In 2017, uncertainty struck the US auto industry after President Trump demanded that US automakers start producing “at home” or face a 35 percent tariff. Automakers responded in rapid succession by suspending their expansion plans in Mexico. Ford cancelled the construction of an assembly plant in San Luis Potosí, while General Motors ceased production of the Chevy Cruze in Ramos Arizpe. Companies such as FCA, Toyota, and Volkswagen, among others, have since stopped considering new investments in Mexico.

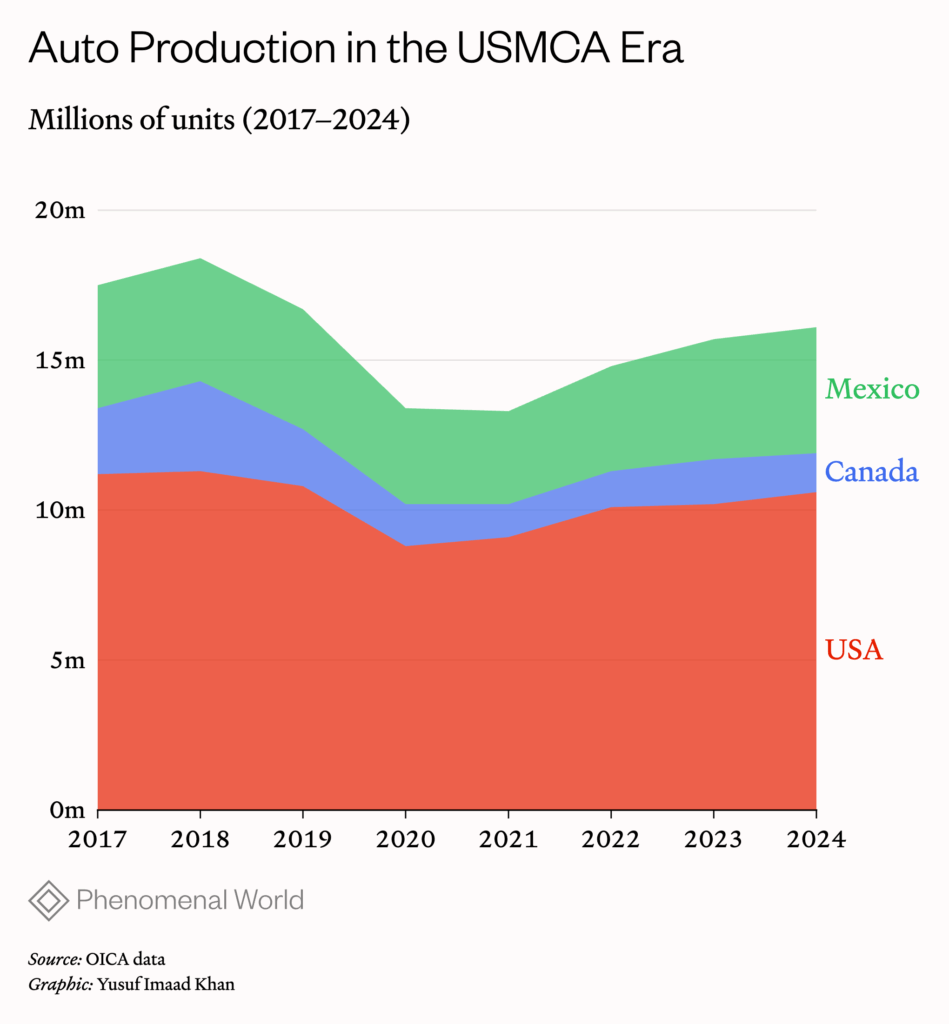

In practice, each corporation made adjustments that allowed them to weather the Trump years without risking their medium and long-term portfolios for the North American region. Trump ended his term in January 2021 claiming to have met his goal of increasing domestic investment and employment. However, in the automotive industry the results were different. US auto production fell by 8 percent in 2017, 1 percent in 2018, 4 percent in 2019, and a massive 19 percent in 2020. Even prior to the pandemic, the Trump administration had accelerated the decline of US industry. The situation extended to employment, as employment declined from 957,100 auto jobs in January 2017 to 949,300 in January 2021. During this period, the North American Free Trade Agreement (NAFTA) was renegotiated, following Trump’s campaign promise to end “the worst trade deal in history,” and replaced by the US, Mexico, and Canada Agreement (USMCA), described by Trump as the “best agreement ever signed.”

