Milk production

GB

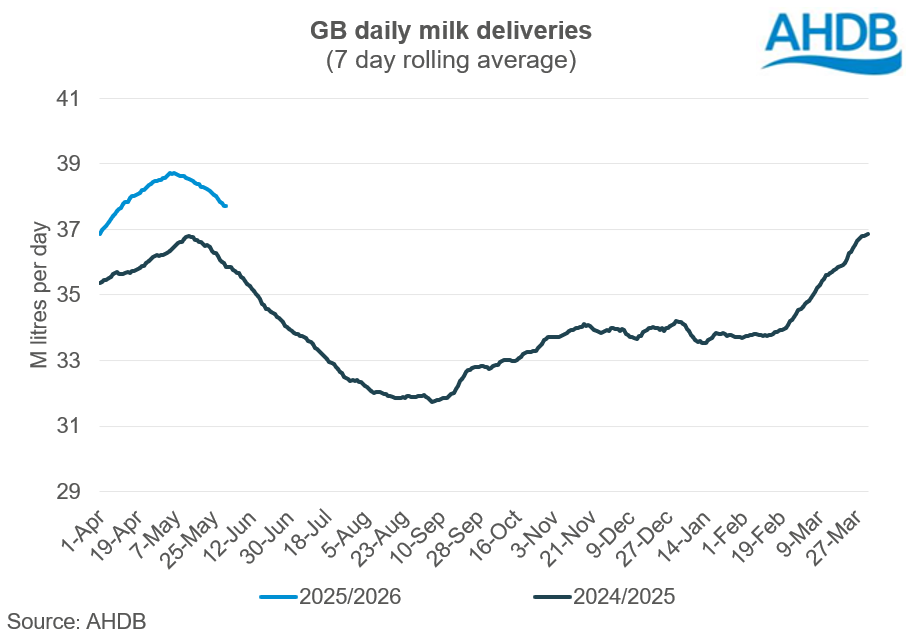

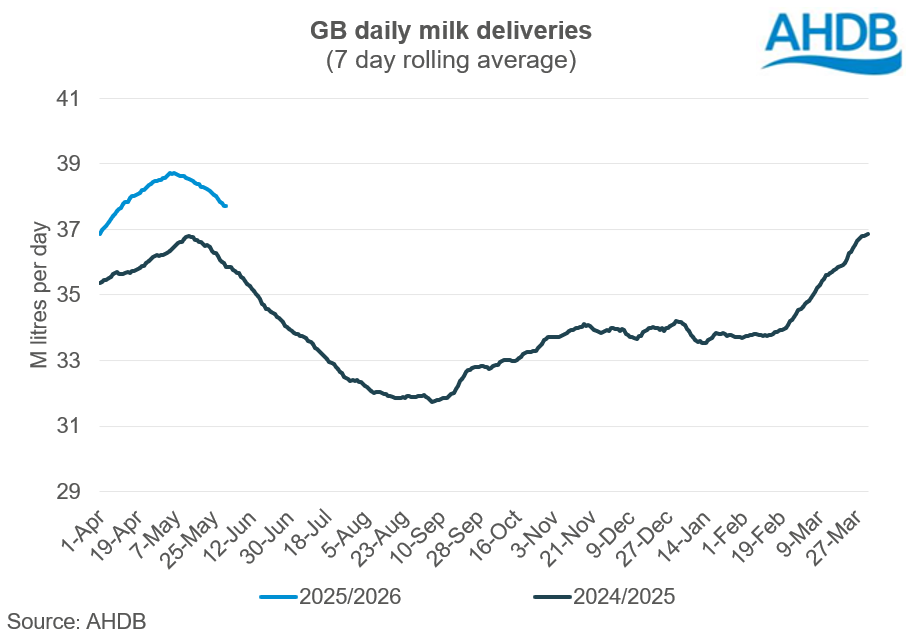

GB milk deliveries are estimated to have totalled 1,186 million litres in May, up 5.2% compared to the same month last year. Daily deliveries averaged 38.27 million litres.

This season’s spring flush has been supported by favourable weather and dairy economics, reaching a peak of 39.01 million (m) litres on 4 May, the highest volume on record.

Following a wet year, the Met Office reported below average rainfall throughout spring. Some rain at the back end of May helped the situation and grass growth has picked up but the June heat wave will not have helped matters, which could limit forage stocks for later in the year.

The milk to feed price ratio remains firmly in the expansion zone and milk price announcements for June have remained fairly stable, despite high milk volumes. Meanwhile, lower milk volumes on the continent in spring and low stocks of butter continue to support commodity prices.

Organic milk production has been in strong recovery this year, recovering to 2023/24 levels. This is in response to better weather and milk prices and recovering consumer demand. We have taken a look at the organic dairy market here.

