Market Size & Trends

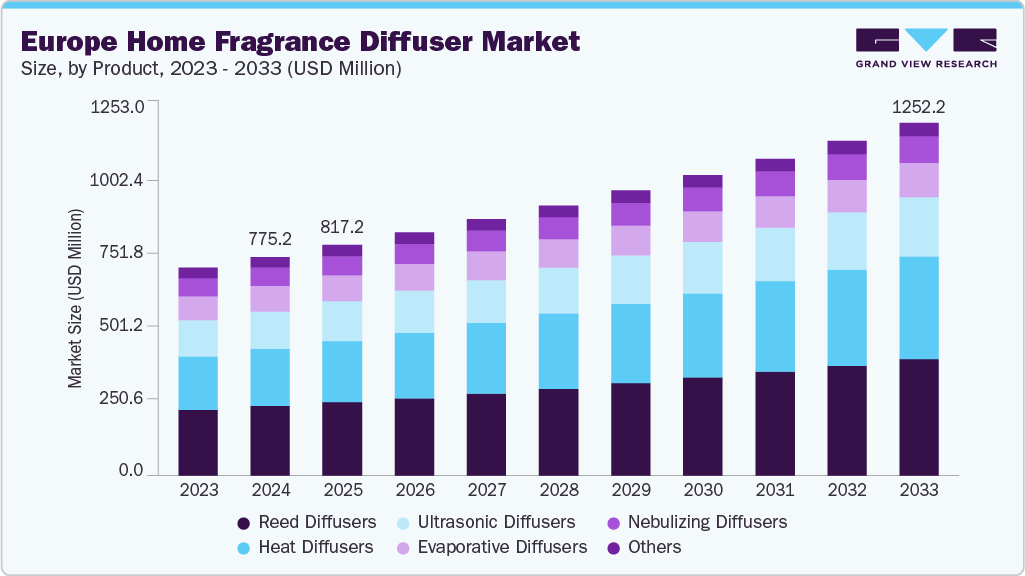

The Europe home fragrance diffuser market size was estimated at USD 775.2 million in 2024 and is projected to reach USD 1252.2 million by 2033, growing at a CAGR of 5.5% from 2025 to 2033. The European home fragrance diffuser industry has been experiencing robust growth due to several interconnected factors that reflect evolving consumer preferences and broader market trends.

One of the central drivers has been heightened awareness of health and wellness among European consumers. In the wake of the COVID-19 pandemic, there is growing recognition of products that contribute positively to emotional well-being, relaxation, and indoor air quality. Home diffusers are increasingly regarded as essential elements for stress relief and mood enhancement, leading both new customers and repeat buyers to integrate them into daily routines, which has fueled substantial market expansion.

Product innovation and technological advancement have further reinforced demand in the category. Manufacturers have responded to competitive pressures and diverse consumer expectations by launching sophisticated diffusers, including ultrasonic, nebulizing, and smart models. These newer offerings often provide enhanced features such as silent operation, adjustable mist output, app-based controls, and attractive designs that blend seamlessly with modern home décor. The infusion of technology not only broadens the consumer base-from value-oriented shoppers to premium segment buyers-but also raises perceived product value, supporting higher price points and brand differentiation.

Expanding omnichannel distribution strategies by leading and emerging brands has helped unlock new avenues for growth. The proliferation of e-commerce platforms, specialty online retailers, and direct-to-consumer models has increased accessibility and convenience for buyers, fostering impulse purchases and efficient product discovery. Despite this digital expansion, traditional retail channels such as department stores, supermarkets, and hypermarkets continue to play a vital role in shaping consumer choice. The synergy between online and offline channels enables brands to maximize reach and optimize inventory while catering to varied customer preferences for buying experiences.

Urbanization and the rise of compact living environments across Europe have notably influenced product requirements and market demand. European cities have seen an increase in apartment living and smaller living spaces, prompting consumers to seek out products that can deliver functional benefits without encroaching on limited space. Diffusers now serve a dual purpose as both aromatic solutions and decorative accents, allowing residents to enhance ambiance, air freshness, and aesthetic appeal-often within a limited footprint. This shift has stimulated interest in space-efficient, visually appealing products tailored to meet the lifestyle needs of urban users.

