Quantum computing people talk about the coming era of quantum “advantage” or “utility”. That is the point at which quantum computing will have an advantage over classical computing – which might mean that it is better at doing certain tasks, or can achieve tasks classical computing cannot, at a cost that is cheap enough to give users a benefit over using classical computing.

The day on which quantum computing might hold the advantage is referred to, with a healthy does of irony by now, as Q-Day.

Of course these phrases don’t mean we’re talking about a replacement of classical computing. Quantum computing will be used in tandem with and alongside high performance and other computing platforms in a hybrid model.

So when are we going to see Quantum Advantage, why does it matter for telecoms – what are the opportunities that quantum technologies offer telcos, and what are the challenges?

When?

Committing to the “when” of Quantum Advantage is not something the industry really wants to do as there are a lot of moving parts to consider. Yes, there’s a lot of money pouring into the sector and things are moving fast – major players such as Google, AWS and Microsoft are joining an ecosystem that has included a number of heavily-backed start-ups. But there is still science to fix, as well as engineering challenges; entering the quantum computing world means coming to terms with terms such as gate fidelity, error correction and more. There are different types of quantum computing (modalities, in quantum-world speak) and emerging approaches that can increase accuracy, such as the creation of logical qubits, which group physical qubits together to work as a group, reducing errors.

Then there is the need for algorithms and software development, and the issue of how to integrate quantum solutions to work with Agentic and other AI. And all of this work is to meet an as-yet unrealised commercial demand for applications from customers. (That’s not to say, however, that there isn’t a visible amount of end user interest from defence, healthcare, biotech, finance, transport and other sectors.)

At the recent Commercialising Quantum event, held by The Economist in London, Patrick Vallance, who is the UK’s Minister of state for science, research and innovation, said that the UK would have deployed a quantum network by 2035. NHS trusts could be benefitting from quantum sensing (quantum computing is not the only application of quantum technology) by 2023.

Subodh Kulkarni, CEO of quantum computing company Rigetti said that the industry is four to five years from unlocking the sort of real time error correction that will be needed to make machines viable at commercial scale. Google research scientist Tom O’Brien said that even thirty years on from Shor’s algorithm, it is still “early days”. The industry has been focussed on the science of making quantum computing a reality, and it is now asking questions on commercialising. He expects it to take about a decade to get to a point where a million qubit machine could be built to a fault tolerant level to deliver practical applications. Lesser machines with 10,000 qubits could be practical in around five years.

