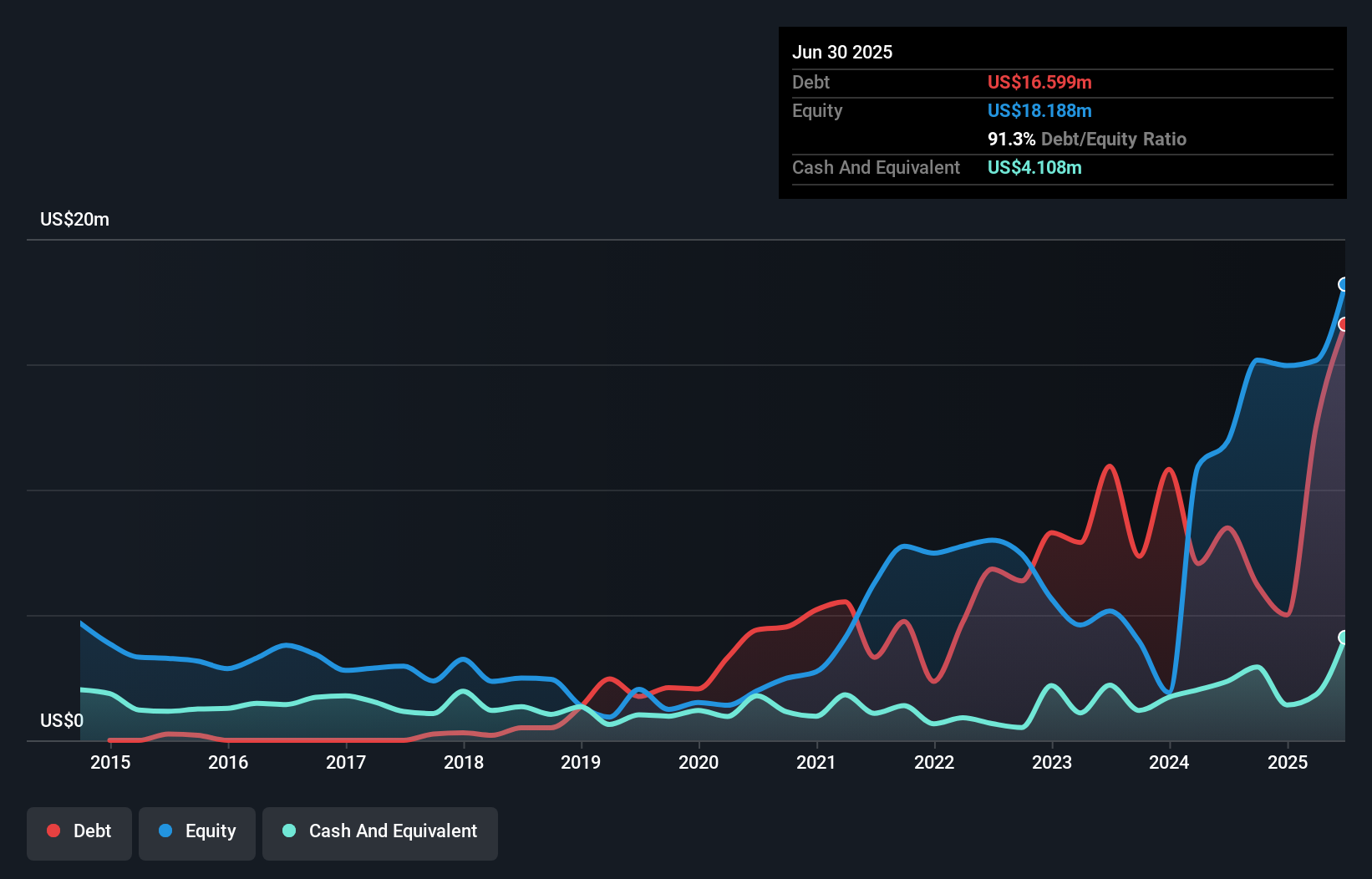

Solesence, a nimble player in the market, has seen its debt to equity ratio improve significantly from 223% to 91.3% over five years, signaling better financial management. Despite a high net debt to equity ratio of 68.7%, the company’s interest payments are comfortably covered by EBIT at 9.8 times coverage. Recent earnings reports show promising growth with Q2 revenue jumping to US$20.36 million from US$13.05 million last year and net income rising to US$2.67 million from US$0.86 million, reflecting robust performance post-rebranding and inclusion in multiple Russell indices this June.

SLSN Debt to Equity as at Sep 2025

SLSN Debt to Equity as at Sep 2025

Simply Wall St Value Rating: ★★★★★☆

Overview: Donegal Group Inc. is an insurance holding company that offers commercial and personal lines of property and casualty coverages, with a market capitalization of $632.84 million.

Operations: Revenue streams for Donegal Group primarily consist of commercial lines at $547.85 million and personal lines at $391.22 million, supplemented by investment income of $50.61 million.