The pursuit of sustainable and ethically produced goods has become a defining element of consumer behavior in the European home fragrance market. Individuals are conscious of factors such as eco-friendly packaging, natural ingredients, and responsible sourcing, leading to rising demand for diffusers manufactured from biodegradable materials or recyclable components. Brands have responded with transparent labelling practices and expanded lines focused on green formulations, such as organic essential oils and natural reeds. These sustainability initiatives are proving instrumental in fostering brand loyalty and attracting environmentally conscious buyers, thereby fueling additional market growth.

Sophisticated marketing campaigns and strategic brand collaborations have intensified competition and elevated consumer engagement in the sector. Social media influencers play a crucial role in promoting new product launches and driving aspirational appeal among younger consumers. Partnerships between diffuser brands and home décor, wellness, or lifestyle companies further amplify market visibility and credibility. These targeted initiatives generate buzz, encourage consumers to experiment with home fragrance solutions, and ultimately support the sustained expansion of the Europe home fragrance diffuser industry.

Product Insights

The reed home fragrance diffusers segment led the market with the largest revenue share of 42.23% in 2024. Reed diffusers hold the most significant segment share in the European home fragrance market mainly due to their simplicity, elegance, and continuous fragrance delivery without the need for electricity. The mechanism involves fragrance oil in a container with porous reeds that release scent through capillary action, providing a consistent and subtle aroma throughout the day without requiring any maintenance or supervision. This low-maintenance, energy-free operation appeals strongly to European consumers who appreciate products that easily integrate into home décor, supporting the region’s strong tradition of stylish and hospitable living environments. Moreover, reed diffusers align well with wellness and eco-conscious trends as they often use natural essential oils and non-toxic ingredients combined with elegant, reusable packaging. The decorative potential, safety, ease of use, and long-lasting nature make reed diffusers a preferred choice in residential and commercial spaces alike, sustaining their dominant market position.

The European reed diffuser market benefits considerably from a growing demand in premium segments, with luxury brands such as Jo Malone and Nest New York setting quality and design benchmarks that attract affluent consumers. This market segment is further propelled by consumer preferences for natural, toxin-free aromatics and refillable, sustainable packaging options, reflecting increasing environmental awareness across Europe. In addition, e-commerce growth enhances accessibility and choice, enabling consumers to explore a wide variety of fragrances and designs. The combination of tradition, aesthetics, safety, and environmental responsibility helps explain why reed diffusers remain the largest and most established segment within the European home fragrance ecosystem.

The heat diffusers segment is anticipated to grow at the fastest CAGR during the forecast period, driven by their superior scent dispersion capabilities and growing consumer demand for immediate and customizable aromatic experiences. These devices use gentle heat to vaporize fragrance oils, offering faster and more intense scent release compared to passive diffusion methods like reeds. Heat diffusers appeal particularly to urban consumers seeking effective scent solutions for compact living spaces, where quick ambiance enhancement and convenience are highly valued. Their compact, stylish designs also cater well to contemporary home aesthetics. Moreover, heat diffusers often allow adjustable settings and timed control, addressing the desire for on-demand, tailored fragrance experiences aligned with wellness and lifestyle trends.

The appeal of heat diffusers is further amplified by technological enhancements that bolster safety, efficiency, and user control. Many models come equipped with temperature regulation, automatic shut-off features, and the ability to use a wide variety of oil blends, broadening their functional versatility. Some heat diffusers also integrate innovative features, allowing remote or app-based control, aligning with the rise of home automation and wellness technology in Europe. These innovations meet shifting consumer expectations for convenience, personalization, and wellness, driving rapid adoption and positioning heat diffusers as a dynamic growth area within the mature home fragrance market.

