- XRP is poised for a breakout from a descending channel, bolstered by renewed risk-on sentiment.

- Large-volume holders and institutional investors continue to show interest in XRP despite fluctuations in price and geopolitical tensions.

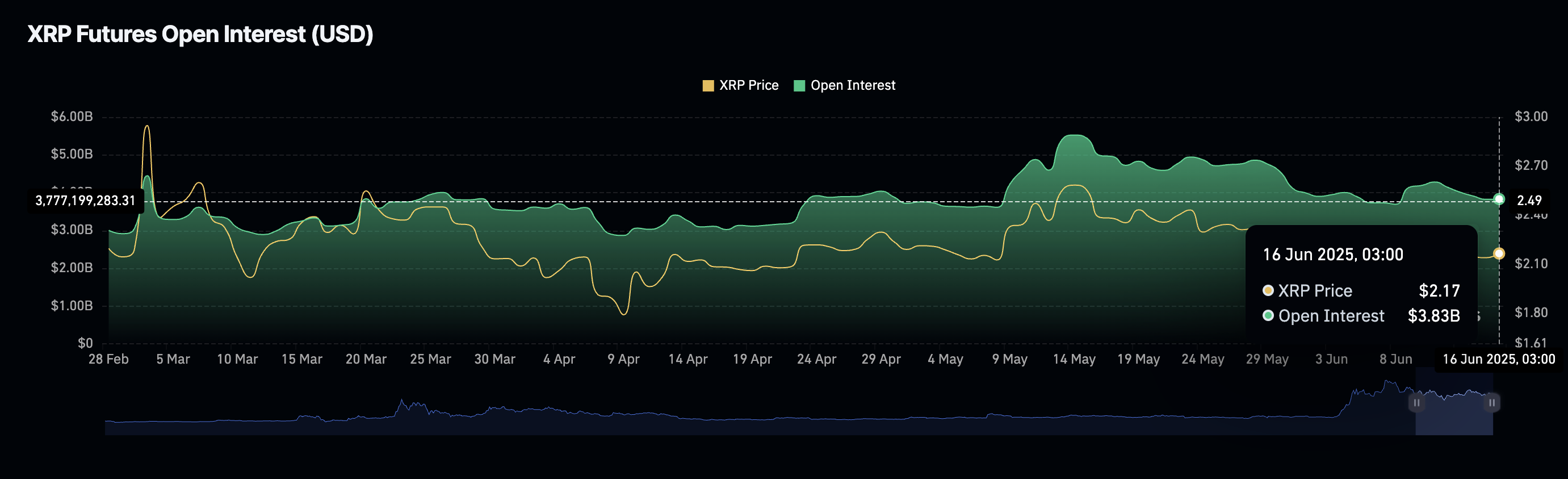

- XRP futures open interest remains steady at $3.83 billion, largely maintaining a downtrend outlook that is likely to hinder interest in the token.

Ripple (XRP) flaunts a short-term bullish outlook as part of the recovery from the sell-off encountered last week after Israel launched attacks on Iran, escalating geopolitical tensions in the Middle East. Meanwhile, XRP hovers at around $2.28 at the time of writing on Monday, rising by over 5% on the day.

Other major assets, including Bitcoin (BTC) and Ethereum (ETH), offer bullish signals amid optimism for a ceasefire between Israel and Iran.

XRP extends gains amid steady risk appetite

Interest in XRP is growing despite heightened volatility due to tensions between Israel and Iran. Large volume holders, with between 1 million and 10 million XRP, continued to buy XRP despite macroeconomic and geopolitical tensions.

According to Santiment, this investor cohort currently holds 9.9% of XRP’s total supply, up from 9.5% on May 1 and 8.24% recorded on January 1.

[16-1750085336436.21.21, 16 Jun, 2025].png)

