Market Size & Trends

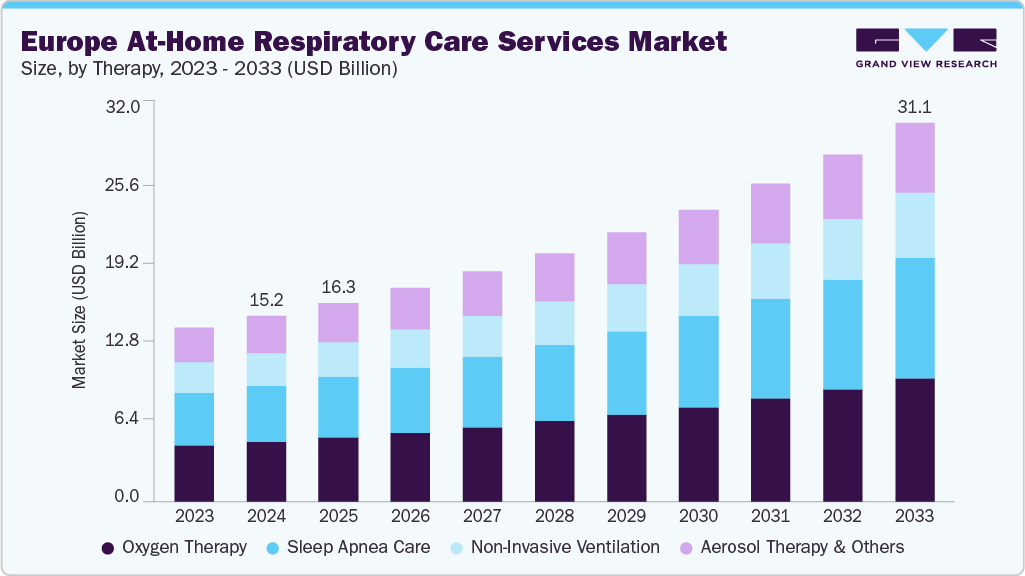

The Europe at-home respiratory care services market size was estimated at USD 15.24 billion in 2024 and is projected to reach USD 31.15 billion by 2033, growing at a CAGR of 8.42% from 2025 to 2033. Technological advancements in medical devices, such as the development of smart inhalers, connected nebulizers, and integrated mobile applications, have revolutionized traditional methods of respiratory management.

For instance, in February 2024, Aptar Pharma, a global provider of drug delivery systems and active material science solutions, launched HeroTracker Sense, an innovative digital respiratory health solution designed to convert traditional pressurized metered dose inhalers (pMDIs) into smart, connected healthcare devices. This cutting-edge technology enables real-time monitoring and data-driven management of respiratory conditions, enhancing treatment adherence and supporting more personalized patient care.

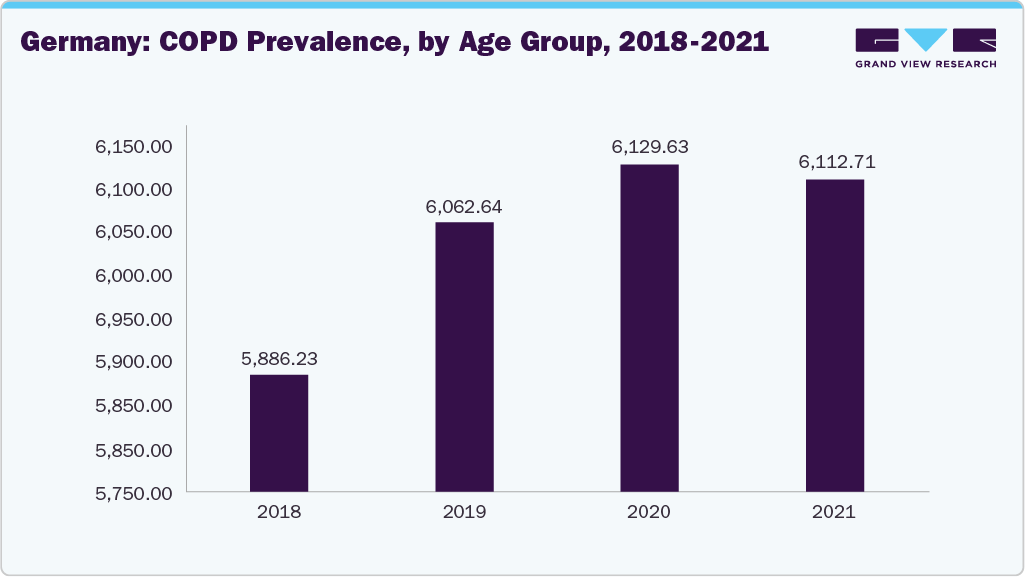

The rising prevalence of chronic respiratory diseases is driving the growth of at-home respiratory care services across Europe. According to a European Respiratory Society article, approximately 36.6 million people in Europe were living with chronic obstructive pulmonary disease (COPD) in 2020, with projections indicating a rise to 49.45 million by 2050, equivalent to a 9.3% prevalence.