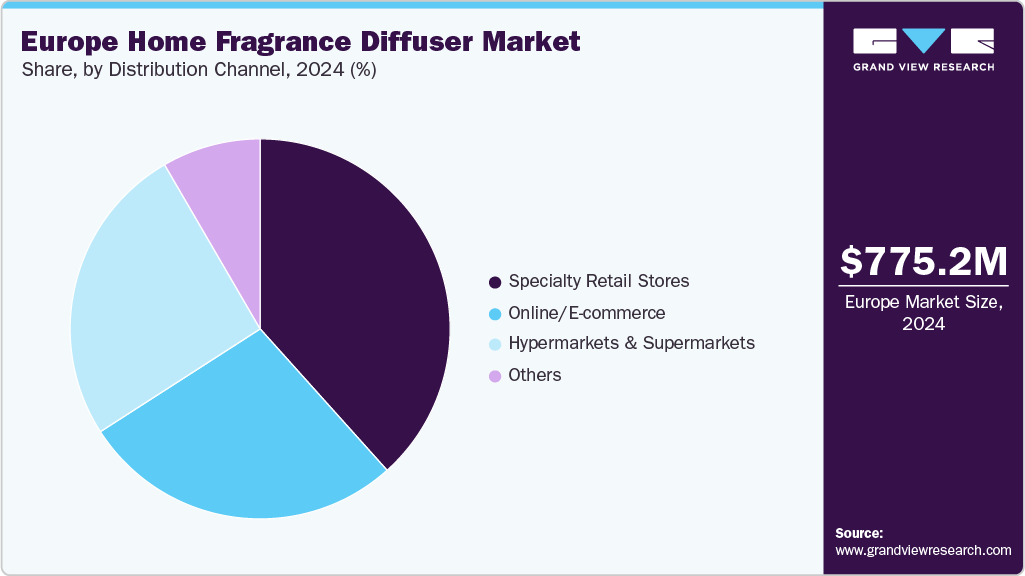

Distribution Channel Insights

The specialty retail stores segment led the market with the largest revenue share of 38.36% in 2024. The segment includes wellness shops, luxury boutiques, home décor stores, and department stores. Specialty retail remains dominant because these stores provide an experiential buying environment where consumers can sample scents, see product designs, and receive personalized recommendations, essential factors for fragrance products. European consumers often prefer purchasing home diffusers in physical stores where they can evaluate quality and fragrance firsthand, which supports specialty retail’s leading position in terms of revenue and volume. This channel is especially prominent in key markets such as Germany, the UK, and France, where established brands and luxury retailers leverage in-store presence to build brand loyalty and elevate premium product positioning.

While e-commerce has witnessed rapid growth and offers convenience and a broader selection, specialty retail still accounts for the largest share in sales due to the nature of home fragrance products that often rely on sensory and emotional engagement. Hypermarkets and supermarkets contribute to overall sales but play a minor role compared to specialty stores and online channels. The coexistence of specialty retail and online enables the market to reach multiple consumer segments. Still, specialty retail’s experiential advantage keeps it as the largest channel in Europe by sales value as of the latest market data.

The online/e-commerce segment is anticipated to grow at the fastest CAGR during the forecast period, driven primarily by consumers’ increasing preference for convenience and wider product variety available through digital platforms. Online retail allows shoppers to browse extensive selections of diffuser types, fragrances, and brands that may not be easily accessible in traditional stores, enabling the discovery of niche or artisanal products alongside mainstream offerings. In addition, online channels provide detailed product descriptions, user reviews, and recommendations, helping consumers make informed decisions independently, which is especially important for fragrance products where personal preference varies greatly.

The rise of digital marketing and social media influencer endorsements has also played a significant role in accelerating online sales growth. Many brands leverage social media campaigns, targeted advertising, and influencer partnerships to engage younger and tech-savvy consumers who prefer shopping via apps and websites. Moreover, subscription services for fragrance refills and promotions exclusive to online shoppers further incentivize repeat purchases and customer loyalty. The COVID-19 pandemic accelerated the adoption of e-commerce habits, which have persisted mainly, reinforcing online retail as the fastest-growing and increasingly crucial channel for home fragrance diffusers in Europe.

