1h agoFri 19 Sep 2025 at 12:27amMarket snapshot

- ASX 200: +0.6% to 8,800 points

- Australian dollar: -0.1% to 66.08 US cents

- S&P 500: +0.5% to 6,632 points

- Nasdaq: +0.9% to 22,471 points

- FTSE: +0.2% to 9,228 points

- Eurostoxx: +0.8% to 555 points

- Spot gold: -0.2% to $US3,637/ounce

- Brent crude: +0.1% to $US67.48/barrel

- Iron ore: +0.2% to $US105.45/tonne

- Bitcoin: -0.3% to $US117,280

Prices current around 10:25am AEST

Live updates on the major ASX indices:

Just nowFri 19 Sep 2025 at 1:49am

Record money flows into ETFs

Global X ETFs, which is a financial institution based in Sydney, claims the Australian Exchange Traded Fund (ETF) market grew $10.2 billion over the month to $299.4 billion across 433 products.

It says that’s a 3.5 per cent increase over the month.

“The Australian ETF market has grown 35.9 per cent over the past year, and is running at a five-year compound annual growth rate (CAGR) of 33.5 per cent per annum,” Global X ETF’s latest report noted.

“This growth was driven by $45.8 billion in net inflows over the past year and positive market movements across multiple asset classes.”

18m agoFri 19 Sep 2025 at 1:31am

HSBC seeking pragmatic approach to boosting productivity

HSBC says it’s “hopeful” productivity levels will rise in Australia in coming years.

Chief economist Paul Bloxham wants policymakers’ focus directed to competition policy, housing affordability, and the tax system — all of which, he says, need reform to boost productivity.

Here’s what Mr Bloxham has to say around tax:

“We need to look at our tax system.

“It’s becoming increasingly inefficient.

“That’s been the case over the past 20 or 25 years because we haven’t done any big-scale tax reform since we introduced the GST in the year 2000.

“We have a corporate tax rate and a personal income tax system that are both some of the highest in terms of, if you look across the world, the developed world, in terms of the proportion of income that comes into the system.

“High corporate tax rates discourage business investment.

“High personal income tax rates discourage participation in the labour market and the most efficient national tax we have is the one that we get very little revenue from.

“And that’s the GST.

“It’s a low rate, it’s got a narrow base, so there’s some really obvious things we could do with the tax system to make it more efficient.”

Paul Bloxham believes reforming competition policy, improving housing affordability and making the tax system more efficient, “will encourage businesses to make the change they need to, to innovate and adopt things like AI and invest and so on and that that will ultimately lead to productivity picking up”.

34m agoFri 19 Sep 2025 at 1:15am

Bonds are a calm ocean

I want to draw your attention to two data points.

First, the VIX: 15.7

Second, the MOVE: 71.91

The VIX is a measure of share market volatility and can help you prepare for stock market shifts — especially downward ones.

The Merrill Lynch Option Volatility Estimate, commonly known as the MOVE Index (MOVE), tracks volatility in treasuries or fixed income.

Both are showing unusual levels of calm in financial markets more broadly.

It’s a far cry from the volatility experienced in early April when the Trump administration announced US reciprocal tariffs on its trading partners.

45m agoFri 19 Sep 2025 at 1:05am

It’s official …

DT is now stepping into the blog as pilot.

I’ve taken over the controls.

I can’t promise a smooth and pleasant journey — there may be turbulence — so please keep your seatbelt fastened while seated.

1h agoFri 19 Sep 2025 at 12:31am

ASIC issues DDO stop orders against credit fund

ASIC has made interim stop orders against the 12 Month Term Account and Two Year Account products offered under the La Trobe Australian Credit Fund — a registered managed investment scheme.

ASIC is concerned the target market determination (TMD) for La Trobe’s 12 Month Term Account and Two Year Account products:

- suggest an inappropriate level of portfolio allocation given the risks of the Fund, and

- do not include appropriate distribution conditions.

ASIC says it is “taking this action to protect consumers and retail investors from acquiring products that may not be suitable for their financial objectives, situation or needs”.

For context, the 12 Month Term Account and Two Year Account are invested almost entirely in loans secured by registered first mortgages, with the exception of small cash and term deposit holdings held to meet cash requirements.

These products are not bank deposits.