Projected Number of COPD Patients in 2050, By Country

Countries

COPD Patients in 2050 (Million)

Germany

7.6

UK

7

Spain

4.8

Italy

4.7

Conditions such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea are increasingly affecting the population, requiring long-term and often continuous respiratory support. These chronic respiratory conditions significantly affect patients’ daily functioning and contribute to increased pressure on national healthcare systems, particularly through elevated hospital admission rates and greater demands on healthcare resources.

Moreover, a growing elderly demographic across Europe is leading to higher incidences of chronic respiratory diseases, increasing the demand for home-based respiratory care. As per the United Nations Population Division report, the share of population aged 65 and above has significantly increased in recent years in Europe, reaching approximately 19.8% in 2023.

Furthermore, the rapid expansion of telehealth and digital health tools is transforming at-home respiratory care services in Europe. Telehealth enables remote consultations, monitoring, and clinical follow-up via digital platforms, reducing the need for physical hospital visits. During the COVID-19 pandemic, the adoption of telemedicine became integral to managing chronic respiratory patients safely at home. In the UK, the NHS launched large-scale remote monitoring initiatives between 2020 and 2023, supporting over 487,000 people at home, including those with COPD and heart failure. Home-based digital tools increased patients’ access improved self-management, and lessened pressure on traditional healthcare facilities.

In addition, empowering patients through education, digital self-management tools, and patient-centered service models is influencing market growth. Initiatives across Europe aim to equip individuals and caregivers with the necessary knowledge and digital resources to effectively manage respiratory conditions at home. For instance, the NHS has invested in tele-coaching, self-care apps, and remote education modules for respiratory patients, which promote adherence and improve disease outcomes.

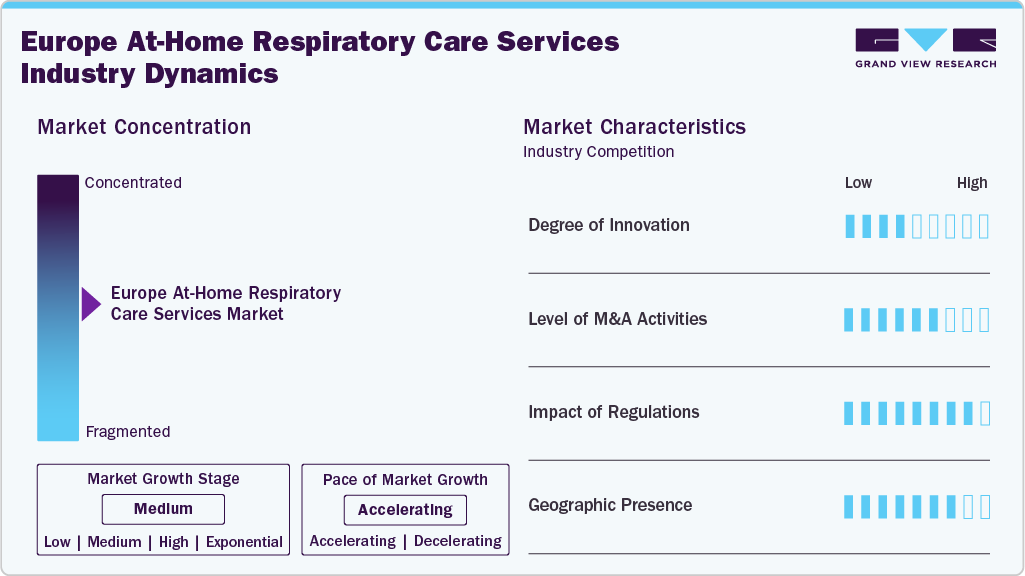

Market Concentration & Characteristics

The market is evolving rapidly, with well-established and emerging players driving transformation through acquisitions, partnerships, and new technologies. The integration of telemonitoring and AI-assisted diagnostic tools is significantly shaping the innovation landscape of the industry. These technologies enable continuous, real-time monitoring of patients’ respiratory parameters, improving early intervention and reducing emergency visits. Smart respiratory devices, such as connected CPAP and oxygen therapy units, are becoming increasingly common in-home settings. In addition, partnerships between traditional MedTech companies and digital health startups are accelerating the development of intelligent home-care solutions. In March 2024, SOL Group continues strengthening its strategic internationalization path in the home care sector, which operates with VIVISOL Companies. The young entrepreneur, Catalin Batrinu, established and managed a new partnership in Romania by acquiring 70 % of the capital of MEDAIR OXIGEN SOLUTION S.R.L., a Romanian operator of in-home respiratory care.

