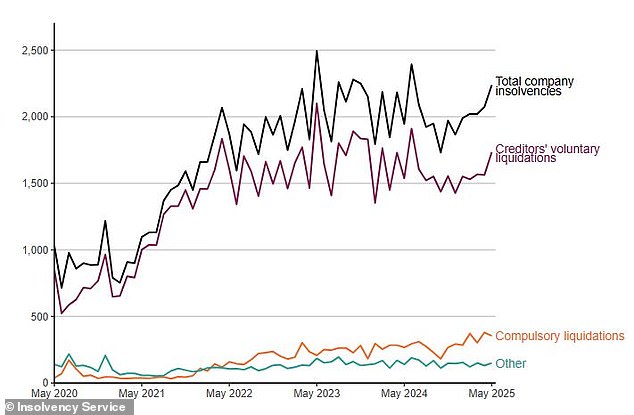

- The number of businesses folding rose 15% year-on-year in May

Business insolvencies across England and Wales rose sharply last month as firms buckled under the pressure of higher labour costs associated with last year’s Autumn Budget, official data suggests.

Insolvencies jumped 8 per cent month-on-month to 2,238 in May, reflecting a 15 per cent increase on the same time last year, according to the Government’s Insolvency Service.

It follows hikes to employer national insurance contributions and the national living wage in the previous month, compounding the impact of lacklustre economic growth, high borrowing costs and fragile consumer confidence.

Mark Ford, partner in the restructuring and recovery team at consultant S&W, said the ‘challenging operating environment’ had ‘eroded cash reserves for businesses and left some in a perilous position’.

He added: ‘Businesses are now facing newer challenges that threaten their viability and this means we are likely to continue to see a steady stream of company insolvencies in the coming months.’

April saw firms shouldered with higher labour costs after hikes to employer national insurance contributions and the national living wage

Insolvency growth in May was driven by 1,734 creditors’ voluntary liquidations, where company directors choose to shut a business down.

The Insolvency Service recorded 354 compulsory liquidations, but this was down 7 per cent on April’s 10-year high.

Giuseppe Parla, restructuring and insolvency director at Menzies, identified construction, wholesale and retail trade, and hospitality as sectors that will continue to struggle against higher costs.

He added: ‘Whilst interest rates may come down further later in the year, stability for our economy seems to be what is required, but how easy will that be to achieve?’

The Insolvency Service also recorded 136 company administrations, which are a recovery procedure often used by larger entities to ensure a better outcome for creditors.

David Hudson, restructuring advisory partner at FRP, said the ‘quiet, but steady’ rise in administrations is ‘particularly concerning’.

He said: ‘These usually involve the very largest businesses and so could prompt a significant knock-on impact in terms of jobs and supply chains if they continue to rise.

‘It’s also an early signal that financial distress is deepening – not just among smaller businesses, but at the top end of the market too.’

Insolvencies have risen sharply since lockdown measures were removed

DIY INVESTING PLATFORMS AJ Bell

AJ Bell AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine InvestEngine

InvestEngine

Account and trading fee-free ETF investing

![]() Trading 212

Trading 212![]() Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

Share or comment on this article:

Insolvencies jump as Rachel Reeves’ labour costs hike hits businesses