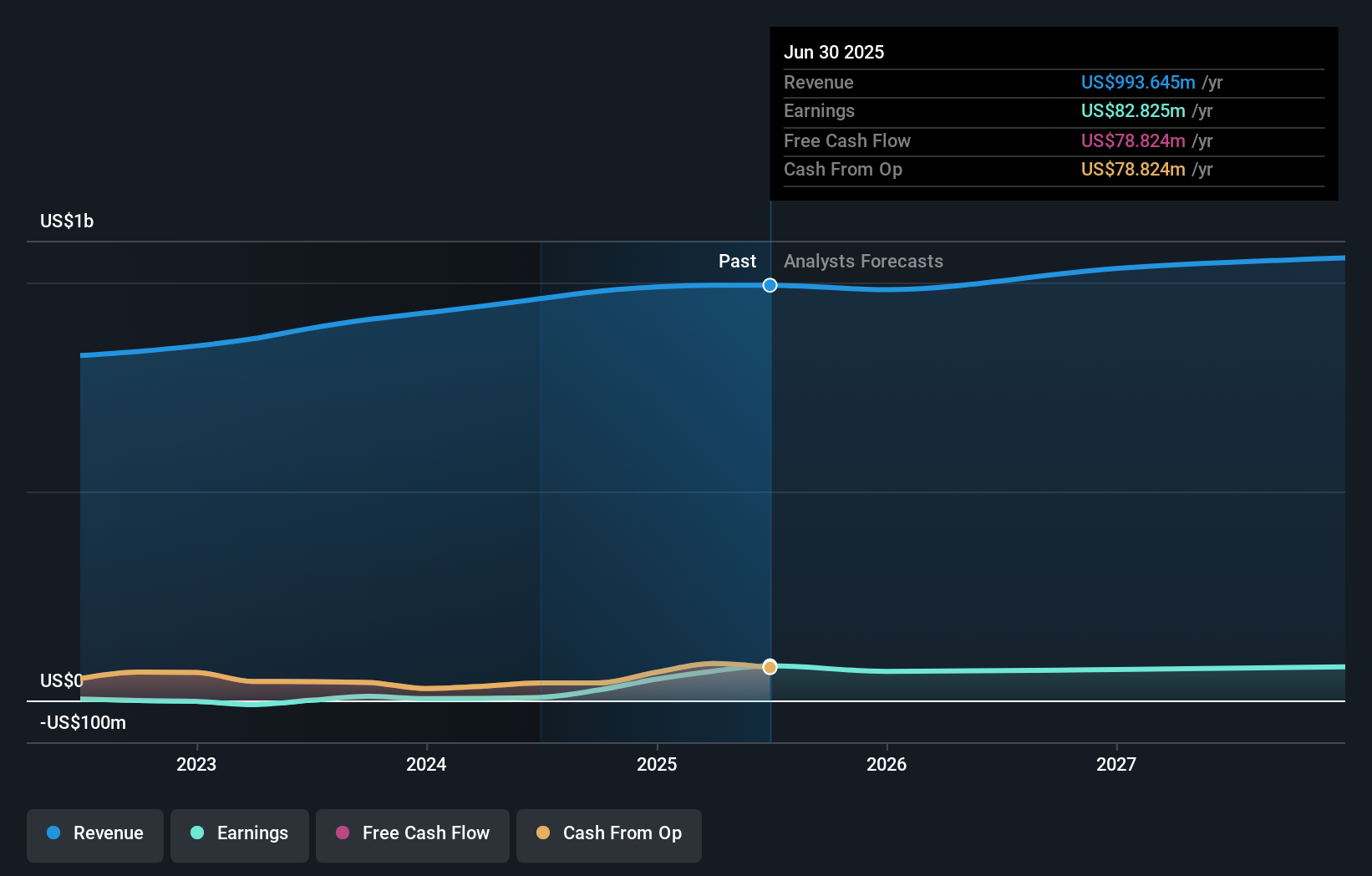

Donegal Group, a niche player in the insurance sector, has demonstrated significant earnings growth of 1029.5% over the past year, outpacing the industry average of 6%. The company’s debt-to-equity ratio has impressively decreased from 18.4% to 5.8% over five years, indicating financial prudence. With a price-to-earnings ratio at 7.9x compared to the US market’s 19.3x, Donegal appears undervalued relative to its peers and industry standards. Despite forecasts suggesting a potential decline in earnings by an average of 1.5% annually over three years, robust interest coverage (78.8x EBIT) and high-quality earnings bolster investor confidence in its stability and value proposition.

DGIC.A Earnings and Revenue Growth as at Sep 2025

DGIC.A Earnings and Revenue Growth as at Sep 2025

Simply Wall St Value Rating: ★★★★★★

Overview: Core Laboratories Inc. offers reservoir description and production enhancement services to the oil and gas industry globally, with a market cap of $539.75 million.