AHDB have adjusted the milk production forecast for the 2025/26 milk year to record a new high at 12.83bn litres, 3.1% more than the previous milk year, according to our June forecast update. This is an upwards revision from the previous forecast by 1% due to economic and weather-related factors.

Strong growth in production is despite low cow numbers. As of 1 April 2025, the latest BCMS data shows that the GB milking herd stood at 1.62 million head, a decline of 0.9% year-on-year. This is the lowest April figure recorded.

Youngstock numbers (under two years of age), continued to decline for the ninth quarter. This was the largest category drop, down by 19,000 head from a year ago. The 2–4 years age category showed a similar decline of 16,000 head. This low supply of youngstock raises concerns about sourcing heifer replacements at accessible prices. Bluetongue spread and increased use of beef semen could impact herd size over the coming years.

A growth in autumn block calving will have intensified the trend towards higher production in the autumn. According to analysis by AHDB utilising BCMS data, the share of GB farms in 2024 running any type of block calving system has risen to 19.6%, while the number of farms running an all year round (AYR)* system remained fairly steady at around 35%. Autumn* block calving moved up 1.8 percentage points from 2021 to 7.2% of total farm numbers in 2024. This movement has exaggerated the peaks and troughs in the seasonal birthing profile of the GB dairy herd.

Global

The latest global production data tells a different story. Accounting for the leap year in 2024, milk deliveries are picking up slightly year-on-year, tipping into growth after a flat month. The EU saw a decline of 0.4%, which is an improvement from the 2.3% losses seen last month. Reports are that BTV is now beginning to slow down on the continent with fewer cases reported. Ireland and Poland continue to grow strongly. US production saw growth of 0.9% with Australia flat and New Zealand up 2.0mn litres per day. Argentina’s production has been recovering strongly (+15.9%) compared to the weakness seen in 2024.

Rabobank expect the key exporting regions to see modest growth in production in 2025 driven by growth in the EU and US. However, the EU was expected to grow by 0.5%, which could already be at risk given the impact of BTV seen so far. Rabobank are expecting 1.0% growth in 2025 and only 0.3% in 2026 with some headwinds emerging from a downturn in global demand and some trade disruption factors including tariffs.

Wholesale markets: May

Overall, the market was noted to be reasonably stable with some downward pressure in spite of soaring milk volumes. Most commentators noted that product demand had seen little change month on month as peak milk production was reached.

Bulk cream prices took the largest hit month on month, with the average price down £87/t in May. Weekly movements were reported as consistently lower as soaring milk production has led to an abundance of cream availability. Alongside this, it was said that demand has been patchy as processing capacity struggled to keep up with volumes.

Average butter prices continued to hold firm, making a marginal gain of £10/t month-on-month with the range in prices tightening significantly during this reporting period. Despite the strength recorded in milk volumes, butter stocks remain tight with demand generally reported as stable month on month. It was noted that the closure of a large facility for maintenance put additional pressure on processing capacity.

SMP continued to ease, with the average price edging down £10/t on average in May. As with butter, the range in prices was very narrow with a little weekly fluctuation driven by demand. Overall, the market was said to have seen little change month-on-month.

Mild cheddar markets this month came under pressure at the end of reporting period, driving the average price lower month on month by £70/t. Availability was reported as good and comfortable while was demand still subdued but steady. However, it was noted that many traders are watching European milk production closely as continental cheese supply is tight.

Farmgate milk prices

The Fair Dealing Obligations Milk (FDOM) regulations will come into force on 9 July and all milk contracts must be compliant by this date. The Agriculture Supply Chain Adjudicator (ASCA) are the body which has been set up to police the new milk purchase contract rules and have set up a mailbox to raise concerns about milk contracts.

Contact ASCA: asca@defra.gov.uk

The latest published farmgate price was for April with a UK average milk price announced by Defra as being 43.69, down 1.18 pence (2.6%) on the previous month.

Latest announced farmgate prices were fairly steady for June.

On retail aligned liquid contracts, most buyers on the AHDB league table held their prices from the previous month. The exception to this was Sainsbury’s, which made a positive price announcement of 0.06ppl.

Looking to non-aligned liquid contracts, most buyers held steady for the month after having seen some cooling off the previous month. Crediton Dairy held steady for the fifth consecutive month. Freshways and Payne’s Dairies held on to their price after a decline of 2.0ppl each the previous month. Muller’s price has been stable since December. Pembrokeshire Creamery was the only one in the category to reduce their price by 0.12ppl.

Cheese contracts were steady except for two buyers on the AHDB League table. First Milk Manufacturing and Belton Cheese lowered their price by 0.50ppl and 1.00ppl respectively. Apart from those, Barbers have been stable since April and Saputo held their price for the eighth consecutive month. Leprino, Lactalis, South Caernarfon Creameries and Wyke Farms also made no changes for another consecutive month.

