Weather: More of the same internationally. Nothing market driving. Locally there is increasing talk around moisture draw on heavy crops given the vacant 15 day forecast. Lower temps have been the saving grace but, with hay values seemingly holding up, many will be running the calcs.

Markets: Argy tax holiday couldn’t come at a worse time for the US soybean grower – the next step will be the interesting part of this mini series. Donald has lost the locker room – the red states, the heartland of his support is getting more than a little frustrated with the lack of progress in the China negotiations – in the meantime, China has loaded up on South American product which makes Dons next move so important. I can’t help but think there is a twist to this story.

Australian Day Ahead: Mixed offshore markets not really providing much direction. All eyes are on the forecast with the BOM still calling dryer Oct for WA but wetter than normal east coast, particularly Qld, messy.

.

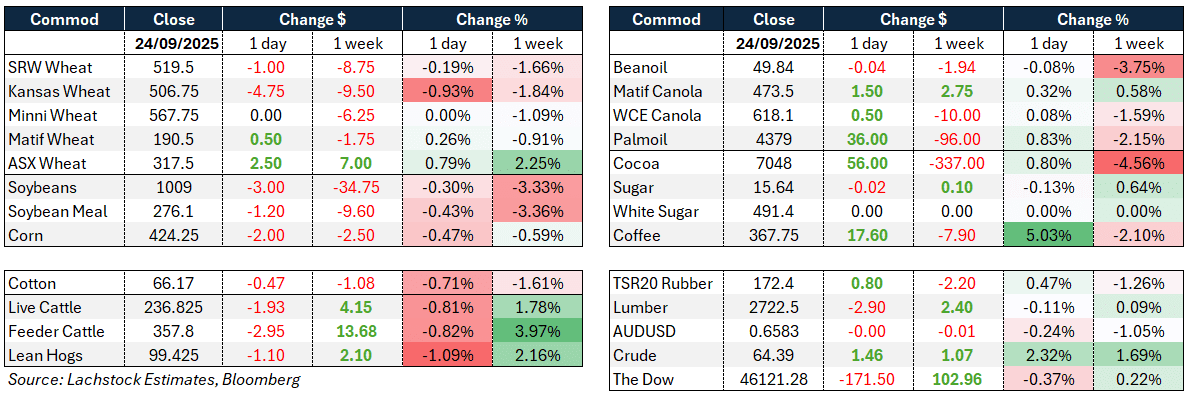

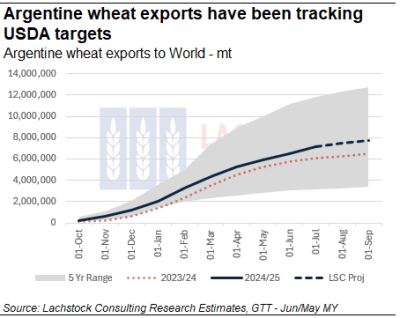

US wheat futures were mixed to slightly lower through the week, with Chicago, Kansas and Minneapolis contracts seeing modest losses.

Spreads were flat to slightly weaker, while Matif December edged higher and Russian cash prices rose.

IKAR lifted its Russian crop forecast to 87.5 million tonnes (Mt), potentially 89Mt if spring wheat yields are realised.

Demand signals were supportive: South Korea bought 50,000t US milling wheat, Algeria purchased up to 690,000t at US$259–261 c&f, and there was speculation of imminent demand from Pakistan and Saudi Arabia.

Indian flour millers lobbied for a partial lifting of export bans given surplus stocks.

EU soft wheat exports remain sluggish, down 33 percent y/y, with incomplete French data complicating flows, though Romania remains the largest shipper.

Weather-wise, frequent US rains have delayed early planting but improved soil moisture for strong establishment ahead of a potentially drier La Niña season.

Overall, seasonal support, reduced acreage expectations, and a large but nervous short underpin prices, though global supply remains ample.

Other grains and oilseeds

Corn futures drifted lower, with December slipping around 0.5pc to $4.24/bu as traders squared positions into quarter end and ahead of the USDA stocks report.

Yields are still the main debate, with consensus nearer 180 bu/acre than 185.

Cash behaviour has some in the market bracing for higher stocks.

US exports have been brisk, with Mexico repeatedly booking large volumes — another 313k reported this week.

Meanwhile, ADM announced it would roll its 11 US feed mills into a JV as part of wider cost cuts and portfolio simplification.

Soybeans remain under pressure, November futures down slightly around $10.08/bu.

The core story is Argentina’s temporary removal of export taxes, which unleashed heavy selling to China — roughly 20 cargoes or 1.3Mt booked this week alone — displacing US origin.

Reports suggest Argentina has already moved about 60pc of its intended $7 bn of no-tax sales.

This has angered the US farm sector, which remains sidelined in new-crop bean sales to China.

The soy complex traded lower into the week’s close, with beans off a few cents, meal down $3–4 and oil weaker, pulling Oct crush margins slightly lower.

EU soybean imports are also tracking 4pc behind last year.

Malaysian palm oil futures steadied near MYR 4,350/t after bargain buying, with Dorab Mistry projecting prices could exceed 5,000 ringgit if Indonesian biofuel mandates tighten supplies.

Macro

Australian CPI accelerated to 3.0pc y/y in August, with electricity costs falling due to subsidies but core inflation risks running higher, pointing to reduced scope for RBA easing beyond November.

In the US, Fed Chair Powell flagged upside inflation risks and downside employment risks, describing policy as a “challenging situation”, while Chicago Fed’s Goolsbee argued against aggressive front-loaded cuts given resilient labour and tariff uncertainty.

US housing surprised to the upside, with new home sales surging 20.5pc in August as mortgage rates eased.

On trade and geopolitics, Canada is seeking to expand agricultural and energy sales to China, while US trade representatives expect to finalise deals with parts of Southeast Asia soon.

Separately, tensions persist with Brazil over Trump’s 50pc tariffs, which Eurasia Group views as unlikely to resolve, raising the risk of a bifurcated global trading system between BRICS and G7 blocs.

CNH’s CEO warned farmer purchasing power will remain weak into 2026, given low crop prices and limited profitability, curbing equipment demand despite recent price stabilisation.

Australia

A slight improvement in prices for WA yesterday with canola bids up to A$815 FIS Albany, wheat was a couple dollars higher at $337, and barley unchanged at $308.

Feeder cattle eased this week, heifers around 20c/kg lw lower, Steers 11c/kg lw easier.

Heavy lambs also eased over the week, down 16c/kg cwt with yardings telling the story. Light lamb numbers were higher while heavy lambs were tighter across national saleyards.

Hay values are always a little hard to find transparency on – offer side of the market is showing Wheaten hay around $330/t while vetch in the high $400’s.