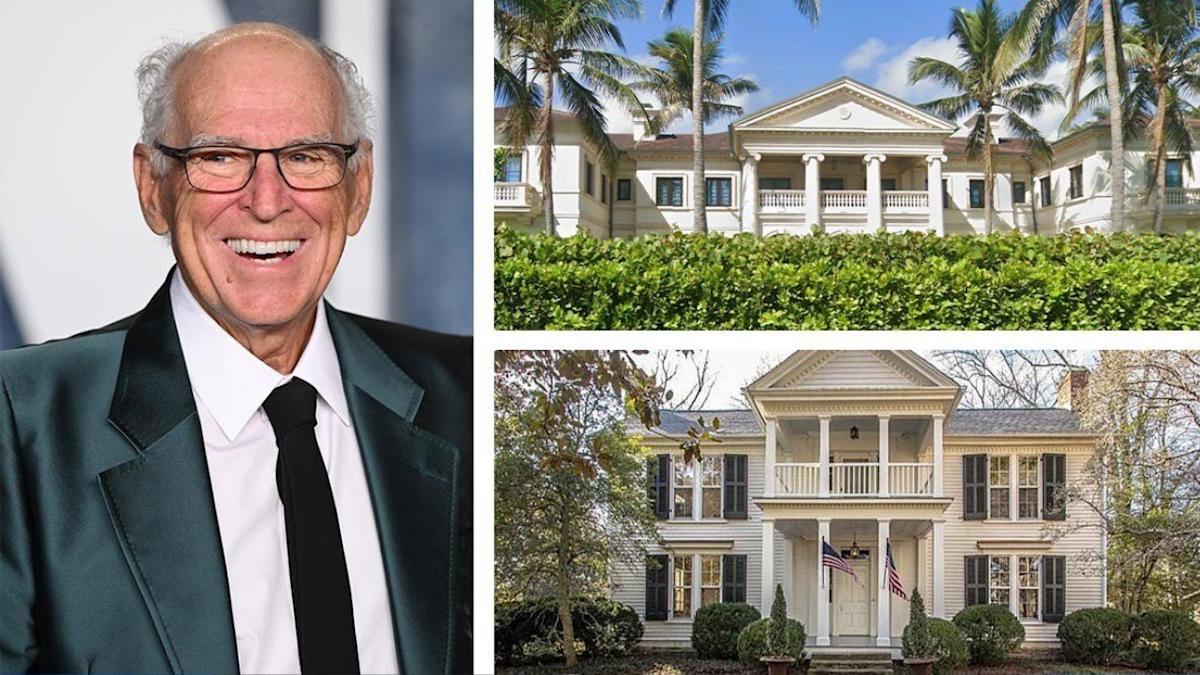

The ongoing litigation surrounding Jimmy Buffett’s $275 million estate is underscoring how, even with a carefully established will and trust, issues can still arise.

CNBC reported that Buffett’s widow, Jane, recently filed a petition “to remove her co-trustee, Richard Mozenter, from the marital trust created to support her after the singer’s death in 2023.”

Jane Buffett is alleging that the co-trustee is “mismanaging the trust and not acting in her best interests, including allegedly withholding financial information from the family,” according to the New York Post.

Meanwhile, Mozenter also filed a lawsuit against Buffett’s widow, alleging she had been “completely uncooperative,” according to CNBC.

While not everyone has Buffett’s fortune, this legal battle matters to everyday homeowners.

In a recent report, Cerulli Associates found that the so-called “Great Wealth Transfer” will amount to an astonishing $105 trillion being transferred to heirs by 2048; and with trillions in assets set to transfer from boomers to their heirs in the coming decades, these high-profile cases offer essential lessons in estate planning, family communication, and legal clarity.

“The legal battle over Jimmy Buffett’s estate is a master class in why estate planning is as much about managing family dynamics as it is about managing assets,” says Jake Howell, a California estate planning attorney and founder of Howell Estate Planning.

He adds that while the $275 million figure is staggering, the underlying issues are universal.

“For the average American family, whose primary asset is their home, the lessons are arguably even more critical because there is far less room for error. A dispute can easily consume a family’s entire inheritance,” Howell adds.

Monique D. Hayes, partner with DGIM Law, echoes the sentiment, noting that for many Americans, the bulk of their wealth is represented by equity in their primary residence (homestead).

“To the extent families intend to transfer that wealth to the next generation, it’s important to do so in a way that minimizes taxes, the need for probate, and internal disputes,” she says. “High-profile cases often highlight the consequences of the failure to plan and implement a strategy to preserve wealth.”

Jimmy Buffett’s estate drama is a window into America’s inheritance future

Buffett’s estate battle reportedly centers on the fact that the two co-trustees are not seeing eye to eye and are petitioning to have each other removed as co-trustees.

CNBC reported that Buffett’s will directs “his assets be placed in a marital trust for Jane.”

Their three children are “so-called remainder beneficiaries of the marital trust, which means they will receive any remaining assets left after Jane’s death.”

The late singer also appointed a co-trustee, Mozenter, who was his accountant.

Now, Mrs. Buffett’s complaint alleges that the majority of her net worth is “controlled by someone she does not trust, and to whom the trust for her benefit must pay enormous fees—more than $1.7 million in 2024 to him and his firm—no matter how badly he treats her,” according to the petition.

Meanwhile, Mozenter alleges in his lawsuit that he was a “trusted financial adviser” to Buffett for several decades, and that the singer had “expressed concerns about his wife’s ability to manage and control his assets after his death,” per The New York Times.

Steve Sexton, CEO of Sexton Advisory Group, notes that this case highlights the importance of clear communication in family trusts, regardless of an estate’s size.