Operations: Core Laboratories generates revenue primarily from its Reservoir Description segment, contributing $342.95 million, and its Production Enhancement segment, which adds $174.83 million. The company’s net profit margin shows a significant aspect of its financial performance worth noting in this context.

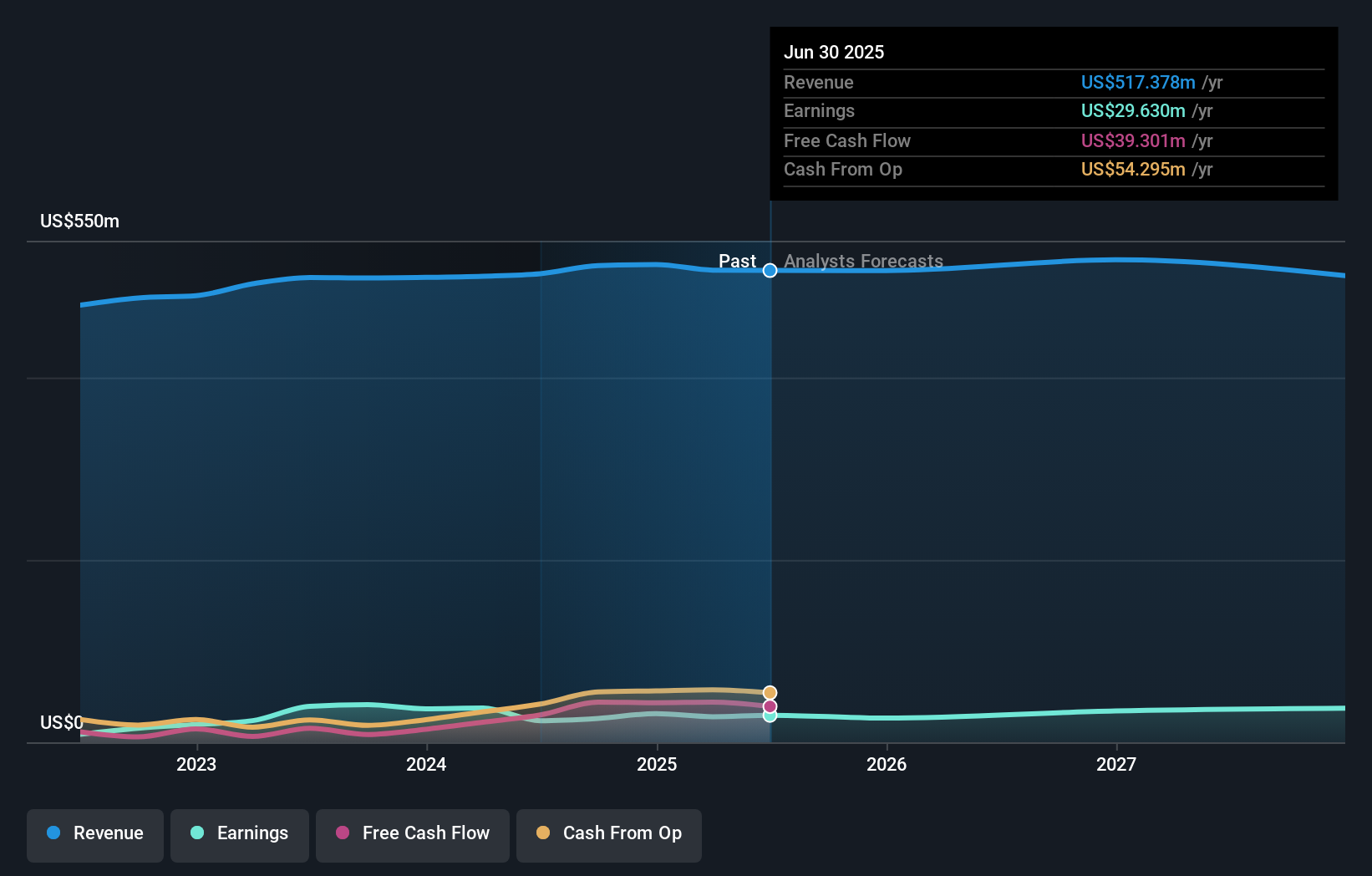

Core Labs, a nimble player in the energy sector, is making waves with its strategic shift towards international markets like the Middle East and Asia Pacific. With earnings growth of 25% last year, it outpaced the broader Energy Services industry. The company’s debt to equity ratio has impressively dropped from 438.8% to 46.6% over five years, reflecting sound financial management. Trading at nearly 64% below estimated fair value suggests potential upside for investors. Recent earnings guidance points to operating margins around 11%, while free cash flow supports share buybacks and future growth initiatives despite challenges in domestic markets.

CLB Earnings and Revenue Growth as at Sep 2025Where To Now?Looking For Alternative Opportunities?

CLB Earnings and Revenue Growth as at Sep 2025Where To Now?Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com