Stock futures are slightly higher as investors await a key inflation report; President Donald Trump laid out a series of new tariffs on pharmaceutical, furniture products and heavy trucks; Trump signed an executive order bringing TikTok under a U.S. ownership group that includes Oracle (ORCL); and Intel (INTC) shares continue to surge. Here’s what you need to know today.

1. Stock Futures Tick Higher Ahead of Inflation Report

Stock futures were slightly higher as investors braced for inflation data that will factor into the Federal Reserve’s decision-making on interest rates. Futures tied to the Dow Jones Industrial Average were up 0.2% recently, while those linked to the S&P 500 and the tech-heavy Nasdaq added 0.1%. The major indexes, which are riding three-day losing streaks after hitting a series of record highs, are on pace to post losses for the week. Bitcoin (BTCUSD) continued to lose ground, trading below $109,000, its lowest level in a month. The yield on the 10-year Treasury note, which affects borrowing costs on all sorts of loans, was holding steady at 4.17%. Gold futures edged higher to around $3,800 an ounce but remained just under recent highs.

2. PCE Inflation Report in Focus After Recent Strong Economic Data

Investors are awaiting the Personal Consumption Expenditures report, which is the Fed’s preferred measure of inflation. The report, scheduled for release at 8:30 a.m. ET, is expected to show that annual inflation increased slightly to 2.7% in August, according to economists surveyed by The Wall Street Journal and Dow Jones Newswires. The closely watched core inflation reading, which excludes volatile food and energy costs, is expected to remain at 2.9%, well above the Fed’s target. The inflation report has taken on even greater significance after other data this week—including a big upward revision to second-quarter GDP growth—have shown the economy to be resilient in the face of tariffs. The Fed cut its key lending rate last week for the first time in 2025 and signaled that more cuts could be coming amid a weakening in the labor market. A hotter-than-expected inflation reading today could tame market expectations for further rate cuts, as the Fed has a dual mandate to keep employment high and inflation low.