XRP Supply Distribution metric | Source: Santiment

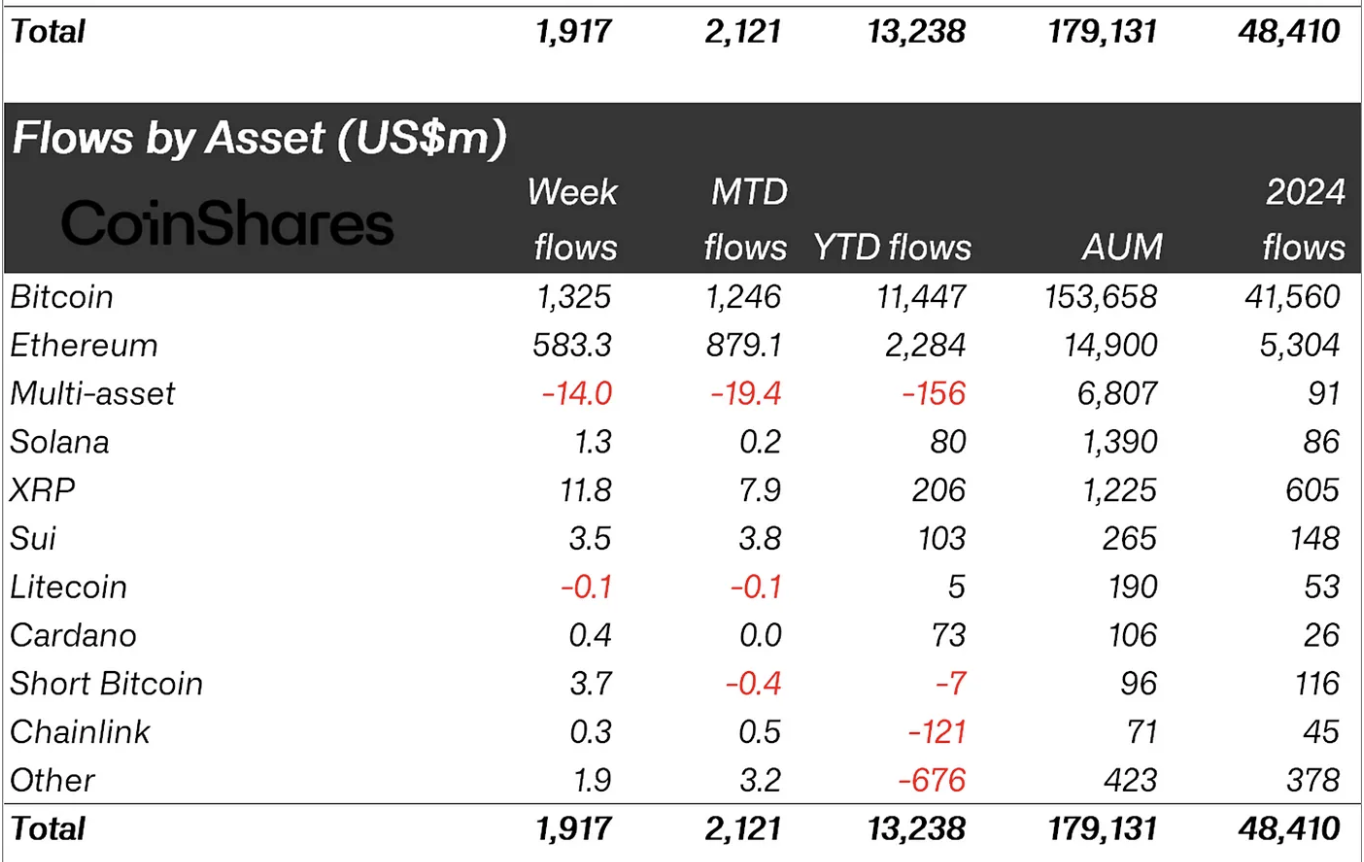

The persistent increase in risk-on sentiment among large volume holders mirrors CoinShares’ weekly digital investment report, which highlights inflows of approximately $11.8 million in XRP-related financial products last week.

“Regional sentiment was positive, led by the US (US$1.9bn), while altcoins like XRP (US$11.8m) and Sui (US$3.5m) also saw renewed investor interest,” CoinShares weekly report highlights.

Weekly digital asset inflows | Source: CoinShares

Meanwhile, interest within the microenvironment is showing signs of consolidation, with the XRP futures Open Interest (OI) steady at around $3.83 billion. From the chart below, OI is sideways but upholds a general downtrend from the recent peak at $5.52 billion, reached in mid-May.

OI refers to the number of futures and options contracts that have yet to be settled or closed. Steady OI suggests that interest in XRP is growing, with traders likely betting on potential price increases in the future.

XRP futures open interest | Source: CoinGlass

Technical outlook: XRP is on the cusp of breakout

XRP’s price rises, hovering around $2.28 at the time of writing. The upswing follows the establishment of support at $2.09, bolstered by the 200-day Exponential Moving Average (EMA).

Key indicators, including the Relative Strength Index (RSI) and the Moving Average Convergence/Divergence (MACD), provide bullish technical signals. The RSI’s return above the 50 midline implies bullish momentum, likely to keep the price of XRP steady in upcoming sessions.

The MACD indicator will likely validate a buy signal if the blue MACD line crosses above the red signal line. Traders can also monitor the indicator’s movement, with recovery toward the mean line alongside the expansion of green histogram bars, potentially triggering a breakout from the descending channel, as illustrated on the daily chart.

XRP/USDT daily chart

A convergence of the 50-day EMA and the 100-day EMA at $2.25 serves as short-term support. Traders would look for a daily close above this level to validate the strength of the uptrend. Meanwhile, breaking above the descending channel resistance could boost momentum as volume surges.

Key areas of interest going forward will include $2.65, a seller congestion 17% above the current level, and the elusive target at $3.00, representing a 32% move above the prevailing market value.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023:

For institutional investors or over-the-counter sales, XRP is a security.

For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token.

While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at.

Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say.

Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation.

While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.