Several key market players are devising business growth strategies in the form of mergers and acquisitions. Through M&A activity, these companies can expand their business geographies. For instance, in May 2025, Air Liquide Healthcare acquired two outpatient intensive care companies, intensivLeben GmbH and AP-Sachsen GmbH, in Germany. These newly acquired firms operate in the Saxony region, one of the most densely populated areas in Eastern Germany, between Berlin and Bavaria. Air Liquide already has a significant presence in this local market. Both companies specialize in the German outpatient intensive care sector, concentrating on Community Care centers and shared living spaces for patients with severe conditions such as chronic respiratory insufficiency, craniocerebral trauma, and neuromuscular diseases. They deliver personalized intensive care services and currently operate nine facilities.

The implementation of the EU Medical Device Regulation (MDR) has increased compliance requirements for respiratory care equipment, affecting time-to-market for innovations. Reimbursement policies vary widely across countries, creating inconsistencies in patient access to home-based care.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. For instance, in October 2023, the new VIVISOL HELLAS store in the Athens area opened. Thus, a new era for Home Respiratory Care officially begins in Attica.

Therapy Insights

The oxygen therapy segment led the market with the largest revenue share of 32.27% in 2024. Oxygen therapy is crucial in managing chronic respiratory diseases, making it one of the most significant therapy segments in the European at-home respiratory care market. It is primarily prescribed for patients with hypoxemia resulting from conditions such as COPD, interstitial lung diseases, pulmonary hypertension, and advanced asthma. The growing burden of COPD, driven by aging populations, smoking habits, and occupational hazards, is significantly boosting the demand for long-term oxygen therapy (LTOT). Patients increasingly prefer home-based solutions as they provide comfort, reduce hospital visits, and lower healthcare costs. In addition, healthcare providers increasingly encourage home therapy to improve patient quality of life, reduce readmissions, and optimize chronic disease management.

The sleep apnea care segment is anticipated to grow at the fastest CAGR during the forecast period, driven by increasing awareness and diagnosis of obstructive and central sleep apnea across Europe. With rising obesity rates and growing recognition of sleep apnea as a significant risk factor for cardiovascular diseases, demand for continuous positive airway pressure (CPAP) and BiPAP devices is surging. CPAP and BiPAP therapies are widely recognized as effective treatments that prevent airway collapse during sleep, improving patient quality of life and reducing cardiovascular risk.

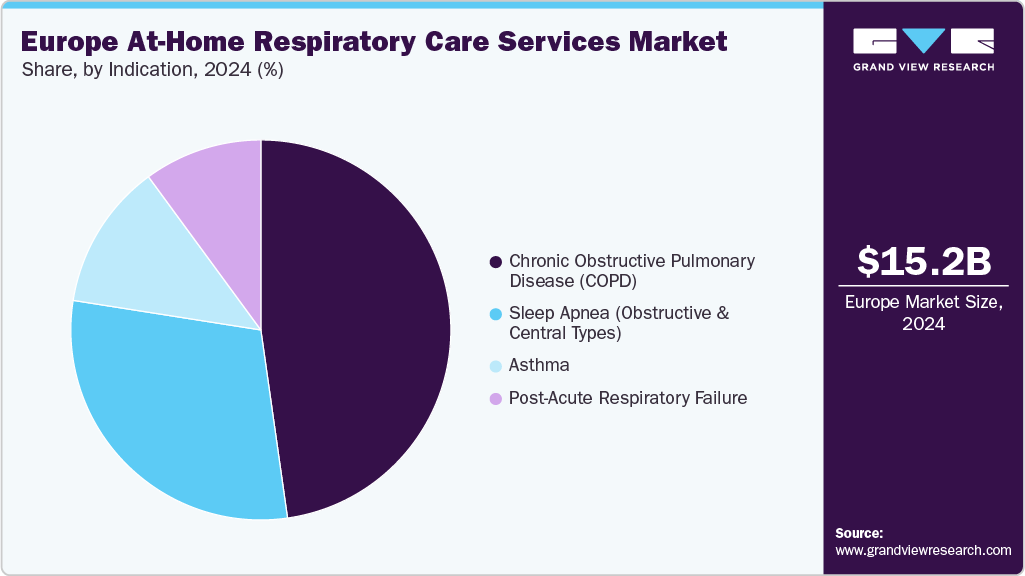

Indication Insights

The chronic obstructive pulmonary disease (COPD) segment led the market with the largest revenue share of 47.75% in 2024. The high prevalence of COPD, fueled by smoking, industrial pollution, and aging populations, makes it a priority for healthcare systems to initiate home-based respiratory support to improve quality of life and reduce hospital admissions in Europe. For instance, the Danish Smoking Habits 2022 report reveals that 23% of the population uses tobacco or nicotine products.COPD patients often require long-term oxygen therapy (LTOT), non-invasive ventilation (NIV), and aerosolized medications to manage persistent airflow limitation and exacerbations, thereby escalating market growth.