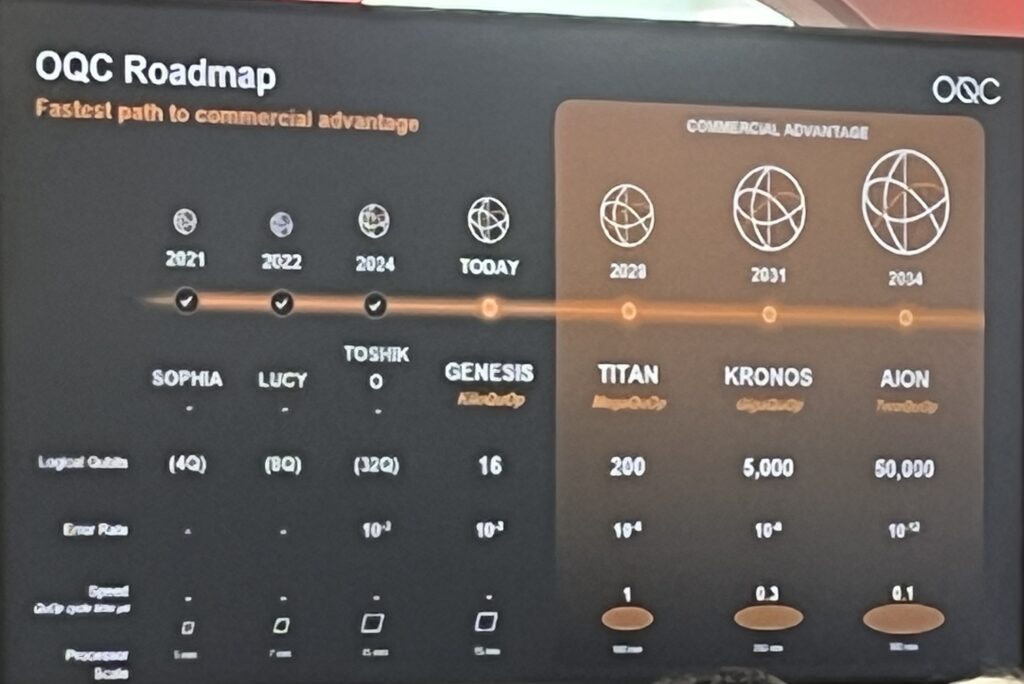

Oxford Quantum Circuits’ Gerald Mullaly said that logical qubit era is the commercial era of quantum computing. Scale in quantum is about how many qubits there are on a single chip or a single system. OQC has built a logical qubit system, Genesis, with 16 logical QUBITS and will have another commercial platform by 2028, its first of the commercial era, targeting usage in finance, security and defence. This will have 200 logical qubits and support millions of operations. The plan is to have a platform with 50,000 logical qubits by 2034.

Quantum computing developer Infleqtion which announced an open source library for error correction research at the conference, says it will be “north of” a hundred logical qubits by 2028, the point at which it can be commercially useful.

In short, taking the measure of the broad industry consensus, somewhere between 5-10 years from now we might have systems that can give users an advantage in speed, fidelity and accuracy over classical systems, at a cost base that makes it worthwhile.

And that’s if surrounding issues such as integrating systems into other compute and AI platforms, delivering software and applications to support customer use cases can be achieved.

Why it matters

But even if 5-10 years may sound far off, the implications of Quantum Advantage/ Quantum Utility/ Q-Day for telecoms are profound.

Most immediately, the power of quantum computing, such as its ability to solve huge probabilistic problems, is a threat to current encryption methods. Telecoms encryption could be broken. If the forecasters are correct, then telcos need to be ready ahead of time for Quantum Advantage.

Telcos have been exploring post-Quantum cryptography, and methods that would keep their data and networks secure in a world where Quantum Computing exists, for years.

That includes different methods of Quantum Key Distribution, which use the quantum state properties of photons to create a key that cannot be tampered with, without the sender knowing.

Telcos have been investing in Quantum-secure technology and quantum communcations networks, and have developed live testbeds and links. There are several commercial QKD companies. These include the likes of Toshiba, which has been working with BT on a data centre to date centre secure connection.

One drawback, according to Luca De Matteis, is the cost of systems. De Matteis is attached to analyst company Appledore and has also been consulting with KETS Quantum, a company founded in 2016, which he says is the only company with a fully integrated photonic chip-based QKD solution. That chip-based solution has the potential to radically reduce costs, and make QKD implementation more affordable across a multi-node network.

Whereas a typical QKD system currently costs between $165,000-300,000, KETS’ aim is to reduce that to $32,000, creating systems that can ultimately be installed as pluggable items inside existing telecoms infrastructure, rather than as discreet, bulky, expensive boxes. KETS’ prototype, funded by a £1.7M Innovate UK contract, is currently being trialled by BT.

According to De Matteis, “Telecoms providers are starting now to move from trials into field solutions. 2025 has been a year of great change in post-quantum security. The sense of urgency has increased, with the realisation that ‘Q-day’ is coming closer than expected.”

“But the challenge is on scale and size, that’s where KETS is changing the game. Telecoms operators will expect vendors to provide an integrated solution. So of their own accord telecom equipment vendors are on a roadmap to provide an integrated router with QKD inside.”

Telco Innovation Departments should be moving now

But quantum’s impact on telecoms is not likely to be limited just to post-quantum cryptography. Eugene Oleynik, head of sales at quantum algorithm developer Kipu Quantum, says that the technology’s ability to deal very well with optimisation problems has clear applications in the telco space.

