Peel Hunt has warned that the exodus of companies from the London stock market is causing a ‘significant challenge’ to the economy.

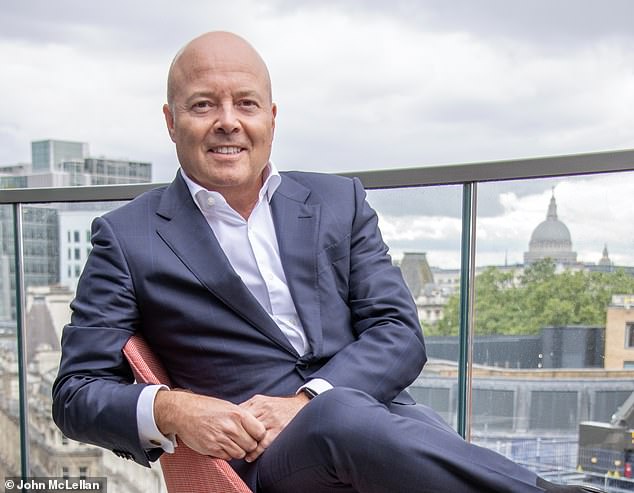

The investment bank’s boss Steven Fine said more companies could be hoovered up by private equity firms in the months to come despite signs of a pick-up in UK valuations.

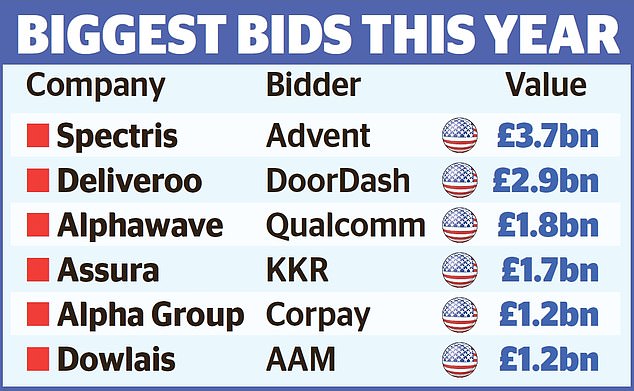

London has seen 30 of its listed firms subjected to takeover bids so far this year with few signs of any revival in initial public offerings (IPOs) that will be needed to replace them.

And in the past couple of weeks, the decision of fintech Wise to abandon London in favour of New York as well as the takeover sagas engulfing the likes of Alphawave and Spectris have added to the impression that the cheap valuations of the London market have left UK-listed firms vulnerable.

Metro Bank this weekend became the latest subject of takeover speculation.

Shareholders in takeaway platform Deliveroo yesterday voted to accept its £2.9billion takeover by US giant DoorDash.

Threat: Peel Hunt boss Steven Fine (pictured) said even more companies could be hoovered up by private equity firms in the months to come.

The IPO weakness has weighed on City firms such as Peel Hunt, which yesterday reported that pre-tax losses for the year to the end of March had widened to £3.5million from £3.3million a year ago.

A spokesman said: ‘The increasing rate at which companies are exiting the London market presents a significant challenge for the UK economy.’

Fine added: ‘You either believe in public markets – that they do good, in transparency, disclosure, investability, liquidity, they pay more tax, they employ more people, the large companies always start small – or you don’t.’

Peel Hunt reported that market activity during its past financial year was hit by economic fears and tariff uncertainty but that the new period has ‘started more positively’ as the Trump administration signed a trade deal with the UK and the Bank of England cut interest rates.

Fine, meanwhile, warned there could be more private equity swoops to come. He said: ‘I don’t think that’s going to stop, even though the market is re-rating a little – there is still a strong perception out there that the UK is cheap – relative.’

He lamented reports over the weekend that Australian bank Macquarie may swoop for three of Britain’s small airports.

‘Why are we selling to an Australian infrastructure fund?’ he said. ‘They’re so cheap, they’re such good value. Why don’t we care here?’

Fine believes that there is a ‘recognition’ now in government that ‘this is a bit excessive’.

‘London is a global financial centre – it should be a global financial centre,’ he said.

Companies to have quit London in recent months include building materials firm CRH, gambling giant Flutter, and equipment hire group Ashtead.

Barbarians’ bid battle

A Private equity titan is locked in two bidding wars for London-listed firms.

New York giant KKR – which featured in the book and film Barbarians At The Gate – is battling it out for scientific instruments maker Spectris and GP surgery owner Assura.

KKR has seen two offers rejected by Spectris, which last week said it was ‘minded’ to back a £3.7bpillion bid from rival private equity house Advent International, sending its shares soaring.

Spectris shares rose another 5.8 per cent yesterday on hopes the bidding war will escalate.

As well as battling Advent for Spectris, KKR was in pole position to buy Assura after the NHS landlord’s board last week backed a £1.7billion offer.

But yesterday Assura said it would also look at an improved offer from rival Primary Health Properties.

DIY INVESTING PLATFORMS AJ Bell

AJ Bell AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine InvestEngine

InvestEngine

Account and trading fee-free ETF investing

![]() Trading 212

Trading 212![]() Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

Share or comment on this article:

London exodus is hurting economy: Peel Hunt boss sounds alarm amid takeover frenzy