Under the design and distribution obligations (DDO), ASIC says financial product issuers and distributors must ensure the product’s TMD is clear and appropriately defines the target market, accurately reflects the product’s risks and features and includes appropriate distribution conditions.

1h agoFri 19 Sep 2025 at 12:21amASX jumps in early trade with every sector higher

It’s an optimistic day on the local share market — must be all those traders who woke up to a sunny Sydney morning and thought, “Y’know what, I’m gonna buy.”

Loading

Literally every sector on the ASX 200 is up, with healthcare, utilities, industrials and technology leading the gains.

In all, 165 out of the top 200 companies were trading higher early on.

That’s pushed the ASX 200 index up 0.8% to 8,813 points.

Aside from some fine spring weather, the positive mood stemmed from renewed optimism in the US (if it had ever faded much in the first place).

“Risk appetite returned overnight as markets reassessed the Fed’s stance, with traders taking a more positive view of the FOMC decision and guidance,” NAB’s Rodrigo Catril noted.

“US equities surged to new highs, with the S&P 500, Nasdaq 100, Dow Jones, and Russell 2000 all closing at new highs.

“Tech outperformed, fuelled by a 23% jump in Intel after Nvidia’s $5bn investment and plans for joint chip development.

“Small caps also rallied, and Chinese equities were buoyed by ongoing AI investment and optimism around domestic chip innovation.”

So, basically, the attitude is buy everything — except safe haven gold, which has been on the nose a bit overnight.

1h agoFri 19 Sep 2025 at 12:06am

Dirty nickel

Batterys why is no one talking about DIRTY NICKEL that is mined and processed for EV BATTERYS and other batterys there was a story done on this not long ago and when Chris Bowen was asked about this by reporters he didnt want to know about it or comment recently when in Indonesia at an energy and renewable conference – makes you think

– chrisso

Hi Chrisso, colleagues across the ABC have done some very good work looking at the pollution from the nickel industry, notably in Indonesia.

This work by Erwin Renaldi and Hellena Souisa is both stunning and disturbing.

2h agoThu 18 Sep 2025 at 11:37pmGovernment seeking new chair and deputy for key financial regulators

The Treasurer Jim Chalmers has put out a couple of job ads via press release.

The chair of the Australian Securities and Investments Commission (ASIC), Joe Longo, has indicated he will not seek another term once his current one ends in May.

“It has been an immense privilege to serve as chair of ASIC and to have been given the opportunity to rebuild and renew the agency,” Mr Longo said in a statement.

“In June this year, I informed the secretary to the Treasury I would not be seeking an extension to my term and I formalised this advice to the Treasurer earlier this month.”

Likewise, the deputy chair of the Australian Prudential Regulation Authority (APRA) Margaret Cole is not seeking an extension to her term past June 2026.

Mr Chalmers says Treasury has already commenced the usual search process to find their replacements.

2h agoThu 18 Sep 2025 at 11:19pmVIDEO: DECARBONISATION ACCELERATION

Australia’s 2035 climate target has been slammed by some including Vanuatu’s Climate Change Minister as being too low.

Business groups have a different view:

Loading…3h agoThu 18 Sep 2025 at 10:28pmAtlassian’s $1.5 billion AI deal

Nasdaq-listed Atlassian is buying developer-intelligence platform DX for roughly $US1 billion ($1.5 billion) in cash and restricted stock, aiming to arm customers with sharper insight into AI investments.

Companies are lifting AI budgets to boost innovation, streamline operations and outpace rivals.

“For developers this means less friction, more flow. For engineering leaders it means more clarity and confidence across the software development lifecycle. For companies, it ensures investments are being made in the right place to win,” Atlassian said.

“Most of DX’s enterprise customers, like Pfizer, Pinterest, and Xero, also use Atlassian to plan and track their work. By joining forces, Atlassian + DX will help hundreds of thousands of software teams amplify their impact.”

3h agoThu 18 Sep 2025 at 10:09pmFirst Guardian and Shield superannuation disasters expose deep flaws in Australia’s $4.3 trillion retirement system

ABC business reporter Nassim Khadem has been investigating failed super funds First Guardian and Shield.

Her latest report lays bare the human toll — with about 12,000 Australians losing more than $1 billion — and exposes deep flaws in the regulation of Australia’s $4.3 trillion superannuation sector.