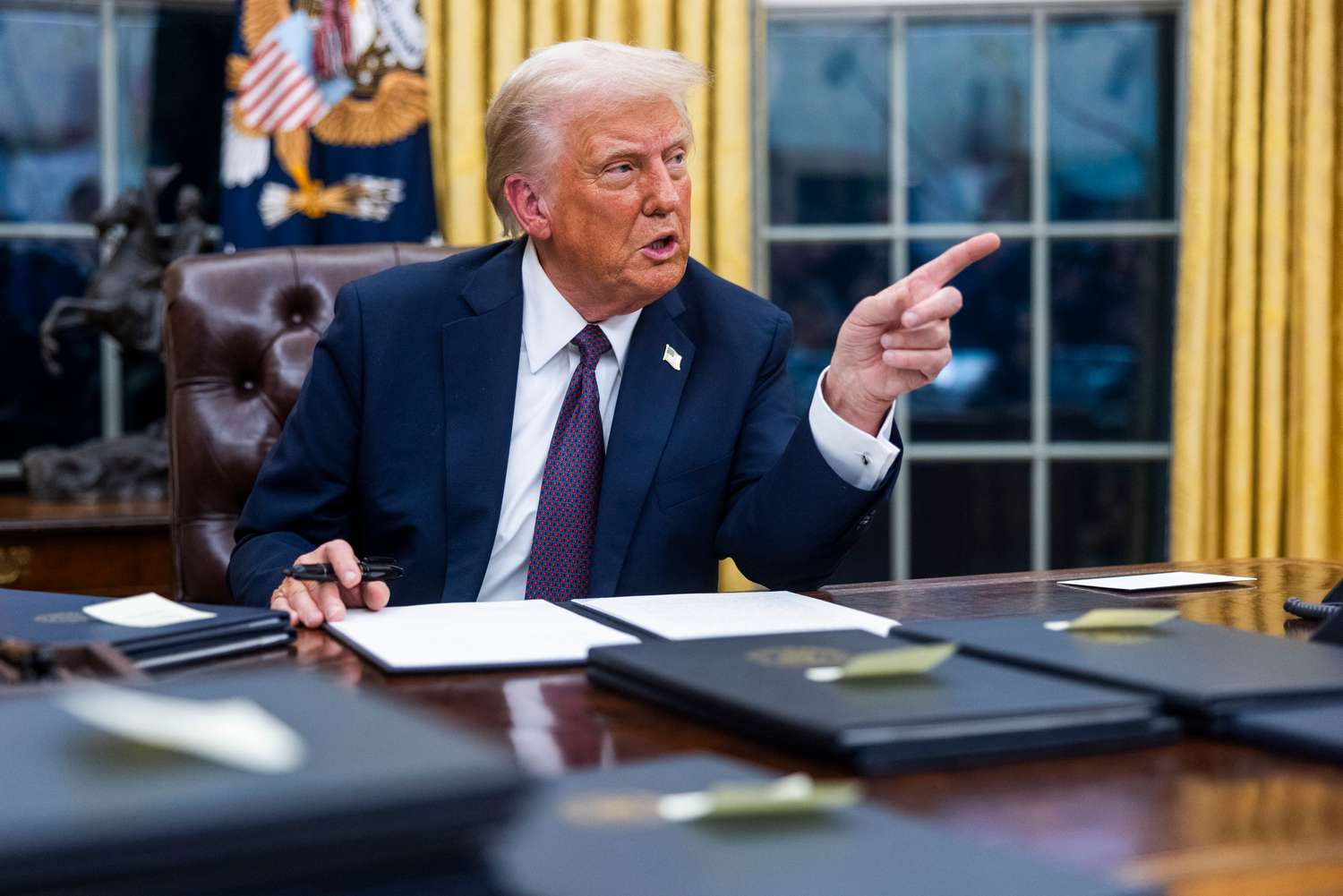

3. Trump Lays Out Tariffs on Pharmaceuticals, Furniture, Heavy Trucks

President Trump late Thursday announced a new slate of tariffs that are set to go into effect on Oct. 1, including a 100% levy on pharmaceutical imports for companies that aren’t building manufacturing plants in the U.S. Trump said that pharmaceutical companies that have started construction on domestic facilities can be exempted from the drug tariffs, which are restricted to “branded or patented” drugs and likely won’t include generics. Trump said that there will be a 50% tariff on kitchen cabinets, bathroom vanities, and associated products, while heavy trucks will be hit with a 25% tariff. Shares of Indiana-based drugmaker Eli Lilly (LLY) were up about 2% in premarket trading, while U.S. listed shares of Denmark’s Novo Nordisk (NVO) declined 1%. Furniture sellers Williams-Sonoma (WSM), Wayfair (W) and RH (RH) were each down 3%.

4. Trump Signs TikTok Executive Order Bringing App Under American Control

Trump signed an executive order on Thursday to bring TikTok’s U.S. operations under American control, averting a ban on the popular Chinese-owned social media app. In a press conference, Trump said the American group set to control TikTok in the U.S. will include billionaire Rupert Murdoch, Dell Technologies (DELL) CEO Michael Dell, and Oracle’s (ORCL) Larry Ellison. TikTok’s Chinese owner ByteDance will copy and lease the algorithm to the joint venture that will control TikTok’s U.S. operations. Oracle will oversee the recommendation software, a White House official had confirmed earlier. Vice President J.D. Vance said that the company could be valued at $14 billion, lower than some had expected. Shares of Oracle were slightly higher ahead of the opening bell.

5. Intel Shares Continue to Surge

Shares of Intel (INTC) are on the rise again this morning amid investor optimism about deals that could revive the struggling chipmaker’s fortunes. A report that Apple (AAPL) could be Intel’s next big investor has fueled big gains this week, after Nvidia (NVDA) last week announced a $5 billion investment. Coming into today’s session, the stock has gained nearly 70% since the start of the year, though it remains well off its 2021 high. Analysts tracked by Visible Alpha have overwhelmingly preferred to stick to the sidelines with “hold” ratings, with targets suggesting they see an eventual pullback in the stock. The current consensus target, at $26, is roughly 25% below Thursday’s close. Intel shares were up 4% in recent premarket trading.