Trump’s return to the presidency has triggered renewed uncertainty within the auto industry and beyond, with the recent threat of 25 percent tariffs on cars, steel, and aluminum. This new tariff-based trade policy aims at the world. “Liberation Day,” April 3, which marked the public announcement of new tariffs, targeted 185 countries. China faced a 54 percent tariff, and Europe, Mexico, and Canada faced 20 percent tariffs.)are not reciprocal() were immediately noted. Estimates for the European Community show that the Community’s average tariff is 5 percent and not 39 percent, as Trump claims. It should be noted that at the end of April 2025, it was announced that the projected tariffs for Mexico would be delayed.” class=”footnote” id=”footnote-3″ href=”#footnote-list-3″>3 Trump has suggested that the tariffs will rebalance the US trade deficit in the auto sector, bringing back domestic investment and jobs.

The future of the USMCA—up for review in 2026—and the greater North American auto sector will be decided not only by the long-term structural trends of the industry, but by the role of organized labor. The current energy transition opens up a window of opportunity for organized workers and affected communities to exercise a more fervent political voice.

Transformations in the US automotive industry

Through the auto sector, Trump is seeking to reestablish the “golden age of American capitalism.” In 1950, the United States manufactured 8 million vehicles, 80 percent of the world’s total. It was also the car consumption center of the globe, home to 76 percent of the 50 million cars registered. This leading position was maintained up until the new century, although output and employment declined in each decade. The Japanese emergency, compounded in 1973–74 by the oil crisis, precipitated the end of this golden age. US dominance in auto manufacturing slipped as new competitors entered the stage, first from Central Europe (with Great Britain, Germany, France, and Italy at the forefront) and then from Japan, which emerged as an immense power of techno-organizational efficiency in the industry.

The Detroit Big Three (General Motors, Ford, and Chrysler) were soon listed alongside Volkswagen, Renault, Fiat, Nissan, Honda, and Toyota. In 2000, the United States was still the top producer of automobiles, manufacturing 12.8 million units. By 2017, however, US production decreased by 14 percent, while China’s production had increased by 1,350 percent. China soon commanded leadership of the industry by invoicing 29 million vehicles, 2.6 times more than the United States, representing 30 percent of the total global production and an equivalent amount of the consumer market. In 2024, China’s sales market continued to grow for a record of 31.3 million cars sold.)half() of the global total in 2024.” class=”footnote” id=”footnote-11″ href=”#footnote-list-11″>11

China has also been at the forefront of the automotive energy transition, with a mastery of electric vehicle (EV) technologies and supply chains, including critical minerals. The global EV market in 2024 reached 17.1 million units or 21 percent of total vehicles. The Chinese market accounted for 11 million, or 64 percent, of total EVs produced, a growth rate of 40 percent. The European market appeared in second place in sales with 3 million, and the United States in third with 1.8 million.

Since 2023, China has become the world’s top vehicle exporter thanks to the placement of Chinese EVs in European markets. China dominates the processing of the five critical materials for battery manufacturing, including lithium, nickel, cobalt, manganese sulfate, and graphite. China has also mastered the production of battery cells, as well as lithium-free (sodium-ion) and lithium-iron-phosphate batteries.)()security-sustainability nexus()().” class=”footnote” id=”footnote-13″ href=”#footnote-list-13″>13 With control of basic EV technologies and architecture, low labor costs, and government subsidies, China outperforms its competitors in the West.

