SUMMARY

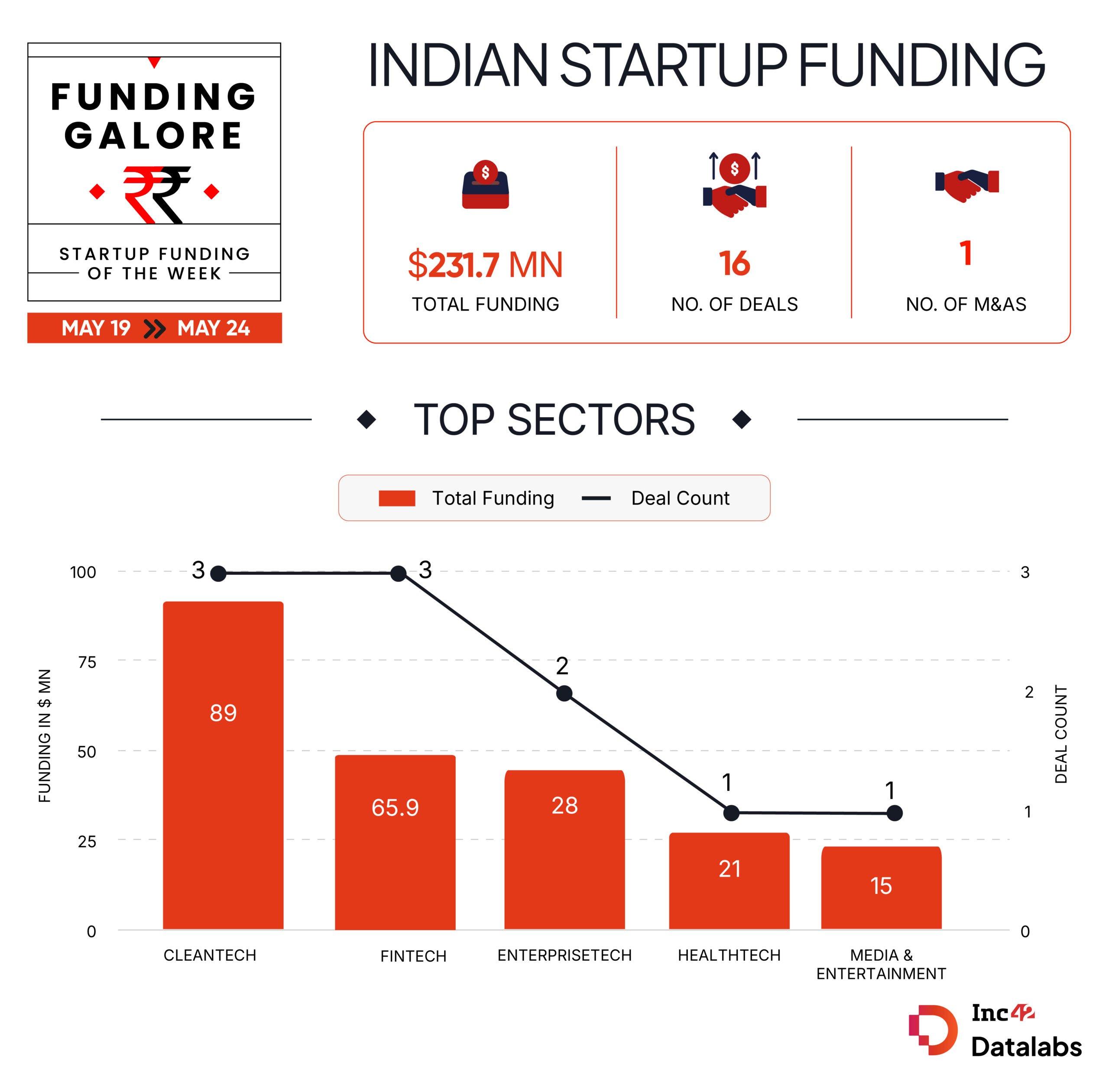

Between May 19 and 24, Indian startups cumulatively raised $231.7 Mn across 16 deals, marking a 53% uptick from the $151.6 Mn raised across 24 deals in the preceding week

While cleantech emerged as the investor favourite sector this week with three startups raising $89 Mn, fintech and ecommerce sectors also three deals materialise this week

UK’s British International Investment emerged as the most active investor this week, backing Euler Motors and CureBay

Investment activity across the Indian startup ecosystem rebounded after a major slump over the past week.

With fresh capital influx and multiple fund launches taking the front seat, startups cumulatively bagged $231.7 Mn across 16 deals between May 19 and 24, marking a 53% uptick from the $151.6 Mn raised across 24 deals in the preceding week.

Besides, startup IPO was among key developments hogging the limelight in the week under the review. With that said, let’s sail through this week’s major developments in the Indian startup ecosystem.

Funding Galore: Indian Startup Funding Of The Week [ May 19 – 23 ]

*Part of a larger round

**Included this week as it was skipped last week

*** Includes both primary and secondary deal

Note: Only disclosed funding rounds have been included

Key Startup Funding Highlights Of The Week

- EV manufacturer Euler Motors pocketed the biggest cheque of $75 Mn this week. On the back of this large-ticket deal, cleantech clinched the top slot in the most funded startup segment this week. Besides, two other startups in the space – Alt Carbon and Promethean Energy – also raised $12 Mn and $2 Mn, respectively.

- At a sectoral level, fintech and ecommerce witnessed a similar number of deals as cleantech this week. While fintech raked in $65.9 Mn across three deals, three ecommerce startups managed to scoop up $6.5 Mn.

- UK’s British International Investment emerged as the most active investor this week, backing Euler Motors and CureBay.

- At the seed stage, although four startups secured $27.6 Mn this week but it was a 7% decline from the previous week.

Fund Updates Of The Week

Startup IPO Developments This Week

Other Developments Of The Week