By Scott Hamilton

June 14, 2025, © Leeham News: Embraer’s 20-year market forecast for airliners with 150 seats or less shows a decline in anticipated turboprops and a jet outlook (100-150 jets) about the same as last year’s study.

The study was released days before the Paris Air Show, which begins Monday.

Credit: Embraer.

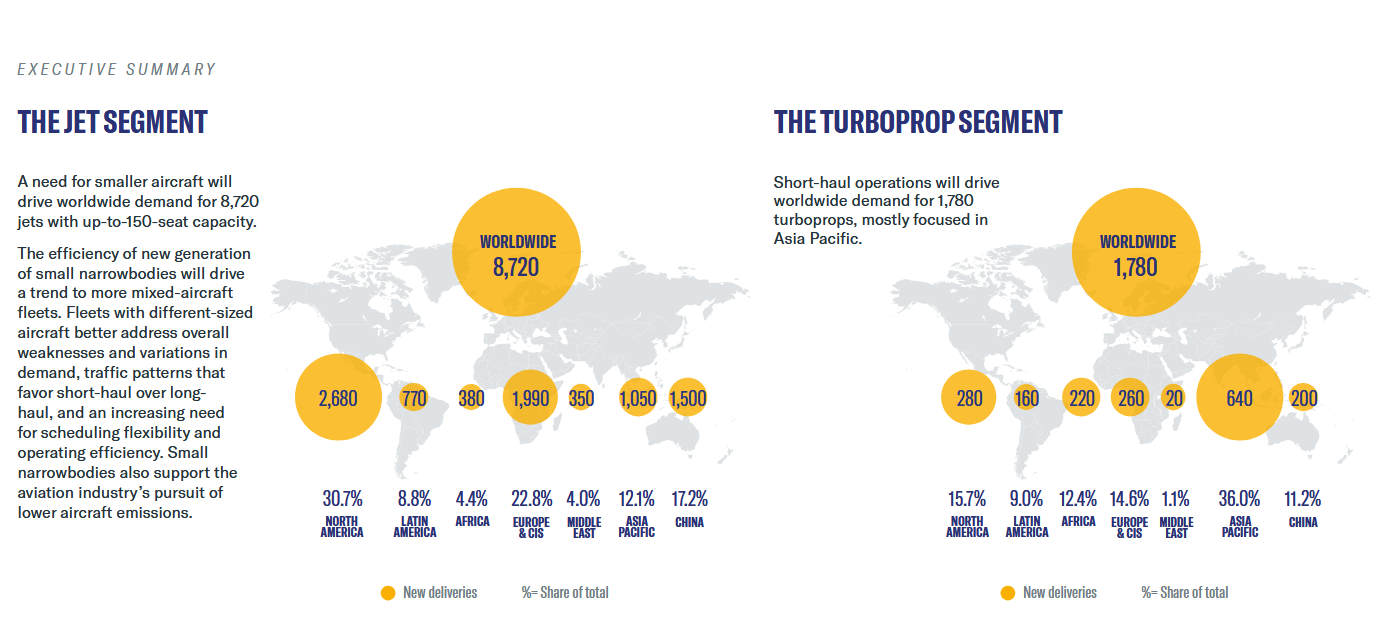

Embraer now sees a demand for 1,780 turboprops and 8,720 jets. Embraer and ATR, now the only new producer of turboprops outside China and Russia, previously forecast a demand for around 2,100 turboprops. A few years ago, Embraer appeared on a path to develop a new turboprop. It shelved the program, stating there wasn’t a new engine available.

Embraer’s current airliner family consists of the 76-seat E-175 E1, the 100-seat E-190-E2 and the 144-seat E-195-E2. Officials publicly acknowledged that Embraer is studying whether to enter the mainline jet segment of 180- to 230 seats.

Small jets still relevant

“Small narrowbody jets, defined as 100 to 150-seat aircraft, are essential in building airline network connectivity in today’s volatile, competitive, and polarized world,” Embraer states in its study.

“A mixed fleet of large and small narrowbodies allows airlines to access every market size, offering the right capacity for every route, and providing the opportunity to add frequencies without introducing excess capacity.

“The small narrowbody segment has become increasingly relevant over the last years. It has proven to be an effective tool for navigating a dynamic environment that seeks growth in secondary markets and flexibility to adjust capacity quickly to changes in demand,” Embraer writes.

Emerging markets, especially in Southeast Asia, helps demand, the company states. Fluid evolution of other markets means airlines should have multiple fleet types of efficient aircraft to efficiently serve these diverse sectors.

Market sizes

Embraer breaks out China for the first time in its forecast. China will lead in annual growth for Revenue Passenger Kilometers and North America (Canada, the USA and Mexico) will lead in jet aircraft deliveries.

“The overall forecast for the number of new sub-150-seat aircraft remains almost unchanged from Embraer’s previous estimate,” Embraer states.

The annual RPK regional growth rate forecast is:

- 7% China

- 7% Latin America

- 4% Africa

- 4% Middle East

- 1% Asia Pacific

- 1% Europe & CIS

- 4% North America

Embraer believes the RPK share by the end of 2044 will be 39% in the Asia-Pacific region.

Related