Intraocular Lens Market Overview

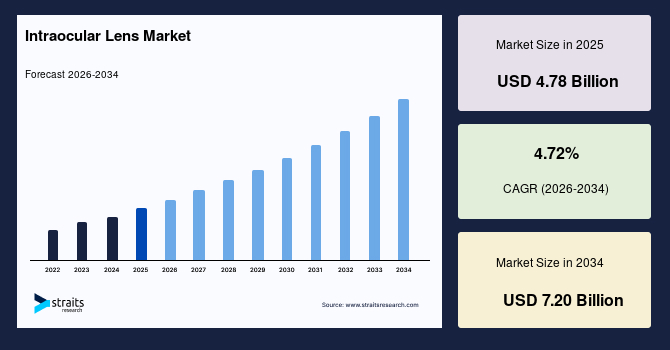

The intraocular lens market size is valued at USD 4.78 billion in 2025 and is anticipated to grow from USD 4.98 billion in 2026 till USD 7.20 billion by 2034, growing at a CAGR of 4.72% from 2026-2034. The growth of the global market is driven by the rising incidence of cataracts and age-related vision problems. In addition, the growing preference for premium and technologically advanced IOLs, such as multifocal, toric, and accommodative lenses, is expanding their adoption across ophthalmic surgical centers. Moreover, rising awareness about vision correction options and advancements in minimally invasive cataract surgery techniques are further driving the intraocular lens industry growth.

Key Market Indicators

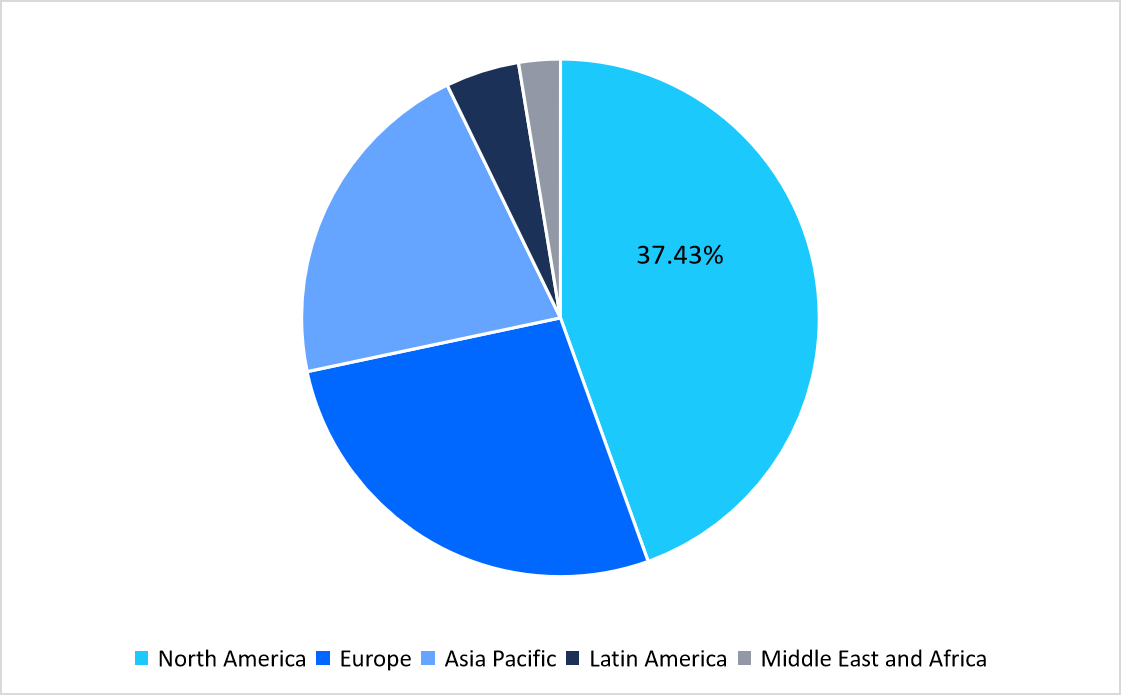

- North America held a dominant share of the global market, accounting for 37.43% share in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 6.07%.