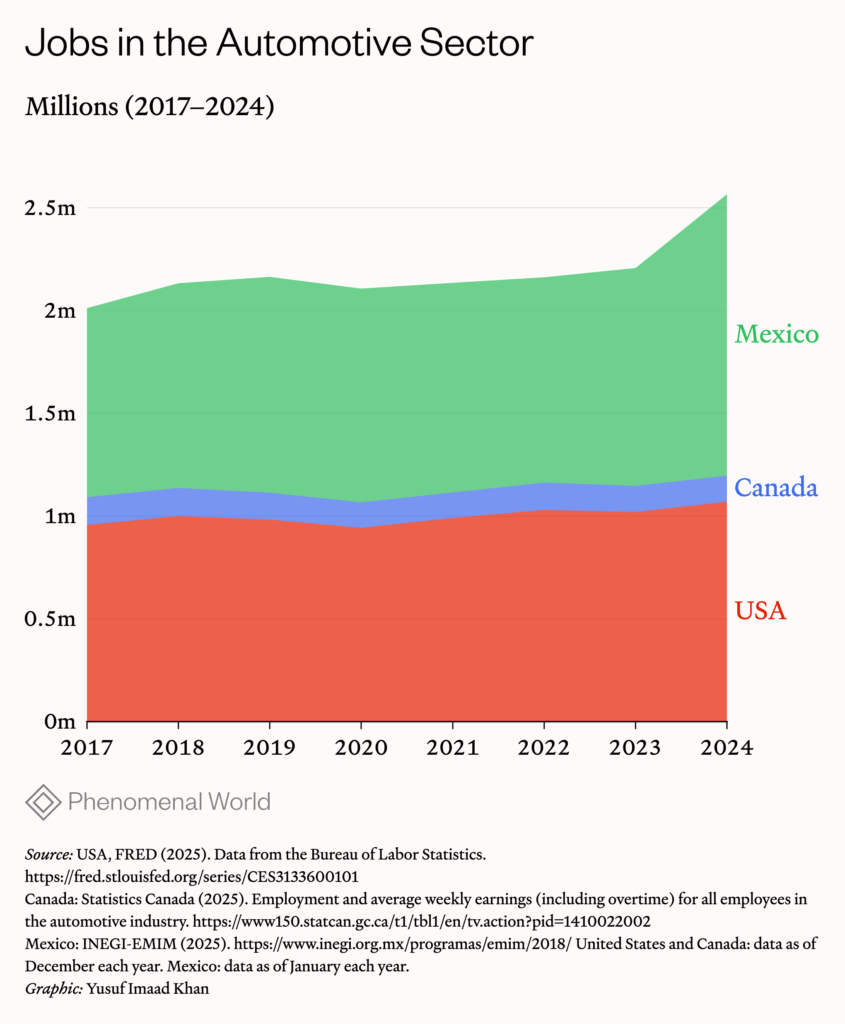

Meanwhile, the geography of automotive production and employment in North America has changed dramatically. Mexico has come to play an increasingly important role in the industry and became the region’s leading employer in the sector.

In the twenty-four years of NAFTA (1994–2018), car production in the region increased by 12 percent. Car production in Mexico, in particular, increased 400 percent, from 800,000 vehicles per year in 1994 to 4 million vehicles per year in 2018. Automotive trade between the United States and Mexico quintupled during the same period, but the United States went from having a surplus of $1.6 billion to a deficit of $64.3 billion. Meanwhile, US-Canada automotive trade has balanced out, with a surplus in favor of the former of $900 million in 2024.

Under NAFTA, auto jobs in the US fell from 1.2 million to 990,000, or by 20 percent, and in Canada they fell from 140,000 to 129,000. On the Mexican side, auto jobs in the sector were multiplied by 11, from 108,000 to 1.2 million by 2018. At the beginning of NAFTA, the United States generated 83 percent of autos in the region, Canada 10 percent, and Mexico 7 percent. By the close of the agreement, the United States was responsible for 43 percent, Canada 5.5 percent, and Mexico 51.5 percent.

The USMCA era

The implementation of the USMCA in July 2020 heralded major changes for the North American automotive industry. A significant provision raised the rule of origin by 12.5 percentage points, meaning that 75 percent of parts and components, and 70 percent of steel and aluminum used in vehicles, needed to originate in North America, with the goal of raising the costs of entry into the regional market for European and Asian producers. The agreement also introduced a labor content rule which established that 40 percent of the value of a vehicle must be produced in plants where workers earn at least $16 per hour. The new agreement also obliged Mexico to modify its labor institutions and adopt a Rapid Response Labor Mechanism (RRM), empowering the United States and Canada to observe and enforce respect for the free organization and collective bargaining rights of Mexican workers. Free access in the North American market is now linked with fundamental labor rights, aiming to strengthen labor enforcement and promote wage growth. Moreover, the changes were meant to prevent Mexico from attracting investment while undermining the basis for fair trade through labor rights violations, which have led to severe wage gaps between Mexican workers and their American and Canadian counterparts.

The adoption of the new labor rights and RRM required a lengthy negotiating process. Amid ongoing protests by the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO) against free trade agreements (FTAs), in 2002 the US Congress directed the president to include mechanisms to promote fundamental labor rights in FTAs. The AFL-CIO and the United Auto Workers International Union (UAW) fought against a reiteration of NAFTA’s labor standards, in which labor compliance was confined to a side agreement. Each new FTA signed by the United States after 2002 introduced increasingly stringent requirements forcing the trade partners to promote labor conditions that strengthened labor institutions.