Regional Insights

Germany dominated the Europe home fragrance diffuser market with the largest revenue share of 24.86% in 2024. The growth of the home fragrance diffuser market in Germany is driven by rising consumer demand for wellness, comfort, and high-quality natural products that enhance indoor living spaces. With a strong preference for eco-friendly and sustainably sourced fragrances, German consumers are increasingly attracted to diffusers made with organic essential oils and recyclable materials. The expanding penetration of specialty retail stores and e-commerce platforms improves product accessibility and variety, enabling consumers to explore a wide range of offerings. In addition, ongoing urbanization and lifestyle trends favor minimalist, spa-like home environments, which increase the appeal of stylish, functional diffusers that contribute to relaxation and ambiance.

The home fragrance diffuser market in Spain is expected to grow at the fastest CAGR of 5.9% between 2025 and 2030. Spain is the fastest-growing market for home fragrance diffusers in Europe due to several key factors. Increasing disposable incomes and a growing middle class have raised consumer spending power, enabling more purchases of premium lifestyle products like scented diffusers. In addition, shifting consumer preferences toward wellness, self-care, and home ambiance have sparked demand as more Spanish consumers prioritize creating relaxing living environments. Urbanization and smaller living spaces further drive demand for compact, aesthetically appealing diffusers suited to modern homes. The country’s expanding modern retail infrastructure and rapid adoption of e-commerce also enhance product availability and convenience, accelerating market growth. These combined economic, lifestyle, and retail dynamics position Spain as a high-growth market in the home fragrance diffuser segment.

Key Europe Home Fragrance Diffuser Company Insights

The competitive landscape of the Europe home fragrance diffuser industry is characterized by the presence of a mix of established global players, regional specialty brands, and emerging niche producers. Major multinational companies such as Procter & Gamble (P&G), SC Johnson, and Reckitt Benckiser dominate the market with well-known consumer brands, extensive distribution networks, and significant marketing budgets that enable wide product availability and strong brand recognition. These players focus on product innovation, sustainable packaging, and expanding their portfolios to include innovative diffusers and wellness-oriented offerings to capture evolving consumer preferences.

Alongside these giants, there is intense competition from regional and artisanal brands that emphasize natural ingredients, eco-friendly formulations, and unique fragrance blends tailored to local tastes. These niche brands often rely on specialty retail channels and online platforms to reach discerning consumers looking for premium, bespoke products. The entry of more minor players drives product differentiation through innovation in design, technology integration, and sustainable sourcing. Collaborations with lifestyle and wellness brands, as well as influencer marketing, provide additional competitive advantages. Overall, the market is moderately fragmented, with competition focused on balancing scale economies with the growing demand for personalization and sustainability.

Key Europe Home Fragrance Diffuser Companies:

- Nest Fragrances

- Diptyque

- Jo Malone London

- Voluspa

- ScentAir

- Vitruvi

- Cocod’or

- Paddywax

- Muji

- Aera

- Edens Garden

- Scentsy

- Young Living Essential Oils

- Air Wick

- Yankee Candle Company

- Procter & Gamble (P&G)

- Reckitt Benckiser

- S. C. Johnson & Son

- Seda France Inc.

Europe Home Fragrance Diffuser Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 817.2 million

Revenue forecast in 2033

USD1252.2 million

Growth rate

CAGR of 5.5 % from 2025 to 2033

Base year for estimation

2024

Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution, region

Regional scope

Europe

Country scope

Germany; UK; France; Italy; Spain

Key companies profiled

Nest Fragrances; Diptyque; Jo Malone London; Voluspa; ScentAir; Vitruvi; Cocod’or; Paddywax; Muji; Aera; Edens Garden; Scentsy; Young Living Essential Oils; Air Wick; Yankee Candle Company; Procter & Gamble (P&G); Reckitt Benckiser; S. C. Johnson & Son; Seda France Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Home Fragrance Diffuser Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Europe home fragrance diffuser market based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2021 – 2033)

-

Reed Diffusers

-

Ultrasonic Diffusers

-

Nebulizing Diffusers

-

Heat Diffusers

-

Evaporative Diffusers

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 – 2033)

-

Regional Outlook (Revenue, USD Million, 2021 – 2033)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-