- Based on product type, the monofocal IOL segment dominated the market with a revenue share of 41.39% in 2025.

- Based on end use, the hospitals segment dominated the market with a revenue share of 51.45% in 2025.

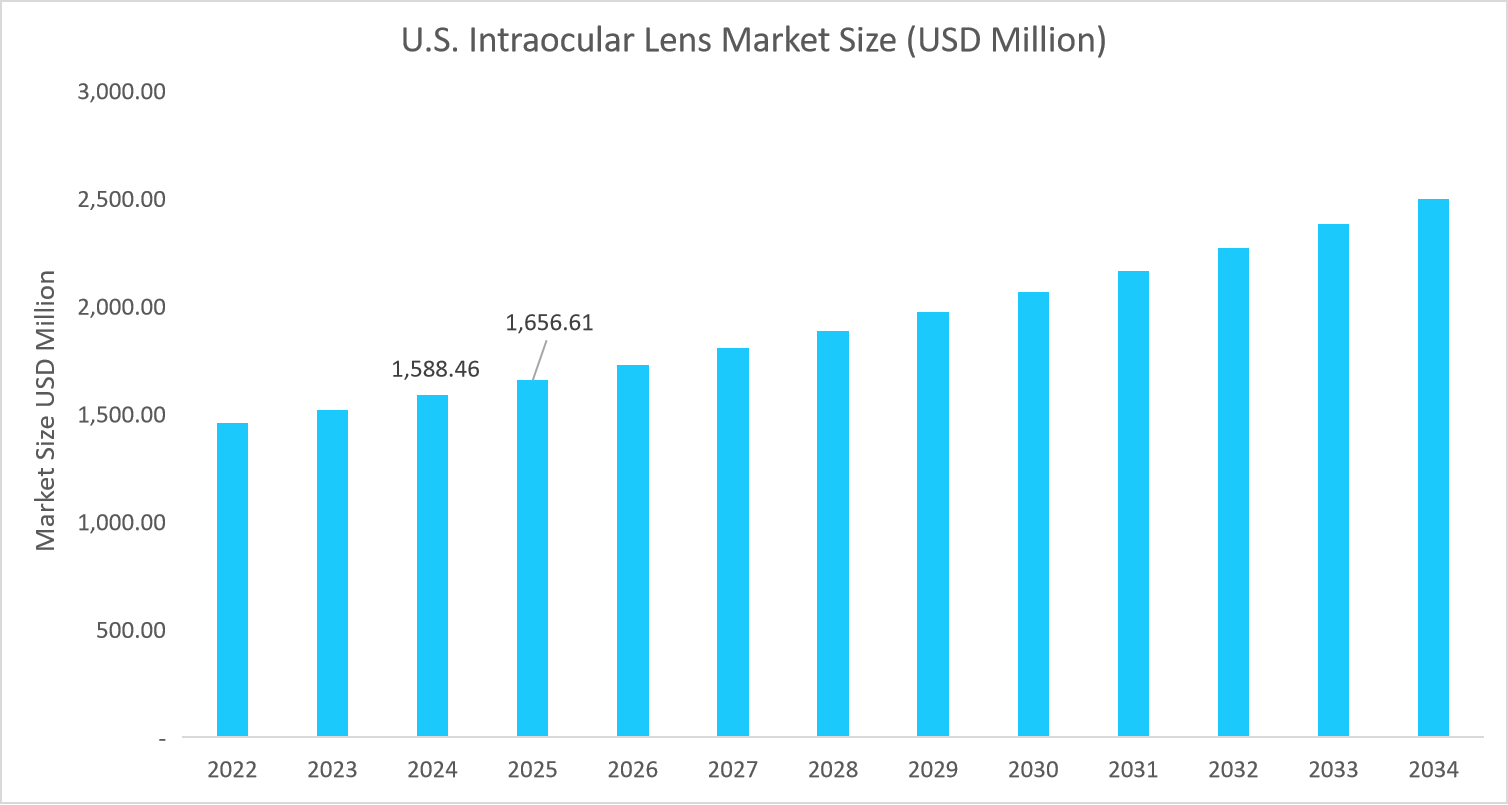

- U.S. dominates the intraocular lens market, valued at USD 1.58 billion in 2024 and reaching USD 1.65 billion in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.78 billion