Until the last moment, Congressional Democrats and labor rights supporters conditioned the signing of the USMCA on the inclusion of the most ambitious labor agenda in Latin America. Thus, the agreement was born as the first of a new generation of labor arrangements for international trade, presenting a model to follow. In addition, the USMCA Implementation Act (H.R. 5430) endorsed the labor position.

This new framework of labor laws and institutions, in addition to the RRM, have granted organized workers more power, albeit with great limitations. Since implementation, thirty-three labor violation cases have been filed through the RRM, most of which have been resolved in favor of the unions claiming free organization and collective bargaining rights.

Four years of the USMCA

The first three years of the USMCA, from July 2020 to May 2023, coincided with Joe Biden’s administration. But effective implementation faced several obstacles. In 2020, the Covid-19 pandemic severely handicapped the industry, prompting a shock that overlapped with the end of the industry’s long expansionary cycle, which began after the 2007–2008 financial crisis and lasted until 2017–18.

In 2020, car production in the region plummeted by 30 percent compared to 2018. By 2024, there was a significant recovery with 16.1 million vehicles manufactured in the region, but still below the 17.4 million of 2018. US production was down 700,000 units from 2018, Canada produced 900,000 fewer cars than in 2017, while Mexico surpassed its 2018 level.

In proportional terms, the United States failed to increase production capacity in the region under the USMCA, maintaining 66 percent of total regional production. Canada lost two points of that production capacity, the same that Mexico captured. Thus, the USMCA did not contain the “leakage” of productive capacity to Mexico.

Mexico employed 53 percent of the region’s auto workers in 2024, three percentage points more than in 2018, the year of its highest production capacity. While Canada lost one percentage point of automotive employment during these years, the United States lost four points.

Autoworker wages in Mexico have increased 1.65 percent per year (8.25 in a five-year aggregate) under the USMCA. Although the country’s new labor institutions and the utilization of the RRM have allowed for more intense union activity with better wage growth, these increases have barely surpassed inflation. Under the USMCA, wages in the Mexican auto industry have gone from $2.30 to $2.50 per hour.

In this sense, the USMCA failed to achieve its wage objective for Mexico. In fact, the wage gap between Mexican automakers and their North American counterparts has widened since the implementation of the agreement. The UAW and Unifor strikes of 2023, undertaken as automakers earned record profits in thirty years (6.6 percent annual average), left average wages at $37 and $43.2 for UAW and Unifor workers, respectively.

Against history

In his second term, President Trump has deployed a tariff policy that challenges the trends of a globally strategic industry. But the recent history of the auto industry does not bode well for the outcome of this shift. Trump was unable to implement the 35 percent tariffs he proposed in his first presidency. The USMCA signed into law by his administration did not stop the loss of productive capacity and employment in the US auto sector, nor did it stop the wage differential for Mexican workers, which continues to incentivize “social dumping” in the industry.

Trump’s tariffs have been most severe on China, raised to 145 percent on April 9, under the belief that competitiveness can be created or ended by imposing tariffs of a magnitude directly proportional to the power of the enemy. Although it is too early to assess the impacts of these measures, recent developments indicate that Trump could fail again. China, we just learned, grew 5.4 percent during the first quarter of 2025. This figure warns that China’s economic health is robust.

Already, Trump’s measures have promoted a trade war which could spur a global recession. China, Europe, and Canada have replicated each US protectionist measures, generating fears of a return to stagflation. Moreover, the dollar has depreciated against other leading currencies, reflecting investors’ expectations and distrust. Stellantis, faced with uncertainty, has cut 900 US jobs and temporarily suspended production at some plants in Mexico and Canada. Trump himself has said that his tariffs with China are not sustainable and recently agreed to lower the ceiling from 145 to 30 percent, as part of a ninety-day truce with China for further negotiations.

The future of the USMCA hangs in the balance. Trump could cancel the agreement, producing grave economic consequences for the region. Or he could decide to promote the North American auto industry and the energy transition under a renewed USMCA. Cross-border coordination could accelerate the manufacturing and commercialization of EVs in the region, and the inclusion of agreements for critical battery minerals exploitation, battery recycling systems, and renewable energy production.

The latter path would require strengthening environmental rights and labor conditions, including enforcement of labor rights throughout the supply chain. This could also help level wages across North America through two “floors”: first, macro-sectoral agreements for the automotive, mining, and energy industries with minimum wages, benefits, and working conditions in place across three countries; second, a labor content rule that 40–45 percent of the value of a vehicle must be produced in facilities where workers earn no less than $16. This is the only way to embark on a path toward a fair and competitive transition in the North American region.