“Despite planning and having the right estate planning structures in place, it seems Buffett’s wife, Jane Buffett, and Richard Mozenter, co-trustee of the estate, did not see eye to eye on details of the trust, leading to bad blood and a lengthy litigation process between the two,” says Sexton.

He notes that while we don’t know whether Buffett attempted to mitigate these issues before his passing, the key takeaway is that it’s essential to communicate the details of your trust to your loved ones and ensure they’re aware of any co-trustees and their roles in advance.

“Failing to execute on this critical step can result in drawn-out arguments, litigation, and unforeseen expenses years after you pass,” he says, adding that the case also highlights the importance of choosing the right trustee.

What Jimmy Buffett did right—and why you should, too

Despite the legal battle, Buffett did several things right when planning his trust.

Ana Mineva, co-founder of DGLegacy, an AI-driven digital legacy planning and inheritance app, explains that when one of the partners is not financially proficient, the high earner typically sets up a trust or family trust to protect their assets and loved ones.

She adds that Buffett did exactly what he should have done: He made an estate plan, he used a family trust to shield assets from probate, and he named trustees to ensure long-term management.

“These are solid, basic steps that everyone—regardless of wealth—should consider. A family trust can be incredibly effective, especially for homeowners, if the assets are properly titled, trustees are selected wisely, and beneficiaries understand the setup,” Mineva says.

And, as Sexton notes, most people think all they need to ensure a smooth transfer of wealth is a will but do not realize that their estate will still go through the probate process without a trust. He says Buffett also likely had his family’s privacy top of mind; since wills can become public record during the probate process, trusts can offer more privacy and flexibility overall.

Where Buffett’s estate planning went wrong

Despite having taken these steps, Buffett’s estate planning still went wrong.

The widow lacked transparency and awareness about the assets under the family trust, which raised questions and uncertainty, says Mineva. As for the other co-trustee, he appears to have refused to share key financial information about the grantor’s estate and has not collaborated efficiently with the beneficiary and co-trustee.

“This led to litigation and emotional strain for the family,” Mineva adds. “Unfortunately, this appears to be common—even when perfectly drafted legal documents are in place.”

Fortunately, steps can be taken to avoid these issues, she says:

-

Selecting trustees who are competent, empathetic, and trusted by the beneficiaries

-

Avoiding co-trustee deadlocks by defining clear roles or adding neutral tie-breakers

-

Implementing digital legacy planning and inheritance solutions that ensure beneficiaries are informed about the assets in the family trust without requiring difficult, emotional conversations during life

-

Maintaining a regularly updated inventory of assets, accessible at the right time

“The high level of trust placed in the trustee—and limited confidence in the surviving partner’s financial literacy—may have laid the foundation for challenges in managing the trust,” Mineva says.

How to avoid dueling trustees and prepare for the ‘Great Wealth Transfer’

Fortunately, there are several ways for people to anticipate these issues and avoid litigation.

As Howell explains, the twin pillars of a successful plan are clarity and transparency, and when a well-funded estate plan ends up in litigation, it’s almost always due to a failure in two key areas: clarity in the legal document and transparency with the family.

“The Buffett case appears to be a textbook example of this breakdown,” he says.

The clarity breakdown

This, as Howell puts it, is the “legal pillar.” Clarity is about the precision of the trust document itself: It must be an unambiguous instruction manual for your trustee. When it’s not, disputes are inevitable, he says.

In addition, he notes that a primary source of conflict is the tension between an income beneficiary (often a surviving spouse who receives income like dividends or rent) and remainder beneficiaries (often children who inherit the core assets later).

“Their interests are diametrically opposed. Maximizing income for one can mean depleting the growth of the inheritance for the other. Without crystal-clear instructions from the trust’s creator, the trustee is caught in a family tug-of-war,” he says.

Finally, be aware of vague language. Phrases like “distribute assets fairly” or “provide for my spouse’s comfort” are invitations for a lawsuit, Howell says.

“Each beneficiary will interpret that language to their own advantage. The plan must be radically specific about who gets what, when, and how,” he adds.

The transparency breakdown

This is the “human pillar,” and it’s about communication, according to Howell.

For instance, a legally perfect document is useless if it’s a secret that explodes on a grieving family—when heirs are unaware of the plan’s contents, the reading of the trust can feel like a shocking verdict.

“This is often where good intentions fail, because good planning requires having difficult conversations we’d rather avoid,” Howell says.

The solution is a family meeting: You don’t need to share every financial detail, but you must explain the what and the why of your decisions, he adds.

Another critical mistake is the “co-trustee trap.” While this may seem “fair” in your own life, especially to avoid choosing between children, it is one of the most common and disastrous mistakes in estate planning, Howell says.

“Co-trustees must typically act unanimously,” he explains. “If they disagree on a decision—whether to sell the family home, how to invest funds, or how much to distribute—the entire estate is paralyzed.”

He recommends appointing a single, trustworthy, and capable trustee. Then, name at least one or two successors in case your first choice cannot serve. And for any situation with complex assets or tense family dynamics, a neutral professional trustee is the safest and often wisest choice, he adds.

Finally, Howell says that a family trust is not merely a financial instrument; it is the final message you leave your loved ones. The battle over Buffett’s estate teaches us that for this message to be received, it must be clear in its content and transparent in its delivery.

“We have all learned in our lives that avoiding a difficult conversation today only creates a bigger problem tomorrow. Estate planning is no different,” he says. “The ultimate lesson here is that embracing that conversation—no matter how uncomfortable—is the only way to ensure your legacy is one of peace, not one of painful, protracted conflict.”

Related Articles