- 2034 Projected Market Size: USD 7.20 billion

- CAGR (2026-2034): 4.72%

- Dominating Region: North America

- Fastest-Growing Region: Asia-Pacific

Source: Straits Research Analysis

Pricing Analysis

An analysis of leading players shows significant price variation across advanced contact and specialty lenses, with products ranging from USD 69.3 to over USD 400 per lens. This pricing diversity reflects the premium positioning of technologically advanced solutions, underlining how affordability and innovation together influence adoption trends in the intraocular lens industry.

Company Name

Contact Lenses

Price (USD)/Lens

Cooper Vision

SynergEyes KC

185.83

Synergeyes A

Menicon Co., Ltd

Rose K

231.75

SEED Co., Ltd

SEED UV-1

69.3

Bausch + Lomb

Zenlens Scleral Lenses

400.45

EssilorLuxottica

eSCone

304.23

AdvantageK

287.59

Market Trends

Shift Towards Multifocal Intraocular Lenses Over Monofocal IOLs

The market for intraocular lens is shifting toward premium and multifocal lenses as advanced alternatives to standard monofocal IOLs.

- For instance, in 2025, Johnson & Johnson Vision expanded its portfolio of multifocal and extended depth of focus lenses to improve visual outcomes across multiple distances.

This shift toward premium and multifocal IOLs is expanding adoption by offering patients improved vision outcomes and greater satisfaction compared to standard monofocal lenses.

Expansion of Outpatient and Private Ophthalmic Surgical Centers

The increasing number of specialized outpatient clinics and private eye hospitals is improving access to cataract surgeries and advanced IOLs.

- For instance, in Brazil 2024, private ophthalmic chains such as OphthalmoHealth and VisionClinics have expanded rapidly, performing thousands of cataract procedures annually.

This expansion is driving the growth of the market.

Market Drivers

Increasing Cataract Surgery Volumes Worldwide

The rising prevalence of cataracts, driven by aging populations and improved access to ophthalmic care, is a key driver for intraocular lens adoption.

- For instance, in fiscal year 2024-25, India’s National Programme for Control of Blindness and Visual Impairment (NPCB&VI) reported 98 lakhs of cataract surgeries, the highest number in the last five years.

This growth in surgical volumes under government schemes increases the uptake of IOLs, which, in turn, supports the market growth.

Rising Demand for Toric and Premium IOLs to Correct Astigmatism and Presbyopia

Patients and surgeons are increasingly preferring premium intraocular lenses such as toric, multifocal, and extended depth of focus (EDOF) designs that offer correction for astigmatism and an improved range of vision.

- For instance, in August 2023, Alcon launched its Clareon Monofocal and Clareon Toric intraocular lenses in India, using the Clareon Monarch IV delivery system.

This trend is pushing manufacturers to expand access to premium lenses in the emerging markets.

Market Restraint

High Cost of Premium Intraocular Lenses

The significant price difference between standard monofocal IOLs and advanced premium lenses is a major restraint for the market growth.

- For instance, according to the American Academy of Ophthalmology (AAO) 2024, premium IOLs can cost patients an additional USD 1,500–3,000 per eye out-of-pocket, as most of the insurance schemes only cover standard monofocal lenses.

The high cost of premium lenses limits their accessibility and impacts the market growth.

Market Opportunity

Expanding Adoption of Intraocular Lenses in Emerging Economies

The increasing focus on eye health, government-supported blindness control programs, and rising disposable incomes in emerging economies are creating a significant growth opportunity for the intraocular lens market. Recent initiatives are improving access to cataract surgeries and premium IOL options in countries such as India, China, and Brazil.

This expansion into underserved regions represents a highly targeted growth avenue for IOL manufacturers, as large patient pools and unmet medical needs drive accelerated adoption during the forecast period.