Read her investigation into what went wrong:

4h agoThu 18 Sep 2025 at 9:45pmMore on Nvidia’s $US5b investment in Intel

Nvidia will invest $US5 billion for roughly 4% of Intel, sending Intel shares up about 23% and handing the once-dominant chipmaker fresh credibility — weeks after Washington arranged a 10% federal stake.

The pair will co-develop multiple generations of PC and data-centre chips.

Nvidia is paying $US23.28 a share, below Intel’s prior close but above the US government’s entry price.

The US government has also taken a 10% stake in Intel.

Nvidia’s Jensen Huang says the administration wasn’t involved in its deal with Intel but would be supportive.

– with reporting from Reuters

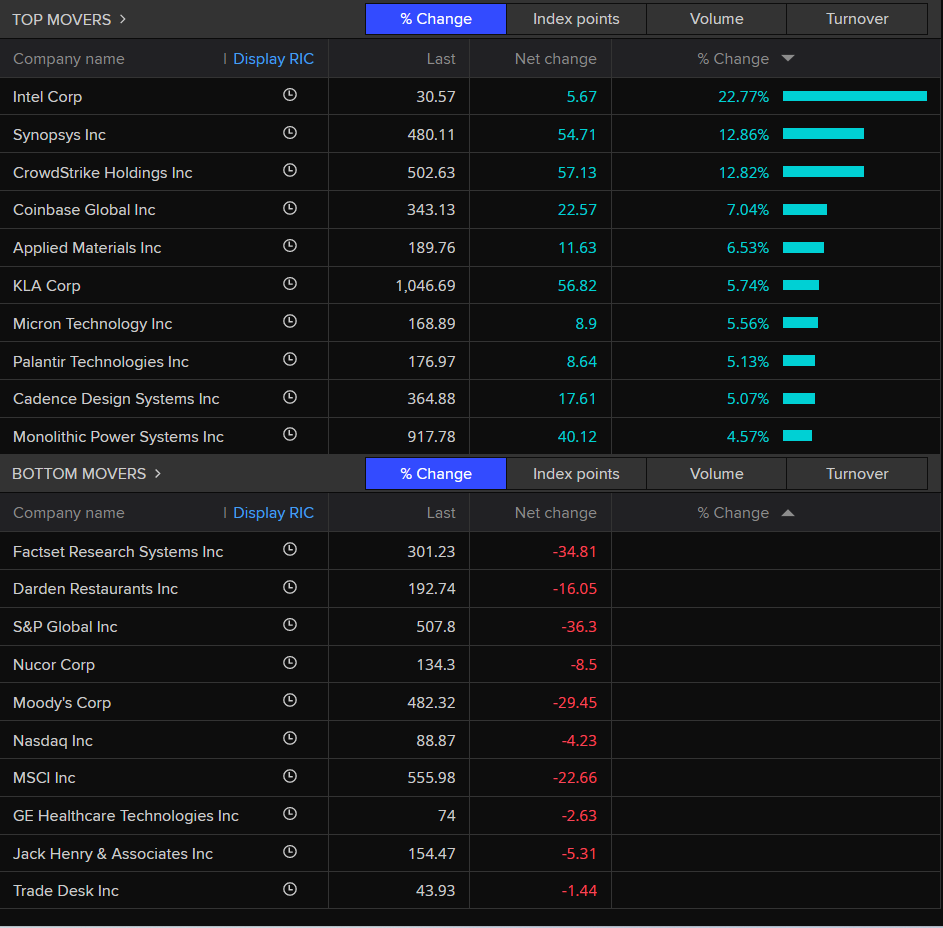

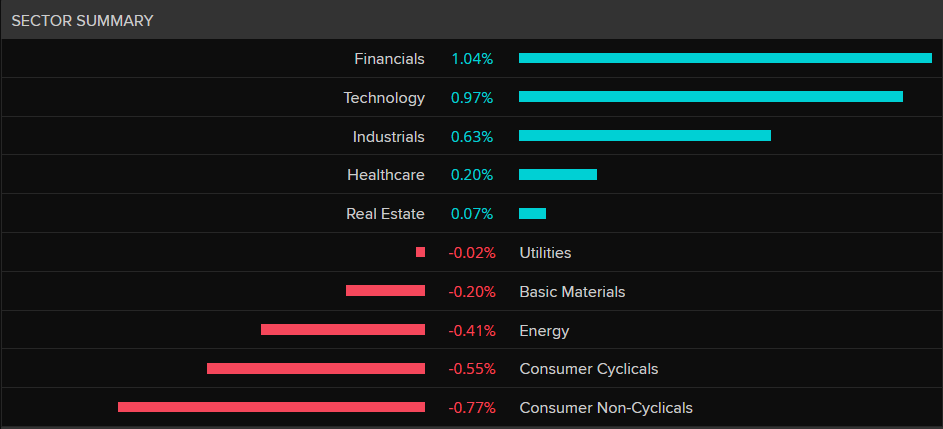

4h agoThu 18 Sep 2025 at 9:17pmIntel helps push S&P 500 to record highs

Here’s a look at how the S&P 500 finished up overnight.

Wall Street’s benchmark index hit record highs on Thursday (US time).

Here’s a look at the last five years on the S&P 500.

5 year S&P 500 (LSEG)

5 year S&P 500 (LSEG)

The index gained almost 0.5% to finish at 6,631 points.

Intel was the top stock after rival Nvidia announced it would invest $US5 billion in the struggling tech company. More on that shortly.

TOP AND BOTTOM MOVERS (LSEG)

TOP AND BOTTOM MOVERS (LSEG)

Sector-wise, the Federal Reserve’s rate cut saw banks finish on top.

S&P 500 sectors (LSEG)

S&P 500 sectors (LSEG)

The Australian share market is also set to gain when trading kicks off at 10am AEST.

4h agoThu 18 Sep 2025 at 8:54pmWall Street up on rate cut and tech stocks

Wall Street notched another set of record closes on Thursday, a day after the US Federal Reserve trimmed rates by 25 basis points and signalled more cuts are on the table as the jobs market cools.

Chip stocks led the charge.

Intel rocketed 22.8% — its biggest one-day gain since October 1987 — after Nvidia said it would invest $US5 billion in the struggling chipmaker. Nvidia rebounded 3.5%, clawing back losses linked to reports Chinese tech firms could curb purchases of its chips.