The company conducted an experiment last year Spain with MasOrange, partnering with Cinfo and QuEra Computing to pre-calculate crisis scenarios. The aim was to use neutral-atom quantum computers to generate a library of optimal network reconfiguration recipes to minimise outages and restore service more quickly. Could quantum computing outperform classical computing when it came to predicting network resilience?

As the algorithm developer, Kipu developed an algorithm to simulate the network’s resilience, identify redundancy gaps and provide optimal configurations. The team then used an analog mode quantum computer with 256 qubits to run the simulations. The results showed that the algorithm proved to be highly efficient and provided accurate resilience measures for the network.

Although this was just an early and limited trial, Oleynik is convinced that further applications exist within telco, and that telco innovation teams should be grappling right now with the implications and opportunities

“If there is no quantum department within a telco, the people responsible for innovation must urgently look into the quantum opportunity. The ones who don’t do this have a risk of falling behind.

“Networking and optimisation problems are one side of it, but you could also do a lot on the consumer side using a quantum computer, where a lot of calculations are needed for estimation where you have a lot of variables and probabilities. Telcos would see business use cases such as risk management, offer management other areas where you can you need to look at different possibilities or perform a lot of calculations.”

Telcos are, of course, already investing heavily in AI models to run on their data just these scenarios. That said, Oleynik said it is still important for those who look after innovation and for telco leadership to start looking at the quantum topic and how this can be useful for them as soon as possible.

“One of the possible ways to go about this is to start exploring the potential use cases of how they can apply quantum in their space, and maybe to already start looking and doing experiments. Involve vendors who could help them compare classical methods against quantum and see where they can gain advantage.”

Timing and sensing

Paul Lipman, Chief Strategy Officer of Infleqtion, says that his company is engaged in two areas of particular relevance to telcos.

One is in providing a means on timing and synch in networks that does not rely on GNSS systems. Infleqtion has developed a quantum atomic frequency clock called Tiqker.

Non-GNSS clocks have uses in areas where GPS is likely to be spoofed or jammed, making them suitable in military applications, but they can also be used to provide redundancy for telcos, especially where regulators are beginning to ask for operators to have a back-up to GPS-related timing.

Lipman proposes that 6G systems will also have higher order timing needs, as radio interfaces climb up the spectrum bands.

“We believe it provides resiliency and forward compatibility to enable these kind of next generation modulation architectures that are potentially going to be part of the 6G environment. So obviously we’re early in that respect to that particular use case, but we believe that these next generation clocks will be really important enabler for that next generation of telecommunication services,” he says.

Infleqtion’s atomic vapour cell

GPS time is based upon caesium atomic clocks, which use atomic vibrations in the microwave portion of the of the spectrum. A quantum atomic clock can vibrate an atom at a much higher frequency than an atomic caesium clock – up to 10,000 time faster in optical not microwave spectrum. That can deliver pico- and even femto-second level timing, Lipman says.

“What you’d see if you opened up one of our clocks is a vapour cell with atomic vapor, in our case it’s rubidium vapor, and a laser that is providing the interrogation of that vapor, and a piece of technology called an optical frequency comb that is taking the resulting signal and then down-converting it to traditional wavelengths that can be manipulated through conventional electronics.”

This has gone from being a lab scale experiment to something that fits in a 3U, rack-mounted device. It has also been demonstrated on board an aircraft, in a trial with BAE and Qinetiq.

A second use case, perhaps more for military use, is in sensing, where Infleqtion has developed a quantum RF (QRF) sensor that is called SqyWire. Here a single atomic cell can detect RF across a wide range of spectrum bands, breaking the relationship between antenna size and signal frequency, giving users the ability to have very small form factor antenas that can detect low level signals with high precision.

The system works by taking a Rubidium atom and exiting the outer electron to a Rydberg state, when it can be tuned to act like a dipole. It is able to be tuned to be extremely sensitive to a particular frequency of interest, “essentially acting like a dipole”, in Lipman’s words.