- 📊 Preview Report Scope and Structure – Gain immediate visibility into key topics, market segments, and data frameworks covered.

- 📥 Evaluate Strategic Insights – Access selected charts, statistics, and analyst-driven commentary derived from the final report deliverables.

Regional Analysis

North America dominated the intraocular lens market in 2025, accounting for 37.43% market share. This dominance is attributed to high adoption of premium and technologically advanced IOLs, and the strong presence of leading manufacturers such as Johnson & Johnson Vision and Alcon that are actively engaged in new product launches. Additionally, favorable reimbursement policies and a growing geriatric population driving demand for vision correction procedures collectively boost the market growth in North America.

A surge in demand for premium intraocular lenses is a major factor driving market growth in the U.S. Rising patient preference for spectacle independence, combined with high disposable income and favorable reimbursement for cataract procedures, is creating strong uptake for advanced IOLs. According to the American Academy of Ophthalmology (AAO) 2024, the U.S. performs over 4 million cataract surgeries annually, one of the highest globally, with an increasing proportion of patients opting for premium lens upgrades. Thus, through strong uptake of premium intraocular lenses, the U.S. leads the IOLs market in North America.

Asia Pacific Market Trends

Asia Pacific is emerging as the fastest-growing region with a CAGR of 6.07% from 2026 to 2034, owing to the increasing prevalence of cataracts and glaucoma, leading to a higher demand for IOLs. Additionally, initiatives by government and non-profit organizations to address cataract surgery backlogs have further boosted product demand. Moreover, increasing disposable income and growing popularity for IOL in the young generation also support the regional market growth.

In China, the intraocular lens (IOL) market is experiencing significant growth, driven by the government’s strategic initiatives to enhance the domestic manufacturing capabilities of high-tech medical devices. Under the “Made in China 2025” industrial policy, the government aims to reduce reliance on foreign suppliers by promoting the development and production of core materials and components within the country. This policy encourages domestic companies to innovate and improve the quality of IOLs, making them more competitive both locally and internationally. This is a major factor supporting the intraocular lens market growth in China

Source: Straits Analysis

Europe Market Trends

Germany’s intraocular lens (IOL) market is propelled by several key factors. The nation’s robust public healthcare system ensures widespread access to cataract surgeries, with over 1 million procedures performed annually. Additionally, the increasing adoption of toric IOLs, which are designed to correct astigmatism, also drives the market growth in Germany. Moreover, strong demand for advanced IOL and a surge in new product approvals are also contributing to the intraocular lens market growth in Germany.

In the UK, the intraocular lens (IOL) market is experiencing significant growth, driven by the increasing volume of cataract surgeries and advancements in lens technologies. A notable factor contributing to this market growth is the expanding role of private clinics in delivering NHS-funded cataract surgeries. The involvement of private clinics has also led to the rapid expansion of IOL providers such as SpaMedica, Newmedica, and Optegra, collectively opening numerous new clinics and supporting market growth in the UK.

Countries Insights

- In Brazil, the intraocular lens (IOL) market is experiencing significant growth, driven by the increasing adoption of advanced surgical techniques and the rising demand for premium IOLs. The introduction of the world’s first spiral IOL by Rayner in Brazil marks a pivotal development in the market. This innovative lens design aims to enhance visual outcomes for patients undergoing cataract surgery, thereby contributing to the overall market growth.

Product Type Insights

The monofocal IOL segment dominated the market in 2025, accounting for 41.39% revenue share, owing to its proven safety, affordability, and widespread availability. In addition, the monofocal lenses effectively correct vision at a single focal point, making them the preferred choice for standard cataract surgeries. Thus, all aforementioned factors boost the segmental market growth.

Source: Straits Analysis

End User Insights

The hospitals segment dominated the market with a revenue share of 51.45% in 2025. This growth is attributed to well-established surgical infrastructure, availability of specialized ophthalmic surgeons, and capacity to handle high volumes of cataract and refractive surgeries. Additionally, hospitals offer advanced IOL options, including premium and multifocal lenses, supported by insurance coverage, which attracts a larger patient base and drives higher revenue in this segment.