Manufacturing contracts were also stable. Meadow held on to their price for the second consecutive month. Pattemores Dairy have made no changes to their price since last seven months. UK Arla Farmers Manufacturing remained steady for the month.

Trade

Total export volumes of dairy products from the UK for Q1 2025 are down year-on-year. However, they are higher compared to the last two quarters. Exports of dairy products to the EU declined by 24,000 t whilst increasing by 7,200 t to non-EU nations.

This was largely driven by a decline in exports of milk and cream which fell by 24,300 t (10.9%). There was also a decline in exports of cheese and curd of 3,300 t (6.4%) and a marginal decline of yoghurt exports by 400 t (3.9%).

In comparison, powders, whey and whey products and butter exports continued to grow year-on-year. Exports of whey recorded a new five-year high. Powders saw the biggest year-on-year increase, up by 5,300 t: bound for non-EU nations such as Asian countries (Pakistan, Malaysia, Indonesia, Bangladesh), Algeria and the United Arab Emirates. This was followed by exports of whey and whey products, which increased by 3,600 t and butter by 2,200 t during the period. Exports of powder picked up year-on-year after declining in the second half of 2024.

Though overall exports to the EU declined, they constituted around 90% of total UK exports. Ireland, Netherlands, France, Belgium, Germany and Poland are the major recipients. In Q1 2025, exports to France increased by 30% to 10,000 t, Germany increased by 80% to 5,400 t and Poland increased by 16% to 3,900 t. Conversely, exports to Ireland declined by 11% to 221,000 t, Netherlands declined by 7% to 20,100 t and Belgium declined by 14% to 7,300 t. Exports to non-EU countries like Morocco, Saudi Arabia, and some Asian and African countries also declined during the period.

The recent series of announcements by US President Donald Trump regarding new tariffs on imports has sent ripples through global trade markets. A new US/UK trade deal should help matters but at the time of writing detail on arrangements for dairy specifically remain scant.

More positively the new arrangements regarding SPS with the EU should help to ease trade frictions and has been welcomed.

Retail performance

During the 52 weeks ending 17 May 2025, volumes of cow’s dairy declined by 1.0% year-on-year (NIQ Homescan POD, Total GB). Spend on cow’s dairy increased by 3.0% year-on-year, due to a growth in average prices of 4.0%.

Cow’s milk volumes continued to decrease, seeing a 2.4% year-on-year (NIQ, 52 w/e 17 May 2025) with a corresponding decline in spend of 2.1%, driven by a decline in in frequency of purchase and volumes purchased per trip. Volume declines were seen for semi-skimmed, skimmed and other cow’s milk (including channel island and 1% fat milk), while whole milk continued to see volume growth (+2.3%) due to an increase in shopper numbers.

Cow’s cheese remained in volume growth, up 3.4% year-on-year, and spend during the period increased by 2.9%, (NIQ, 52 w/e 17 May 2025). Cheddar, which represents 41.5% of all cow cheese volumes, saw a 4.3% increase in volumes. Almost all cow cheeses saw year-on-year volume growth, apart from British regionals and processed, which saw a 4.1% and 1.6% decrease in volumes purchased, respectively.

Cow’s butter, at a total level, experienced a 2.3% decline in volume but a 5.4% increase in spending, which was driven by 7.9% increase in average price paid (NIQ, 52 w/e 17 May 2025). Block butter, however, continued to see volume increases of 6.6%, driven by an increase in shopper numbers and an increase in shopper frequency of purchase. Cow butter spreads, which represent 69.1% of all cow’s butter, saw a volume decrease of 5.8%. Plant-based spread volumes also continued to increase (+1.4%) despite a decrease in shopper numbers. However, those shoppers who remained made more frequent purchases, likely due to a 3.7% decrease in average prices paid.

Cow’s yoghurt, yoghurt drinks and fromage frais volumes continue to see growth (+5.8%), with spend increasing by 8.7% (NIQ, 52 w/e 17 May 2025). All segments saw volume growth during the period, apart from fromage frais (-11.1%). Cow’s fat free yoghurt saw the greatest actual growth with an additional 12.1m kilos purchased year-on-year (+8.1%), while cow’s standard plain yoghurt saw the fastest growth of 23.1% year-on-year.

Cow’s cream volumes experienced a 1.7% increase year-on-year, driven by increased frequency of purchase and increase in volume purchased per shop (NIQ, 52 w/e 17 May 2025). Clotted (+3.1%), double (+4.7%) and sour cream (+5.5%) all experienced volume growth and drove overall cow cream performance.

See the full data and these insights visualised on our GB household dairy purchases retail dashboard.