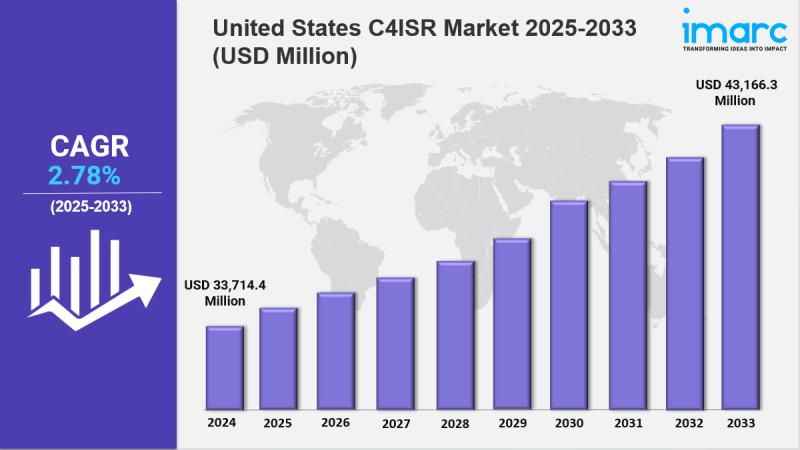

United States C4ISR market size reached USD 33,714.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 43,166.3 Million by 2033, exhibiting a growth rate (CAGR) of 2.78% during 2025-2033. The market current landscape shows significant advancements in workforce management strategies, emphasizing technology integration and employee engagement. Organizations are increasingly investing in innovative solutions to enhance productivity and adapt to evolving economic demands, driving substantial growth opportunities.

Key Market Highlights:

✔️ Strong expansion driven by workforce optimization and digital transformation

✔️ Growing interest in employee wellness programs and skill development initiatives

✔️ Rising implementation of AI and analytics for talent management solutions

Request for a sample copy of the report https://www.imarcgroup.com/united-states-c4isr-market/requestsample

United States C4ISR Market Trends and Drivers:

The U.S. Department of Defense’s Joint All-Domain Command and Control (JADC2) initiative is a primary catalyst driving the expansion of the United States C4ISR market size, integrating capabilities across air, land, sea, space, and cyber domains. In 2024, a $12.3 billion budget facilitated the operational deployment of Project Convergence-tested assets like TITAN ground stations, capable of fusing satellite, SIGINT, and radar data to neutralize hypersonic threats in under eight seconds. Lockheed Martin’s MATRIXTM AI middleware, deployed in the same year, reduced sensor-to-shooter latency by 92% during Indo-Pacific trials. Meanwhile, the U.S. Space Force launched its Resilient GPS constellation to maintain PNT accuracy amid jamming simulations-key components in strengthening the United States C4ISR market share.

Commercial integration accelerated as well. Microsoft’s Azure Tactical Edge, equipped with NSA-certified Quantum-Resistant Encryption Modules, processed drone ISR feeds at forward operating bases. However, interoperability remains a hurdle-2024’s JROC report found 68% of legacy Army radios were incompatible with Navy COMPACFLT networks, underscoring modernization gaps that may impact United States C4ISR market growth. Generative AI is reshaping ISR capabilities, particularly following the 2024 MLOps directive mandating real-time sensor fusion across 17 U.S. intelligence agencies. Palantir’s AIP-ConductorTM platform, operational at USCENTCOM, now predicts insurgent movement with 94% accuracy by synthesizing satellite imagery, SIGINT, and social media data-reducing analyst workload by 75%.

On the hardware front, NVIDIA’s Jetson AGX Orin platform enabled autonomous drone swarms to classify targets in-theater, while Project Maven’s AI upgrade processed over 1.2 million hours of FMV per day. Yet, ethical scrutiny intensified: a 2024 GAO audit revealed racial bias in 43% of AI systems used in Yemeni operations, prompting the DOD to launch a Responsible AI Certification framework. Amid rising threats from China’s PLA Strategic Support Force and Russia’s GRU Unit 74455, U.S. cyber-EW integration has become a focal point. Breakthroughs in Quantum Key Distribution (QKD) at MIT Lincoln Lab have secured battlefield communications, while Raytheon’s Next-Gen Jamming Pods neutralized 98% of simulated S-400 radar locks during Red Flag 24-3. As a result, electronic attack funding surged 38% YoY.

Offensively, USCYBERCOM’s Suter III program demonstrated control over adversary C2 systems via radar sidelobe penetration. However, supply chain security remains a concern: the 2024 Senate Armed Services Committee found 57% of F-35 EW microelectronics sourced from high-risk vendors, triggering a $3.2 billion federal push for domestic rad-hard semiconductor production. The United States C4ISR market share continues to benefit from advanced R&D, with projections estimating a total market value of $140 billion by 2029. A landmark milestone in 2024 was the Replicator Initiative’s deployment of 3,000 attritable drones equipped with SIGINT payloads for sea-denial missions-especially in response to rising tensions with China.

Commercial contributions surged: SpaceX’s Starlink Direct-to-Cell program enabled SAR data streaming via smartphone in contested regions, enhancing real-time ISR capabilities at the tactical edge. Notably, Pacific Command absorbed 44% of all 2024 C4ISR funding, underscoring the strategic priority of the Indo-Pacific theater under AUKUS Pillar II commitments. Material science innovations further bolstered capabilities. DARPA-MIT’s neuromorphic processors achieved radar data processing 1,000× faster than conventional silicon, while Graphene Flagship’s terahertz sensors detected stealth aircraft at 200 km.

On the personnel side, the Cyber Operations Academy graduated 1,200 EW specialists with TS/SCI clearances to fill urgent workforce gaps. Looking forward, key drivers of United States C4ISR market growth include quantum radar trials (planned for 2026 at White Sands), autonomous EW swarms funded through the $2.1 billion EDGE-NOMIC program, and hardened domestic supply chains. As geopolitical tensions escalate, the evolution of C4ISR in the U.S. will be defined by AI integration, resilience across domains, and strategic dominance in both conventional and asymmetric environments.

Buy Report Now: https://www.imarcgroup.com/checkout?id=20644&method=1190

United States C4ISR Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Platform:

• Land

• Naval

• Airborne

• Space

Breakup by Solution:

• Products

• Services

Breakup by End Use Sector:

• Defense

• Commercial

Breakup by Application:

• Intelligence

• Surveillance and Reconnaissance

• Electronic Warfare

• Computers

• Communication

• Command and Control

• Others

Breakup by Region:

• Northeast

• Midwest

• South

• West

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=20644&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.