The sleep apnea segment is anticipated to grow at the fastest CAGR during the forecast period. Sleep apnea is a rapidly growing problem within Europe, primarily driven by rising obesity rates and greater awareness of sleep-related breathing disorders. Obstructive Sleep Apnea (OSA) is more prevalent, caused by repeated upper airway collapses during sleep. Moreover, central sleep apnea (CSA) involves irregular brain signaling to breathing muscles and is often linked to heart failure. For instance, according to a 2023 Elsevier article, 5 to 7 million people in Spain have Obstructive Sleep Apnea Syndrome (OSAS), with about 2 million experiencing significant symptoms requiring treatment.

Country Insights

UK At-home Respiratory Care Services Market Trends

The UK dominated the Europe at-home respiratory care services market with the largest revenue share of 23.17% in 2024. High demand for at-home respiratory care services is anticipated to drive the market owing to the rising prevalence of chronic respiratory diseases in the country. According to an article published by the Sleep Apnea Trust in April 2020, up to 10 million people in the UK suffer from the most prevalent type of obstructive sleep apnea (OSA). Among these, around 4 million people suffer from either moderate or severe OSA.

France At-home Respiratory Care Services Market Trends

The at-home respiratory care services market in France is expected to grow at the fastest CAGR during the forecast period. The growing incidence of respiratory disorders in France is anticipated to fuel market growth over the forecast period. According to an article published by NIH in May 2023, a study involving 20,151 participants found that the prevalence of treated sleep apnea was 3.5%.

Germany At-home Respiratory Care Services Market Trends

The Germany at-home respiratory care services market is experiencing significant growth. The growing incidence of respiratory disorders in France is anticipated to fuel market growth over the forecast period. According to an article published by NIH in May 2023, a study involving 20,151 participants found that the prevalence of treated sleep apnea was 3.5%.

Key Europe At-Home Respiratory Care Services Company Insights

The market is undergoing steady transformation, driven by both established healthcare providers and emerging digital health companies. The market remains moderately fragmented, with regional disparities in service availability and reimbursement structures. Key players are actively pursuing partnerships, acquisitions, and technological innovation to expand their reach and improve home-based patient care.

Key Europe At-Home Respiratory Care Services Companies:

- Linde Healthcare

- Bastide Group

- Vivisol (SOL Group)

- SOS Oxygène

- Air Liquide Healthcare

Recent Developments

-

In June 2025, The Bastide Group announced the sale of its two Belgian subsidiaries, Dorge Medic, specializing in the sale and rental of médical equipment and products for home care and orthopedics, and Dyna Médical, specializing in bandages, i.e. the manufacture, adaptation, and sale of custom-made médical devices such as bandages, orthoses, abdominal belts, support stockings, and orthopedic shoes. In the 2023-2024 financial year, Dorge Medic and Dyna-Médical, acquired in 2013 and 2014 respectively, generated a combined turnover of USD 11.27 million. The two subsidiaries are being sold to Aqtor!, a specialist in technical orthopedics based in Belgium and a subsidiary of the Eqwal Group, a disability compensation company.

-

In April 2024, Air Liquide acquired home care activities in Belgium and the Netherlands. This move allows the Group to enhance its presence and offerings in these regions. The two entities acquired in Belgium and the Netherlands support 10,000 patients facing respiratory insufficiency, sleep apnea syndrome, or needing infusion or nutritional treatments.

-

In July 2023, The Bastide Group entered the Netherlands with the acquisition of the Dutch company Oxigo. Oxigo specializes in consulting and online sales of oxygen therapy and respiratory assistance equipment in Europe. This acquisition expands Bastide Group’s geographical presence in the Netherlands, a fast-growing respiratory assistance segment.

Europe At-Home Respiratory Care Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.32 billion

Revenue forecast in 2033

USD 31.15 billion

Growth rate

CAGR of 8.42% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 – 2023

Forecast data

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy, indication, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy

Key companies profiled

Linde Healthcare; Bastide Group; Vivisol (SOL Group); SOS Oxygène; Air Liquide Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe At-Home Respiratory Care Services Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Europe at-home respiratory care services market report based on therapy, indication, and region:

-

Therapy Outlook (Revenue, USD Billion, 2021 – 2033)

-

Indication Outlook (Revenue, USD Billion, 2021 – 2033)

-

Chronic Obstructive Pulmonary Disease (COPD)

-

Sleep apnea (obstructive and central types)

-

Asthma

-

Post-acute respiratory failure

-