Those moves lifted the Philadelphia Semiconductor Index 3.6%, helped the tech-heavy Nasdaq higher and pushed the S&P 500’s tech sector up 1.36%. Seven of the S&P’s 11 sectors advanced, while consumer staples and consumer discretionary lagged.

Small caps joined the party: the Russell 2000 closed at a record 2,466, with investors betting a lower-rate environment will give domestically focused companies a leg-up.

The Dow Jones rose 0.27% to 46,142 points, the S&P 500 gained half a per cent to 6,631 points. The tech-heavy Nasdaq Composite finished the day almost 1% higher at 22,470 points.

Traders are now pricing roughly 44.2 basis points of additional cuts by the end of 2025, according to LSEG data — a backdrop that keeps the recent AI-driven rally well supported.

– with reporting from Reuters

5h agoThu 18 Sep 2025 at 8:25pmMarket snapshot

- ASX futures: +0.5% to 8,838 points

- Australian dollar: -0.6% to 66.12 US cents

- Wall Street: S&P 500: +0.5% to 6,631 points

- Dow Jones: +0.3% to 46,142 points

- Nasdaq: +0.9% to 22,470 points

- FTSE: +0.2% to 9,228 points

- Eurostoxx: +0.8% to 555 points

- DAX: +1.3% to 23,674 points

- Spot gold: -1% to $US3,678/ounce

- Brent crude: -0.7% to $US67.53/barrel

- Iron ore: -0.3% to $US105.60/tonne

- Bitcoin: -0.1% to $US117,554

Prices current around 7:53am AEST

Live updates on the major ASX indices:

5h agoThu 18 Sep 2025 at 8:19pmGood morning

Good morning and a happy Friday to you all.

Rhiana Whitson here signing on for blog duties this morning.

It’s looking like a positive for the Australian share market this morning, after the index slipped on Thursday to close -0.8% to 8,745 points.

On Wall Street overnight, the S&P 500 hit a record high as investors embraced the Federal Reserve’s rate cut.

Tech stocks also starred after Nvidia announced a $US5 billion investment in rival Intel.

I’ll bring you more on all of the above as the morning rolls on.