Competitive Landscape

The global intraocular lens market is moderately consolidated, with a major multinational company dominating the premium IOL segment. Leading players maintain their strong foothold in the market through continuous product innovation and regulatory approvals.

The major players in the market include Alcon Inc., Johnson & Johnson Vision Care, Bausch + Lomb, Carl Zeiss Meditec AG, and Hoya Corporation. These industry players are inclined towards gaining a competitive share in the market through introducing innovative technologies such as accommodating IOLs, light-adjustable lenses, and others.

Adaptilens, Inc.: An emerging market player

Adaptilens, a preclinical biotech company, is emerging in the IOL market with its development of an accommodating intraocular lens (A-IOL) technology that mimics the eye’s natural focus mechanism.

- In April 2024, Adaptilens raised USD 17.5 million in a Series A funding round (led by Perceptive Xontogeny Venture Funds) to advance its A-IOL into first-in-human trials.

Through its accommodating lens technology and successful funding, Adaptilens is positioning itself as an emerging player in the intraocular lens industry.

List of key players in Intraocular Lens Market

- Alcon Inc.

- Johnson & Johnson Vision Care, Inc.

- Bausch + Lomb Incorporated

- Carl Zeiss Meditec AG

- HOYA Corporation

- Rayner Group

- Eyekon Medical

- Lenstec, Inc.

- STAAR SURGICAL

- HumanOptics Holding AG

- Ophtec

- USIOL Inc.

- Innexus

- Oculentis GmbH

- Physiol S.A.

Recent Development

- 2nd April 2025: Alcon, the global leader in eye care, has launched its Clareon PanOptix Pro intraocular lens (IOL) for cataract patients in the U.S.

Analyst Opinion:

As per the analyst’s opinion, the market for intraocular lens is steadily growing, owing to the rising global prevalence of cataracts, expanding access to cataract surgeries, and growing demand for premium lenses that reduce dependence on spectacles. The market is also experiencing a shift toward advanced IOL technologies such as toric, multifocal, extended depth of focus (EDOF), and light-adjustable lenses, which are enhancing patient satisfaction and clinical outcomes.

Intraocular Lens Market Segmentations

By Product Type (2022-2034)

- Monofocal IOL

- Premium IOL

- Multifocal

- Toric

- Accommodating

- Phakic Intraocular Lens (PIOL)

- Others

By End Use (2022-2034)

- Hospitals

- Ophthalmic Clinics

- Ambulatory Surgery Centers

- Others

By Region (2022-2034)

-

North America

- U.S.

- Canada

-

Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Russia

- Nordic

- Benelux

- Rest of Europe

-

APAC

- China

- Korea

- Japan

- India

- Australia

- Taiwan

- South East Asia

- Rest of Asia-Pacific

-

Middle East and Africa

- UAE

- Turkey

- Saudi Arabia

- South Africa

- Egypt

- Nigeria

- Rest of MEA

-

LATAM

- Brazil

- Mexico

- Argentina

- Chile

- Colombia

- Rest of LATAM

Frequently Asked Questions (FAQs)

The intraocular lens market size is anticipated to grow from USD 4.98 billion in 2026 till USD 7.20 billion by 2034, growing at a CAGR of 4.72% from 2026-2034.

The primary factors fueling market growth include the rising number of cataract surgeries globally and the growing demand for toric and premium intraocular lenses to address astigmatism and presbyopia.

The monofocal IOL segment is the leading segment in the market by product type, holding a 41.39% revenue share in 2025.

North America dominates the market, holding a 37.43% market share in 2025.

Top players present globally are Alcon Inc., Johnson & Johnson Vision Care, Inc., Bausch + Lomb Incorporated, Carl Zeiss Meditec AG, HOYA Corporation, Rayner Group, Eyekon Medical, Lenstec, Inc., STAAR SURGICAL, HumanOptics Holding AG, Ophtec, USIOL Inc., Innexus, Oculentis GmbH, Physiol S.A.